Category: Finance, Business, Management, Economics and Accounting

ORIGINAL

Measuring Financial Well-Being in Generation Z in Indonesia

Medición del bienestar financiero de la Generación Z en Indonesia

Sandra Rosalie Siregar1 ![]() *, Zulpahmi1

*, Zulpahmi1 ![]() *, Meita Larasati1

*, Meita Larasati1 ![]() *, Renalyn C. Enciso2

*, Renalyn C. Enciso2 ![]() *, Sumardi1

*, Sumardi1 ![]() *, Edi Setiawan1

*, Edi Setiawan1 ![]() *, Arif Widodo Nugroho1

*, Arif Widodo Nugroho1 ![]() *

*

1University of Muhammadiyah Prof. Dr. Hamka, Economics and Business. Jakarta, Indonesia.

2Central Luzon State University, Business Administration. Munoz Nueva Ecija, Phillipines.

Cite as: Siregar SR, Zulpahmi Z, Larasati M, C. Enciso R, Sumardi S, Setiawan E, et al. Measuring Financial Well-Being in Generation Z in Indonesia. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:.995. https://doi.org/10.56294/sctconf2024.995

Submitted: 07-02-2024 Revised: 03-05-2024 Accepted: 18-08-2024 Published: 19-08-2024

Editor: Dr.

William Castillo-González ![]()

Corresponding author: Sandra Rosalie Siregar *

ABSTRACT

Financial well-being is one of the elements of wellness that everyone aspires to pursuit the quality in their life. This topic has also been raised in several countries with various research subjects. However, in Indonesia only a few studies have examined financial well-being. This research aims to examine the influence of financial knowledge, financial behaviour, financial stress and financial socialization on the financial well-being of generation Z in Indonesia. By using non-purposive sampling technique, 461 respondents who live in Indonesia were collected. All respondents completed an online survey containing valid and reliable instruments. Data were analysed using SEM technique with Smart-PLS 4.0 as a tool for hypothesis testing. The results showed that financial knowledge and financial behaviour have no effect on financial well-being, while financial stress and financial socialization have a positive and significant effect on financial well-being.

Keywords: Financial Knowledge; Financial Behaviour; Financial Strain; Financial Socialization; Financial Well-Being.

RESUMEN

El bienestar financiero es uno de los elementos de bienestar a los que todo el mundo aspira para buscar la calidad en su vida. Este tema también se ha planteado en varios países con diversos temas de investigación. Sin embargo, en Indonesia sólo unos pocos estudios han examinado el bienestar financiero. Esta investigación pretende examinar la influencia de los conocimientos financieros, el comportamiento financiero, el estrés financiero y la socialización financiera en el bienestar financiero de la generación Z en Indonesia. Mediante una técnica de muestreo no intencional, se seleccionaron 461 encuestados residentes en Indonesia. Todos los encuestados rellenaron una encuesta en línea que contenía instrumentos válidos y fiables. Los datos se analizaron mediante la técnica SEM con Smart-PLS 4.0 como herramienta para la comprobación de hipótesis. Los resultados mostraron que los conocimientos financieros y el comportamiento financiero no tienen ningún efecto sobre el bienestar financiero, mientras que el estrés financiero y la socialización financiera tienen un efecto positivo y significativo sobre el bienestar financiero.

Palabras clave: Conocimientos Financieros; Comportamiento Financiero; Tensión Financiera; Socialización Financiera; Bienestar Financiero.

INTRODUCTION

The Covid-19 pandemic is a concrete evidence of the destabilization of the world economy, one of which is Indonesia.(1,2) The number of people affected by the Covid-19 pandemic has made them far from feeling secure in many aspects, especially in financial. Currently, the topic of financial well-being is frequently discussed among researchers in various countries.(3) Meanwhile, financial well-being is a situation where people have enough money to live a comfortable life at present and still have choices for their lives in the future.(4,5,6,7) To achieve financial well-being it requares knowledge and skills in the area in financial management. By managing financial resources properly, a person will be able to achieve financial well-being.(4,8,9) However, the study of financial well-being is an interdisciplinary discussion that involves not only researchers from financial economics aspect but also from the psychology aspect of society.

Indonesia is one of the country with a large population. In fact, the current total population of Indonesian is 278 696,2 million people.(10) Therefore approximately 78,94 million people were categorized as Generation Z or who were born in 1997–2012.(11) There is a survey that shows that 37 % of Generation Z is unaware of their financial.(12) Those results similar to the studies in 2020–2022 even having a high income does not guarantee having a better life than the previous generation.(13,14) On the other hand, the government continues to initiate financial literacy improvement programs to create a financially literate generation that has reached 49,68 % in 2022.(15) Financial well-being is a new field of study that is being conducted objectively.(16,17) However, the determinants of this complex concept are being narrowed down to particular individual predictors such as financial technology, financial attitude, financial behaviour(18), financial freedom, financial fragility(19), financial capability, financial knowledge, psychological factors(20), attitude towards money(21), financial socialization, financial self-efficacy, financial stress, Locus of Control(22) and many more.

Financial knowledge in many cases was the main factor that influences financial well-being.(23) In addition, financial knowledge as bridge to understanding financial terms and concepts in everyday life.(8) There are personal finance courses that can broaden participants' understanding that will help improve financial well-being.(24) This is in line with the researcher's statement in 2019(25) which states that through financial knowledge a person is able to manage his finances properly and correctly, so that financial well-being can be achieved. Therefore, financial behaviour is the main factor that affects financial well-being.(8) Nevertheless, financial behaviour comes from the mindset and knowledge that a person acquires in life. Good financial behaviour grows from good habits and it also born from thoughtful mind.(12) By practicing a proper financial behaviour, it implies that a person is able to apply their knowledge wisely because(2) shows good financial behaviour can be implemented in the optimising of financial knowledge.

There is also financial strain, which is a concept regarding to poverty except it slightly different from poverty according to Ray et al.(26) because financial strain describes how a person perceives their financial situation. Financial strain can be caused by a lack of understanding of the importance of well-managed finances. However only a few students have implemented personal financial management.(27) As a result, it has led to a low individual mentality towards money which is also a contributing factor to financial stress. Financial socialization is one of the variables used by.(28,29,30) Whereby financial socialization is an interaction that occurred by parents, friends, and others. According to the parents are primary source of financial socialization and have a significant role in enhancing financial knowledge.(31) By providing monthly money to their children, it becomes an important informal tool to develop their financial habits.(21) The development of financial habits comes from good financial knowledge and good behaviour, which drive to financial well-being.

