doi: 10.56294/sctconf2024.1138

Category: Finance, Business, Management, Economics and Accounting

ORIGINAL

The evolution of accounting and auditing in the era of digital technologies: the role of cloud services and process automation

La evolución de la contabilidad y la auditoría en la era de las tecnologías digitales: el papel de los servicios en la nube y la automatización de procesos

Svitlana Matchuk1 ![]() *, Valentyna Havrylenko2

*, Valentyna Havrylenko2 ![]() *, Iryna Lukanovska3

*, Iryna Lukanovska3 ![]() *, Tetiana Kharkhalis4

*, Tetiana Kharkhalis4 ![]() *, Yana Ostapenko5

*, Yana Ostapenko5 ![]() *

*

1Interregional Academy of Personnel Management, Kyiv, Ukraine.

2Cherkasy State Technological University, Department of Accounting, Analysis and Taxation, Cherkasy, Ukraine.

3West Ukrainian National University, Faculty of Finance and Accounting, Department of Accounting and Taxation, Ternopil, Ukraine.

4Lviv Polytechnic National University, Department of Management of Organization, Lviv, Ukraine.

5State Tax University, Faculty of Taxation, Accounting and Audit, Department of Accounting Technologies and Business Analytics, Irpin, Ukraine.

Cite as: Matchuk S, Havrylenko V, Lukanovska I, Kharkhalis T, Ostapenko Y. The evolution of accounting and auditing in the era of digital technologies: the role of cloud services and process automation. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:.1138. https://doi.org/10.56294/sctconf2024.1138

Submitted: 06-02-2024 Revised: 03-05-2024 Accepted: 17-08-2024 Published: 18-08-2024

Editor: Dr.

William Castillo-González ![]()

ABSTRACT

Introduction: the rapid development of the digital economic space in Ukraine has made digitising the accounting system a paramount issue. Ukraine’s integration trend into the European economic sphere has also contributed to this situation.

Objectives: this research aims to analyse the current role of digital transformation tools in optimising the accounting system.

Method: the study employed general methods of scientific inquiry, including analysis and synthesis, induction and deduction, abstraction, concretisation, and formalisation.

Results: the research established that digital accounting transformation is an obligatory optimisation stage in developing the modern business environment. The analysis considered the feasibility and potential of implementing innovative artificial intelligence capabilities in accounting while ensuring adequate security measures. It was concluded that modern digital tools offer opportunities to streamline the collection and aggregation of accounting information through specialised industry software products. The identified risks associated with implementing artificial intelligence technologies into information systems were discussed.

Conclusions: the study demonstrated that intensifying the integration of digital technologies into accounting processes can increase managerial decisions’ accuracy and efficiency.

Keywords: Audit; Audit Activity; Audit Entities; Information Technology; Digitalisation; Cloud Technologies.

RESUMEN

Introducción: el rápido desarrollo del espacio económico digital en Ucrania ha convertido la digitalización del sistema contable en una cuestión primordial. La tendencia a la integración de Ucrania en la esfera económica europea también ha contribuido a esta situación.

Objetivos: el objetivo de esta investigación es analizar el papel actual de las herramientas de transformación digital en la optimización del sistema contable.

Método: en el estudio se emplearon métodos generales de investigación científica, como el análisis y la síntesis, la inducción y la deducción, la abstracción, la concreción y la formalización.

Resultados: la investigación estableció que la transformación digital de la contabilidad es una etapa de optimización obligatoria en el desarrollo del entorno empresarial moderno. El análisis examinó la viabilidad y el potencial de la aplicación de capacidades innovadoras de inteligencia artificial en la contabilidad, garantizando al mismo tiempo medidas de seguridad adecuadas. Se llegó a la conclusión de que las herramientas digitales modernas ofrecen oportunidades para racionalizar la recopilación y agregación de información contable a través de productos de software especializados en el sector. Se debatieron los riesgos identificados asociados a la implantación de tecnologías de inteligencia artificial en los sistemas de información.

Conclusiones: el estudio demostró que intensificar la integración de las tecnologías digitales en los procesos contables puede aumentar la precisión y la eficacia de las decisiones de gestión.

