doi: 10.56294/sctconf2024.1259

ORIGINAL

Research on factors affecting green financial development in Vietnam

Investigación sobre los factores que afectan el desarrollo financiero verde en Vietnam

Nguyen Thi Ngoc Diep1 ![]() *, Vu Thi Hoang Yen2

*, Vu Thi Hoang Yen2 ![]() *

*

1Ho Chi Minh City Open University. Vietnam.

2VNU University of Economics and Business, Vietnam National University. Hanoi, Vietnam.

Cite as: Diep NTN, Yen VTH. Research on factors affecting green financial development in Vietnam. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:.1259. https://doi.org/10.56294/sctconf2024.1259

Submitted: 05-04-2024 Revised: 14-07-2024 Accepted: 16-10-2024 Published: 17-10-2024

Editor: Dr.

William Castillo-González ![]()

Corresponding Author: Vu Thi Hoang Yen *

ABSTRACT

This study was conducted to examine the factors affecting the development of green finance in Vietnam.Using quantitative research methods, based on a survey of 152 employees and managers of 7 financial institutions and 7 large enterprises in Vietnam. The research results show that there are 5 factors that have a similar and direct impact in descending order on the development of green finance in Vietnam, specifically as follows: The level of awareness and demand for green investment; Legal environment; Economic environment; Institutional capacity; and International finance. These findings underscore the importance of raising awareness, attracting green investment, and leveraging international financial resources. Based on the results of the study, a number of incentives are offered to stakeholders to promote green finance, including strengthening the regulatory environment, improving institutional capacity, raising awareness and demand for green investment, leveraging international finance, and maintaining a favorable economic environment. This study contributes to a better understanding of the factors affecting the development of green finance in Vietnam, thereby providing important insights to develop effective policies and strategies to promote this sector in developing countries.

Keywords: Green Finance Development; Green Finance; Vietnam.

RESUMEN

Este estudio se realizó para examinar los factores que afectan el desarrollo de las finanzas verdes en Vietnam. Utilizando métodos de investigación cuantitativos, basados en una encuesta de 152 empleados y gerentes de 7 instituciones financieras y 7 grandes empresas en Vietnam. Los resultados de la investigación muestran que hay 5 factores que tienen un impacto similar y directo en orden descendente en el desarrollo de las finanzas verdes en Vietnam, específicamente de la siguiente manera: El nivel de conciencia y demanda de inversión verde; Entorno legal; Entorno económico; Capacidad institucional; y Finanzas internacionales. Estos hallazgos subrayan la importancia de crear conciencia, atraer inversiones verdes y aprovechar los recursos financieros internacionales. Con base en los resultados del estudio, se ofrecen una serie de incentivos a las partes interesadas para promover las finanzas verdes, incluido el fortalecimiento del entorno regulatorio, la mejora de la capacidad institucional, la sensibilización y la demanda de inversiones verdes, el aprovechamiento de las finanzas internacionales y el mantenimiento de un entorno económico favorable. Este estudio contribuye a una mejor comprensión de los factores que afectan el desarrollo de las finanzas verdes en Vietnam, proporcionando así información importante para desarrollar políticas y estrategias efectivas para promover este sector en los países en desarrollo.

Palabras clave: Desarrollo de Finanzas Verdes; Finanzas Verdes; Vietnam.

INTRODUCTION

Green finance is seen as an important mechanism to address environmental challenges and promote sustainable development in a global context.(1) Developing countries such as Vietnam, especially vulnerable to the adverse impacts of climate change, make the need for green finance more urgent.(2) The fact that Vietnam faces natural disasters, sea level rise and extreme weather patterns requires increased green investment to ensure the country's long-term socio-economic development.

According to the World Bank(3), Vietnam is one of the five countries most affected by climate change, which highlights the country's urgency in embracing green finance. Green finance can help mobilize private capital for sustainable projects, reduce greenhouse gas emissions, and support the transition to a green economy.(4) However, the development of green finance in Viet Nam faces many challenges, from policy barriers to institutional capacity constraints.(5)

Nguyen et al.(6) argue that there is a significant gap between the potential and the actual development of green finance in Vietnam. Therefore, this study aims to identify and measure the influence of important factors that promote or hinder the development of green finance in Vietnam, with the ultimate goal of providing insights and recommendations to support the expansion of green finance in the country.

