doi: 10.56294/sctconf2024.1182

ORIGINAL

Construction of a Model for Evaluating the Operating Efficiency and Performance of State-Owned Enterprises Using Fuzzy Comprehensive Evaluation

Construcción de un modelo para evaluar la eficiencia operativa y el desempeño de las empresas estatales mediante la evaluación comprensiva difusa

Xiayi Zhang1 *, Mohamed Hisham Dato Haji Yahya, Norhuda Abdul Rahim, Nazrul Hisyam Ab Razak

1School of Business and Economics, Universiti Putra Malaysia. UPM Serdang, Selangor Darul Ehsan, 43400, Malaysia.

Cite as: Zhang X, Haji Yahya MHD, Abdul Rahim N, Ab Razak NH. Construction of a Model for Evaluating the Operating Efficiency and Performance of State-Owned Enterprises Using Fuzzy Comprehensive Evaluation. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:.1182. https://doi.org/10.56294/sctconf2024.1182

Submitted: 03-03-2024 Revised: 04-06-2024 Accepted: 06-10-2024 Published: 07-10-2024

Editor:

Dr.

William Castillo-González ![]()

Corresponding Author: Xiayi Zhang *

ABSTRACT

State-owned energy, transportation, and telecommunications enterprises power many countries’ economies and societies. Considering commercial and social objectives, SOE performance evaluation is complex. Rather than innovation, sustainability, and stakeholder satisfaction, financial factors have determined SOE’s success. The present study simulates an SOE Fuzzy Comprehensive Evaluation approach to overcome the constraint. The model encompasses quantitative and qualitative performance. The proposed model prioritizes the whole evaluation aim and follows it with performance criteria and sub-criteria. This paper used the analytical hierarchy process with expert survey input to fine-tune the standard weights. Fuzzy logic addresses the uncertainty in qualitative analysis. This method performs traditional financial ratio analysis, balanced scorecard, and data envelope analysis.

Keywords: State-Owned Enterprises; Fuzzy Comprehensive Evaluation; Analytic Hierarchy Process; Machine Learning; Balanced Scorecard; Data Envelopment Analysis.

RESUMEN

Las empresas estatales de energía, transporte y telecomunicaciones impulsan las economías y sociedades de muchos países. Si se tienen en cuenta los objetivos comerciales y sociales, la evaluación del desempeño de las empresas estatales es compleja. En lugar de la innovación, la sostenibilidad y la satisfacción de las partes interesadas, los factores financieros han determinado el éxito de las empresas estatales. El presente estudio simula un enfoque de evaluación integral difusa de las empresas estatales para superar la limitación. El modelo abarca el desempeño cuantitativo y cualitativo. El modelo propuesto prioriza todo el objetivo de la evaluación y lo sigue con criterios y subcriterios de desempeño. Este documento utilizó el proceso de jerarquía analítica con aportes de encuestas a expertos para ajustar los pesos estándar. La lógica difusa aborda la incertidumbre en el análisis cualitativo. Este método realiza análisis de ratios financieros tradicionales, cuadro de mando integral y análisis de datos.

Palabras clave: Empresas Públicas; Evaluación Integral Difusa; Proceso de Jerarquía Analítica; Aprendizaje Automático; Cuadro de Mando Integral; Análisis Envolvente de Datos.

INTRODUCTION

State-owned enterprises play a significant role in the economic and social landscape of many countries, particularly in emerging and transitional economies.(1,2) The SOE are more related to the fields of industry like energy, transportation, and telecommunications, as such sectors are more public related and contribute to nation development.(3) Evaluating such enterprises contributes to particular challenges as those enterprises are built to achieve commercial and social goals.(4) To evaluate the performance of such establishments, the traditional models such as financial ratio analysis or basic efficiency measures struggle to identify and include the complex nature of SOE performance as it includes financial viability, operational efficiency, innovation, sustainability, and stakeholder satisfaction.(5,6) A comprehensive model considers the quantitative and qualitative aspects of the SOE’s performance to evaluate such enterprises.(7,8) because the available models that are in practice to evaluate such enterprises only focus on financial indicators or operational metrics and fail to consider factors such as innovation capacity, sustainability practices, and stakeholder satisfaction.(9,10) This narrowed approach leads to incomplete assessments that could lead to suboptimal decision-making by policymakers and managers. This research aims to address the limitations of current SOE performance evaluation models by developing a comprehensive framework that integrates multiple performance dimensions.

The primary objectives of this study are:

· The project aims to create a model that integrates quantitative and qualitative factors in evaluating SOEs, assesses the significance of performance criteria through AHP and expert surveys, and validates the model through empirical analysis.