Palabras clave: Auditoría; Actividad de Auditoría; Entidades de Auditoría; Tecnologías de la Información; Digitalización; Tecnologías en Nube.

INTRODUCTION

In Ukraine’s economy, optimising the accounting system is crucial amidst actively developing market relations. The priority direction is the utilisation of digital technologies. Contemporary accounting practices demonstrate the strengthening influence of automated information systems. Therefore, it is particularly relevant to investigate the key aspects of organising accounting using digitisation tools and identifying risks in this sphere.

Numerous works by scholars(1,2,3) are dedicated to studying some aspects of the discussed issue. These works are characterised by fragmentary and overview aspects, mostly revealing the general theoretical aspects of information processing problems using digitisation and digitalisation tools. Substantial attention has also been devoted to this topic in the scholarly works of researchers,(4,5) who explore practical directions for optimising accounting through cloud technologies.

Despite significant scholarly achievements, it is essential to note that further scientific analysis is required to address the normative regulation of the process of digitising accounting activities.(6,7) This process should be positioned as a priority concept for the symbiosis of overall management system digitalisation and accounting digitisation to optimise the qualitative characteristics of the investigated process. The transformation occurs in the context of identifying digitisation as a catalyst for developing a new economic society. Despite the undeniable significance of scholars’ developments, the issue of accounting information digitisation and the formation of requirements and approaches to them requires further in-depth study.

The results of researchers’ work form the scientific and methodological basis of the researched problem focused on aspects of implementing automation technologies in accounting processes and cloud computing, as well as the general problem of transforming accounting systems towards digitisation and actively leveraging the opportunities of innovative technologies, along with seeking ways to mitigate associated risks. Numerous publications on the topic have been published in scientific and professional journals. Some elements of innovative mechanisms for automating accounting processes are examined in the studies of several contemporary scholars.(8,9) Among the array of research results, it is worth highlighting the works(10,11) that fundamentally substantiate the prospects for maximising the potential of cloud technologies.

Simultaneously, some scholars(12,13) highlight the complexity of implementing specific elements of innovative technologies into the accounting system. A group of researchers(14,15) has developed an algorithm for digitalising financial accounting processes, updating the hub of digitalisation technological tools and electronic document management in the accounting sphere. However, despite the significant scientific and practical achievements of scholars in the researched problem area, there is a need to intensify scientific research into the potential of cloud technologies and automation tools for accounting processes to ensure compliance with the level of development of the accounting field with modern requirements for the intensive development of innovative technologies.

This study aims to provide theoretical analysis and substantiation of trends and challenges of the impact of modern digital transformation on the accounting system in terms of the potential of cloud technologies and automation of accounting processes.

METHOD

Scientific research combines general methods of inquiry. The methodological and theoretical basis of the work was formed by prioritising comprehensive research based on a systemic approach. The principle of comprehensiveness allowed for the analysis of the object and subject of study as a system with a corresponding set of interrelationships.

The study used a qualitative approach to understand the experience of implementing the phenomenon under study, as well as to uncover the underlying causes of their impact.

The study employed methods of analysis and synthesis to identify the factors and stages of development of the researched object, along with its defining elements. The comparison method was used to determine the specificity of development and characteristics of the digital optimisation process of accounting. Deduction and induction were applied to develop proposals for optimising management processes in synergy with accounting processes as interrelated and interdependent components of the economic activity system. The research employed the abstract-logical and dialectical methods of scientific inquiry, as well as the method of scientific abstraction, to form theoretical generalisations, refine the conceptual apparatus, highlight key concepts and categories, draw conclusions, and form a concept of the holistic process of digital optimisation of accounting processes. The formalisation method was performed to identify priority vectors for system optimisation and to structure accounting digitisation’s principles, functions, tasks, and priorities.