This research used some variables such as financial knowledge, financial behaviour, financial strain and financial socialization to prove the effect of each variable on financial well-being. In addition, the sample of this research is Indonesian citizens who are identified as Generation Z. Those variables were used to measure how many of them has achieved financial well-being at productive age. Moreover, they are the main component of Indonesia “Golden Era” in 2045. Thus, it is expected to measure the success of Generation Z in preparing for its Golden Era also to increasing awareness of the important of knowledge, behaviour, stress and socialization in order to achieve financial well-being. Thus, numerous studies have examined Generation Z on financial well-being sphere, including Malaysia, Greece, United States, United Kingdom, Bangladesh, Estonia, Ghana, and other countries. Meanwhile in Indonesia there are only a few studies on financial well-being so throughout this research it can expanded the knowledge and may be used as a reference for further research in Indonesia and worldwide.

Financial well-being

According to Joo et al.(32) financial well-being is the key to influencing someone’s well-being. Someone who control their finances well maintain yet if their financial situation has been disturbed, it will eventually affect their psychological, emotional, and interpersonal well-being. The CFPB(33) Financial wellness known as the situation when a person can completely satisfy their current and ongoing financial responsibilities, be able to feel safe in their future finances, and is able to make choices to allow them to enjoy life. Arilia RA et al.(34) financial well-being is the condition of someone who able to afford their primary needs and still have leftover money, can manage their finances and feel financially safe. Based on those definitions, it can be summarized that financial well-being is a situation when someone has a sense of financial security both at present of primary needs until the future yet still have the choice to enjoy life.

Financial knowledge

Being aware of a financial concepts and having the capacity to managing the money to make wise financial decisions is known as financial knowledge.(35,36,37) Financial knowledge also one of the factors used as a foundation for achieving well-being. However, Balasubramnian B et al.(38) revealed that young adult who perceive themselves with "high" financial knowledge but bad literacy levels indicate to attract high-risk financial activities. Hence, having an adequate level of financial knowledge is a must for the youth.(39)

Renaldo N et al.(40) release that to increase the financial knowledge, people needs to build financial literacy as well as learn how to use financial instruments like insurance policies, investments, and budgeting. Knowing that interest rates, finance and credit charges, credit and credit interest rates, financial management, investment, and credit reports can help anyone with their financial knowledge, which varies based on their capacity.(41) Related to research by Sorgent et al.(3) there are various variables affected financial well-being but the most significant are financial knowledge and financial behaviour. Conforming to Riitsalu L et al.(42) with the right financial knowledge, attitudes and behaviour can improve someone’s well-being.

A research stating that women should have financial knowledge because they manage their money because the women will make financial decisions every day.(43) However, there are some research state that there are various factors that influence financial well-being such as trust in the government(44) formal financial services (high financial inclusion)(45) and so on.

Financial behaviour

According to Widyakto et al.(46) in the book(47) it was found that financial behaviour is a study that explains the pattern of individual behaviour in treating, managing, and using their financial resources. In additional to Yuniningsih(48) Financial behaviour is a science with a combination of theories from economics, psychology and sociology which are used to make a decision. Meanwhile, the actions of handling basic money matters, such as saving, spending, and even investing, may be applied to define financial behaviour.(49,50) There are several previous research that used financial behaviour on financial well-being from the perspective of young adult.(51,52) The young generation is used as the object of research because they have an important role as future leaders who will lead the world into more challenging situations in the future. It is essential for them to explore various skills, one of which is finance.

Currently, the financial behaviour of young generation in Indonesia may be considered poor due to the level of consumption and the use of online loans that continues to increase every year.(53,54) If this behaviour is not immediately fixed, it will lead financial downturn. Hence, good financial behaviour, especially by planning and saving regularly, can lead the younger generation to financial well-being.(55) However, there is a research states that long-term financial behaviour has negatively effected on financial well-being(56) because participants did not clearly express long-term goals and indicated the perceptions and interpretations of financial well-being would include specific saving or investment strategies. In addition, it is important to know the traits of financial behaviour and devising economic policies that may help in improving the financial well-being of the people, especially those in the low-income group.

Financial strain

Financial stress is the result of having less money and having to deal with complexity and general financial responsibilities.(57) It can be inferred that financial stress happens due to an inability to afford basic needs. Generally, those who has strong financial knowledge and socialization are able to adopt good financial behaviours, and decreasing their financial strain and more likely to lead them to financial well-being. Financial stress has an adverse impact on mental health. The recent results by PricewaterhouseCoopers (PwC) survey showed that 53 % of adult workers feel financial stress that affects their work performance and causes significant financial losses.(58) There are many financial challenges and stresses that employees face as an outcome of the high cost of living, instability income, and the increasing of money spending as a result of unclear financial goals.

Mokhtar N et al.(59) claimed that financial strain has positively effected on financial well-being. It was caused by the lower the income, the lower the financial pressure, the lower financial pressure, the higher financial well-being. Magli AS et al.(60) states that financial stress has negatively effected on household financial well-being. If the level of debt keep raising up every years and the knowledge of finance was low followed by the impulsive buying behaviour in society which caused by unrealistic goals they had it will drowning their financial stability and it will hard for people to reach their financial wel-being.(35,61,62)

Financial socialization

Financial socialization is an interaction of someone with their social environment, such as parents, educators, and friends that are important among young generations to optimize money and wealth.(63) Ameliawati M et al.(64) financial socialization is an insight that is shared with individuals to develop financial literacy. Therefore, financial socialization has an impact on financial behaviour, financial literacy, financial confidence and even financial well-being. It is a common phenomenon that the financial behaviour followed by individuals in their teenage years is the result of the financial attitudes and behaviour they learn from family, peers, and society.(29)

Financial socialisation is assumed to be a discussion between parents and children from infancy about saving, investment, financial instruments, financial planning and spending behaviour.(65,66) Sabri found that when parents trust their children with the primary purpose socialization will have beneficial long-term effect on their financial well-being, basic understanding of managing finances and financial behaviour forms.(39) Furthermore, as claimed by(67,68,69) the relationship between giving monthly money to youth can increase confidence in adulthood. Nevertheless, financial socialization is not only about managing finances but also improving standard, values, norms and attitudes that will prevent or even encourage financial capability among individuals to increase financial well-being.(29)

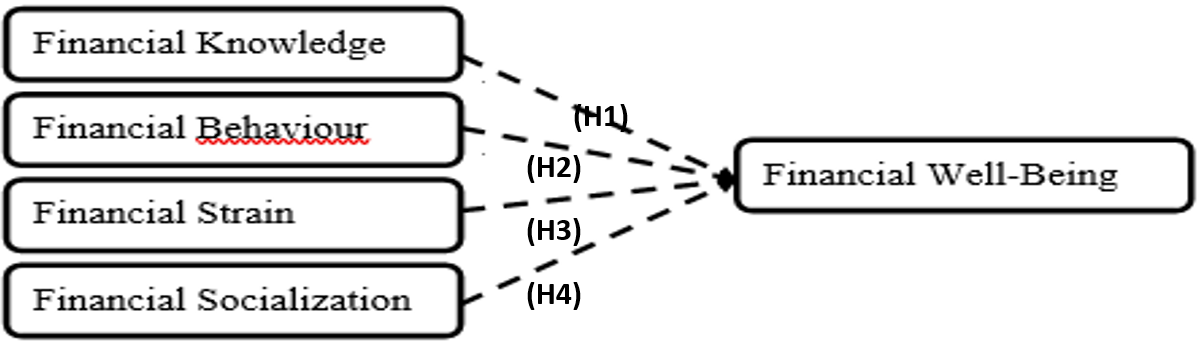

Based on the literature mentioned above, the reserach framework shown in figure 1:

Figure 1. Conceptual Framework

Figure 1 state the hypotheses of the research as follows:

H1: Financial knowledge has a positive influence on financial well-being.

