doi: 10.56294/sctconf2024.1137

Category: Finance, Business, Management, Economics and Accounting

ORIGINAL

Economic policy adjustments amidst military conflict: strategies for sustaining economic and financial stability

Ajustes de política económica en medio de conflictos militares: estrategias para mantener la estabilidad económica y financiera

Kseniia Chichulina1 ![]() *, Nataliia Klievtsievych2

*, Nataliia Klievtsievych2 ![]() *, Oleksii Kharchenko3

*, Oleksii Kharchenko3 ![]() *, Olga Zadorozhna4

*, Olga Zadorozhna4 ![]() *, Gennadii Sanchenko5

*, Gennadii Sanchenko5 ![]() *

*

1National University “Yuri Kondratyuk Poltava Polytechnic”, Department of Economics, Entrepreneurship and Marketing, Poltava, Ukraine.

2State Organization “Institute of Market and Economic & Ecological Researches of the National Academy of Sciences of Ukraine”, Odesa, Ukraine.

3Zhytomyr Polytechnic State University, Faculty of National Security, Law and International Relations, Department of National Security, Public Administration and Management, Zhytomyr, Ukraine.

4V. N. Karazin Kharkiv National University, Department of International Economy and World Economy, Kharkiv, Ukraine.

5Interregional Academy of Personnel Management, Kyiv, Ukraine.

Cite as: Chichulina K, Klievtsievych N, Kharchenko O, Zadorozhna O, Sanchenko G. Economic policy adjustments amidst military conflict: strategies for sustaining economic and financial stability. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:.1137. https://doi.org/10.56294/sctconf2024.1137

Submitted: 07-02-2024 Revised: 04-05-2024 Accepted: 26-08-2024 Published: 27-08-2024

Editor: Dr.

William Castillo-González ![]()

ABSTRACT

Introduction: in the context of military conflict, a country’s economic policy and financial system become particularly vulnerable to numerous challenges, requiring immediate and comprehensive measures to ensure their resilience and subsequent recovery.

Objective: this work aims to analyse and assess the effectiveness of economic policy reforms implemented during the military conflict to ensure the resilience of the economy and the financial system.

Method: the research employed methods of analysing literary sources, statistical data, generalization, and systematization. To evaluate the impact of reforms on economic resilience during the war, a survey of expert scientists in economic (Group 1) and legal (Group 2) fields was conducted. Correlation analysis was used to identify the relationship between the implemented reforms and the issues of restoring economic stability.

Results: according to the research results, correlation analysis showed a significant relationship between the decline in financial stability and the reform of the financial sector (r=0,514 at p>0,050), the reform of the energy sector (r=0,425 at p>0,114), and measures to improve the business climate (r=0,473 at p>0,075). The research found that the issues of declining financial stability, increasing emissions of harmful substances into the atmosphere, energy blackmail, and deteriorating investment climate are the most relevant for the country’s economic stability during the military conflict.

Conclusions: in this context, the reform of the financial sector, the energy sector, and the implementation of measures to improve the business climate have the most significant impact on ensuring the resilience of the Ukrainian economy and the financial system in military conflict.

Keywords: Circular Economy; Closed-Loop Economy; Financial Sector; Business; Entrepreneurship; Territorial Community; Sustainable Development; Digitalization.

RESUMEN

Introducción: en el contexto de un conflicto militar, la política económica y el sistema financiero de un país se vuelven particularmente vulnerables a numerosos desafíos, lo que requiere medidas inmediatas e integrales para garantizar su resiliencia y posterior recuperación.

Objetivo: este trabajo tiene como objetivo analizar y evaluar la efectividad de las reformas de política económica implementadas durante el conflicto militar para garantizar la resiliencia de la economía y el sistema financiero.

Método: la investigación empleó métodos de análisis de fuentes literarias, datos estadísticos, generalización y sistematización. Para evaluar el impacto de las reformas en la resiliencia económica durante la guerra, se realizó una encuesta a científicos expertos en los campos económico (Grupo 1) y legal (Grupo 2). Se utilizó el análisis de correlación para identificar la relación entre las reformas implementadas y las cuestiones de restauración de la estabilidad económica.

Resultados: según los resultados de la investigación, el análisis de correlación mostró una relación significativa entre el deterioro de la estabilidad financiera y la reforma del sector financiero (r = 0,514 a p > 0,050), la reforma del sector energético (r = 0,425 a p > 0,114) y las medidas para mejorar el clima empresarial (r = 0,473 a p > 0,075). La investigación encontró que las cuestiones de deterioro de la estabilidad financiera, aumento de las emisiones de sustancias nocivas a la atmósfera, chantaje energético y deterioro del clima de inversión son las más relevantes para la estabilidad económica del país durante el conflicto militar.