RESULTS

Today, accounting information management must adapt to the requirements of digitisation. The concept of Industry 4.0 introduces innovative potential for modernising accounting processes with the involvement of digital tools. Modern advancements in information technology significantly impact economic activities and make global computerisation and the construction of information systems necessary. Consequently, there is an increasing demand for professional skills in utilising digitisation tools. Using digitised accounting information systems significantly contributes to increased productivity and efficient accounting organisation while minimising time losses.(12,13)

The implementation of cloud technologies is the most significant innovative trend in accounting. The use of remote servers enables the storage and processing of various types of information, including accounting and management systems and electronic document management. Artificial intelligence is also significant in the digitisation of accounting, primarily for quickly processing and analysing large volumes of information. Using digitisation technologies for routine accounting processes allows companies to transition to remote offices. Specialised tools facilitate increased resource utilisation efficiency and significant cost reduction.(16,17)

Applying digitising tools to accounting offers significant benefits. Specifically, digital optimisation allows for rapidly acquiring up-to-date accounting information in real time, automated calculations with absolute accuracy, and time-saving report generation. Additionally, modern password protection systems in most accounting software ensure that informative data is stored securely. The digital economy has dramatically expanded the functional capabilities of accountants and the range of opportunities available to them. Modern employers require accountants to be trained in fulfilling current accounting and analytical tasks using digitisation tools. Transforming accounting information to meet the innovative requirements of global digitisation is a necessary stage in its development. The popularisation of digital technologies drives economic transformations and promotes the establishment of principles for sustainable financial development.(18)

The accounting process in the context of digitising accounting is determined by the requirements of the data processing system, as well as the data accumulation and storage process. Applying digitisation technical tools and innovative software can optimise the technological process of digitised accounting. To achieve comprehensive digitisation in the industry, it is recommended that digitisation systems be used to form the functional and supporting components of the system. The functional part of the subject area ensures the resolution of specific tasks, while the supporting part comprises subsystems that embody the technology of digitised information processing. These subsystems include informational, technical, programmatic, mathematical, organisational, and legal support. The variability of tasks in the specified process area is determined by the economic content’s specificity, the presence of primary and summarising documents, interconnected calculation algorithms, and methodological tools and regulatory documents.

The utilisation of digitisation tools enables the near-complete automation of the accounting process. The foundation of accounting technology consists of operations that facilitate the modernisation of the process structure while ensuring an appropriate level of functional organisation. The use of digitisation tools for accounting tasks brings about significant technological, operational, and procedural changes, but the fundamental structure of accounting remains unchanged. Digitisation is a logical progression in the transformation of accounting practices. According to some scholars, companies benefit economically from modern digitisation tools, such as management information systems, enabling real-time control of business processes. The main advantage of digitisation tools is the timely prevention of significant economic risks. Table 1 illustrates the impact of digitisation on optimising accounting.

|

Table 1. Optimisation of Accounting by Using Digitalisation Tools |

|

|

Issue |

Solution |

|

Essential digital solutions and technologies |

· Cloud technologies · Artificial intelligence · Blockchain technologies |

|

Learning and personal skills |

· Artificial intelligence application skills · Analytical and critical thinking · Optimisation of accounting skills · Communication skills · Formation of management decisions |

|

Accounting functionality |

· Automation of structured functionality · Implementation of some functionality using cloud processes · Independent control and performance evaluation systems |

The challenges of implementing digitisation in accounting arise from the need for more motivation among economic entities and a low level of awareness regarding the benefits of digitalisation. Consequently, the objective of implementing digitisation tools does not align with strategic goals, and the digital transformation process itself needs to be more adequately formalised. When a company decides to implement a digitisation system for accounting, typical goals include creating a unified information space, tracking production and supply in real-time, optimising financial management, and digitising document flow.