H2: Financial behavior has a positive influence on financial well-being.

H3: Financial strain has a positive influence on financial well-being.

H4: Financial socialization has a positive influence on financial well-being.

METHOD

This research method uses quantitative methods with non-purposive and convenience sampling techniques. All data was collected by spreading online questionnaires form using Google forms. The source of the questionnaire statements contained in this study is from previous research.(70) All collected data will be processed using the Partial Least Squares Structural Equation Model (SEM-PLS) and SmartPLS version 4.0 as recommended by(71) which does not use distribution assumptions and maximises the variations described by the model developed.(72)

Sampling

This research used Hair theory on find the minimum respondents. Because of the number of the population is unknown and if the size of the sample was too much it found to be hard to set the right of the goodness of fit size. Therefore, Hair state the minimum size sample is between 5–10 observation for each estimated parameter. This study use scale 10 because this study use large scale society. Thus, the number of statement items(34) times 10 resulting the total sample 340 respondents with the margin error 10 % (error rate 10 % and 90 % correct rate).(73) There are 461 respondents was collected from various area in Indonesia which higher than the total minimum respondents. The criteria for respondents to this study are: a population aged 17 to 26, income, and willingness to participate in this study. A total of 461 samples were collected, containing 197 males and 264 females, 67,2 % of respondents were 21-25 years old, 50,3 % were undergraduates, 36,9 % were employees, and 33,2 % of respondents’ monthly income around 3 million and 5 million rupiah. Details of the respondent's demographic profile are shown in table 1.

Measures

In the financial knowledge variable, there are six statement items developed by Sabri(39) and being used in this research. On financial behaviour consists of seven statements. Then, there are seven statement in the financial strain variable. Followed by the next variable, namely financial socialization, there are nine statement items that are used as a benchmark for the financial influence of the closest environment such as parents. The final variable is financial well-being, which has five statement items adapted from the journal.(74) The respondents' answers were in the form of a Likert’s scale consisting of 1 (strongly disagree) to 5 (strongly agree).

|

Table 1. Respondents' demographic profile |

|||

|

Characteristics |

Frequency (n) |

% |

|

|

Gender |

Female |

264 |

57,3 |

|

|

Male |

197 |

42,7 |

|

Age |

17-21 |

106 |

23 |

|

|

22-25 |

310 |

67,2 |

|

|

26 |

45 |

9,8 |

|

Education Level |

SMA |

140 |

30,4 |

|

|

D3 |

80 |

17,4 |

|

|

S1 |

232 |

50,3 |

|

|

S2 |

9 |

2 |

|

Profession |

Employee |

169 |

36,7 |

|

|

Student |

170 |

36,9 |

|

|

Lecturer |

33 |

7,2 |

|

|

Police/Soldier |

16 |

3,5 |

|

|

Entrepreneur |

21 |

4,6 |

|

|

Civil Servant |

25 |

5,4 |

|

|

Others |

27 |

5,7 |

|

Monthly Income |

Rp. 1 000 000 - Rp. 2 000 000 |

137 |

29,7 |

|

|

Rp. 2 000 000 - Rp. 3 000 000 |

80 |

17,4 |

|

|

Rp. 3 000 000 - Rp. 5 000 000 |

153 |

33,2 |

|

|

Rp. 5 000 000 - Rp. 10 000 000 |

76 |

16,5 |

|

|

Up to Rp. 10 000 000 |

15 |

3,3 |

RESULTS

Discriminant Validity and Construct Reliability

The values of Crosbach's alpha in validity and reliability tests must be greater than 0,70. Values of 0,60 to 0,70 are acceptable in exploration studies, while in further studies, values between 0,70 and 0,90 can be considered satisfactory.(71) An average variance extracted (AVE) less than 0,50 indicates that there is a defect or error in a structure; an AVE 0,50 or higher indicates that the average structure has a good degree of convergent validity. In table 1 below, it can be seen that for discriminant validity and construct reliability, all existing items are above the recommended minimum value. Details of the Convergent Validity and Internal Consistency Reliability are shown in table 2.