THEORETICAL BASIS AND LITERATURE REVIEW

Green finance and green finance development

Green finance has gained considerable attention in recent years as a tool to address environmental challenges and promote sustainable development. Several professional organizations and several academics have offered definitions and understanding of green finance and green finance development.

According to the United Nations Environment Programme (UNEP) green finance is understood as the financing of investments that bring environmental benefits in the context of sustainable development.(7) This definition emphasizes the role of green finance in supporting environmentally friendly projects and initiatives that contribute to sustainable development.

In addition, the European Investment Bank (EIB) said that green finance is a source of funding to support environmentally sustainable economic activities, such as renewable energy, energy efficiency, sustainable transportation and climate change adaptation (EIB, 4nd). This definition emphasizes the importance of financing sustainable economic activities that address climate change and promote a greener economy.

In addition, Tolliver et al.(8) define green finance as “financial activities that lead to investments in low-carbon, climate-adapted and environmentally sustainable initiatives and infrastructure” (page 1). The study highlighted the role of green finance in supporting low-carbon, climate resilient and environmentally sustainable projects.

Green finance development also aims to address environmental challenges and promote sustainable development by encouraging financial institutions to incorporate environmental, social and governance (ESG) factors into their decision-making processes. Zhang et al.(9) emphasize that green finance development is the process of integrating environmental considerations into financial decisions, products and services to support environmentally sustainable economic activities. This finding shows the importance of integrating environmental factors into financial decision-making to support sustainable economic growth.

Meanwhile, Volz et al.(10) argue that green finance development is the expansion and improvement of the financial system to support environmentally sustainable economic activities and the transition to a green economy. The study shows the role of the financial system in supporting sustainable economic activities and facilitating the transition to a green economy.

Factors affecting green financial development

The review process of studies in the world on the influence of factors on green financial development, including some of the following studies:

Legal environment

Several studies have demonstrated the significant impact of the policy framework and regulatory environment on green finance development. Banga(11) reviewed the role of green bond regulations and found that a clear policy framework and supportive regulatory environment are critical for the development of green bond markets in developing countries. Similarly, Dou et al.(12) investigated the impact of environmental regulations on green finance in China and found that tighter environmental policies and enforcement could stimulate green investment and lending. In the European context, Hafner et al.(13) analyzed the European Union's policy framework on sustainable finance and emphasized the importance of disclosure requirements and harmonized classifications to promote green finance among member states. In addition, Azhgaliyeva et al.(14) studied green finance policies in ASEAN countries and identified the need for clear policy frameworks, including green finance roadmaps, incentives, and regulations to accelerate the transition to a sustainable financial system.

These studies emphasize the important role of governments and policymakers in creating an enabling environment for green finance through effective policy frameworks and legal measures.

Institutional capacity

Volz et al.(10) assessed the capacity of financial institutions to manage environmental risks and found that many banks and investors lack the necessary expertise and tools to effectively integrate sustainability considerations into their operations. Similarly, a study by the International Finance Corporation(15) highlights the need for training and capacity building programs to develop green finance knowledge and skills in financial institutions. The United Nations Environment Program(16) emphasizes the importance of having supportive institutions, such as green banks and climate funds to promote green investment. The study also notes that establishing green finance networks and platforms can facilitate knowledge sharing and collaboration between organizations. Furthermore, research by Campiglio et al.(17) examined the role of public financial institutions in mobilizing private green finance and found that strategic use of financial instruments and their risk-sharing mechanisms can help mitigate the risks of green investment and attract private capital. These studies emphasize the need to build strong institutional capacity and create favorable institutional frameworks to accelerate the development of green finance.