This research proposes a Fuzzy Comprehensive Evaluation (FCE) model to evaluate SOE to achieve the above objectives. The FCE model is designed to combine multiple criteria into a single performance score that shows the overall performance of an enterprise. The model uses Fuzzy Logic (FL) to handle the inherent uncertainties in evaluating qualitative aspects of performance. The model includes performance indicators such as financial performance, operational efficiency, innovation capacity, sustainability practices, and stakeholder satisfaction. Each metric is weighted based on relative importance and measured using AHP and the Delphi method. The FCE model is designed hierarchically to evaluate SOE performance at the top, followed by key performance criteria and sub-criteria. The model aggregates the evaluations of these sub-criteria through fuzzy aggregation methods and results in a final crisp score that represents the SOE’s overall performance.

Fuzzy Set Theory

A fuzzy set is denoted as A⊆X, where X is the universe of discourse, and A is a set of ordered pairs. Each pair (x,μA (x)) consists of an element x∈X and its degree of membership μA (x), where μA : X∈[0,1]. The function μA (x) is called the membership function of x in A, and it quantitatively represents the grade of membership of x ranging from complete non-membership (0) to full membership (1). The following are set of operations that are defined on fuzzy sets:

Union: the union of two fuzzy sets A and B in X is a fuzzy set C where the membership function is defined as:

![]()

Intersection: the intersection of fuzzy sets A and B is defined by:

![]()

Complement: the complement of a fuzzy set A is a set Ac where:

![]()

METHOD

Model Design

The FCE model is structured hierarchically with the topmost Goal Layer, denoted as G, which measures the overall objective of the evaluation process. Next to the Goal Layer follows the Criteria Layer, represented as:

![]()

Where each criterion Ci corresponds to SOE performances in financial performance, operational efficiency, innovation capacity, sustainability, and stakeholder satisfaction. Each criterion Ci is independently evaluated to measure the overall performance assessment.

Further down the hierarchy is the Sub-Criteria Layer, where each criterion Ci is broken down into a set of sub-criteria.

![]()

Where Sij represents the j-th sub-criterion under the i-th criterion. The evaluation of each sub-criterion Sij is expressed through a fuzzy evaluation set:

![]()

Where Ek corresponds to a linguistic term like Poor, Fair, Good, or Excellent. These terms are associated with fuzzy membership functions, which evaluate the degree to which an input value x belongs to the fuzzy set representing each sub-criterion. The membership function μij (x) operates over the interval [0,1], quantifying the degree of membership for the input value x in the fuzzy set of the sub-criterion Sij. The fuzzy rule base comprises a series of if-then rules that establish relationships between input variables (sub-criteria evaluations) and output variables (overall performance scores). Each rule Rk takes the form: “If Si1 is E1 and Si2 is E2, then Ci is Ek.” These rules are applied during the fuzzy inference process to derive conclusions based on the input data. The overall fuzzy evaluation for each criterion Ci is obtained by aggregating the weighted evaluations of its sub-criteria:

![]()

Where wij is the weight assigned to the sub-criterion Sij, and μ(Sij) (x) is the membership value for the subcriterion. The overall evaluation G is then aggregated from the criteria evaluations using:

![]()

Where wi is the weight assigned to the criterion Ci, and μ(Ci) (x) is the aggregated fuzzy score for the criterion. The final step in the FCE model is defuzzification, which transforms the fuzzy output μG (x) into a crisp score Gcrisp.

![]()

Key Performance Indicators (KPI) for SOE

The KPIs are chosen to capture the multi-layered nature of SOE performance, including financial and non-financial aspects. The following table 1 presents the KPIs considered in this work:

|

Table 1. Key Performance Indicators (KPIs) for the State-Owned Enterprise (SOE) |

|||

|

Category |

KPI |

Description |

Formula |

|

Profitability |

KPI_1: Return on Assets (ROA) |

Measures the ability of the SOE to generate income relative to total assets. |

ROA = Net Income / Total Assets |

|

KPI_1: Return on Equity (ROE) |

Measures the ability of the SOE to generate income relative to shareholders’ equity. |

ROE = Net Income / Shareholder’s Equity |

|

|

KPI_1: Net Profit Margin (NPM) |

Measures the percentage of revenue that is converted into profit. |

NPM = Net Profit / Revenue |

|

|

Liquidity |

KPI_2: Current Ratio (CR) |

Evaluates the ability of the SOE to meet short-term obligations with current assets. |