|

Table 2. Convergent Validity and Internal Consistency Reliability |

||||||

|

Construct |

Item Code |

Outter Loading |

Cronbach's alpha |

Rho_a |

CR |

AVE |

|

FBV |

FBV1 |

0,789 |

0,868 |

0,867 |

0,899 |

0,561 |

|

|

FBV2 |

0,753 |

|

|

|

|

|

|

FBV3 |

0,802 |

|

|

|

|

|

|

FBV4 |

0,637 |

|

|

|

|

|

|

FBV5 |

0,798 |

|

|

|

|

|

|

FBV6 |

0,672 |

|

|

|

|

|

|

FBV7 |

0,776 |

|

|

|

|

|

FKN |

FKN1 |

0,690 |

0,824 |

0,833 |

0,871 |

0,531 |

|

|

FKN3 |

0,794 |

|

|

|

|

|

|

FKN4 |

0,674 |

|

|

|

|

|

|

FKN5 |

0,772 |

|

|

|

|

|

|

FKN6 |

0,689 |

|

|

|

|

|

|

FKN7 |

0,747 |

|

|

|

|

|

FST |

FST2 |

0,746 |

0,902 |

1,015 |

0,912 |

0,598 |

|

|

FST3 |

0,828 |

|

|

|

|

|

|

FST4 |

0,764 |

|

|

|

|

|

|

FST5 |

0,667 |

|

|

|

|

|

|

FST6 |

0,716 |

|

|

|

|

|

|

FST7 |

0,819 |

|

|

|

|

|

|

FST8 |

0,854 |

|

|

|

|

|

FSZ |

FSZ1 |

0,678 |

0,880 |

0,886 |

0,903 |

0,509 |

|

|

FSZ2 |

0,604 |

|

|

|

|

|

|

FSZ3 |

0,770 |

|

|

|

|

|

|

FSZ4 |

0,676 |

|

|

|

|

|

|

FSZ5 |

0,724 |

|

|

|

|

|

|

FSZ6 |

0,790 |

|

|

|

|

|

|

FSZ7 |

0,691 |

|

|

|

|

|

|

FSZ8 |

0,731 |

|

|

|

|

|

|

FSZ9 |

0,738 |

|

|

|

|

|

FWB |

FWB1 |

0,737 |

0,828 |

0,841 |

0,879 |

0,594 |

|

|

FWB2 |

0,855 |

|

|

|

|

|

|

FWB3 |

0,851 |

|

|

|

|

|

|

FWB4 |

0,686 |

|

|

|

|

|

|

FWB5 |

0,709 |

|

|

|

|

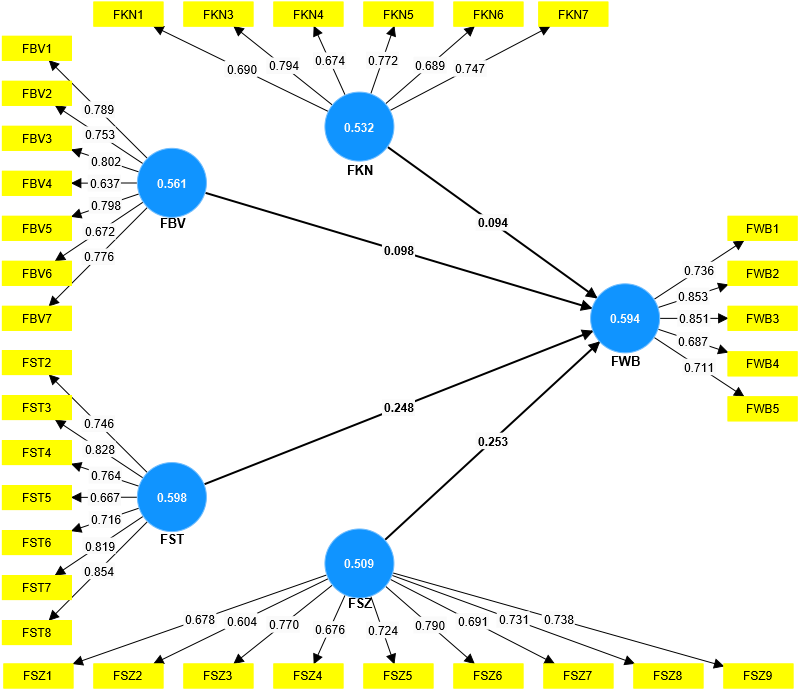

Figure 2. PLS-PATH Model

Discriminant validity : hetertrait-monotrait (htmt)

HTMT values above 0,90 indicate a lack of discriminant validity.(71) For each construct in this study, it was found that the value of the heterotrait-monotrait test results was below 0,90. The highest value of the construct from the HTMT test results is 0,765. These results indicate that, through the heterotrait-monotrait (HTMT) test, all items in this study meet the recommended discriminant validity standards. Similar to Fornell-Larker criteration a measurement that compares the square root of the AVE value with the latent variable relationship. Thus, the square root value of each AVE construct must be greater than its correlation value with other constructs. Hence, the Fornell-Lecker value should be up to 0,50(75) and the highest value of the construct from Fornell-Lecker test is 0,773. Details of the Discriminant Validity: Hetertrain-Monotrait (HTMT) and Fornell-Lecker are shown in table 3.

|

Table 3. Fornell Lecker |

|||||

|

FBV |

FKN |

FST |

FSZ |

FWB |

|

|

FORNELL LECKER-CRITERION |

|||||

|

FBV |

0,749 |

|

|

|

|

|

FKN |

0,646 |

0,729 |

|

|

|

|

FST |

0,390 |

0,367 |

0,773 |

|

|

|

FSZ |

0,681 |

0,563 |

0,463 |

0,713 |

|

|

FWB |

0,427 |

0,391 |

0,437 |

0,487 |

0,771 |

|

DISCRIMINANT VALIDITY (HTMT) |

|||||

|

FBV |

|

|

|

|

|

|

FKN |

0,765 |

|

|

|

|

|

FST |

0,410 |

0,404 |

|

|

|

|

FSZ |

0,776 |

0,652 |

0,529 |

|

|

|

FWB |

0,493 |

0,456 |

0,375 |

0,540 |

|

Structure Evaluation Model

Evaluation of the structural model is related to hypothesis testing of the influence between research variables. The structural model evaluation test consists of examining the absence of multicollinearity between variables with an Inner VIF (Variance Inflacted Factor) size below 5, hypothesis testing and 95 % confidence interval of estimated path coefficient parameters, the effect of direct variables at the structural level, namely the direct effect with the size of F square.(75)

R-square test

From the results of the R-square testing, correlation values between independent variables and dependent variables were 0,31 or 31 %. It can be stated that there are other factors which has influence up to 69 %. According to(76) that R-square value identified as good if the value is around 0,33 up to 0,67, moderate if it is more than 0,19 up to 0,33 and if the value is lower than 0,19 it is identified as low. Q square result is 0,283 which means that the model has predictive relevance(75), the SRMR value of 0,090 is still acceptable.(77) There are also evaluation results on the structural model showing that the model is acceptable, namely there is no multicollinearity between variables indicated by VIF <5. In addition, the result also showed low to moderate predictive power of the exogenous variables for the endogenous variables (R2 = 0,31; Q2 predict = 0,28).

|

Table 4. Structure Evaluation Model (SEM) |

||||||

|

|

VIF |

F-Square |

R2 |

R2 adjusted |

Q² predict |

SRMR |

|

FBV -> FWB |

2,309 |

0,006 |

0,310 |

0,304 |

0,283 |

0,090 |

|

FKN -> FWB |

1,825 |

0,007 |

||||

|

FST -> FWB |

1,305 |

0,068 |

||||

|

FSZ -> FWB |

2,112 |

0,044 |

||||

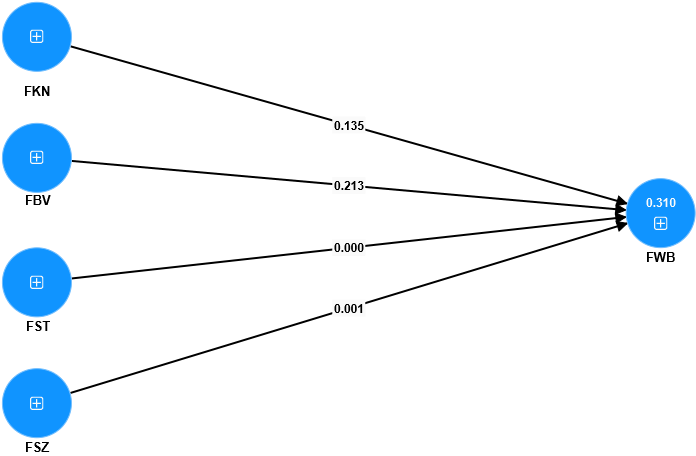

Hypothesis

All the tests carried out using Smart PLS 4.0, the results obtained are that each hypothesis shows a value. First, financial knowledge on financial well-being had β=0,098 a T-statistics value of 1,245 with a P-value of 0,135. Second, financial behaviour towards financial well-being has a T-statistics value of 1,494 and a P-value of 0,213. Third, financial strain towards financial well-being has a T-statistics value of 4,801 and a P-value of 0,000. Lastly, financial socialization versus financial well-being has a T-statistics value of 3,359 with a p-value of 0,001.