Conclusiones: en este contexto, la reforma del sector financiero, el sector energético y la implementación de medidas para mejorar el clima empresarial tienen el impacto más significativo en asegurar la resiliencia de la economía ucraniana y el sistema financiero en el conflicto militar.

Palabras clave: Economía Circular; Economía De Circuito Cerrado; Sector Financiero; Empresa; Espíritu Empresarial; Comunidad Territorial; Desarrollo Sostenible; Digitalización.

INTRODUCTION

In the context of military conflict, ensuring the financial system’s and the economy’s resilience is a primary task considering the destruction of infrastructure, the decline in the population’s purchasing power, restricted access to capital and foreign investments, and the decrease in national production productivity. Reforms and strategically-oriented measures to ensure the financial sector’s resilience, entrepreneurship, ecology, energy sector, and so forth represent an essential component of economic recovery and maintaining the country’s viability during a military conflict. Systematic transformations in these sectors are critical for restoring financial stability, trust in financial institutions, energy infrastructure, and other priority areas.

This scientific article aims to study the impact of economic policy reforms implemented during the military conflict on the resilience of the economy and the financial system. The main focus is on analyzing and evaluating the effectiveness of these reforms, their impact on risk reduction, and the enhancement of economic resilience in the context of the conflict.

Literature review

In the context of military conflict in Ukraine, the Government must ensure the most effective functioning of the national economy, which is crucial for preserving statehood.(1) Given the imposition of martial law and the active hostilities, a large number of enterprises, both state and private, have slowed down or completely stopped their production activities, leading to a decline in business activity and the inability of enterprises, particularly those located in conflict zones, to operate.(2) Thus, it becomes necessary to intensify economic policy reforms and increase state influence on economic processes in Ukraine. However, in the framework of economic policy reform, it is essential to create documents that embody real political responsibility and are based on the revision of legislative and regulatory acts and the updating of relevant documents.(3)

Essential areas for ensuring economic resilience, according to Vorotin and Shinkarev,(4) include the development of strategies and measures in critical areas such as the restoration of industrial and energy infrastructure, communication development, military infrastructure, and the military-industrial complex. At the same time, Onofriychuk A(5) sees the primary necessity in improving the system of military-economic resilience of the state. However, Zaluzhna ZV,(6) Klevchik L et al.,(7) and Vorobets NR(8) emphasise the primary necessity of effective financial resource management, meticulous planning and the reorientation of the state budget to meet critical needs.

METHOD

In the course of the research, methods of analyzing literary sources, statistical data analysis, as well as methods of generalization and systematization were used, which allowed for identifying the main points of modern reforms and highlighting the problems of ensuring the resilience of the economy and the financial system in the context of military conflict. Thus, the issues of economic resilience identified in the study should be addressed through the implementation of appropriate reforms, particularly in the financial and energy sectors, as well as in the fields of entrepreneurship and ecology.

Therefore, the expert evaluation method was applied to assess the impact of the implemented reforms on improving economic resilience. A survey was conducted among scientists in the economic (Group 1 – 7 professors from the Department of Economics and Entrepreneurship) and legal (Group 2 – 7 professors from the Department of Legal Regulation of the Economy) fields regarding the systematicity, feasibility, and significance of the existing reforms. To identify the correlation between the determined factors, the statistical program JASP was used, which allowed for determining the degree of correlation between two measured variables: the issues of restoring the resilience of the economy and the financial system and the economic policy reforms during the military conflict. According to the results of the correlation analysis, a significant degree of interconnection was found between the decrease in financial stability and such areas as the reform of the financial sector (r=0,514 at p>0,050), reforms in the energy sector (r=0,425 at p>0,114), and initiatives to improve the business climate (r=0,473 at p>0,075).