CR = Current Assets / Current Liabilities |

|

KPI_2: Quick Ratio (QR) |

Measures the ability to meet short-term obligations excluding inventory. |

QR = (Current Assets - Inventory) / Current Liabilities |

|

|

Leverage |

KPI_3: Debt-to-Equity Ratio (DER) |

Assesses the degree to which the SOE is utilizing borrowed funds. |

DER= Total Liabilities / Shareholder’s Equity |

|

KPI_3: Debt-to-Assets Ratio (DAR) |

Measures the percentage of the SOE’s assets financed by debt. |

DAR= Total Liabilities / Total Assets |

|

|

Operational Efficiency |

KPI_4: Asset Turnover Ratio (ATR) |

Reflects how efficiently the SOE is using its assets to generate revenue. |

ATR= Revenue / Total Assets |

|

KPI_4: Inventory Turnover Ratio (ITR) |

Measures how effectively inventory is managed by comparing the cost of goods sold to average inventory. |

ITR = Cost of Goods Sold / Average Inventory |

|

|

KPI_5: Operating Expense Ratio (OER) |

Measures the SOE’s ability to manage its operational costs. |

OER = Operating Expenses / Revenue |

|

|

KPI_5: Cost-to-Income Ratio (CIR) |

Assesses the operational cost management relative to income generated. |

CIR= Total Operating Cost / Total Income |

|

|

Productivity |

KPI_6: Labor Productivity (LP) |

Examines the output relative to the labor input. |

LP= Output / Labor Input |

|

KPI_6: Capital Productivity (CP) |

Evaluates the efficiency of capital usage relative to the output produced. |

CP = Output / Capital Input |

|

|

Innovation Capacity |

KPI_7: R&D Intensity |

Evaluates the level of investment in research and development activities. |

R&D Intensity = R&D Expenditure / Total Revenue |

|

KPI_8: Patent Intensity (PI) |

Measures innovation output through the number of patents filed or granted relative to R&D expenditure. |

PI = Number of Patents / R&D Expenditure |

|

|

Sustainability Practices |

KPI_9: Carbon Footprint (CF) |

Assesses the environmental footprint of the SOE’s operations. |

CF= Total CO₂ Emissions |

|

KPI_9: Energy Efficiency (EE) |

Measures how effectively energy is utilized in operations. |

EE = Output / Energy Input |

|

|

KPI_10: Water Usage Efficiency (WUE) |

Evaluates the efficiency of water usage relative to the output produced. |

WUE = Output / Water Input |

|

|

KPI_10: Recycling Rate (RR) |

Measures the proportion of materials that are recycled relative to total waste generated. |

RR= Recycled Materials / Total Waste |

|

|

Stakeholder Satisfaction |

KPI_11: Customer Satisfaction (CS) |

Measures the level of satisfaction among the SOE’s customers. |

CS Score = Survey-Based Score |

|

KPI_12: Employee Engagement |

Evaluates the engagement and satisfaction of employees. |

Retention Rate = Number of Retained Employees / Total Number of Employees |

|

|

KPI_13: Community Contribution Index (CCI) |

Assesses the SOE’s contributions to the community relative to its total revenue. |

CCIx = Community Contributions / Total Revenue |

|

Methodology for Assigning Weights to Different Criteria

The AHP method determines the weights of criteria in multi-criteria decision-making models. This process organizes the evaluation criteria into a hierarchical structure of goals based on priority. Then, pairwise comparisons are made between each criterion based on a scale (1 to 9). For example, if Criterion C1 is judged to be more important than the Criterion C2, the pairwise comparison matrix A for two criteria is depicted as:

![]()

Where A12=3 indicates that C1 is three times more important than C2, and A21=1/3 indicates that C2 is one-third as important as C1. The pairwise comparison matrix is then used to calculate the relative weights of the criteria by finding the principal eigenvector w of the matrix A:

![]()

Where λmax is the largest eigenvalue of the matrix A. A Consistency Ratio (CR) is calculated to ensure the pairwise comparisons’ consistency. The Consistency Index (CI) is determined as follows:

![]()

Where n is the number of criteria. The CR is then computed by dividing the Cl by the Random Index (RI):

![]()

A CR value of 0.1 or less is considered acceptable. In addition to AHP, expert surveys and the Delphi method are employed to fine-tune the weight assignments. The Delphi method is an iterative process that involves a panel of experts who provide their input through multiple rounds of surveys.

1. Round 1: experts assign initial weights to the criteria based on their experience and understanding of the evaluation context. These weights are aggregated to form an initial weight vector.

2. Round 2: the experts will reassess their weight assignments using feedback from the first round. This process is repeated until the weights converge to stable values.