Figure 3. Hypotesis PLS-Path Model

|

Table 5. Hypothesis Test |

||||

|

(β) |

Standard Deviation |

T Statistics |

P Values |

|

|

0,098 |

0,101 |

1,245 |

0,135 |

|

|

0,094 |

0,098 |

1,494 |

0,213 |

|

|

FST -> FWB |

0,248 |

0,255 |

4,801 |

0,000 |

|

FSZ -> FWB |

0,253 |

0,249 |

3,359 |

0,001 |

In addition, The results of the total effect model assessment as shown in Table 5 indicate a strong but insignificant positive relationship between financial knowledge and financial well-being (β = 0,098, t-value = 1,245, p = 0,135), financial behavior and financial well-being (β = 0,094, t-value = 1,494, p = 0,001). Thus, hypotheses H1 and H2 cannot be accepted. On the other hand, financial strain and financial well-being show a positive and significant relationship (β = 0,450, t-value = 7,439, p = 0,000), as well as financial socialization and well-being (β = 0,253, t-value = 3,359, p = 0,001). Then, hypotheses H3 and H4 accepted.

DISCUSSION

From the research, the hypothesis of financial knowledge on financial well-being shows that it has no effect on financial well-being. It means that the first hypothesis (H1) was rejected. There are some researches that has similar results such as(42,78) claimed that financial knowledge has no effect on financial well-being. This phenomenon happened because a person has financial experience which fosters awareness of money management. However, contradictive results was shown by Lusardi A(79) financial knowledge is closely linked to financial well-being. Similar to these researchers(8,12,26,80,81) because young adults who were working on enhanching their levels of knowledge in finance will have a better confidence and ability to implement the information into action to make wise financial decisions in real-life situations. This is due to a better understanding of the financial responsibilities they have to fulfill over time. Therefore, those who has lack of financial knowledge need to be pushed on increasing financial knowledge in order to understand how the money works to reach financial well-being.

Apparently, financial behaviour also has no effect on financial well-being. It means the second hypothesis (H2) was also rejected. This can happen when someone has an excessive level of consumption without self-control. Hence, it can adverse impact on financial wellness. Nowadays, the lifestyles of society was beyond their capabilities and unpracticed proper financial behaviors. The results of financial behaviour are in line with(82) because saving methods, insurance programs, paying loans on time, etc. are not the only measures in improving financial well-being. However, investment is well-known by most of the young generation but not all of them are understand how to invest their money and how the money work for them. Thus, it makes some people are loss amount of money in it.

Meanwhile, those who have positive financial behaviors throughout their lives are more likely to have a better financial future. According to(42,57,62,78,83,84,85) financial behaviour has positive effect on financial well-being. Creating a personal budget as prioritize spending money, and not making compulsive purchases in order to encourage wisdom in spending money. As a result, these actions will make students feel secure with their finances and be able to achieve financial well-being.

On the other hand, the effect of financial strain on financial well-being positively significant which means the third hypothesis (H3) was accepted. This is similar to a research done by.(86) In Indonesia there are some people who had lower income but are able to reach financial well-being. By having enough knowledge and managing their income properly based on their income those people can slowly reach their financial well-being but still may afford the basic need at the same time. On the other side, there is also a social phenomenon that those who ware working as scavengers and beggars which identics of having finance difficulities tend to invite emphaty to some pople in society which lead them to give amount of money to the scavengers and/or beggars whereas in fact those scavengers and beggars are having a house and vehicle. Although, there are also some contrary results that claimed financial strain has negative effect on financial well-being.(39,57,62,87) The study by Kurnia declare the influence of financial pressure on financial well-being produces a negative influence because there are other factors such as budgeting, investment and other problems.(88)

Parents who acknowledge proper financial example from an early age can give birth to young adults who are more confident in managing their personal funds.(89,90) This study showed that in financial education, the aspect of implicit financial socialization should be given more attention. By establishing educational tools from the conceptual scales used in this study is one way that might help draw implicit socialization into a more explicit domain for parents and emerging adults. Practice with this tool could include further communication of important financial issues and clarification. That results are in line with previous research revealed that there is an indirect effect of the quality of family communication on young people's financial well-being depending on the extent to which they model their parents' financial behavior.(65,83) This suggests that not only communication about finances is important, but also the quality of communication, for young adults' financial development. However Ullah Set al.(29) obtained different results where financial socialization, which was influenced by parents has no significant effect on financial well-being. Perhaps, the financial socialization though peers are significant than either through parent or even a teacher.

CONCLUSION

This research discovery various variables that have been tested for their influence on financial well-being, including financial knowledge, financial behaviour, financial strain, and financial socialization, where generation Z in Indonesia is the target. This was done to find out which variables influence the most. The research shows that several variables, including financial knowledge and financial behaviour, not significantly influence the achievement of financial well-being of generation Z in Indonesia. Therefore, in order to increasing the knowledge and on finance for reaching the financial well-being, people need to realize that by allocate 10 % of income for emergency situation is a must due to the unexpected situation and also by keep up the bills after spending the money may help people to managing their expense and keep on track shopping list. However, there are other variables that has the most significant influence on financial well-being, namely financial strain followed by financial socialization. It is because most of the respondent were having less pressure on their financial situation and knew how to be a good consumers.

This research can be utilized by educational institutions needs to increased support for students who have not yet achieved financial well-being. By providing scholarships and job opportunities in a wide range of sectors might help students to have skills. For the policymakers, this can be used as a reference to improve policies to raise the importance of proper money management from an early age. In this case, the government can develop educational programs for parents and children. For generation Z who have not yet achieved financial well-being, to continue digging and implement financial knowledge everyday life. The use of credit cards can also be taken, but it must also be balanced with appropriate literature so as not to get stuck in debt, which leads to financial pressure. But the discipline that has been improved in financial management so that the allocation of funds can be monitored and controlled, young adult needs to do so in order to ensure their financial well-being in the future.

Implication

There are some shortcomings in this research. First, the total influence of variable on achievement of a someone financial well-being was low. It means there are other variables which has more influence is expected to be used further research on financial well-being. Secondly, the questionnaire distribution was broad so in the future it is expected to use more specific areas and be able to conduct data comparisons. Thirdly, this study only focused on generation Z, which was the only subject of the study. In the future, the researchers hope that the next target respondents from the two generations will be able to compare which generation is better off in terms of financial well-being.

BIBLIOGRAPHIC REFERENCES

1. Lavonda P, Ignatius Roni S, Ekadjadja M. Determinants of Financial Well-Being Among Young Workers in Jakarta During the Covid-19 Pandemic. Jurnal Ekonomi. 2021.18;26(2):295.

2. Yuesti A, Rustiarini NW, Suryandari NNA. Financial literacy in the covid-19 pandemic: Pressure conditions in indonesia. Entrepreneurship and Sustainability Issues. 2020;8(1):884–98.

