doi: 10.56294/sctconf2024.1175

ORIGINAL

Choosing a securities brokerage on the stock market: the risk governance perspective

Elección de una correduría de valores en el mercado de valores: la perspectiva de la gobernanza del riesgo

Duy Thuan Dao1

![]() , Luu Nguyen Phu1

, Luu Nguyen Phu1

![]() , Cao Minh Tien1

, Cao Minh Tien1

![]() *

*

1Academy of Finance. Vietnam.

Cite as: Thuan Dao D, Nguyen Phu L, Minh Tien C. Choosing a securities brokerage on the stock market: the risk governance perspective. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:.1175. https://doi.org/10.56294/sctconf2024.1175

Submitted: 26-02-2024 Revised: 02-06-2024 Accepted: 06-09-2024 Published: 07-09-2024

Editor:

Dr.

William Castillo-González ![]()

Corresponding Author: Cao Minh Tien *

ABSTRACT

Introduction: the role of a securities company is demonstrated through operations such as brokerage, investment consulting and portfolio management for investors. Therefore, investors’ decisions in choosing a securities company affect the profitability and risks of their investment activities.

Objetive: the research objective is to clarify the factors that determine investors’ choice of stock brokers as securities companies in Vietnam’s stock market.

Method: the data sample was collected by the author in an online survey from 250 individual and institutional stock investors from January 2023 to December 2023. Conducted through multivariate quantitative regression research method on SPSS 20 software.

Results: the article has identified 6 factors that influence the decision to choose a stock broker as a securities company, including: (1) Modern technical facilities, modern core software ( VCCKT); (2) Company size (QMCT); (3) Quality of consulting staff (NVTV); (4) Type of specialized/multi-function securities company (CDDN); (5) Relationship (MQH); (6) Brand marketing (MTMK).

Conclusions: based on the research results, the authors have recommended solutions for securities companies in expanding market share of securities investors such.

Keywords: Stock Market Investors; Vietnamese Stock Market; Vietnamese Securities Companies; Customers; Market.

RESUMEN

Introducción: el papel de una sociedad de valores se demuestra a través de operaciones como el corretaje, la consultoría de inversiones y la gestión de carteras para inversores. Por tanto, las decisiones de los inversores al elegir una sociedad de valores afectan la rentabilidad y los riesgos de sus actividades de inversión.

Objetivo: es aclarar los factores que determinan la elección de los inversores de corredores de bolsa como compañías de valores en el mercado de valores de Vietnam.

Método: la muestra de datos fue recopilada por el autor en una encuesta en línea a 250 inversores en acciones individuales e institucionales desde enero de 2023 hasta diciembre de 2023. Se llevó a cabo mediante un método de investigación de regresión cuantitativa multivariante en el software SPSS 20.

Resultados: el artículo ha identificado 6 factores que influyen en la decisión de elegir un corredor de bolsa como sociedad de valores, entre ellos: (1) Instalaciones técnicas modernas, software central moderno (VCCKT); (2) Tamaño de la empresa (QMCT); (3) Calidad del personal de consultoría (NVTV); (4) Tipo de sociedad de valores especializada/multifunción (CDDN); (5) Relación (MQH); (6) Marketing de marca (MTMK).

Conclusiones: basándose en los resultados de la investigación, los autores han recomendado soluciones para que las compañías de valores amplíen la cuota de mercado de tales inversores en valores.

Palabras clave: Inversores Bursátiles; Bolsa Vietnamita; Sociedades de Valores Vietnamitas; Clientes; Mercado.

INTRODUCTION

In recent decades, especially after the collapse of the stock market in the United States and globally in 1987, the bankruptcies of three investment banks, namely Silicon Valley Bank (SVB), Signature Bank, and Silvergate Bank in the US, served as warning signals for investors regarding the selection of advisory and investment securities companies and the associated risks. Investor behavior has undergone significant changes towards caution and exploration, and these changing phenomena have been explained by researchers, one of which can be explained through behavioral finance theory. Behavioral finance theory fundamentally addresses the psychological factors influencing investment decisions and the selection of securities companies in the market. Accordingly, investment decisions and the selection of advisory securities companies are influenced by investors’ psychological factors, as investors tend to focus only on new information while paying little attention to past and future information.

Securities companies are financial intermediaries operating in the stock market, a market characterized by high sensitivity and risks that affect the interests of investors. According to behavioral finance theory, stock market investors are divided into two basic types: informed investors and uninformed investors, and these two groups tend to choose different securities companies. Informed investors focus on research and analysis to seek superior information compared to the market in order to make informed choices of securities companies and rational investment decisions, resulting in higher income than the market. On the other hand, the group of uninformed investors does not concentrate on seeking information about securities companies or investment products. Instead, they rely on speculation, relationships, and brand perception.

Over the past decade, organizational behavior researchers have been interested in and sought answers about what factors influence customer behavioral intentions. Some studies to mention include:(18,15,10,22,26,6,24,28)…research results show that factors such as modern technical facilities, modern core software, Company size, Quality consulting staff, type of specialized/multi-purpose securities company and the relationship between the brokerage company and the customer affect the customer’s intention to choose a broker.

In Vietnam, over 80 % of stock assets are self-managed by individual investors, while in China, it is only about 42 % (as of December 31, 2020), in the United States, it is around 11 % (in 2020), in Taiwan and South Korea, it is 35 % (2018) and 38 % (2013) respectively, or even lower, such as Japan with only 17 % (2018) and Hong Kong with only 14 % (2019). This indicates that the selection of securities companies by Vietnamese investors is facing difficulties. The important role of securities companies in supporting investors to generate profits on their capital in a safer and more sustainable manner, helping investors allocate resources rationally and mitigate risks, cannot be underestimated. Therefore, the mission of securities companies is to strive for optimal long-term investment efficiency and risk management for clients, build long-term trust, and contribute to the stability of the stock market by reducing the high proportion of self-managed individual investors in the Vietnamese stock market in recent decades.

Vietnam’s stock market has characteristics and fundamental differences compared to other countries in the region and the world. Besides good companies, there still exists a large number of small-scale companies. The technical infrastructure system still does not meet the requirements of investors. The e-commerce stock trading system still contains many risks and inadequacies. The quality of consulting human resources is not yet professional, inexperienced, and the quality of consulting is not high. Meanwhile, the business results of businesses have not been fully reflected on the stock market, trust in businesses and the stock market is still limited.