3. Final Weight Vector: The final weight vector W={w1,w2,…,wm } is derived by averaging the weights from the final round of the Delphi process. These weights are then normalized to ensure that their sum equals 1:

![]()

The weights obtained from AHP and expert surveys are integrated into the FCE model by multiplying them with the membership values for each criterion and sub-criterion. The weighted scores are then aggregated to generate the overall evaluation score.

Fuzzy Evaluation Method: Steps to Aggregate and Defuzzify the Input Data

The FCE method involves the following steps: constructing the fuzzy evaluation matrix, aggregating the fuzzy evaluations, and finally, demulsifying the aggregated results to obtain a crisp score.

Step 1: for each criterion Ci and sub-criteria Sij, a fuzzy evaluation matrix Ri is constructed. The fuzzy evaluation matrix Ri is expressed as:

Where μ(Sij) (Ek) represents the membership degree of the sub-criterion Sij to the linguistic term Ek.

Step 2: the fuzzy evaluations of the sub-criteria are aggregated to obtain a fuzzy evaluation vector Bi for each criterion Ci. The fuzzy evaluation vector Bi is calculated as follows:

Where each element μCi Ek represents the aggregated membership degree of criterion Ci to the linguistic term Ek.

Step 3: the overall fuzzy evaluation of the SOE is obtained by aggregating the fuzzy evaluation vectors Bi of all criteria Ci. This aggregation uses the weight vector W={w1,w2,…,wm } assigned to the criteria. The overall fuzzy evaluation vector BG is calculated as:

Here each element μG Ek represents the overall membership degree of the SOE to the linguistic term Ek

Step 4: the most commonly used defuzzification method is the centroid (center of gravity) method, which calculates the crisp score Gcrisp as follows:

![]()

Where, Ek represents the numerical value corresponding to the linguistic term Ek (e.g., Poor =1, Fair =2, Good =3, Excellent =4), and μG Ek is the membership degree of the SOE to the term Ek.

RESULTS

Data Collection

|

Table 2. data type and the source of data |

|||

|

Data Category |

Data Type |

Details/Variables |

Source of Data |

|

Financial Performance |

Quantitative |

Profitability (ROA, ROE, NPM), Liquidity (Current Ratio, Quick Ratio), Leverage (Debt-to-Equity Ratio, Debt-to-Assets Ratio) |

Annual Reports, Financial Statements, Stock Exchanges (e.g., SSE, HKEX) |

|

Operational Efficiency |

Quantitative |

Asset Utilization (Asset Turnover Ratio, Inventory Turnover Ratio), Cost Efficiency (Operating Expense Ratio, Cost-to-Income Ratio) |

Annual Reports, Corporate Filings, Investor Relations Portals |

|

Innovation Capacity |

Quantitative |

R&D Intensity (R&D Expenditure/Total Revenue), Patent Activity (Number of Patents, Patent Intensity) |

Patent Databases (e.g., CNIPA), R&D Reports, Industry Reports |

|

Sustainability Practices |

Quantitative/Qualitative |

Environmental Impact (CF, EE), Sustainable Resource Use (WUE, RR) |

Sustainability Reports, CSR Reports, Government and Regulatory Databases |

|

Stakeholder Satisfaction |

Qualitative |

Customer Satisfaction (Survey Scores, NPS), Employee Engagement (Engagement Index, Retention Rate) |

Survey Data, Expert Interviews, Employee and Customer Surveys |

|

Strategic Importance |

Qualitative |

Strategic initiatives related to national interests, involvement in critical infrastructure projects |

Government and Regulatory Databases (e.g., SASAC), Industry Reports |

|

Corporate Governance |

Qualitative/Quantitative |

Ownership Structure, Governance Practices, Board Composition |

Corporate Filings, Stock Exchange Disclosures, Government Databases |

|

Regulatory Compliance |

Qualitative |

Compliance Records, Fines and Penalties, Regulatory Ratings |

Regulatory Databases (e.g., CSRC), Government Reports |

|

Corporate Social Responsibility (CSR) |

Qualitative |

Community Impact (CCI), CSR Initiatives, Charitable Contributions |

CSR Reports, Sustainability Reports, News Media |

|

Market Position |

Quantitative/Qualitative |

Market Share, Competitive Positioning, Industry Benchmarking |

Industry Reports, Market Research Firms (e.g., CEIS, CASS) |

|

Macroeconomic Indicators |

Quantitative |

GDP Contribution, Sector Growth Rate, Economic Indicators related to SOE sectors |

National Bureau of Statistics of China (NBSC), Government Reports |

|

Recent Developments |

Qualitative |

Strategic Decisions, Mergers & Acquisitions, Policy Changes |

News Media (e.g., Xinhua, China Daily, Reuters), Press Releases |

The proposed model was evaluated and analysed using the following metrics from the collected data. Also, in this study, data related to the performance of SOE operating in China were gathered from multiple government sources. The primary data sources include financial reports, annual statements, Corporate Filings, Regulatory Disclosures, Survey data, and Industry reports. The following table 2 presents the types of data collected and its source.