3. Fan L, Henager R. A Structural Determinants Framework for Financial Well-Being. J Fam Econ Issues. 2022 Jun 1;43(2):415–28.

4. Arilia RA, Lestari W. Peran self control sebagai mediasi literasi keuangan dan kesejahteraan keuangan wanita karir. Journal of Business and Banking. 2022 Sep 20;12(1):69.

5. Lindiawati, Lestari W, Lestari S. The Role of Financial Behavior in Developing Financial Well-Being Among Career Women in East Java. Vilnius Gediminas Technical University. 2023;21(1).

6. Prendergast S, Blackmore D, Kempson E, Russell R, Kutin J. Financial well-being, A survey of adults in Australia. ANZ Melbourne. 2018.

7. West T, Cull M, Johnson D. Income more important than financial literacy for improving wellbeing. Academy of Financial Services. 2021;29(3):187–207. https://academyfinancial.org/Journal-Access

8. Iramani R, Lutfi L. An integrated model of financial well-being: The role of financial behavior. Accounting. 2021;7(3):691–700.

9. Marpaung O. Bijak Mengelola Keuangan Keluarga Kunci Keluarga Sejahtera. Abdimas Universal. 2021;3(1):50–4.

10. BPS - Statistics I. bps.go.id. 2023. Jumlah Penduduk Pertengahan Tahun (Ribu Jiwa), 2021-2023. https://www.bps.go.id/indicator/12/1975/1/jumlah-penduduk-pertengahan-tahun.html

11. BPS. Hasil Sensus Penduduk 2020-2021. https://demakkab.bps.go.id/news/2021/01/21/67/hasil-sensus-penduduk-2020.html

12. Renaldo N, Sudarno S, Marice HBr. The Improvement of Generation Z Financial Well-Being in Pekanbaru. Jurnal Manajemen dan Kewirausahaan. 2020 Sep 1;22(2):142–51.

13. Bachtiar Y, Koroy RT, Akbar M, Nastiti R, Normalina, Syahdan SA, et al. Edukasi Financial Capability: Mempersiapkan Generasi Muda Mencapai Financial Well-Being. Abdimas Universal. 2022;4(2):186–90.

14. Mubarokah S, Rita MR. Anteseden Perilaku Konsumtif Generasi Milenial: Peran Gender Sebagai Pemoderasi. International Journal of Social Science and Business. 2020;4(2):211–20.

15. OJK. Infografis Hasil Survei Nasional Literasi dan Inklusi Keuangan Tahun 2022. https://ojk.go.id/id/berita-dan-kegiatan/info-terkini/Pages/Infografis-Survei-Nasional-Literasi-dan-Inklusi-Keuangan-Tahun-2022.aspx

16. Collins MJ, Urban C. Measuring financial well-being over the lifecourse. European Journal of Finance. 2020;26(4–5):341–59.

17. Sehrawat K, Vij M, Talan G. Understanding the Path Toward Financial Well-Being: Evidence From India. Front Psychol. 2021;12(July).

18. Chavali K, Mohan Raj P, Ahmed R. Does Financial Behavior Influence Financial Well-being? Journal of Asian Finance, Economics and Business. 2021;8(2):273–80.

19. Philippas ND, Avdoulas C. Financial literacy and financial well-being among generation-Z university students: Evidence from Greece. European Journal of Finance. 2020 Mar 23;26(4–5):360–81.

20. Mahendru M. Financial well-being for a sustainable society: a road less travelled. Emerald Insight. 2020;16(3–4):572–93.

21. Utkarsh, Pandey A, Ashta A, Spiegelman E, Sutan A. Catch them young: Impact of financial socialization, financial literacy and attitude towards money on financial well-being of young adults. Int J Consum Stud. 2020;44(6):531–41.

22. Mansor M, Sabri MF, Mansur M, Ithnin M, Magli AS, Husniyah AR, et al. Analysing the Predictors of Financial Stress and Financial Well-Being among the Bottom 40 Percent (B40) Households in Malaysia. Int J Environ Res Public Health. 2022;19(19):12490.

23. Kurniawati AA, Lestari HS. Faktor-Faktor yang Mempengaruhi Financial Well-Being. Jurnal Ilmiah Manajemen Bisnis dan Inovasi Universitas Sam Ratulangi (JMBI UNSRAT). 2022:1577–98.

24. Wagner J. Financial Education and Financial Literacy by Income and Education Groups. Journal of Financial Counseling and Planning. 2019; (1):132–41.

25. Aulia N, Yuliati LN, Muflikhati I. Kesejahteraan Keuangan Keluarga Usia Pensiun: Literasi Keuangan, Perencanaan Keuangan Hari Tua, dan Kepemilikan Aset. Jurnal Ilmu Keluarga dan Konsumen. 2019 (1):38–51.

26. Sabri MF, Anthony M, Wijekoon R, Suhaimi SSA, Abdul Rahim H, Magli AS, et al. The Influence of Financial Knowledge, Financial Socialization, Financial Behaviour, and Financial Strain on Young Adults’ Financial Well-Being. International Journal of Academic Research in Business and Social Sciences. 2021;11(12):1–16.

27. Rachmawati N, Nuryana I. Peran Literasi Keuangan dalam Memediasi Pengaruh Sikap Keuangan, dan Teman Sebaya terhadap Perilaku Pengelolaan Keuangan. Economic Education Analysis Journal. 2020;9(1):166–81.

28. Rea JK, Danes SM, Serido J, Borden LM, Shim S. “Being Able to Support Yourself”: Young Adults’ Meaning of Financial Well-Being Through Family Financial Socialization. J Fam Econ Issues. 2019;40(2):250–68.

29. Ullah S, Yusheng K. Financial Socialization, Childhood Experiences and Financial Well-Being: The Mediating Role of Locus of Control. Front Psychol. 2020;1–11.

30. Utkarsh, Pandey A, Ashta A, Spiegelman E, Sutan A. Catch them young: Impact of financial socialization, financial literacy and attitude towards money on financial well-being of young adults. Int J Consum Stud. 2020;44(6):531–41.

31. Agnew S, Maras P, Moon A. Gender differences in financial socialization in the home—An exploratory study. Int J Consum Stud. 2018;42(3):275–82.

32. Tahir MS, Ahmed AD, Richards DW. Financial literacy and financial well-being of Australian consumers: a moderated mediation model of impulsivity and financial capability. International Journal of Bank Marketing. 2021;39(7):1377–94.

33. CFPB. Financial well-being: The goal of financial education. 2019.

34. Arilia RA, Lestari W. Peran self control sebagai mediasi literasi keuangan dan kesejahteraan keuangan wanita karir. Journal of Business and Banking. 2022;12(1):69.