The level of awareness and demand for green investment

The study by Tolliver et al.(8) surveyed investors in various countries and found that those with higher environmental awareness were more likely to invest in green financial products. The study also highlights the importance of financial literacy and education in driving the need for sustainable investment. Similarly, a report by the Global Sustainable Investment Alliance(18) notes that growing public awareness of climate change and sustainability issues is a key driver of the rapid expansion of sustainable investment assets globally. In the corporate sector, research by Krueger et al.(19) found that companies with higher environmental awareness and sustainability commitments tend to attract more green financing and have lower capital costs. Furthermore, the study by Amel-Zadeh et al.(20) looked at the factors influencing the demand of institutional investors for ESG information and found that perceived materiality of sustainability issues and the presence of ESG-oriented beneficiaries are important determinants. These studies show that raising awareness and understanding of green finance among investors, businesses and the public is important to stimulate demand and promote the development of sustainable financial markets.

International Finance

Access to international green finance resources has been identified as an important factor affecting green finance development in different countries, especially in emerging and developing economies. Banga(11) looked at the role of multilateral development banks in the development of private green finance and found that their use of risk sharing tools and technical assistance can help raise significant amounts of international capital for green projects in developing countries. Similarly, research by the Organisation for Economic Co-operation and Development (OECD)(21) highlights the importance of international climate finance flows, such as those from the Green Climate Fund and the Global Environment Fund, in supporting the transition to low-carbon and climate resilient economies in developing countries. The study also highlights the need for countries to develop green finance frameworks and roadmaps in line with international standards to attract foreign investors. In addition, the report of International Finance Corporation(22) notes that the issuance of green bonds in emerging markets is an important channel to access international green finance with the support of multilateral organizations and development financial institutions. Furthermore, the Falcone et al.(23) study analyzed the green bond market in Europe and found that the presence of international investors and compliance with global green bond standards are important factors driving the market's growth. These studies show the importance of accessing international green finance sources to accelerate the development of green finance in different national contexts.

Economic environment

Eyraud et al.(24) analyzed the impact of macroeconomic factors on the green bond market and found that economic growth, low inflation and stable interest rates are conducive to the issuance of growth green bonds. The study also highlights the importance of the well-developed domestic bond market and financial system in supporting green finance expansion. Similarly, a report by the Asian Development Bank(25) notes that the overall investment environment and market liquidity are important determinants of green financial flows in emerging Asian economies. The study highlights the need for countries to maintain macroeconomic stability, develop capital markets and improve business convenience to attract green investment. Moreover, Deschryver et al.(26) looked at the relationship between sustainable economic and financial development and found that countries with higher levels of GDP per capita and developed financial markets tend to have more advanced green financial ecosystems. The study also highlights the potential trade-offs between short-term economic growth targets and long-term sustainability targets in some countries. Furthermore, a study by Monasterolo et al.(27) investigated the impact of climate-related financial risks on macroeconomic stability and found that the transition to a low-carbon economy has a significant impact on financial markets and economic growth, especially in countries with low-carbon economies. These studies emphasize the complex interplay between macroeconomic conditions, market developments, and the growth of green finance, and emphasize the need for policymakers to consider these factors in designing effective green finance strategies.

METHOD

Research models and hypotheses

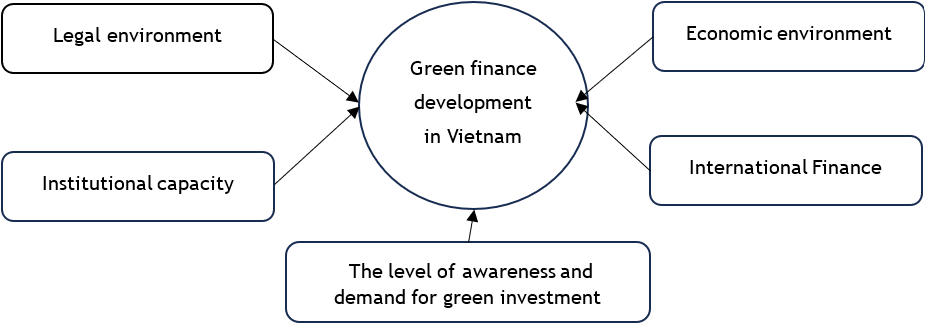

Based on the theoretical basis and previous studies analyzed above, the proposed theoretical model is as follows:

Figure 1. Research model on green financial development in Vietnam

With the multiple regression model as follows: GFDV = β0 + β1*LEN + β2*ICA + β3*ADI + β4*IFI + β5*EEN + ε

Where: β1, β2… is the regression coefficient, β0 is the intercept coefficient, ε is the residual.