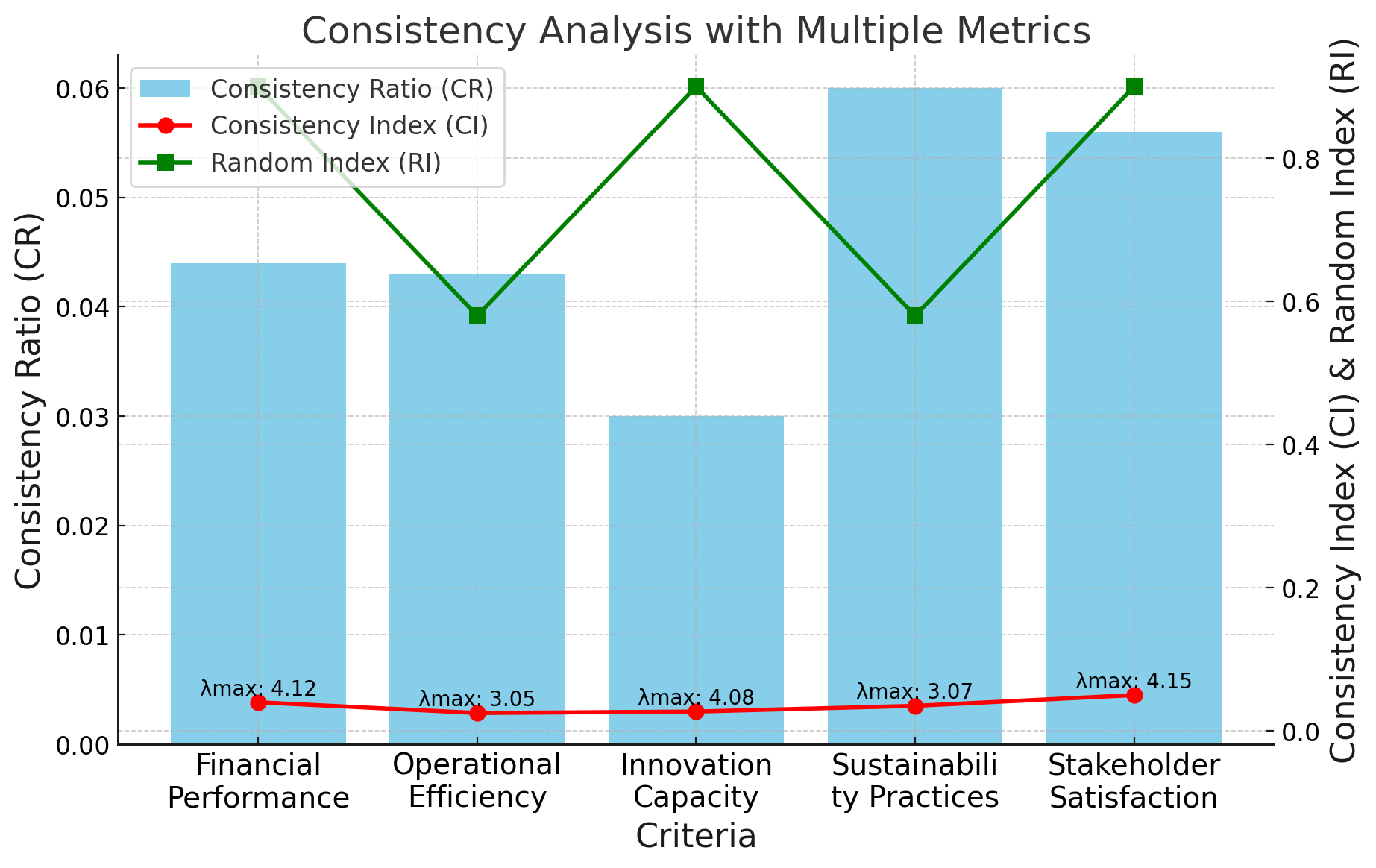

Consistency Ratio (CR)

The CR evaluates the reliability of the weight assignments derived through the AHP. A CR value of 0,1 or less is generally considered acceptable, indicating that the weight assignment process is consistent. Table 3 and figure 1 displays the consistency ratio of the proposed model.