Thus, previous studies in the world and Vietnam have not been able to systematize nor clarify the factors affecting the intention to choose a stock broker, in a context such as the Vietnamese stock market. , the stock market has a limited scale. In particular, the authors rely on the theoretical basis of the Theoretical Framework of Planned Behavior,(27) and the Technology Acceptance Model,(23) to build scales and questionnaires. survey and interpret the results. The multivariate regression model research method based on collected data that has been cleaned before analysis will provide reliable results. New findings contribute to improving the operational efficiency of securities companies in the context of Vietnam and the world in the 4.0 revolution.

The structure of the article is presented and explained by the authors as follows. Part 1 introduces the research problem. In Part 2, the authors review and analyze documents related to factors affecting the choice of stock broker based on investors’ risk management perspectives. Part 3, based on the article’s documents, provides research methods and proposes a research model. Part 4, through regression and testing results, the authors analyze the research results. In Part 5, the authors discuss the results of the regression model, thereby proposing solutions. Part 6 concludes the contents of the research.

Literature Review

Main foundation theory:

The theoretical framework of planned behavior is provided by Ajzen(27), a set of theories used in variations to understand the behavior of investors and customers. Investor behavior will be influenced by three factors: attitude toward behavior, subjective standards, and perceived behavioral control. Attitudes toward the behavior can be positive or negative. Subjective standards can also be good or bad comments. The determinant of self-awareness, or the ability to perform a behavior, is called perceived behavioral control.

The technology acceptance model, developed by Davis(23), is a reliable and basic model in modeling the acceptance of information technology (Information Technology - IT) used by investors. The main content of the model has the following five main variables:

External variables (exogenous variables): These are variables that affect perceived usefulness and perceived ease of use.

Variable Perceived Usefulness: users certainly perceive that using particular application systems will increase their efficiency/productivity for a particular job.

Perceived ease of use variable: is the level of ease that users expect when using the system.

Attitude towards use: an attitude towards using a system created by beliefs about its usefulness and ease of use.

Usage decision variable: is the user’s decision when using the system. The decision to use is closely related to actual use.

The technology acceptance model measures and predicts investors’ use of information technology for work. Perceived usefulness is the degree to which investors and customers use technology systems to improve the efficiency of their investment or work. Meanwhile, communication is an important channel in operating technology systems, based on information systems. System quality is a system that helps make information exploitation activities more effective. Information quality is the quality of the system’s output, meeting the requirements of reliability, completeness and timeliness. Service quality is a guarantee of reliability, and limits risks. The compatibility of technology and work is to bring investors convenience in using the technology system. Ease of use is the degree to which the investor believes that using a particular system does not require significant effort. The ease with which investors use computers for work depends on the technology interface, computer training, language, software, etc. and finally the attitude towards the user. negative or positive feelings about performing the goal-directed behavior.

According to Keloharju et al.(18), the positive relationship between investors and advisory staff, ownership rights, and ownership scale will stimulate investors to buy and hold shares of companies they frequently engage with. The authors argue that this influence is stronger for staff members who have good and long-term relationships with customers. Additionally, the reciprocal relationship is inherited assets and gifts that significantly influence investment decisions. Customers perceive securities investment as a consumer commodity.

Mallya(15) states that banks with better human resource factors and better responsiveness to specific customer segments are preferred by customers. The author evaluated this based on five specific SERVQUAL dimensions: reliability, responsiveness, assurance, empathy, and tangibles. Data was collected through a specially designed questionnaire for bank employees and customers. The author highlights challenges faced by bank leadership, such as long queues and waiting times for services, as well as staff shortages even during peak periods. Bank leaders need to enhance employee welfare policies, especially in terms of customer care training, at different stages rather than just when employees join the organization. Banks should conduct regular research on customer needs and desires, and how to effectively meet them, by developing service strategies and priorities for older age groups and creating a favorable environment for them.

Narteh(10) suggests that factors such as price, credit availability, service quality, and attributes of bank staff are decisive factors in customers’ choice of banks. The research was conducted through a survey of 503 small and medium-sized enterprises randomly selected from the database of the National Board for Small Scale Industries in Ghana. Exploratory factor analysis, multiple regression analysis, and correlation analysis were used to analyze the data. Enterprises were interested in services such as loans and advances, cash collection, transfers, bank guarantees, and advisory services.

Dincer et al.(22) employed a Multi-Criteria Decision-Making (MCDM) model, Fuzzy Analytic Hierarchy Process (FAHP), and Fuzzy Technique for Order of Preference by Similarity to Ideal Solution (FTOPSIS) along with sensitivity analysis to determine and rank the best-performing industry sectors.(22) The proposed model was applied to the Borsa Istanbul Stock Exchange 100 Index (BIST 100) in Turkey. The results indicate that (i) investors’ perceptions of market conditions and global financial situations influence their industry sector preferences for company stocks, (ii) investors’ perceptions of portfolio investment depend heavily on the performance and risk of each asset/stock, and (iii) financial sector stocks (along with its sub-sectors) have higher performance expectations compared to stocks in other sectors such as technology, services, and tourism.

According to Boru(26), banks with quality service, modern technical infrastructure, and a modern network are often the choice of depositors. The selection of a bank by customers is an important factor in the competitive strategies of banks in the increasingly fierce current environment. In order to plan an appropriate marketing strategy, retain existing customers, and attract new customers, commercial banks need to identify the criteria that customers rely on to make their bank selection. The author collected data through a Likert scale questionnaire survey. The convenience sampling method was used, and factor analysis was conducted to reduce the total number of manageable variables. In addition to the above conclusions, the author found that factors such as innovation, financial efficiency, and electronic banking are less considered by customers when choosing a bank. The author suggests that banks should conduct regular marketing research to monitor and evaluate the ever-changing perspectives of customers in order to develop products or services that meet their current preferences.

According to Servera-Francés et al.(6) in their study “The Impact of Corporate Social Responsibility on Consumer Loyalty through Consumer Perceived Value”, researchers clarified that companies investing in growth policies associated with social responsibility satisfy customers’ perceptions of the company. To reach this conclusion, scientists conducted surveys with 408 customers in Spain. The novelty of this research lies in focusing on customers and investors as a core element that differentiates the competitive strategy of a company.