RESULTS

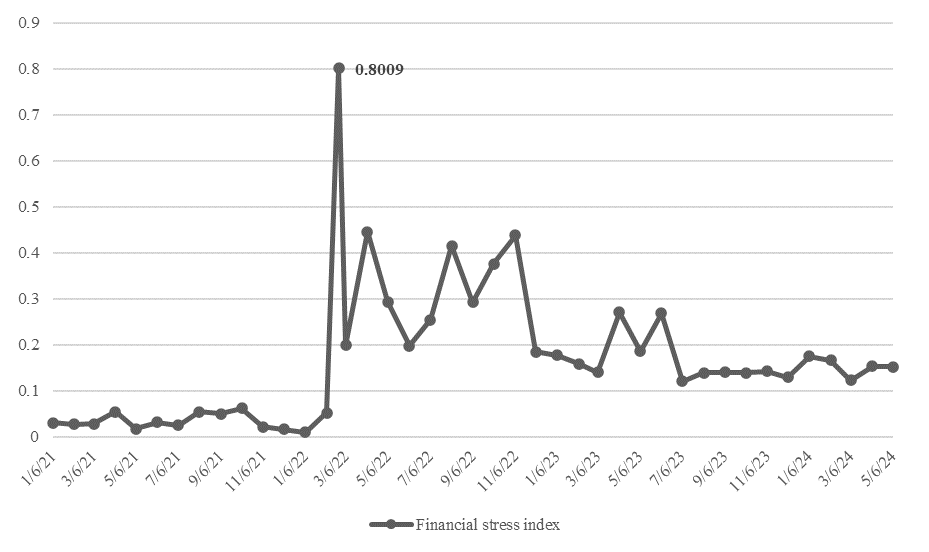

In the context of military conflict, the country’s economy and financial system become particularly vulnerable to external and internal challenges that can significantly undermine its stability and efficiency. The Financial Stress Index broadly demonstrates the scale of the conflict’s impact on the country’s financial system. Financial resilience has significantly decreased over the past three years, as indicated by high financial stress levels following the start of active hostilities (Figure 1). Since the beginning of Russia’s full-scale invasion of Ukraine (0,8), the Financial Stress Index has gradually decreased (to 0,17 at the beginning of 2023 and 0,18 in 2024) but remained at an elevated level compared to the pre-war figure (0,0098 at the beginning of 2022).

Figure 1. Financial Stress Index in Ukraine for 2021-2024

Source: NBU(9)

One key aspect of stabilizing the country’s political and economic situation is reforming economic policy. Reforms aimed at restoring the energy sector, improving environmental conditions, and supporting the business segment are intended to ensure the recovery of economic activity and financial stability and address local challenges arising during the military conflict period.

Problems of restoring economic and financial system resilience

The need to reform economic policy to ensure the resilience of the economy and the financial system during military conflict is driven by market instability increased financial risks, limited access to capital and foreign investments, as well as the deterioration of the political and socio-economic situation within the country (table 1).

|

Table 1. Challenges in Restoring Economic and Financial System Resilience |

|

|

Issue |

Features |

|

Financial sector |

|

|

Reduced financial stability |

Increased risk of bankruptcy of financial institutions due to reduced solvency of borrowers and increased default rates |

|

Increased financial risks for banks and other financial institutions |

Increased credit and liquidity risk due to deteriorating asset quality and reduced solvency of consumers of goods and services |

|

Decreased confidence in financial institutions due to the unstable economic situation |

Decreased investor confidence in financial institutions due to lack of transparency and deteriorating financial performance of the Ukrainian economy |

|

Deterioration of the investment climate and reduction of foreign investment inflows |

Loss of attractiveness of Ukraine for foreign investors due to the instability of the economic and political situation, which leads to a decrease in investment and foreign financial flows |

|

Business climate |

|

|

Political instability and legal unpredictability |

Fluctuations in political processes and changes in legislation and regulation make it difficult to plan and forecast business conditions |

|

Increased cost of lending and raising capital |

Increased political and economic risk in the context of the conflict leads to higher lending, investing, and raising capital costs, which burdens financial planning and economic activity. |

|

Small and medium-sized businesses |

|

|

High regulatory pressure |

Systematic legislative changes and administrative restrictions create additional costs and difficulties for businesses. |

|

Bureaucratic barriers and administrative procedures |

In times of war, business representatives need to simplify the regulatory environment, reduce administrative pressure, introduce efficient public services and digitalize procedures |

|

Ecology |

|

|

Increased emissions of harmful substances into the atmosphere |

Excessive use of natural resources and environmental impacts of industrial and transport activities cause. |

|

The need to protect the ozone layer |

The use of ozone-depleting substances and fluorinated greenhouse gases in the course of economic activity |

|

Underdevelopment of environmental reporting |

Lack of clear and mandatory requirements for reporting on the environmental performance of enterprises and inconsistency of national standards with those of the European Union |

|

Energy sector |

|

|

Energy blackmail |

Russia’s use of energy resources to exert political and economic pressure on Ukraine |

|

Destruction of energy infrastructure |

Shelling of critical infrastructure, including thermal and nuclear power plants, hydroelectric power plants and electricity transmission substations |

Study of the effect of implementing economic policy reforms during a military conflict

It is assumed that the previously identified issues of ensuring the resilience of the economy and the financial system should be addressed by implementing appropriate reforms, particularly in the financial and energy sectors and the fields of entrepreneurship and ecology. Therefore, to assess the impact of the implemented reforms on improving economic resilience, a survey was conducted among scientists in the economic (Group 1 – 7 professors from the Department of Economics and Entrepreneurship) and legal (Group 2 – 7 professors from the Department of Legal Regulation of the Economy) fields regarding the systematicity, feasibility, and significance of the existing reforms (Appendix A).