|

Table 3. CR of different criteria |

||||||

|

Criterion |

Number of Sub-Criteria |

Largest Eigenvalue (λ max) |

CI |

RI |

CR |

Acceptable (Yes/No) |

|

Financial Performance |

4 |

4,12 |

0,040 |

0,90 |

0,044 |

Yes |

|

Operational Efficiency |

3 |

3,05 |

0,025 |

0,58 |

0,043 |

Yes |

|

Innovation Capacity |

4 |

4,08 |

0,027 |

0,90 |

0,030 |

Yes |

|

Sustainability Practices |

3 |

3,07 |

0,035 |

0,58 |

0,060 |

Yes |

|

Stakeholder Satisfaction |

4 |

4,15 |

0,050 |

0,90 |

0,056 |

Yes |

Figure 1. CR analysis

For the criterion of Financial Performance with four sub-criteria, the largest eigenvalue (λ max ) was 4,12, resulting in a CI of 0,040. With a RI of 0,90, the CR is measured at 0,044. Similarly, the largest eigenvalue for Operational Efficiency with three sub-criteria was 3,05, generating a CI of 0,025. With an RI of 0,58, the CR was 0,043, confirming that the weight assignments in this criterion are consistent. Innovation Capacity, another criterion with four sub-criteria, had the largest eigenvalue of 4,08, leading to a CI of 0,027. Given the same RI of 0,90, the CR was determined to be 0,030, also falling within the acceptable range. Sustainability Practices, evaluated through three sub-criteria, exhibited a largest eigenvalue of 3,07 and a CI of 0,035. With an RI of 0,58, the resulting CR was 0,060, within acceptable limits, demonstrating consistency in the pairwise comparisons. Lastly, the Stakeholder Satisfaction criterion, which includes four sub-criteria, had the largest eigenvalue of 4,15, resulting in a CI of 0,050. With the RI set at 0,90, the CR was calculated as 0,056, confirming that the comparisons were consistent.

Sensitivity Analysis (SA)

SA measures how changes in input parameters, such as weight assignments or membership functions, impact the model’s final output. Table 4 and figure 2 present the results for sensitivity. The sensitivity analysis shows that Financial Performance and Operational Efficiency are the most influential criteria, with sensitivity coefficients of 0,43 and 0,28, respectively. Innovation Capacity shows moderate sensitivity (0,20), while Sustainability Practices (0,13) and Stakeholder Satisfaction (0,10) have minimal influence, with weight variations resulting in only minor changes to the final score.