According to Cuesta-Valiño et al.(24) in their study “Impact of Corporate Social Responsibility on Customer Loyalty in Hypermarkets: A New Perspective on Social Responsibility”, the aim was to test the level of impact of social activities on the operational effectiveness of businesses based on data collected from 667 customers in Spain. The hypothesis was tested using a Partial Least Squares Structural Equation Modeling. The results showed that customer loyalty and satisfaction, image, and customer quality also intervene in their relationships.

According to Adam(28), customers are interested in and choose banks based on service quality, low interest rates, high commissions on savings deposits, online convenience, reasonable service fees, and online banking. The author obtained the results through a designed survey to accumulate data from the identified domain. Data was collected through a questionnaire, with 150 samples selected. Customers were individuals with a relationship with the bank requiring an account and considering the time of service. To maintain their accounts with a specific bank, there are factors that attract customers to that bank. Studies explain how banks succeed when they focus on customers. This is because meeting customer needs related to service quality is significantly important for the bank’s reputation. Banks need to explore different ways that customers consider when making decisions. Such evaluation serves as a foundation for determining appropriate marketing strategies.

Ling et al.(16), investment activities through mobile phones are popular in today’s era. This is the technological advancement of mobile device functions. The authors explored factors that influence investment intentions through the use of technology such as mobile phones. Factors taken into consideration are the individual, the creativity of the mobile device and the attitude and reputation of the technology. Based on data collected from 213 customer feedback forms. As a result, mobile device usefulness, investment intention, perceived reputation, and attitude toward the technology influence investment intention. The article has revealed missing information by identifying the important factors of mobile investment adoption using a new framework developed from the perspective of personal and traditional factors of platform provider. In addition, this article provides some important practical implications in developing policies and strategies to encourage suppliers to adopt technology as the foundation of their investments.

In Vietnam, there are also notable studies on the choices of investors in the stock market, such as:

According to Nguyen(9), educational level plays an important role in the investment decisions of investors in the stock market. Investors with higher education tend to be optimistic and confident in their decisions. Therefore, according to the authors, investors’ decisions often depend on the following factors: (1) excessive optimism, (2) herd mentality, (3) excessive confidence, (4) risk aversion, and (5) pessimism.(9) Analyzing investor behavior in the stock market is crucial for brokers, as it forms the basis for them to consider appropriate solutions to meet the needs and desires of investors.

Nguyen et al.(8), aggregate factors such as perceived trust, privacy and cost influence investor satisfaction in online stock transactions. The results of the study showed that the integrated model demonstrated high predictive power, explaining up to 64 % of the volatility and changes in investor loyalty. The article also proves that in the technology context in Vietnam, cognitive trust has a positive impact on perceived ease of use, as well as usefulness; Perceived ease of use has a positive impact on perceived usefulness; Perceived trust and perceived usefulness have opposite effects on satisfaction; and importantly, investor satisfaction has a positive impact on their loyalty.

According to Van(2,3), brokers with strong brands and high financial capabilities are preferred choices for investors. Solutions to enhance financial capacity may include (i) actively increasing the scale of equity ownership in Vietnamese securities companies, such as increasing retained earnings for reinvestment (during this phase, surplus dividend policies can be applied), increasing capital contributions from owners, issuing shares (e.g., preferred shares to enhance the effectiveness of stock issuance channels), merging with securities companies with similar financial capabilities and business characteristics, or merging with domestic and foreign financial institutions with strong financial capabilities, (ii) reducing debt capital or restructuring debt towards increasing the proportion of long-term debt (debt capital can be raised through issuing convertible bonds with a reasonable maturity of 2-3 years, with this form addressing short-term capital needs, and the debt will be converted into equity after the bond’s maturity), and (iii) improving the efficiency of lending activities while maintaining high available capital. In addition, long-standing securities companies recommend restructuring their organization to enhance ROE, which will lead to sustainable growth for the company.

METHOD

The study primarily utilizes quantitative research methods.

The objective of the quantitative study is to test the model of factors determining the selection of securities brokerage firms (brokerage firms) by investors in the Vietnam securities market (securities market), using the SPSS20 software.

The research includes the following tests: evaluation of the reliability of the measurement scale using Cronbach’s alpha coefficient; exploratory factor analysis (EFA); multiple regression analysis; analysis of variance (ANOVA) for the factors determining the selection of securities brokerage firms. Finally, the study presents conclusions, managerial implications, limitations of the research, and suggestions for future research directions for subsequent researchers.

The model takes the following form: QDLC = β0 + β1*VCKT + β2*QMCT + β3*NVTV + β4*CDDN + β5*MQH + β6*MTKT

Where:

· QDLC: decision of selecting a securities company

· VCKT: modern technical infrastructure, advanced core software

· QMCT: company scale

· NVTV: quality of advisory staff

· CDDN: specialized securities company/multi-functional bank

· MQH: relationship

· MTKT: marketing

* Research data. The article conducted a survey of 250 votes/investor in all three times of distributing online surveys, which is completely suitable for running the model using SPSS 20 software from January 2023 to December 2023. The variables in the quantitative model are measured using the 5-degree Linkert scale,(17) built in 5 levels, with the number 1 described by the person being completely meaningless, number 2 disagreeing, number 3. is a neutral rating, number 4 is agree, number 5 is completely agree.

* Structure of survey subjects: urvey results of 165 votes were 66,00 % individual investors. There were 85 votes from institutional investors accounting for 34,00 %. The collected results are entered into an Excel table. For individual investors with the following sociological characteristics: if classified by age, there are 65 people aged 31-35 years old (39,39 %), 88 people aged 36-40 years old. age (53,33 %), 12 employees over 40 years old (7,27 %). Regarding training and professional qualifications, there are 122 people with university degrees (73,94 %), 43 people with postgraduate degrees (26,06 %). Regarding experience and seniority at work, there are 85 people with less than 10 years (51,52 %), 69 people with 11-15 years (41,82 %), 11 people with more than 16 years (6,67 %) . Regarding institutional investors, 100 % are domestic.

|

Table 1. Survey Sample Composition |

||

|

Investor Type |

Number of Respondents |

Percentage |

|

Individual |

165 |

66,00 |

|

Institutional |

85 |

34,00 |

Table 1 demonstrates that the survey sample size is relatively evenly distributed and accurately reflects the reality.