As a result of processing the obtained values, the weighted average scores calculated using the Excel Analysis ToolPak (the “AVERAGE” function) for the criteria decreased financial stability (P1=8,15), increased emissions of harmful substances into the atmosphere (P9=8,69), energy blackmail (P12=8,23), and deteriorating investment climate and reduced foreign investment (P4=8,0) are the highest, indicating the highest degree of threat and significance of the negative consequences for the country’s economic stability. All other criteria have lower values (ranging from 7,07 to 7,46), but they are also exceptionally high, given the priority of addressing most economic issues in the context of military conflict.

The same groups of experts also evaluated the set of program measures within the framework of economic policy reforms during the military conflict (Appendix B). Thus, the highest weighted average scores were noted for financial sector reform and development (R1=8,71) and reforms to support small and medium-sized enterprises (R3=7,79), which are the most effective for ensuring the resilience of the economy and the financial system during the military conflict and the subsequent recovery period of the country.

A detailed correlation analysis using the JASP statistical program (Appendix C) is necessary to determine the nature and direction of these reforms’ most effective implementation. The results of the correlation analysis are presented in table 2.

|

Table 2. Correlation Analysis Between Implemented Economic Policy Reforms and Economic Sustainability Issues |

||||||||||||||

|

Pearson’s Correlations |

||||||||||||||

|

Variable |

P1 |

P2 |

P3 |

P4 |

P5 |

P6 |

P7 |

P8 |

P9 |

P10 |

P11 |

P12 |

P13 |

|

|

R1 |

r |

0,514 |

-0,347 |

0,479 |

-0,203 |

0,059 |

-0,042 |

-0,201 |

-0,080 |

0,369 |

-0,189 |

-0,119 |

0,297 |

-0,403 |

|

p-value |

0,050 |

0,206 |

0,071 |

0,468 |

0,835 |

0,883 |

0,472 |

0,778 |

0,176 |

0,499 |

0,672 |

0,283 |

0,137 |

|

|

R2 |

r |

-0,473 |

0,426 |

-0,457 |

0,125 |

0,194 |

-0,067 |

-0,095 |

0,277 |

-0,270 |

0,328 |

0,102 |

-0,233 |

0,476 |

|

p-value |

0,075 |

0,113 |

0,086 |

0,656 |

0,488 |

0,811 |

0,737 |

0,317 |

0,331 |

0,233 |

0,717 |

0,403 |

0,073 |

|

|

R3 |

r |

-0,028 |

-0,074 |

0,006 |

-0,014 |

-0,387 |

-0,301 |

0,286 |

-0,199 |

0,259 |

0,160 |

0,381 |

-0,164 |

0,386 |

|

p-value |

0,920 |

0,794 |

0,982 |

0,961 |

0,154 |

0,275 |

0,301 |

0,476 |

0,351 |

0,570 |

0,162 |

0,558 |

0,156 |

|

|

R4 |

r |

-0,029 |

0,065 |

0,041 |

0,131 |

0,254 |

-0,032 |

0,085 |

0,297 |

0,211 |

0,015 |

0,189 |

0,467 |

0,085 |

|

p-value |

0,917 |

0,818 |

0,883 |

0,643 |

0,362 |

0,910 |

0,762 |

0,283 |

0,450 |

0,957 |

0,500 |

0,079 |

0,764 |

|

|

R5 |

r |

0,425 |

0,072 |

0,392 |

-0,311 |

0,149 |

0,374 |

0,215 |

-0,171 |

0,002 |

0,095 |

-0,073 |

-0,167 |

0,088 |

|

p-value |

0,114 |

0,799 |

0,149 |

0,260 |

0,596 |

0,170 |

0,441 |

0,541 |

0,994 |

0,736 |

0,795 |

0,552 |

0,756 |

|

According to the results of the correlation analysis, it should be noted that a significant effect and the most substantial degree of interconnection is observed between decreased financial stability and financial sector reform and development (r=0,514 at p>0,050), indicating the effectiveness of the reform in the financial sector and its high impact on increasing the country’s financial stability; between decreased financial stability and reform of the energy sector (r=0,425 at p>0,114), indicating a significant impact of energy sector reforms on reducing financial stability; and between decreased financial stability and reforms aimed at improving the business climate (r=0,473 at p>0,075). Thus, reforms aimed at improving the business climate play a significant role in ensuring financial stability.