|

Table 4. Sensitivity Analysis Results |

||||||

|

Criterion |

Original Weight |

Weight Variation (%) |

Performance Score Before Variation (Gcrisp) |

Performance Score After Variation (Gcrisp) |

Change in Performance Score |

Sensitivity Coefficient |

|

Financial Performance |

0,30 |

+10 |

7,85 |

7,98 |

+0,13 |

0,43 |

|

Financial Performance |

0,30 |

-10 |

7,85 |

7,72 |

-0,13 |

0,43 |

|

Operational Efficiency |

0,25 |

+10 |

7,85 |

7,92 |

+0,07 |

0,28 |

|

Operational Efficiency |

0,25 |

-10 |

7,85 |

7,78 |

-0,07 |

0,28 |

|

Innovation Capacity |

0,20 |

+10 |

7,85 |

7,89 |

+0,04 |

0,20 |

|

Innovation Capacity |

0,20 |

-10 |

7,85 |

7,81 |

-0,04 |

0,20 |

|

Sustainability Practices |

0,15 |

+10 |

7,85 |

7,87 |

+0,02 |

0,13 |

|

Sustainability Practices |

0,15 |

-10 |

7,85 |

7,83 |

-0,02 |

0,13 |

|

Stakeholder Satisfaction |

0,10 |

+10 |

7,85 |

7,86 |

+0,01 |

0,10 |

|

Stakeholder Satisfaction |

0,10 |

-10 |

7,85 |

7,84 |

-0,01 |

0,10 |

Figure 2. Sensitivity analysis

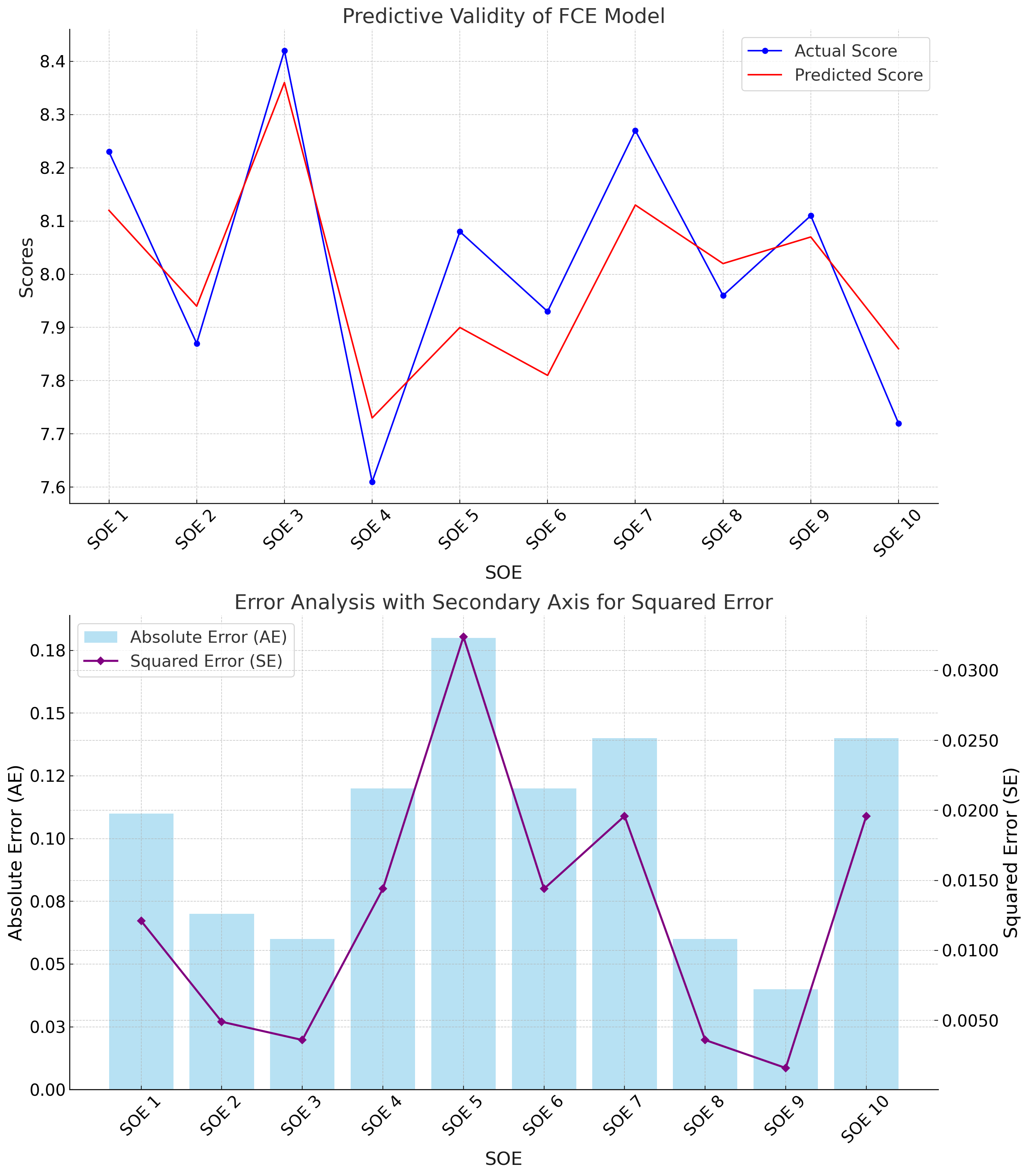

Comparative Accuracy and Predictive Validity

Comparative accuracy is measured using Mean Absolute Error (MAE)

![]()

A high correlation or low MAE indicates that the model accurately reflects the performance of the SOEs.

The Predictive validity is measured using Root Mean Square Error (RMSE)

![]()

A low RMSE and a high R2 value indicates strong predictive validity. The results are presented in table 5 and figure 3.

|

Table 5. Predictive Validity |

||||

|

SOE |

Actual Future Performance Score |

FCE Model Predicted Score |

Absolute Error (AE) |

Squared Error (SE) |

|

SOE 1 |

8,23 |

8,12 |

0,11 |

0,0121 |

|

SOE 2 |

7,87 |

7,94 |

0,07 |

0,0049 |

|

SOE 3 |

8,42 |

8,36 |

0,06 |

0,0036 |

|

SOE 4 |

7,61 |

7,73 |

0,12 |

0,0144 |

|

SOE 5 |

8,08 |

7,90 |

0,18 |

0,0324 |

|

SOE 6 |

7,93 |

7,81 |

0,12 |

0,0144 |

|

SOE 7 |

8,27 |

8,13 |

0,14 |

0,0196 |

|

SOE 8 |

7,96 |

8,02 |

0,06 |

0,0036 |

|

SOE 9 |

8,11 |

8,07 |

0,04 |

0,0016 |

|

SOE 10 |

7,72 |

7,86 |

0,14 |

0,0196 |

Figure 3. Predictive validity: a) Actual vs predicted, b) Absolute Error vs Squared Error