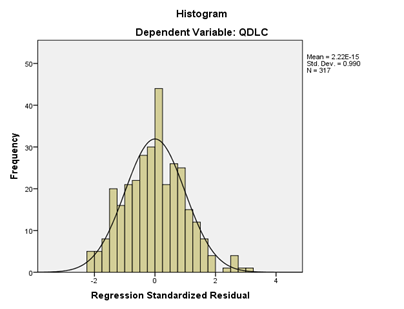

Figure 1. Distribution of survey data

The survey data has been cleaned, making it relatively homogeneous. The dataset has a relatively good quality for testing the regression model.

The variables included in the survey are:

1. Modern technical infrastructure and advanced core software (VCKT).

2. Company scale (QMCT).

3. Quality of advisory staff (NVTV).

4. Type of securities company specializing in business/banking (CDDN).

5. Relationship (MQH).

|

Table 2. Measurement scales of variables in multiple regression model |

|||

|

No. |

Code |

Survey Question Content |

Citation |

|

I |

Decision of choosing a securities company |

||

|

1 |

QDLC1 |

Securities company selection |

Keloharju et al. (2012); Mallya (2013); Narteh (2013); Dincer et al. (2016); Boru (2017); Servera-Francés et al. (2019); Cuesta-Valiño et al. (2019); Adam (2020); Nguyen Duc Hien and Dam Van Hue (2012); Tran Van Hai (2023) |

|

2 |

QDLC2 |

Not selecting a securities company, self-trading |

|

|

3 |

QDLC3 |

Allocate half of the time for self-trading and the other half for brokerage advisory services. |

|

|

II |

Modern Technical Infrastructure and Core Software |

||

|

1 |

VCKT1 |

Modern software used in work |

(20); (7); (21); (19); Dincer et al. (2016); (25);Adam (2020); Tran Van Hai (2023) |

|

2 |

VCKT2 |

Reliable software for operations |

|

|

3 |

VCKT3 |

The information system is regularly updated and adjusted to align with the brokerage firm. |

|

|

III |

Company Size |

||

|

1 |

QMCT1 |

The securities companyhas a capital scale of over 1,000 billion VND, a capital adequacy ratio of over 180 %, and is listed. |

Keloharju et al. (2012); (1); Mallya (2013); Narteh (2013); Dincer et al. (2016); Boru (2017); Servera-Francés et al. (2019); Cuesta-Valiño et al. (2019); Adam (2020); Nguyen Duc Hien and Dam Van Hue (2012); Tran Van Hai (2023) |

|

2 |

QMCT2 |

The securities companyhas a capital scale ranging from 500 to 1,000 billion VND, with a capital adequacy ratio of over 180 %. |

|

|

3 |

QMCT3 |

The remaining securities company. |

|

|

IV |

Quality of Investment Advisors |

||

|

1 |

NVTV1 |

Control the quality of securities company staff. |

Keloharju et al. (2012); Boru (2017); Servera-Francés et al. (2019); Cuesta-Valiño et al. (2019); Adam (2020); Nguyen Duc Hien and Dam Van Hue (2012); Tran Van Hai (2023) |

|

2 |

NVTV2 |

Ensure the quality of securities company staff. |

|

|

3 |

NVTV3 |

Comprehensively manage the quality of securities company staff. |

|

|

V |

Type of Securities Company: Specialized/Universal Banking |

||

|

1 |

CDDN1 |

Specialized securities company |

(4), Tran Van Hai (2023), (11), (13), (12) |

|

2 |

CDDN2 |

Diversified securities company |

|

|

3 |

CDDN3 |

Diversified securities company affiliated with a bank |

|

|

VI |

Relationship (MQH) |

||

|

1 |

MQH1 |

No relationship |

Keloharju et al. (2012), Mallya (2013), Narteh (2013), Dincer et al. (2016), Boru (2017), Servera-Francés et al. (2019), (14), (5) |

|

2 |

MQH2 |

Normal relationship |

|

|

3 |

MQH3 |

Close relationship |

|

|

VII |

Boosting marketing communication (MTKT) |

||

|

1 |

MTKT 1 |

Planning and designing authority structure to support all channels |

Dincer et al. (2016); Boru (2017); Servera-Francés et al. (2019); Cuesta-Valiño et al. (2019); Adam (2020); Nguyen Duc Hien and Dam Van Hue (2012); Tran Van Hai (2023) |

|

|

MTKT 2 |

Planning and designing authority structure to support all channels; Control and measurement |

|

|

3 |

MTKT 3 |

Planning and designing authority structure to support all channels; Control and measurement; Automation and use of reporting and analysis tools |

|

|

Source: synthesized from theoretical foundations |

|||

RESULTS

The reliability of each scale was examined, and the Cronbach’s alpha coefficient serves as a standard. A scale with a Cronbach’s alpha coefficient greater than 0,7 is considered reliable.

Analysis of the Decision-Making scale: The Cronbach’s alpha coefficient for this scale is 0,876, which is greater than 0,7, indicating that the scale meets the testing requirements. Similarly, the constituent factors of the scale have Cronbach’s alpha coefficients ranging from 0,799 to 0,869, demonstrating that the scale derived from the survey yields good results. Cronbach’s Alpha coefficient is 0,876, greater than 0,7, details in the table below:

|

Table 3. Presents the results of the analysis of the dependent variable scale |

|||||

|

Reliability Statistics |

|||||

|

Cronbach's Alpha |

N of Items |

||||

|

0,876 |

3 |

||||

|

Item-Total Statistics |

|||||

|

Variable |

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item-Total Correlation |

Cronbach's Alpha if Item Deleted |

|

|

QDLC1 |

4,77 |

2,047 |

0,724 |

0,869 |

|

|

QDLC2 |

4,69 |

2,207 |

0,777 |

0,811 |

|

|

QDLC3 |

4,34 |

2,319 |

0,799 |

0,799 |

|

|

Source: report extracted from SPSS 20 software |

|||||

Analysis of the Technical Infrastructure scale (VCKT) The securities business field requires advanced technological infrastructure, accompanied by the strong development of technical courses and computer technology serving securities business operations worldwide. Notably, the development of online trading in developed countries, the connection between the investment community and securities companies, and the stock market is borderless, allowing anyone from anywhere to participate in trading on one of the hundreds of stock markets worldwide. Alongside diverse trading forms such as margin trading, short selling, futures, options, and non-physical commodity volumes, sophisticated modern computer systems are required to handle complex trading transactions. Therefore, the technology of the securities company must also meet technological standards to satisfy the needs of securities investors.