In addition, a significant degree of interconnection is noted between Increased financial risks for financial institutions and Reforms aimed at improving the business climate (r=0,426 at p>0,113), decreased confidence in financial institutions and financial sector reform and development (r=0,479 at p>0,71), and energy blackmail and reforms in the field of ecology (r=0,467 at p>0,079).

DISCUSSION

Financial sector reform and development

Before the start of the full-scale aggression by the Russian Federation against Ukraine, the priority task of economic policy was to implement measures to modernize the accounting and financial reporting system in the public sector. To harmonise national legislation with European legislation in the field of auditing, Ukraine adopted the Laws “On the Audit of Financial Statements and Auditing Activities”, “On Accounting and Financial Reporting in Ukraine”, and an essential document in this context is the Resolution of the Cabinet of Ministers of Ukraine “On the Implementation of the Association Agreement between Ukraine, on the one hand, and the European Union, the European Atomic Energy Community and their Member States, on the other hand”.

Within the framework of these laws, bodies for public oversight of auditing activities were created, procedures for the election of representatives of professional organizations to supervisory bodies were approved, the maintenance of registers of auditors and audit entities was organized, quality control mechanisms for auditing were established, and the financing of supervisory bodies’ activities was ensured. It should be noted that during the wartime period, the reform in the field of accounting and auditing continues, with measures being implemented to improve national accounting standards, considering the adopted international financial reporting standards and the amendments made to them, such as: “Implementation of EU Practices for Accounting, Financial Reporting and Audit in Ukraine”; “EU for Stronger Public Finance Systems of Local Governments”; “Public Finance Management Program in Ukraine” (EU4PFM).

Significant transparency and efficiency are ensured within the framework of Ukraine’s financial sector reform. The new Financial Sector Development Strategy,(10) adopted by the National Bank of Ukraine, the Ministry of Finance, the National Securities and Stock Market Commission, and the Deposit Guarantee Fund, is aimed at achieving five strategic goals, including macroeconomic and financial stability, the restoration of the financial system, the development of modern financial services, and the strengthening of the institutional capacity of regulators.(11)

One of the key outcomes of the reform is the reduction of financial crisis risks and the increase in trust in financial institutions among the population and international investors. It is achieved by implementing precise regulatory requirements governing the activities of banks and other financial institutions, systematic monitoring and analysis of financial risks, and ensuring transparency in financial operations. Additionally, the reforms contribute to creating a favourable investment climate that attracts foreign capital and promotes economic growth. Strengthening the role of regulators and ensuring their institutional capacity also enhances supervisory practices and prevents systemic risks in the financial sector.(11)

Reforms to improve the business climate

In the context of military conflict, one of the central government strategies is a reform to create beneficial conditions for entrepreneurship. This initiative includes deregulation, eliminating costly regulatory restrictions and simplifying inefficient administrative procedures. The Ministry of Economy and other central executive bodies actively implement these measures to reduce administrative pressure, combat corruption, and create advantageous conditions for entrepreneurship. A key aspect of successful deregulation is effective interaction between government structures, the business community, public organizations, and scientists. This creates a transparent and conducive regulatory environment for all participants in the country’s economic life.

Thus, the Government is implementing the provisions of the Cabinet of Ministers of Ukraine’s Order “On Approving the Action Plan for Deregulation of Economic Activities and Improving the Business Climate, the Action Plan for Improving Business Conditions in Ukraine, and Recognizing Some Orders of the Cabinet of Ministers of Ukraine as Invalid” as part of the Government’s policy to eliminate regulatory and administrative barriers that hinder practical business activities; the Cabinet of Ministers of Ukraine’s Resolution “Some Issues of Ensuring Business Activities under Martial Law” to support the development and conduct of business during wartime on a declarative basis;(10) as well as the Cabinet of Ministers of Ukraine’s Resolution “On the Establishment of an Interdepartmental Working Group on Accelerated Review of State Regulation Instruments for Economic Activities” on forming an Interdepartmental Working Group for the accelerated review of state regulation instruments for economic activities.(12)

This Interdepartmental Working Group held 18 meetings and reviewed the activities of 20 central executive bodies. A total of 1323 state regulation instruments were reviewed, of which 465 were recommended for cancellation, 584 for optimization (digitalization), 268 for retention, and 15 for additional processing.