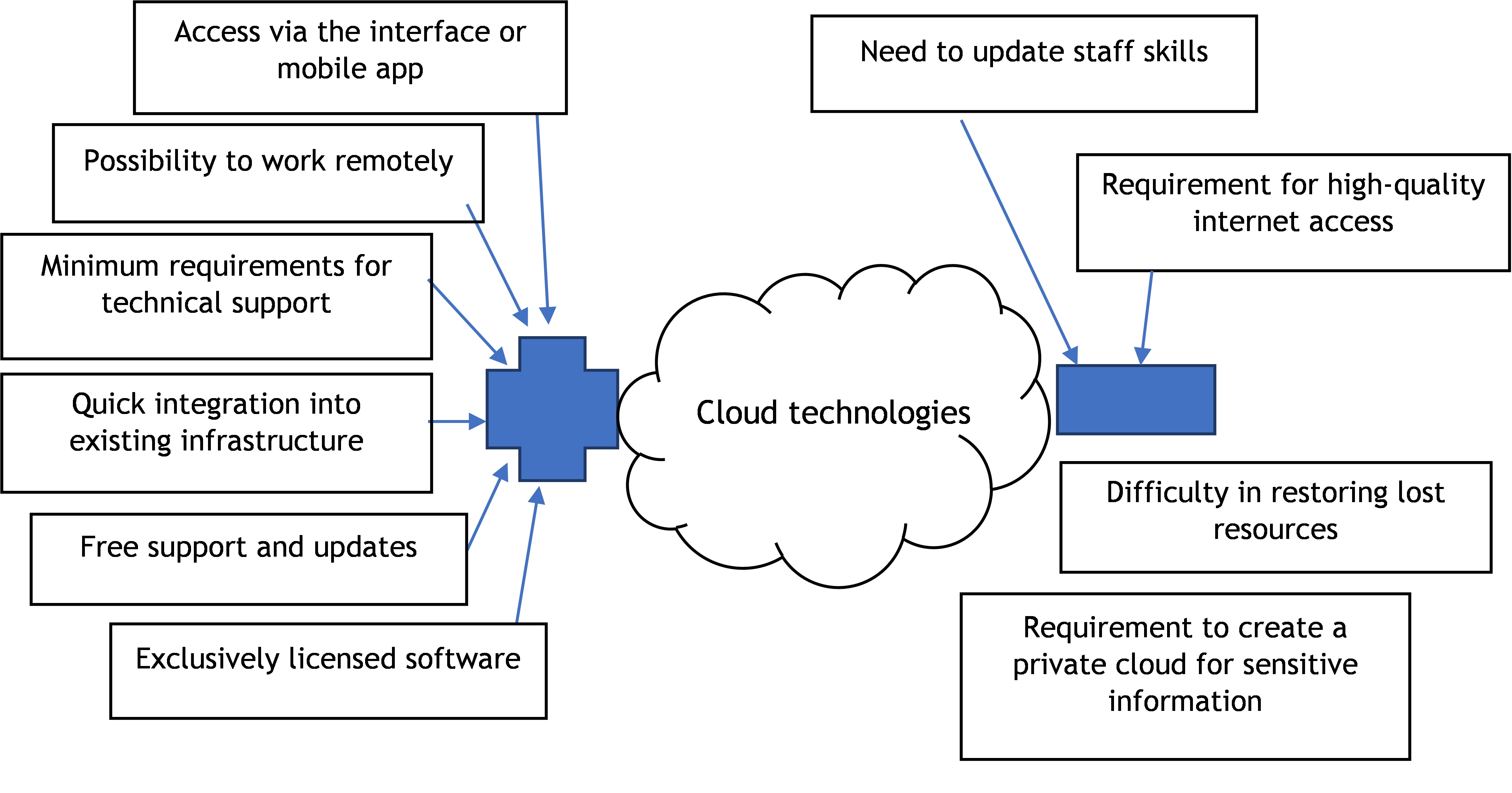

Specialised accounting software developed to meet the specific digitisation requirements is highly efficient and productive. It involves developing an individual model with a high level of uniqueness. Although this process is lengthy and expensive, successful implementation provides the opportunity to automate not only the accounting process but also other management processes. Figure 1 presents the advantages and disadvantages of using cloud technologies in accounting.

It should be noted that contemporary software producers in the studied field diligently monitor changes in reporting formats and promptly provide users with adaptive corrections. However, this detail poses additional challenges for a society that is sceptical of digitalisation because innovations must be individually configured based on the specific activities of each economic entity.(8,9) Moreover, using digital tools, such as artificial intelligence, involves the creation of integrated databases of informative data, including confidential information. It presents potential cybersecurity threats and undermines information security guarantees. Implementing digitalisation tools can result in various benefits, including improved systematisation of accounting information, reduced accounting errors, and increased speed and accuracy of the process.