The Cronbach’s alpha coefficient of the scale is 0,796 > 0,7, meeting the testing requirements. Similarly, the constituent factors of the scale have Cronbach’s alpha coefficients ranging from 0,738 to 0,830, indicating that the scale collected from the survey produces good results. Cronbach’s Alpha coefficient is 0,798, greater than 0,7, details in the table below:

|

Table 4. Results of the Technical Infrastructure scale analysis |

|||||

|

Reliability Statistics |

|||||

|

Cronbach's Alpha |

N of Items |

||||

|

0,798 |

3 |

||||

|

Item-Total Statistics |

|||||

|

Variable |

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item-Total Correlation |

Cronbach's Alpha if Item Deleted |

|

|

VCKT1 |

7,67 |

3,122 |

0,628 |

0,738 |

|

|

VCKT2 |

7,50 |

3,346 |

0,541 |

0,830 |

|

|

VCKT3 |

7,49 |

2,934 |

0,770 |

0,789 |

|

|

Source: report extracted from SPSS 20 software |

|||||

Analysis of the Company Scale scale (QMCT)

A large company scale is a factor that influences the psychology of investors in choosing brokers, as it is believed to be reputable, providing accurate decisions and high reliability for securities investors. It also supports investors in margin securities lending.

The Cronbach’s alpha coefficient of the scale is 0,845 > 0,7, meeting the testing requirements. Similarly, the constituent factors of the scale have Cronbach’s alpha coefficients ranging from 0,700 to 0,8796, indicating that the scale collected from the survey produces good results. Cronbach’s Alpha coefficient is 0,845, greater than 0,7, details in the table below:

|

Table 5. Results of the Company Scale scale analysis |

|||||

|

Reliability Statistics |

|||||

|

Cronbach's Alpha |

N of Items |

||||

|

0,845 |

3 |

||||

|

Item-Total Statistics |

|||||

|

Variable |

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item-Total Correlation |

Cronbach's Alpha if Item Deleted |

|

|

QMCT1 |

7,17 |

1,880 |

0,724 |

0,796 |

|

|

QMCT2 |

6,79 |

2,680 |

0,650 |

0,847 |

|

|

QMCT3 |

6,95 |

2,197 |

0,804 |

0,700 |

|

|

Source: report extracted from SPSS 20 software |

|||||

Analysis of the Advisor scale (NVTV) The human resources of a securities company represent the collective workforce, consisting of individuals who coordinate and combine their individual resources to contribute to the organization. The strength of the workforce is applied to achieve the organization’s common goals while also fulfilling each member’s individual objectives. In terms of planning, recruitment, training, and deployment, managing securities business personnel requires strategic long-term thinking to develop a highly qualified workforce with ethical and professional standards, satisfying the needs of investors.

The Cronbach’s alpha coefficient of the scale is 0,811 > 0,7, meeting the testing requirements. Similarly, the constituent factors of the scale have Cronbach’s alpha coefficients ranging from 0,756 to 0,785, indicating that the scale collected from the survey produces good results. Cronbach’s Alpha coefficient is 0,811, greater than 0,7, details in the table below:

|

Table 6. Results of the Advisor scale analysis |

|||||

|

Reliability Statistics |

|||||

|

Cronbach's Alpha |

N of Items |

||||

|

0,811 |

3 |

||||

|

Item-Total Statistics |

|||||

|

Variable |

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item-Total Correlation |

Cronbach's Alpha if Item Deleted |

|

|

NVTV1 |

7,12 |

2,707 |

0,660 |

0,756 |

|

|

NVTV2 |

7,25 |

3,015 |

0,724 |

0,777 |

|

|

NVTV3 |

6,89 |

3,542 |

0,621 |

0,785 |

|

|

Source: report extracted from SPSS 20 software |

|||||

Analysis of the Type of Securities Company scale (CDDN) Many securities investors believe that brokers affiliated with commercial banks are more trustworthy. However, many specialized brokers still demonstrate their professionalism.

The Cronbach’s alpha coefficient of the scale is 0,765 > 0,7, meeting the testing requirements. Similarly, the constituent factors of the scale have Cronbach’s alpha coefficients ranging from 0,704 to 0,777, indicating that the scale collected from the survey produces good results. Cronbach’s Alpha coefficient is 0,765, greater than 0,7, details in the table below:

|

Table 7. Results of the Type of Securities Company scale analysis |

|||||

|

Reliability Statistics |

|||||

|

Cronbach's Alpha |

N of Items |

||||

|

0,765 |

3 |

||||

|

Item-Total Statistics |

|||||

|

Variable |

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item-Total Correlation |

Cronbach's Alpha if Item Deleted |

|

|

CDDN1 |

5,43 |

3,252 |

0,606 |

0,777 |

|

|

CDDN2 |

5,55 |

3,388 |

0,610 |

0,771 |

|

|

CDDN3 |

5,67 |

3,748 |

0,582 |

0,704 |

|

|

Source: report extracted from SPSS 20 software |

|||||

Evaluation of the Relationship scale (MQH) In addition to the information gathered, investors also consider the relationship with brokers when engaging in investment advisory activities.

The Cronbach’s alpha coefficient of the scale is 0,849 > 0,7, meeting the testing requirements. Similarly, the constituent factors of the scale have Cronbach’s alpha coefficients ranging from 0,784 to 0,933, indicating that the scale collected from the survey produces good results. Cronbach’s Alpha coefficient is 0,849, greater than 0,7, details in the table below:

|

Table 8. Results of the Relationship scale analysis |

|||||

|

Reliability Statistics |

|||||

|

Cronbach's Alpha |

N of Items |

||||

|

0,849 |

3 |

||||

|

Item-Total Statistics |

|||||

|

Variable |

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item-Total Correlation |

Cronbach's Alpha if Item Deleted |

|

|

MQH1 |

5,7098 |

2,517 |

0,817 |

0,789 |

|

|

MQH2 |

5,6120 |

2,479 |

0,821 |

0,784 |

|

|

MQH3 |

5,9022 |

3,595 |

0,548 |

0,933 |

|

|

Source: report extracted from SPSS 20 software |

|||||

Evaluation of the Marketing scale

Brand promotion helps brokers convey positive information about the brand and the quality of advice, thereby maximizing benefits for investors based on effective risk management.