35. Mansor M, Sabri MF, Mansur M, Ithnin M, Magli AS, Husniyah AR, et al. Analysing the Predictors of Financial Stress and Financial Well-Being among the Bottom 40 Percent (B40) Households in Malaysia. Int J Environ Res Public Health. 2022;19(19).

36. Chong KF, Sabri MF, Magli AS, Rahim HA, Mokhtar N, Othman MA. The Effects of Financial Literacy, Self-Efficacy and Self-Coping on Financial Behavior of Emerging Adults. Journal of Asian Finance, Economics and Business. 2021;8(3):905–15.

37. Hazudin SF, Tarmuji NH, Kader MARA, Majid AA, Aziz NNA, Ishak M. The relationship between previous mathematics performance, and level of financial literacy and financial well-being of university students. Mathematical Sciences as the Core of Intellectual Excellence (SKSM25). 2018;1974(July).

38. Balasubramnian B, Sargent CS. Impact of inflated perceptions of financial literacy on financial decision making. J Econ Psychol. 2020;80(July):102306. https://doi.org/10.1016/j.joep.2020.102306

39. Sabri MF, Anthony M, Wijekoon R, Suhaimi SSA, Abdul Rahim H, Magli AS, et al. The Influence of Financial Knowledge, Financial Socialization, Financial Behaviour, and Financial Strain on Young Adults’ Financial Well-Being. International Journal of Academic Research in Business and Social Sciences. 2021 Dec 18;11(12):1–16.

40. Renaldo N, Sudarno S, Marice HBr. The Improvement of Generation Z Financial Well-Being in Pekanbaru. Jurnal Manajemen dan Kewirausahaan. 2020 Sep 1;22(2):142–51.

41. Arifin ZA. Influence factors toward financial satisfaction with financial behavior as intervening variable on Jakarta area workforce. European Research Studies Journal. 2018. XXI (1):90–103.

42. Riitsalu L, Murakas R. Subjective financial knowledge, prudent behaviour and income: The predictors of financial well-being in Estonia. International Journal of Bank Marketing. 2019. 37(4):934–50.

43. Khotimah K, Isbanah Y. Demografi, Faktor Individu, dan Literasi Keuangan Wanita Karir di Surabaya. Jurnal Ilmu Manajemen. 2019;7(2).

44. Barrafrem K, Västfjäll D, Tinghög G. Financial well-being, COVID-19, and the financial better-than-average-effect. J Behav Exp Finance. 2020. https://doi.org/10.1016/j.jbef.2020.100410

45. Nandru P, Chendragiri M, Velayutham A. Examining the influence of financial inclusion on financial well-being of marginalized street vendors: an empirical evidence from India. Int J Soc Econ. 2021;48(8):1139–58.

46. Widyakto A, Liyana ZW, Rinawati T. The influence of financial literacy, financial attitudes, and lifestyle on financial behavior. Diponegoro International Journal of Business. 2022;5(1):33–46.

47. Boy Singgih Gitayuda M. Manajemen Keuangan Perspektif Financial Management Behavior Pada Mahasiswa Penerbit Cv.Eureka Media Aksara. 1st ed. Dwi Winarni, S.E., M.Sc. A, editor. Purbalingga: EUREKA MEDIA AKSARA; 2023.

48. Yuniningsih. Perilaku Keuangan Dalam Berinvestasi . Vol. 2, Jurnal Keuangan. Indomedia Pustaka; 2020. 14–15 p. http://repository.upnjatim.ac.id/54/1/perilaku_keuangan.pdf

49. Mukmin, Gunawan A, Arif M, Jufrizen. Construct validity of financial literacy for University Students. Jurnal Ilmiah Manajemen Dan Bisnis. 2021;22(2):291–303: http://jurnal.umsu.ac.id/index.php/mbisnis291-303

50. Siregar QR, Simatupang J. The Influence of Financial Knowledge, Income, and Lifestyle on Financial Behavior of Housewives at Laut Dendang Village. Journal of International Conference Proceedings. 2022;5(2):646–54. https://doi.org/10.32535/jicp.v5i2.1850

51. Sabri MF, Abd Rahim H, Wijekoon R, Zakaria NF, Magli AS, Reza TS. The Mediating Effect of Money Attitude on Association Between Financial Literacy, Financial Behaviour, and Financial Vulnerability. International Journal of Academic Research in Business and Social Sciences. 2020;10(15).

52. Lanz M, Sorgente A, Danes SM. Implicit Family Financial Socialization and Emerging Adults’ Financial Well-Being: A Multi-Informant Approach. Emerging Adulthood. 2019;8(6):443–52.

53. Mumtaz ZA, Dharta FY, Oxcygentri O. Fenomena Belanja Online Dikalangan Mahasiswa Bekasi Penonton Tayangan #Racuntiktok. Nusantara: Jurnal Ilmu Pengetahuan Sosial. 2022;9(8):2–2. http://jurnal.um-tapsel.ac.id/index.php/nusantara/index

54. Sazali H, Rozi F. Belanja Online dan Jebakan Budaya Hidup Digital pada Masyarakat Milenial. JURNAL SIMBOLIKA: Research and Learning in Communication Study. 2020 Oct 30;6(2):85–95.

55. She L, Rasiah R, Turner JJ, Guptan V, Sharif Nia H. Psychological beliefs and financial well-being among working adults: the mediating role of financial behaviour. Int J Soc Econ. 2021;49(2):190–209.

56. Fan L, Henager R. A Structural Determinants Framework for Financial Well-Being. J Fam Econ Issues. 2022;43(2):415–28.

57. Rahman M, Isa CR, Masud MM, Sarker M, Chowdhury NT. The role of financial behaviour, financial literacy, and financial stress in explaining the financial well-being of B40 group in Malaysia. Future Business Journal. 2021 Dec;7(1).

58. PWC. “PwC’s 9th annual employee financial wellness survey COVID-19 update”. 2020. https://www.pwc.com/us/en/industries/private-company-services/images/pwc-9th-annual-employee-financial-wellness-survey-2020.pdf

59. Mokhtar N, Husniyah AR. Determinants of Financial Well-Being among Public Employees in Putrajaya, Malaysia. Pertanika J Soc Sci & Hum. 2017;25(3):1241–60.

60. Magli AS, Sabri MF, Rahim HA, Othman MA, Mahzan NSA, Satar NM, et al. Mediation effect of financial behaviour on financial vulnerability among b40 households. Malaysian Journal of Consumer and Family Economics. 2021;27(S1):191–217.

61. Prakash N, Alagarsamy S, Hawaldar A. Demographic characteristics influencing financial wellbeing: a multigroup analysis. Managerial Finance. 2022 Sep 9;48(9–10):1334–51.

62. Shwu-Fang C, Ab-Rahim R. Measuring Financial Wellness Of The Malaysian Employees. UNIMAS Review of Accounting and Finance. 2020;4(1).

63. Danes SM. Parental perceptions of children’s financial socialization. Journal of Financial Counseling and Planning. 1994;5:127–49.