Figure 1. Advantages and Disadvantages of Using Cloud Technologies in Accounting

Acknowledging the risks and challenges associated with digitalising accounting information is essential. Therefore, a dualistic approach to the phenomenon is currently observed. Automating specific tasks is optimal for achieving the enterprise’s strategic goal. However, it is crucial to consider the possible lack of competence among personnel in applying information technologies, as well as the need for a clear and effective methodology for strategic development.(10,11) Challenges to successful digitalisation may arise due to inadequate information technology infrastructure and differences in goals between general digitalisation management and accounting digitalisation.(19, 20)

Therefore, the best approach to digitally transforming accounting information is a gradual, phased process of digitising individual business processes within the enterprise. This process should involve management and focus on the long-term development of the process. If the proposed approach is implemented effectively, the digitalisation of accounting processes will create opportunities for successfully automating routine tasks, freeing up significant resources to address management challenges. Involving management in digital transformation and implementing phased optimisation principles will enable tracking of the connection between IT solutions and management processes. It will significantly enhance the qualification level of management.(4,5) Additionally, timely access to accurate accounting data will enable prompt resolution of issues arising during operations.

When analysing the impact of digitalisation on the accounting system, it is vital to identify the system’s specific requirements. Modern accounting information must meet quality requirements, such as timely, well-documented, and reliable. Additionally, it must have the resources to respond to the demands of a digitised management and control system while also being open to investment and continuous improvement. Given the global importance of digitalisation to modernise accounting information, it is essential to note that the topic under investigation will remain relevant for the foreseeable future as it continues to evolve and be supplemented with new ideas and innovations.

DISCUSSION

Many contemporary scholars consider innovative technological optimisation in financial and economic management as the foundation for effective transformation towards sustainable development. Most researchers view the active impact of digital capabilities on accounting operations as a prerequisite for enhancing the quality and speed of optimisation in the economic sphere.

Some researchers(21) highlight the primary positive outcomes of employing artificial intelligence-supported accounting technologies as high speed, minimising the risk of data loss or unauthorised use, and saving time resources on routine accounting operations. Certain scholars(22) believe that a recent trend in utilising artificial intelligence in the accounting system is enhancing the cybersecurity level of cloud providers through automated threat identification.

Contemporary scholars(23) emphasise that the global use of digital technologies presents a challenge in preparing professionals. They stress the importance of optimising timeliness to ensure the effectiveness of accounting and analytical activities, enabling timely intervention in production processes and managerial decision-making. According to Savić and Pavlović,(24) digitisation is identified as a direction of innovative development in accounting processes. The challenges of accounting digitisation largely depend on the complexity of accounting procedures. Researchers highlight challenges related to the automation of accounting processes. The introduction of remote work and widespread use of information and communication technologies has made it necessary to encrypt informative data and implement modern protection strategies.

Representatives of current research trends(25) argue that digitising accounting processes is a complex and multi-stage process requiring significant financial investments. According to scholars, the main goal of the digital transformation of accounting is the synergy of data sets for optimal utilisation. Achieving this goal is possible through various practical algorithms. The authors emphasise that several factors influence the digital optimisation process, including time constraints, financial capabilities, and the level of intellectual resources.

Contemporary researchers(26) emphasise that only a few aspects of accounting and financial processes are consumers of innovative technologies and automated solutions. Some researchers(27,28) believe that the demand for various variations of cloud services will rapidly increase in the future, as they create opportunities for efficient use of a range of programs, applications, and disk space without direct purchase. According to scholars, the development of cloud technologies can significantly influence the adaptive dynamics of software for accounting tasks, leading to fundamental changes in approaches to organising accounting.