The Cronbach’s alpha coefficient of the scale is 0,798 > 0,7, meeting the testing requirements. Similarly, the constituent factors of the scale have Cronbach’s alpha coefficients ranging from 0,738 to 0,830, indicating that the scale collected from the survey produces good results. Cronbach’s Alpha coefficient is 0,798, greater than 0,7, details in the table below:

|

Table 9. Results of the Marketing scale analysis |

||||

|

Reliability Statistics |

||||

|

Cronbach's Alpha |

N of Items |

|||

|

0,798 |

3 |

|||

|

Item-Total Statistics |

||||

|

Variable |

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item-Total Correlation |

Cronbach's Alpha if Item Deleted |

|

VCKT1 |

7,67 |

3,122 |

0,628 |

0,738 |

|

VCKT2 |

7,50 |

3,346 |

0,541 |

0,830 |

|

VCKT3 |

7,49 |

2,934 |

0,770 |

0,789 |

|

Source: report extracted from SPSS 20 software |

||||

Correlation matrix. The article examines the Pearson correlation coefficients with a significance level of less than 5 % (Sig<5 %). From table 8, it can be observed that all variables, including the dependent variable, satisfy the regression conditions.

|

Table 10. Pearson correlation matrix between variables in the model |

||||||||

|

Correlations |

||||||||

|

Variable |

QDLC |

VCKT |

QMCT |

MTKT |

NVTV |

CDDN |

MQH |

|

|

QDLC |

Pearson Correlation |

1 |

0,409** |

0,019 |

0,638** |

0,109 |

-0,156** |

0,175** |

|

Sig. (2-tailed) |

|

0,000 |

0,000 |

0,000 |

0,000 |

0,000 |

0,000 |

|

|

N |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

|

|

VCKT |

Pearson Correlation |

0,409** |

1 |

0,108 |

0,443** |

0,080 |

-0,034 |

0,031 |

|

Sig. (2-tailed) |

0,000 |

|

0,054 |

0,000 |

0,157 |

0,544 |

0,588 |

|

|

N |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

|

|

QMCT |

Pearson Correlation |

0,009 |

0,108 |

1 |

0,024 |

0,154** |

-0,281** |

0,037 |

|

Sig. (2-tailed) |

0,878 |

0,054 |

|

0,675 |

0,006 |

0,000 |

0,512 |

|

|

N |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

|

|

MTKT |

Pearson Correlation |

0,638** |

0,223** |

0,024 |

1 |

0,052 |

-0,039 |

0,165** |

|

Sig. (2-tailed) |

0,000 |

0,000 |

0,675 |

|

0,356 |

0,494 |

0,003 |

|

|

N |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

|

|

NVTV |

Pearson Correlation |

0,109 |

0,080 |

0,154** |

0,052 |

1 |

-0,253** |

0,103 |

|

Sig. (2-tailed) |

0,053 |

0,157 |

0,006 |

0,356 |

|

0,000 |

0,068 |

|

|

N |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

|

|

CDDN |

Pearson Correlation |

-0,156** |

-0,034 |

-0,281** |

-0,039 |

-0,253** |

1 |

-0,081 |

|

Sig. (2-tailed) |

0,005 |

0,544 |

0,000 |

0,494 |

0,000 |

|

0,148 |

|

|

N |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

|

|

MQH |

Pearson Correlation |

0,175** |

0,031 |

0,037 |

0,165** |

0,103 |

0,081 |

1 |

|

Sig. (2-tailed) |

0,002 |

0,588 |

0,512 |

0,003 |

0,068 |

0,148 |

|

|

|

N |

250 |

250 |

250 |

250 |

250 |

250 |

250 |

|

|

**. Correlation is significant at the 0,01 level (2-tailed). |

||||||||

|

Source: report extracted from SPSS 20 software |

||||||||

Based on the sample data collected from the survey on the parameters of the regression model, the results indicate the adequacy of the model (table 11).

|

Table 11. Results of the model validation for the factors determining the selection of stockbrokers by investors in the Vietnamese stock market |

|||||||||

|

Model Summaryb |

|||||||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

Change Statistics |

||||

|

R Square Change |

F Change |

df1 |

df2 |

Sig. F Change |

|||||

|

1 |

0,679a |

0,661 |

0,651 |

0,50145 |

0,561 |

44,206 |

6 |

310 |

0,000 |

|

a. Predictors: (Constant), MQH, VCKT, CDDN, NVTV, QMCT, MTKT |

|||||||||

|

b. Dependent Variable: QDLC |

|||||||||

|

Source: data obtained from SPSS 20 software |

|||||||||

From table 11, we can observe that the values of R Square (R2) and Adjusted R Square (Adjusted R2) are 0,679 and 0,651 respectively, both > 0,5. The F-statistic value, calculated from the R2 value of the full model with a significance level (Sig value = 0,000) smaller than 5 %, indicates that the multiple linear regression model is appropriate for the dataset.

|

Table 12. Results of the regression analysis on the factors determining the selection of stockbrokers by investors in the Vietnamese stock market |

||||||

|

Coefficientsa |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

T |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

1,173 |

0,276 |

|

4,256 |

0,000 |

|

VCKT |

0,118 |

0,038 |

0,147 |

3,128 |

0,000 |

|

|

QMCT |

0,017 |

0,042 |

0,018 |

0,409 |

0,000 |

|

|

MTKT |

0,542 |

0,047 |

0,548 |

11,574 |

0,000 |

|

|

NVTV |

0,092 |

0,035 |

0,114 |

2,606 |

0,000 |

|

|

CDDN |

-0,127 |

0,036 |

-0,157 |

-3,513 |

0,000 |

|

|

MQH |

0,070 |

0,038 |

080 |

1,871 |

0,000 |

|

|

a. Dependent Variable: QDLC |

||||||

|

Source: author's statistical analysis using SPSS 20 software |

||||||

Based on table 12, the regression results can be written as follows: QDLC = 0,118*VCKT + 0,017*QMCT + 0,092*NVTV -0,127*CDDN + 0,070*MQH + 0,542*MTKT

In the remaining independent variables table, all variables satisfy the condition of having a significance value (sig) less than or equal to 0,05, indicating that these variables are statistically significant.