In addition, on the initiative of the Ministry of Economic Development, Trade and Agriculture of Ukraine, the Better Regulation Delivery Office (BRDO) developed the Effective Regulation Platform for the regulator (online RIA) for analyzing the regulatory impact of legal acts using relevant tools, such as online calculators, the M-Test, methodological materials, catalogues on public administration issues, statistical data, and more.(13) It should be noted that as a result of the implementation of initiatives and legal acts within the framework of the reform, it has become possible to significantly improve the efficiency of state regulation of economic activities, simplify administrative procedures, and reduce administrative pressure on the business environment in the context of military conflict.

Reforms to support small and medium-sized enterprises

The small and medium-sized enterprise (SME) sector holds one of the critical positions in the Ukrainian economic space, providing about 64 % of added value, 81,5 % of employed workers in business entities, and 37 % of tax revenues. However, the military conflict and the introduction of martial law have significantly limited the rights and legitimate interests of individuals and legal entities, necessitating a quick response and intervention by government structures in the business sector.

To ensure the stable and competitive development of the SME sector, it is vital to reform it in a way that creates a predictable regulatory environment and expands access to critical resources such as knowledge, markets, and capital. Specifically, the Government has developed the “eWork” grant support project for new business representatives, aimed at developing SMEs, which includes the programs “Own Business” and “Affordable Loans 5-7-9 %,” as well as several local programs for the development of processing enterprises, the establishment of new orchards or greenhouse farms, and the creation of new companies in the IT sector. These programs are regulated by the state, particularly by the Cabinet of Ministers of Ukraine Resolution “Some Issues of Providing Grants to Businesses”, which defines the procedure for providing grants for creating or developing one’s own business.

These programs gained traction during the war period. In 2022-2023, 4044 microgrants were provided under the “Own Business” program, and 226,221 requests were made to participate in the “Affordable Loans 5-7-9 %” program, indicating the need for further government support for business entities in wartime conditions.(14) Thus, implementing these initiatives is essential for the Government and the SME sector to ensure sustainable economic development and overcome challenges in Ukraine’s complex political and socio-economic context.(15)

Furthermore, to reduce regulatory pressure on the SME sector, according to the Laws “On the List of Permissive Documents in the Sphere of Economic Activity” and “On Licensing of Types of Economic Activity”, the need to obtain most permits and licenses was cancelled, changes were introduced to the practice of the declarative principle through digitalization, mainly based on the submission of declarations through the Diia Portal, and the legislative framework was changed to transfer all licensing procedures online.

It should also be noted that the Government developed the draft Law “On Consumer Protection” to regulate SMEs when providing consumer goods and services and harmonise the national consumer protection system. The draft Law addresses consumer guarantees, price indication and alternative dispute resolution offline and online, consumer contracts, including timeshare contracts, e-commerce, and the prohibition of unfair trading practices. The strategic goals achieved within the reform framework include ensuring effective state policy for SME development and creating conditions to improve SMEs’ access to finance, mainly through expanding microgrant programs.

Environmental reforms

The state’s participation in ensuring environmental sustainability is regulated by relevant legislative norms, in particular, the Law of Ukraine “On the Fundamental Principles (Strategy) of the State Environmental Policy of Ukraine for the Period until 2030”. According to the definition of the Ministry of Environmental Protection and Natural Resources of Ukraine, state environmental policy encompasses the measures of state bodies aimed at guaranteeing every citizen’s constitutional right to a safe environment for life and health and compensating for damage caused by the violation of this right.

In the context of hostilities, environmental disasters, and the generally unsatisfactory environmental situation, the Government implements provisions of several regulatory acts to reduce emissions of harmful substances into the atmosphere, including the Laws “On the Fundamentals of Monitoring, Reporting and Verification of Greenhouse Gas Emissions”, “On the Regulation of Economic Activities with Ozone-Depleting Substances and Fluorinated Greenhouse Gases”, and others; and to avoid the consequences of climate change, such as the Concept for the Implementation of State Policy in the Field of Climate Change for the Period until 2030 and the Action Plan for the Implementation of the Concept for the Implementation of State Policy in the Field of Climate Change. Thus, the environmental sector’s reform during the war aims to address comprehensive climate change issues and preserve the ozone layer by forming and implementing integrated state policies that align with international norms.(16)

However, in the long term, the Government needs to reconsider the necessity of implementing a circular approach at the state level, which changes the traditional linear economic concept by introducing the principle of 3R, that is, the efficient use of resources, their reduction, and recycling for reuse.(17) Given that the circular economy creates more economic opportunities with less use of materials and energy, it ensures the improvement of the environmental situation and the saving of critical resources for national production.