At the same time, scholars(29,30) have identified specific prerequisites for effective digitisation of accounting in transitional economies. These include having an appropriate resource base and participants’ readiness for dynamic changes. Some contemporary researchers(31,32) suggest that accounting in sustainable development conditions requires digital support based on rational resource utilisation principles and increased efficiency of communication interaction. This approach can help improve the transformation process of the financial-economic field towards sustainability concepts.

The predicted trend towards greater emphasis on sustainable development principles suggests that future industry needs increasingly rely on transparent management decision-making(33). The research studies mentioned above, as well as the current research results, suggest that public administration has become a fundamental element of the system that ensures optimal balanced development in sustainable conditions. It is important to note that implementing balanced development principles based on optimal public administration requires gradual and efficient goal achievement through innovative opportunities and digitisation technologies.

The study is limited by the lack of access to extensive data and the difficulty of implementing an empirical test of theoretical conclusions. At the same time, the study demonstrated that intensifying the integration of digital technologies into accounting processes can improve the accuracy and efficiency of management decisions.

CONCLUSION

During the research, we analysed the impact of digitisation technologies on the accounting system and assessed their functionality. Intensive digitisation of processes for collecting and processing financial information has been found to enhance the quality of accounting processes and strengthen the position of digital tools in innovative trends in global economic integration.

The article also discussed probable risks and obstacles to digital accounting optimisation and identified adaptation tools for the traditional accounting system to digitisation requirements. Modern information technologies, artificial intelligence tools, and digitisation enable the development and implementation of customised solutions to optimise accounting information.

Further research should focus on analysing the integration of digitisation tools and artificial intelligence with other economic activities. Additionally, a cyber security system should be developed to ensure the safety of confidential financial data.

It has been proven that developing modern economic relations requires transforming accounting processes using modern digitisation tools. Digitisation tools provide speed, accuracy, and reliability in accounting operations and facilitate communication processes. Digitisation has the potential to increase labour productivity and unlock valuable resources significantly.

REFERENCES

1. Liubymov MO, Kulyk VA. Opportunities, threats, and prospects of using “cloud” technologies in accounting. Scientific Bulletin of PUET. Series “Economic Sciences” 2020, 2(93). https://dspace.pdau.edu.ua/server/api/core/bitstreams/2af59db1-51a8-4e63-84cb-39e2827252a7/content

2. Kuzub MV. Development of “cloud” technologies in accounting. Collection of Theses of the All-Ukrainian Scientific and Practical Internet Conference “Development of accounting, taxation and control in the conditions of integration processes” 2020; 43–45. Kherson. https://isu-conference.com/wp-content/uploads/2024/02/Scientific_theories_and_practices_as_an_engine_of_modern_development.pdf

3. Spivak S, Panchyshyn D, Skochylias M, Yaremchuk K. Digitalisation of accounting processes. Electronic scientific professional publication “Socio-Economic Problems and the State” 2021; 2(25): 113–119. https://doi.org/10.33108/sepd2022.02.113

4. Mykhailovyna SO, Matros OM, Polishchuk OM. “Cloud” technologies as an essential aspect of the development of the accounting and taxation system. Efficient economy 2021; 8. https://doi.org/10.32702/2307-2105-2021.8.86

5. Ma D, Fisher R, Nesbit T. Cloud-based client accounting and small and medium accounting practices: Adoption and impact. International Journal of Accounting Information Systems 2021; 41. https://doi.org/10.1016/j.accinf.2021.100513

6. Koshova S, Parkhomenko-Kutsevil O, Kovtun O, Fedoruk O. Basic Framework for Introducing Space Activities for Security and Deffense. Economic Affairs (New Delhi) 2023; 68(1): 99–106. https://doi.org/10.46852/0424-2513.1s.2023.25

7. Klochan V, Piliaiev I, Sydorenko T, Khomutenko V, Solomko A, Tkachuk A. Digital platforms as a tool for the transformation of strategic consulting in public administration. Journal of Information Technology Management 2021; 13: 42–61. https://jitm.ut.ac.ir/article_80736.html

8. Moudud-Ul-Huq S, Asaduzzaman M, Biswas T. Role of cloud computing in global accounting information systems. The Bottom Line 2020; 33(3): 231–250. https://doi.org/10.1108/BL-01-2020-0010