Detailed results are as follows:

Variables Modern technical facilities, modern core software (VCKT), Company size (QMCT), Quality of consulting staff (NVTV), Relationships (MQH) have the same impact on Decision decision to choose a securities company - QDLC (positive regression coefficient), statistically significant with P-value<=0,05.

The variable Type of specialized/multi-purpose banking securities company (CDDN) has a negative impact on the decision to choose a securities company - QDLC (negative regression coefficient), statistically significant with P-value<=0,05.

This test result is appropriate in Vietnam, investors tend to choose securities companies with advanced information technology systems, large company scale, professional staff systems, and Partly related to relationships as according to data reported to the Ho Chi Minh City Stock Exchange (HoSE). According to the announcement of the third quarter of 2023, the 10 leading securities companies hold 69,7 % of the stock brokerage market share in the market, which are VPS Securities Joint Stock Company and SSI Securities Joint Stock Company. , VnDirect (VNDS), Techcom Securities (TCBS), MB Securities (MBS), HSC, Mirae Asset (MAS), Vietcap, KIS Vietnam, Vietnam Joint Stock Commercial Bank for Foreign Trade Securities Company Limited VCBS.

|

Table 13. Ranking of 10 securities companies with the largest market share on HoSE |

|

|

Name of stock broker (securities company) |

Market share (%) |

|

1. VPS |

19,92 |

|

2. SSI |

10,59 |

|

3. VNDS |

7,21 |

|

4. TCBS |

6,80 |

|

5. MBS |

5,09 |

|

6. HSC |

5,06 |

|

7. MAS |

4,71 |

|

8. VIETCAP |

4,00 |

|

9. KIS |

3,34 |

|

10. VCBS |

3,04 |

|

Source: provided by HoSE March 2024 |

|

DISCUSSION

Based on the results of the regression model analysis, the authors propose the following solutions for securities brokerage firms to expand their customer base:

Firstly, increasing the scale of the company. As the capital profit share is negligible, it is necessary to raise additional capital. For companies organized as joint-stock companies, this can be achieved through issuing new shares. For companies organized as limited liability or joint venture companies, additional capital can be obtained by attracting existing shareholders or admitting new shareholders.

With good business results, securities companies in group 1 will retain a part of their after-tax profits to reinvest, not only increasing the equity of the securities company but also reducing the cost of capital, because the equity capital of the securities company has full rights to use. used without pressure on time and conditions for debt repayment or interest payments, however, securities companies must achieve profits on equity greater than bank interest rates. Thus, to increase shareholder equity from retained profits, the securities company will not only ensure capital needs for business operations without admitting new members, but also must share control of the company while increasing financial autonomy and independence main.

During operations, the securities company has a need to increase equity but does not want to “dilute” control of the company and benefits for new shareholders. Securities companies issue additional shares to mobilize additional equity from existing shareholders. When newly issued shares are distributed to existing shareholders according to the proportion of contributed shares, the rights of shareholders are not changed. However, in both cases the dividend of a stock is the same. The number of additional shares issued increases in the same direction as the profits earned, so the dividend per share remains unchanged.

Mobilizing to increase equity by issuing additional shares from existing shareholders has the advantage of not increasing the number of shareholders, so you do not have to share the management rights of the securities company as well as the benefits that the company brings, so it is easy to be stocked. crowded support. To increase equity by issuing additional existing shares, the most reasonable option is to pay dividends in shares.

Secondly, investing in advanced core technology. The global trend in the securities industry is the application of the internet and the establishment of online brokerage systems to provide advisory services to investors, offering better infrastructure for investors. Understanding investors’ needs and providing personalized services according to customer situations bring advantages in business operations.

Thirdly, building an effective marketing strategy. In a specific segment or target market, if a securities company is the only one, the supply service fees will certainly generate profits for the company. However, in reality, many securities companies are pursuing the same target market, and their products and services do not have significant differences, resulting in lower fees than expected. Therefore, securities companies need to identify niche customer segments to penetrate. In this regard, companies should strive to operate flawlessly and provide customers with the best, reliable, and competitive services.

With a specific segment or target market, if the securities company is the only one, the service provision fee will certainly bring profits to the business, but in reality there are many securities companies pursuing the target market and The products do not have significant differences, leading to fees that are not as high as expected by the securities company. Therefore, securities companies need to find a niche customer segment to penetrate. In this situation, securities companies need to: operate perfectly, provide customers with the best, reliable and competitive services. Close relationships with customers, deep understanding of customer needs and desires, ability to quickly respond to specific and specialized needs. Leading in products, providing customers with new products and services that add more value and benefits to customers than competitors. After carefully segmenting the market, selecting target customer groups and determining the desired positioning in the market, the ability to launch appropriate products and services to the market is highly likely to be successful. Compared to other securities companies, product, price, promotion and channel strategies will depend on the target market that the securities company is aiming for, with the motto that wherever the company’s customers are, the company will go there. serve.

Fourthly, establishing close relationships with customers, gaining deep insights into their needs and desires, and having the ability to quickly respond to specific and specialized demands. Leading in product offerings, supplying customers with new products and services that add more value and benefits compared to competitors. After carefully segmenting the market and selecting target customer groups, securities companies can determine their desired market positioning. The success of product, pricing, promotion, and distribution strategies will depend on the target market that the company aims to serve. The company should focus on where its customers are and provide services accordingly.

Comprehensive research shows that choosing securities companies is relatively complicated, thereby drawing global practical evidence. The study has identified 6 factors that influence the decision to choose a stock broker as a securities company, including: (1) Modern technical facilities, modern core software (VCCKT); (2) Company size (QMCT); (3) Quality of consulting staff (NVTV); (4) Type of specialized/multi-function securities company (CDDN); (5) Relationship (MQH); (6) Brand marketing (MTMK). This is consistent with reality in Vietnam when the fluctuations of the stock market depend heavily on objective factors. The limitation of the research is that there is no classification of the choice behavior of investors, whether customers are organizations or individuals, and there is no specific area by region or business domain, because these factors have an influence. more or less depends on the choice of securities company by investors and customers.