The Recommendations for Piloting the Circular Economy in Ukraine outline the general directions for implementing circular economy strategies, including new business models, efficient use of resources, and cleaner technologies.(18) At the level of individual territorial communities, it is essential not only to adhere to the 3R principle but also to consider several indicators: production volumes, consumption levels, amount of resources, percentage reduction of waste, as well as disposal and pollution of the environment.(17, 19) This approach will address the issue of limited state and local budgets in the context of the crisis and prolonged armed aggression.

Reforming the energy sector

The issue of Ukraine’s energy security in the context of full-scale armed aggression is a priority due to energy blackmail from Russia and attacks on the country’s energy infrastructure.(20) As part of the energy sector reform to ensure its compliance with new conditions, the Government created the Energy Strategy of Ukraine until 2035. This strategy is approved by the Resolution of the Cabinet of Ministers of Ukraine “On the Approval of the Energy Strategy of Ukraine for the Period until 2035 ‘Security, Energy Efficiency, Competitiveness’”.

Thus, the energy sector reform aims to implement comprehensive regulatory mechanisms to demonopolisation and stimulate competitive processes in energy markets. The reform also includes the integration of national energy markets with European systems, creating competitive conditions for developing electricity production from renewable sources, eliminating administrative barriers, and simplifying procedures for market participants. In addition, it provides for the introduction of effective economic and fiscal incentives for the development of both traditional and non-traditional hydrocarbon deposits, as well as the liberalization of market conditions for the sale of crude oil and gas condensate produced in Ukraine.

CONCLUSIONS

The research results indicate that reforms aimed at improving the business climate potentially reduce financial risks for financial institutions, highlighting the importance of carefully implementing these reforms to avoid negative consequences. Financial sector reforms and development demonstrate a significant impact on the confidence level in financial institutions, emphasizing the need to ensure transparency and efficiency of these reforms to restore public trust. Environmental reforms are essential in countering energy blackmail, highlighting their critical importance for ensuring the country’s energy security and stability. Thus, to achieve sustainable economic development and stability in the context of military conflict, it is crucial to consider the interconnection and impact of various reforms on critical aspects of the economic and financial system.

REFERENCES

1. Vdovenko L. Instruments of state financial support of the agricultural sector under martial law. Economy and Society [Internet] 2022 [cited: 25/10/2022]; 44. Available in: https://doi.org/10.32782/2524-0072/2022-44-82

2. Kostyuk AS. Business in wartime: how legislation has changed // Actual problems of labour relations during martial law: abstracts of reports students of higher education of the Faculty of Engineering and Power Engineering and other participants of the educational process according to the results of the thematic “round table” on engineering and energy faculty. MNAU [Internet] 2022 [cited: 28/09/2022]; 21-24. Available in: https://dspace.mnau.edu.ua/jspui/handle/123456789/11726

3. Lagutin VD. Economic policy of the state: essence, stages, mechanisms. Economic theory [Internet] 2006 [cited: 29/10/2013]; 4: 16-26. Available in: http://etet.org.ua/docs/ET_06_4_16_uk.pdf

4. Vorotin VE, Shinkarev AM. Public economic policy of Ukraine: challenges of martial law [Internet] 2022; 66-75. Available in: https://doi.org/10.52363/2414-5866-2022-1-8

5. Onofriychuk A. Conceptual scheme of the system of ensuring the military-economic stability of the state. Actual Issues in Modern Science [Internet] 2024 [cited: 22/03/2024]; 3(21). Available in: https://doi.org/10.52058/2786-6300-2024-3(21)-86-99

6. Zaluzhna ZV. Stability of the economic front and efficiency of budgeting of state bodies during 777 days of the Great War. In Financial instruments for sustainable economic development: materials of the VI International Scientific and Practical Conference. Yuriy Fedkovych Chernivtsi National University [Internet] 2024 [cited: 10/05/2024]; 70-75. Available in: https://www.researchgate.net/profile/Jan-Urban-Sandal/publication/380513338_2024_Conference_CHERNIVTSI/links/663f71ff35243041539abc1d/2024-Conference-CHERNIVTSI.pdf#page=71

7. Klevchik L, Garnik O, Pavlyuk S. Assessment of economic stability and sustainability of national economies in the context of global business structures. Scientific Perspectives [Internet] 2024 [cited: 09/06/2024]; 5 (47): 726-740. Available in: https://doi.org/10.52058/2708-7530-2024-5(47)-726-740