9. Yau-Yeung D, Yigitbasioglu O, Green P. Cloud accounting risks and mitigation strategies: Evidence from Australia. Accounting Forum 2020; 44(4): 421–446. https://doi.org/10.1080/01559982.2020.1783047

10. Appelbaum D, Nehmer RA. Auditing cloud-based blockchain accounting systems. Journal of information systems 2020; 34(2): 5–21. https://doi.org/10.2308/isys-52660

11. Carlsson‐Wall M, Goretzki L, Hofstedt J, Kraus K, Nilsson CJ. Exploring the implications of cloud‐based enterprise resource planning systems for public sector management accountants. Financial accountability & management 2022; 38(2): 177–201. https://doi.org/10.1111/faam.12300

12. Yoon S. A study on the transformation of accounting based on new technologies: Evidence from Korea. Sustainability 2020; 12(20). https://doi.org/10.3390/su12208669

13. Fotoh LE, Lorentzon JI. The impact of digitalisation on future audits. Journal of Emerging Technologies in Accounting 2021; 18(2). https://doi.org/10.2308/JETA-2020-063

14. Coman DM et al. Digitisation of accounting: The premise of the paradigm shift of role of the professional accountant. Applied Sciences 2022; 12(7). https://doi.org/10.3390/app12073359

15. Zhang M, Ye T, Jia L. Implications of the “momentum” theory of digitalisation in accounting: evidence from Ash Cloud. China Journal of Accounting Research 2022; 15(4). https://doi.org/10.1016/j.cjar.2022.100274

16. Zhuk I, Khaletska A, Stepura T, Shchepanskiy E, Sadova U, Pyla V. Public administration system in the field of finance under the influence of digitalization. Economic Affairs (New Delhi) 2022; 67(3): 225–231. https://doi.org/10.46852/0424-2513.3.2022.11

17. Shevchenko I, Lysak O, Zalievska-Shyshak A, Mazur I, Korotun M, Nestor V. Digital economy in a global context: World experience. International Journal of Professional Business Review 2023; 8(4). https://doi.org/10.26668/businessreview/2023.v8i4.1551

18. Bielialov T, Kalina I, Goi V, Kravchenko O, Shyshpanova N. Global experience of digitalization of economic processes in the context of transformation. Journal of Law and Sustainable Development 2023; 11(3). https://doi.org/10.55908/sdgs.v11i3.814

19. Novak A, Pravdyvets O, Chornyi O, Sumbaieva L, Akimova L, Akimov O. Financial and economic security in the field of financial markets at the stage of European integration. International Journal of Professional Business Review 2022; 7(5): e0835. https://doi.org/10.26668/businessreview/2022.v7i5.e835

20. Levytska S, Pershko L, Akimova L, Akimov O, Havrilenko K, Kucherovskii O. A risk-oriented approach in the system of internal auditing of the subjects of financial monitoring. International Journal of Applied Economics. Finance and Accounting 2022; 14(2): 194–206. https://doi.org/10.33094/ijaefa.v14i2.715

21. Taib A, Awang Y, Shuhidan SM, Rashid N, Hasan MS. Digitalisation in accounting: Technology knowledge and readiness of future accountants. Universal Journal of Accounting and Finance 2022; 10(1): 348–357. https://doi.org/10.13189/ujaf.2022.100135

22. Mansoor MA, Salmanand EM, Al-Sartawi A. Transformation of Managerial Accounting Trends in the Era of Digitalization. Lecture Notes in Networks and Systems 2023; 557. https://doi.org/10.1007/978-3-031-17746-0_57

23. Cagle MN. Reflections of Digitalization on Accounting: The Effects of Industry 4.0 on Financial Statements and Financial Ratios. Contributions to Management Science, pp. 473–501. Springer, Cham; 2020. https://doi.org/10.1007/978-3-030-29739-8_23