64. Ameliawati M, Setiyani R. The Influence of Financial Attitude, Financial Socialization, and Financial Experience to Financial Management Behavior with Financial Literacy as the Mediation Variable. KnE Social Sciences. 2018 3(10):811.

65. Utkarsh, Pandey A, Ashta A, Spiegelman E, Sutan A. Catch them young: Impact of financial socialization, financial literacy and attitude towards money on financial well-being of young adults. Int J Consum Stud. 531–41.

66. Vosylis R, Klimstra T. How Does Financial Life Shape Emerging Adulthood? Short-Term Longitudinal Associations Between Perceived Features of Emerging Adulthood, Financial Behaviors, and Financial Well-Being. Emerging Adulthood. 2022(1):90–108.

67. Cherney K, Rothwell D, Serido J, Shim S. Subjective Financial Well-Being During Emerging Adulthood: The Role of Student Debt. Sage Journals. 2020;8(6):485–95.

68. Sansone D, Rossi M, Fornero E. “Four Bright Coins Shining at Me”: Financial Education in Childhood, Financial Confidence in Adulthood. Journal of Consumer Affairs. 2019;53(2):630–51.

69. Sirsch U, Zupančič M, Poredoš M, Levec K, Friedlmeier M. Does Parental Financial Socialization for Emerging Adults Matter? The Case of Austrian and Slovene First-Year University Students. Sage Journals. 2019;8(6):509–20.

70. Latan H, Chiappetta Jabbour CJ, Lopes de Sousa Jabbour AB. Ethical Awareness, Ethical Judgment and Whistleblowing: A Moderated Mediation Analysis. Journal of Business Ethics. 2019;155(1):289–304.

71. Hair JFH, Risher JJ, Sarstedt M, Ringle CM. The Results of PLS-SEM Article information. Emerald Insight. 2019;31(1):2–24.

72. Pahlevan Sharif S, Naghavi N, Sharif Nia H, Waheed H. Financial literacy and quality of life of consumers faced with cancer: a moderated mediation approach. International Journal of Bank Marketing. 2020;38(5):1009–31.

73. Hair JF, Howard MC, Nitzl C. Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. J Bus Res. 2020 Mar 1;109:101–10.

74. She L, Rasiah R, Turner JJ, Guptan V, Sharif Nia H. Psychological beliefs and financial well-being among working adults: the mediating role of financial behaviour. Int J Soc Econ. 2022 Jan 12;49(2):190–209.

75. Hair JFH, Risher JJ, Sarstedt M, Ringle CM. The Results of PLS-SEM Article information. Emerald Insight. 2019;31(1):2–24.

76. Chin W MG. The Partial Least Squares Approach to Structural Formula Modeling. Mahwah, NJ: Lawrence Erlbaum Associates. 1998;8.

77. Hair JF, Black WC, Babin BJ, Anderson RE. Multivariate data analysis (8th edition). 8th ed. Mason: Cengage; 2018.

78. Lindiawati, Lestari W, Lestari S. The Role of Financial Behavior in Developing Financial Well-Being Among Career Women in East Java. Vilnius Gediminas Technical University . 2023;21(1). https://creativecommons.

79. Lusardi A. Financial literacy and the need for financial education: evidence and implications. Swiss J Econ Stat. 2019 Dec 1;155(1):1–8.

80. Butar IDB, Pangaribuan CH, Puteri OY, Setiono B, Belda YR. A Study on Financial Well-Being of Indonesian Millennials Predicting stock returns View project A Study on Financial Well-Being of Indonesian Millennials. The European Journal of Finance. 2019;

81. Sumani, Roziq A. Financial Literation: Determinants of Financial Well-Being in the Batik Small and Medium Industries in East Java. Journal of Applied Management (JAM). 2020;18(2):289–99.

82. Sumani, Roziq A. Financial Literation: Determinants of Financial Well-Being in the Batik Small and Medium Industries in East Java. Journal of Applied Management (JAM). 2020;18(2):289–99. http://dx.doiorg/10.21776/ub.jam.2020.018.02.

83. Sabri MF, Wahab R, Mahdzan NS, Magli AS, Rahim HA. Mediating Effect of Financial Behaviour on the Relationship Between Perceived Financial Wellbeing and Its Factors Among Low-Income Young Adults in Malaysia. Front Psychol. 2022;13.

84. Setiyani R, Solichatun I. Financial Well-being of College Students: An Empirical Study on Mediation Effect of Financial Behavior. KnE Social Sciences. 2019 Mar 24;3(11):451.

85. Yuliani Y. The Effect of Financial Knowledge on Financial Literacy with Mediated by Financial Behavior in Society of Palembang City South Sumatera. Mix Jurnal Ilmiah Manajemen. 2019;9(3):421.

86. Mokhtar N, Husniyah AR. Determinants of Financial Well-Being among Public Employees in Putrajaya, Malaysia. Pertanika J Soc Sci & Hum. 2017;25(3):1241–60.

87. Fan L, Henager R. A Structural Determinants Framework for Financial Well-Being. J Fam Econ Issues. 2022 Jun 1;43(2):415–28.

88. Kurniawati AA, Lestari HS. Faktor-Faktor yang Mempengaruhi Financial Well-Being. Jurnal Ilmiah Manajemen Bisnis dan Inovasi Universitas Sam Ratulangi (JMBI UNSRAT). 2022;9:1577–98.

89. Friedline T, Elliott W, Chowa GAN. Testing an asset-building approach for young people: Early access to savings predicts later savings. Econ Educ Rev. 2013;33:31–51.

90. Sirsch U, Zupančič M, Poredoš M, Levec K, Friedlmeier M. Does Parental Financial Socialization for Emerging Adults Matter? The Case of Austrian and Slovene First-Year University Students. Sage Journals. 2019;8(6):509–20.

FINANCING

No financing.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Sandra Rosalie Siregar, Zulpahmi, Meita Larasati, Renalyn C. Enciso.

Data curation: Sumardi, Edi Setiawan, Arif Widodo Nugroho.

Formal analysis: Sandra Rosalie Siregar, Zulpahmi, Meita Larasati, Renalyn C. Enciso.

Acquisition of funds: Zulpahmi, Sumardi.

Research: Sandra Rosalie Siregar, Zulpahmi, Meita Larasati, Renalyn C. Enciso.

Methodology: Sumardi, Edi Setiawan.

Project management: Zulpahmi, Meita Larasati.

Resources: Sandra Rosalie Siregar, Zulpahmi, Meita Larasati, Renalyn C. Enciso.

Software: Arif Widodo Nugroho.

Supervision: Zulpahmi, Meita Larasati, Renalyn C. Enciso.

Validation: Zulpahmi, Meita Larasati, Renalyn C. Enciso.

Display: Sandra Rosalie Siregar.

Drafting - original draft: Sumardi, Edi Setiawan.

Writing - proofreading and editing: Edi Setiawan, Arif Widodo Nugroho.