8. Vorobets, NR. Institutional features of the formation and functioning of information security in Ukraine. Regional studios [Internet] 2023 [cited: 30/08/2023]; 75-80. Available in: https://doi.org/10.32782/2663-6170/2023.34.12

9. NBU. About the Financial Stress Index. National Bank of Ukraine [Internet] 2024. Available in: https://bank.gov.ua/ua/stability/fsi

10. USAID. Strategy for the development of the financial sector of Ukraine. USAID project [Internet] 2023. Available in: https://bank.gov.ua/admin_uploads/article/Strategy_finsector_NBU.pdf?v=7

11. NBU. A new strategy for the development of the financial sector: confronting the challenges of the war in the financial sector and supporting the recovery of the Ukrainian economy. National Bank of Ukraine [Internet] 2023 [cited: 29/08/2023]. Available in: https://bank.gov.ua/ua/news/all/nova-strategiya-rozvitku-finansovogo-sektoru-protistoyannya-viklikam-viyni-u-finansovomu-sektori-ta-pidtrimannya-vidnovlennya-ekonomiki-ukrayini

12. Verkhovna Rada of Ukraine. Some issues of ensuring the conduct of economic activity in the conditions of martial law: Resolution of the Cabinet of Ministers of Ukraine dated 18.03.2022 No. 314-2022-p. Legislation of Ukraine [Internet] 2024. Available in: https://zakon.rada.gov.ua/laws/show/314-2022-%D0%BF#Text

13. PRO. Effective regulation platform for the regulator. A platform for effective regulation [Internet] 2024. Available in: https://regulation.gov.ua/regulator

14. Semenets-Orlova I, Kushnir V, Rodchenko L, Chernenko I, Druz O, Rudenko M. Organizational development and educational changes management in public Sector (case of public administration during wartime. International Journal of Professional Business Review [Internet] 2023 [cited: 14/04/2023]; 8(4); 15. Available in: https://doi.org/10.26668/businessreview/2023.v8i4.1699

15. Koval V, Mikhno I, Tamosiuniene R, Kryshtal H, Kovalenko-Marchenkova Y, Gui H. Ensuring sustainable consumption behaviors in circular economy engagement. Transformations in Business and Economics [Internet] 2023 [cited: 18/09/2023]; 22(2): 161-177. Available in: https://etalpykla.vilniustech.lt/handle/123456789/115576

16. Lopatynskyi Y, Belei S, Kapelista I, Pavlyshyn M. The effectiveness of the management system in the conditions of war and its influence on the development of agribusiness. Review of Economics and Finance [Internet] 2023 [cited: 02/08/2023]; 21: 932-940. Available in: https://archer.chnu.edu.ua/xmlui/handle/123456789/8180

17. Atstaja D, Koval V, Grasis J, Kalina I, Kryshtal H, Mikhno I. Sharing model in circular economy towards rational use in sustainable production. Energies [Internet] 2022 [cited: 27/01/2022]; 15(3). Available in: http://dx.doi.org/10.3390/en15030939

18. EU4Environment. Recommendations for piloting the circular economy in Ukraine. Centre of resource-efficient and clean production [Internet] 2024 [cited: 12/04/2024]; 1-37. Available in: http://www.recpc.org/wp-content/uploads/2024/04/Guidelines-on-piloting-circular-economy-in-Ukraine.pdf

19. Dmytryshyn M. Implementation of circular economy mechanisms in territorial communities’ practice. Peculiarities of modern management of socio-economic development of territorial communities. НАІР [Internet] 2023 [cited: 07/04/2023]; 111-141. Available in: https://www.researchgate.net/publication/371006127

20. Kotsur V, Maletych M, Pogrebytskyi M, Negoda A, Trachuk T, Andriushchenko M. Ensuring National Security in Conditions of War: NATO’s Influence. Economic Affairs [Internet] 2022 [cited: 27/09/2022]; 67(4s): 707-714. Available in: https://doi.org/10.46852/0424-2513.4s.2022.4

FINANCING

The authors did not receive funding for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Data curation: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Formal analysis: Kseniia Chichulina, Nataliia Klievtsievych, Gennadii Sanchenko.

Research: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Methodology: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Project management: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Resources: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Software: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Supervision: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Validation: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Display: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Drafting – original draft: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.

Writing – proofreading and editing: Kseniia Chichulina, Nataliia Klievtsievych, Oleksii Kharchenko, Olga Zadorozhna, Gennadii Sanchenko.