24. Savić B, Pavlović V. Impact of Digitalization on the Accounting Profession. Digital Transformation of the Financial Industry: Approaches and Applications. Contributions to Finance and Accounting; pp. 19–34. Springer, Cham; 2023. https://doi.org/10.1007/978-3-031-23269-5_2

25. Andreeva SV. The Accounting System of the Company in the Context of Digitalization. Lecture Notes in Networks and Systems 2022; 304. https://doi.org/10.1007/978-3-030-83175-2_54

26. Haje P, Arystanbaeva A, Оralbaeva Z, Kupenova Z. The role and importance of accounting information system in the context of digitalisation. Farabi Journal of Social Sciences 2019; 5(1): 64–73. https://doi.org/10.26577/CAJSH-2019-1-s8

27. Agostino D, Saliterer I, Steccolini I. Digitalisation, accounting and accountability: A literature review and reflections on future research in public services. Financial Accountability & Management 2022; 38(2): 152–176. https://doi.org/10.1111/faam.12301

28. Kovalevska N, Nesterenko I, Lutsenko O, Nesterenko O, Hlushach Y. Problems of accounting digitalisation in conditions of business processes digitalisation. Amazonia Investiga 2022; 11(56). https://doi.org/10.34069/AI/2022.56.08.14

29. Jans M, Aysolmaz B, Corten M, Joshi A, van Peteghem M. Digitalisation in accounting–Warmly embraced or coldly ignored? Accounting, Auditing & Accountability Journal 2022; 36(9): 61–85. https://doi.org/10.1108/AAAJ-11-2020-4998

30. Gulin D, Hladika M, Valenta I. Digitalisation and the Challenges for the Accounting Profession. Entrenova-Enterprise Research Innovation 2019; 5(1): 428–437. https://hrcak.srce.hr/clanak/365065

31. Kanimozhi V, Jacob T. Artificial Intelligence based Network Intrusion Detection with Hyper-Parameter Optimization Tuning on the Realistic Cyber Dataset CSE-CIC-IDS2018 using Cloud Computing. In 2019 International Conference on Communication and Signal Processing (ICCSP), Chennai, India; 2019; 33–36. https://doi.org/10.1109/ICCSP.2019.8698029

32. Shaukat K, Luo S, Varadharajan V, Hameed I, Xu M. A Survey on Machine Learning Techniques for Cyber Security in the Last Decade. IEEE Access 2020; 8. https://doi.org/10.1109/ACCESS.2020.3041951

33. Kryshtanovych M, Shulyar R, Svitlyk M, Zorya O, Fatiukha N. Theoretical and methodological approaches to the formation of a model for increasing the efficiency of the system for ensuring the economic security of a banking institution. Financial and Credit Activity: Problems of Theory and Practice 2023; 2(49): 56–64. https://doi.org/10.55643/fcaptp.2.49.2023.3994

FINANCING

The authors did not receive funding for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION:

Conceptualization: S. Matchuk, V. Havrylenko, I. Lukanovska, T. Kharkhalis, Ya. Ostapenko.

Data curation: S. Matchuk, V. Havrylenko, I. Lukanovska.

Formal analysis: S. Matchuk, V. Havrylenko, I. Lukanovska, T. Kharkhalis, Ya. Ostapenko.

Research: S. Matchuk, V. Havrylenko, I. Lukanovska, T. Kharkhalis, Ya. Ostapenko.

Methodology: S. Matchuk, V. Havrylenko, I. Lukanovska, T. Kharkhalis, Ya. Ostapenko.

Project management: T. Kharkhalis, Ya. Ostapenko.

Resources: S. Matchuk, V. Havrylenko, I. Lukanovska, T. Kharkhalis, Ya. Ostapenko.

Software: S. Matchuk, V. Havrylenko.

Supervision: I. Lukanovska, T. Kharkhalis.

Validation: Ya. Ostapenko.

Display: S. Matchuk.

Drafting – original draft: S. Matchuk, V. Havrylenko, I. Lukanovska, T. Kharkhalis, Ya. Ostapenko.

Writing – proofreading and editing: S. Matchuk, V. Havrylenko, I. Lukanovska, T. Kharkhalis, Ya. Ostapenko.