The predictive validity analysis shows that the absolute errors range between 0,04 and 0,18. SOE 5 and 10 show the highest absolute errors of 0,18 and 0,14, respectively. On the other hand, the most minor absolute error is observed for SOE 9, with a value of 0,04, which displays a close alignment between the predicted and actual scores. The squared errors also display the model’s better predictive performance. The SOEs 5 and 10 have the highest squared errors (0,0324 and 0,0196), which indicate the need for refinement. The model also shows lower squared errors for SOE 3, 8, and 9 (ranging from 0,0016 to 0,0036) that reflect accurate predictions.

CONCLUSIONS

The state-owned enterprise is considered an essential driving factor in the country, as is social responsibility in many countries. Assessing the performance of such an enterprise was never easy as it involves multiple factors that must be considered, particularly all aspects of finance and society. The traditional models employed to perform such tasks did not consider both aspects, resulting in poor assessment. The work proposed a Fuzzy Comprehensive Evaluation (FCE) model that combined quantitative and qualitative performance dimensions to handle these challenges. The fuzzy model handles the uncertainties and subjectivities inherent in evaluating these diverse criteria, and it capitalized the measures from the Analytic Hierarchy Process (AHP) and expert surveys to determine the relative importance of each criterion. The model’s performance was examined in terms of multiple metrics, and the results showed that the proposed model had better evaluation capability for state-owned enterprises.

BIBLIOGRAPHIC REFERENCES

1. Vagliasindi, M., Cordella, T., & Clifton, J. (2023). Introduction: Revisiting the role of state-owned enterprises in strategic sectors. Journal of Economic Policy Reform, 26(1), 1-23.

2. Panibratov, A., & Klishevich, D. (2023). Emerging market state-owned multinationals: a review and implications for the state capitalism debate. Asian Business & Management, 22(1), 84-117.

3. Jahanger, A., & Usman, M. (2023). Investigating the role of information and communication technologies, economic growth, and foreign direct investment in the mitigation of ecological damages for achieving sustainable development goals. Evaluation Review, 47(4), 653-679.

4. Steiner, A., Calò, F., & Shucksmith, M. (2023). Rurality and social innovation processes and outcomes: A realist evaluation of rural social enterprise activities. Journal of Rural Studies, 99, 284-292.

5. Medas, P., & Sy, M. (2023). State-owned enterprises: Struggling to be efficient. In Handbook on public sector efficiency (pp. 219-249). Edward Elgar Publishing.

6. Hoang, G., & Oh, K. B. (2023). An Empirical Study of SOE Corporate Governance Attributes for Emerging Markets. Springer.

7. Rochmatullah, M. R., Rahmawati, R., Probohudono, A. N., & Widarjo, W. (2023). Is quantifying performance excellence really profitable? An empirical study of the deployment of the Baldrige Excellence Measurement Model in Indonesia. Asia Pacific Management Review, 28(3), 287-298.

8. Kaunda, E., & Pelser, T. (2023). Corporate governance and performance of state-owned enterprises in a least developed economy. South African Journal of Business Management, 54(1), 3827.

9. Zopounidis, C., & Lemonakis, C. (2024). The Company of the Future: Integrating Sustainability, Growth, and Profitability in Contemporary Business Models. Development and Sustainability in Economics and Finance, 100003.

10. Aman, S., Seuring, S., & Khalid, R. U. (2023). Sustainability performance measurement in risk and uncertainty management: An analysis of base of the pyramid supply chain literature. Business Strategy and the Environment, 32(4), 2373-2398.

FINANCING

None.

CONFLICT OF INTEREST

The authors declare that the research was conducted without any commercial or financial relationships that could be construed as a potential conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Xiayi Zhang, Mohamed Hisham Dato Haji Yahya, Norhuda Abdul Rahim, Nazrul Hisyam Ab Razak.

Investigation: Xiayi Zhang, Mohamed Hisham Dato Haji Yahya, Norhuda Abdul Rahim, Nazrul Hisyam Ab Razak.

Methodology: Xiayi Zhang, Mohamed Hisham Dato Haji Yahya, Norhuda Abdul Rahim, Nazrul Hisyam Ab Razak.

Writing - original draft: Xiayi Zhang, Mohamed Hisham Dato Haji Yahya, Norhuda Abdul Rahim, Nazrul Hisyam Ab Razak.

Writing - review and editing: Xiayi Zhang, Mohamed Hisham Dato Haji Yahya, Norhuda Abdul Rahim, Nazrul Hisyam Ab Razak.