BIBLIOGRAPHIC REFERENCES

1. Yale G, Grove, H., & Clouse, M.. Risk management lessons learned: countrywide report. Corporate Ownership & Control, 11(1-1), 33-46. 2013.

2. Van Hai T. Factors Affecting The Performance Of Brokerage Companies On The Vietnamese Stock Market. Journal of Positive School Psychology. 2022;6(7):4018-27.

3. Van Hai T. Development Of Investment Banking Model In Capital Market. Journal of Positive School Psychology. 2022;6(8):5856-67.

4. Tien CM. The relationship between capital structure and performance of securities brokerage firms–a case study in Vietnam. International Journal of Professional Business Review: Int J Prof Bus Rev. 2023;8(1):25.

5. Tien CM, editor The Influence of Free Cash Flow (FCF) on the Performance of Securities Companies in Vietnam. International Conference on Research in Management & Technovation; 2023: Springer.

6. Servera-Francés D, Piqueras-Tomás L. The effects of corporate social responsibility on consumer loyalty through consumer perceived value. Economic research-Ekonomska istraživanja. 2019;32(1):66-84.

7. Scherbina T, Afanasieva, O., & Lapina, Y. . Risk management, corporate governance and investment banking: The role of chief risk officer. Corporate Ownership & Control, 10(3-2), 313-330. 2013.

8. Nguyen H, Pham L, Williamson S, Hung ND. Individual investors’ satisfaction and loyalty in online securities trading using the technology acceptance model. International Journal of Management and Decision Making. 2020;19(2):239-66.

9. Nguyen Duc Hien DVH. Explore and build a model to measure psychological factors of individual investor behavior in the Vietnamese stock market. 2020.

10. Narteh B. SME bank selection and patronage behaviour in the Ghanaian banking industry. Management Research Review. 2013;36(11):1061-80.

11. Mo NT, Tien CM, Anh TTL, Van Hai T. Human Resource Management Factors in Financial Analysis of Securities Companies. International Journal of Economics and Financial Issues. 2024;14(4):154-62.

12. Mo NT, Binh NT, Hung PH, Cu HM, Linh NT, Van Hai T. EMPLOYEE SATISFACTION, ENGAGEMENT AND FINANCIAL PERFORMANCE IN STOCK BROKERAGE COMPANIES. Jurnal Ilmiah Ilmu Terapan Universitas Jambi. 2024;8(1):284-99.

13. Minh TC, Thi MN, Thuy LV, Van HH, Huy HP, Tran ATL, et al. IMPACT OF FINANCIAL CAPABILITY ON THE SUSTAINABLE GROWTH OF SECURITIES COMPANIES: A CASE STUDY. Risk Governance & Control: Financial Markets & Institutions. 2024;14(1).

14. Minh TC, Naderi N. Unleashing the role of green finance, clean energy, and environmental responsibility in emission reduction. Journal of Environmental Assessment Policy and Management. 2022;24(03):2250033.

15. Mallya FM. Assessment of Customer Service Quality and Customer Satisfaction Levels in Tanzania Banking Industry: Mzumbe; 2013.

16. Ling P-S, Lee KYM, Ling L-S, Mohd Suhaimi MKA. Investors’ intention to use mobile investment: an extended mobile technology acceptance model with personal factors and perceived reputation. Cogent Business & Management. 2024;11(1):2295603.

17. Likert R. A technique for the measurement of attitudes. Archives of psychology. 1932.

18. Keloharju M, Knüpfer S, Linnainmaa J. Do investors buy what they know? Product market choices and investment decisions. The Review of Financial Studies. 2012;25(10):2921-58.

19. Jizi M. ow banks’ internal governance mechanisms influence risk reporting. Corporate Ownership & Control, 12(3), 55-72. 2015.

20. Grove H, Clouse M, editors. A Financial Risk and Fraud Model Comparison of Bear Stearns and Lehman Brothers: Was the Right or Wrong Firm Bailed Out? International conference in Rome; 2013.

21. Eulerich M, Velte P, Theis J. Internal auditors’ contribution to good corporate governance. An empirical analysis for the one-tier governance system with a focus on the relationship between internal audit function and audit committee. Corporate ownership and Control. 2015;13(1).

22. Dincer H, Hacioglu U, Tatoglu E, Delen D. A fuzzy-hybrid analytic model to assess investors’ perceptions for industry selection. Decision Support Systems. 2016;86:24-34.

23. Davis FD. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly. 1989:319-40.

24. Cuesta‐Valiño P, Rodríguez PG, Núñez‐Barriopedro E. The impact of corporate social responsibility on customer loyalty in hypermarkets: A new socially responsible strategy. Corporate Social Responsibility and Environmental Management. 2019;26(4):761-9.

25. Coluccia D, Fontana, S., Graziano, E. A., Rossi, M., & Solimene, S. Does risk culture affect banks’ volatility? The case of the G-SIBs. Corporate Ownership & Control, 15(1), 33-43. 2017.

26. Boru M. DETERMINANT FACTORS FOR BANK SELECTION DECISION IN A CUSTOMERS PERSPECTIVE AND ITS IMPACT ON CUSTOMERS LOYALTY: EVIDENCE FROM SELECTED ETHIOPIAN COMMERCIAL BANKS: St. Mary’s University; 2017.

27. Ajzen I. The theory of planned behavior. Organizational behavior and human decision processes. 1991;50(2):179-211.

28. Adam S. Factors affecting customers’ choice of Banks: Mzumbe University; 2020.

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Duy Thuan Dao, Cao Minh Tien.

Data curation: Duy Thuan Dao, Cao Minh Tien.

Formal analysis: Duy Thuan Dao, Cao Minh Tien.

Acquisition of funds: Duy Thuan Dao, Cao Minh Tien.

Research: Cao Minh Tien.

Methodology: Duy Thuan Dao, Cao Minh Tien.

Project management: Duy Thuan Dao, Cao Minh Tien.

Resources: Cao Minh Tien.

Software: Cao Minh Tien.

Supervision: Cao Minh Tien.

Validation: Cao Minh Tien.

Display: Duy Thuan Dao, Cao Minh Tien, Luu Nguyen Phu.

Drafting - original draft: Duy Thuan Dao, Cao Minh Tien, Luu Nguyen Phu.

Writing - proofreading and editing: Duy Thuan Dao, Cao Minh Tien, Luu Nguyen Phu.