Dependent variable: Green finance development in Vietnam (GFDV)

Independent variables: Legal environment (LEN); Institutional capacity (ICA); The level of awareness and demand for green investment (ADI); International Finance (IFI); Economic environment (EEN).

Data collection and processing

The author collects data through the use of questionnaires to collect opinions on factors affecting green financial development in Vietnam of the following subjects:

· Credit officers, financial directors, directors of commercial banks, investment banks, insurance companies, and financial institutions that offer green financial products and services, such as green loans, green bonds, and green insurance. These people can provide insights into green finance needs, the challenges they face in providing green financial products, and the legal and policy frameworks that affect their operations. The 7 financial institutions surveyed include Vietcombank, VietinBank, BIDV, Agribank, VPBank, Viet Capital Securities Joint Stock Company, and Bao Viet Insurance Corporation.

· At the same time, the author also sent questionnaires to environmental officers, financial directors, project managers of companies, especially companies in the green sector such as renewable energy, sustainable agriculture and clean technology seeking green financing for their projects and activities. These officers can express their views on access to green finance, the challenges they face, and their perceptions of green finance needs in Viet Nam. There are 7 surveyed enterprises including, Trung Nam Group, in the field of Wind and Solar Energy; Gia Lai Electricity Joint Stock Company (GEC); Hoa Phat Group - Steel Production and Renewable Energy; Thanh Thanh Cong Group (TTC) - Agriculture and Renewable Energy; VinGroup - Real Estate and Renewable Energy; Vietnam Electricity Group - Electricity Production and Distribution; Vietnam Aviation Corporation - Aviation.

To assess the level of development of green finance in Vietnam (dependent variable), the author uses a 5-level Likert scale of agreement, from: (1) Strongly disagree to (5) Strongly agree. Evaluating independent variable factors, the author uses the Likert scale of 5 levels of influence, from: (1). Very low to (5). Very high. The number of scales measuring the variables is presented in the following table 1.

|

Table 1. Attribute coding of factors affecting green financial development |

|||

|

No. |

Symbol |

Internal category of survey questions |

Source |

|

I |

Legal environment (LEN) |

||

|

1 |

LEN1 |

Current laws and regulations encourage the development of green finance. |

(9,10,13) |

|

2 |

LEN2 |

The enforcement mechanism is effective in ensuring compliance with green finance regulations. |

(8,10) |

|

3 |

LEN3 |

Green finance-related policies and regulations are clear and consistent. |

(10,30) |

|

II |

Institutional capacity (ICA) |

||

|

4 |

ICA1 |

Financial institutions have the expertise and resources to develop and promote green financial products and services. |

(13,14,34) |

|

5 |

ICA2 |

Training and capacity building programs to effectively improve the knowledge and skills of financial institutions and regulators on green finance. |

(6,10) |

|

6 |

ICA3 |

Regulators effectively coordinate and collaborate with each other to support green finance development. |

(4,10) |

|

III |

The level of awareness and demand for green investment (ADI) |

||

|

7 |

ADI1 |

The concept of green finance and green investment is really familiar to me. |

(10,20) |

|

8 |

ADI2 |

Investing in environmentally sustainable projects or businesses is important to my organization. |

(19,20,13) |

|

9 |

ADI3 |

My organization regularly invests in green projects, products, or services. |

(23,2,6) |

|

10 |

ADI4 |

My organization has considered the possibility of green investment in the future. |

(2,32) |

|

IV |

International Finance (IFI) |

||

|

11 |

IFI1 |

My organization has access to international financing for green projects and initiatives. |

(21,22,25) |

|

12 |

IFI2 |

International financial institutions regularly provide financial support for green projects and initiatives. |

(21,22,25) |

|

13 |

IFI3 |

Foreign direct investment (FDI) and foreign portfolio investment (FPI) are critical to the development of green finance. |

(13,31,34) |

|

14 |

IFI4 |

International cooperation facilitates access to international financing of green projects and initiatives. |

(8,10) |

|

V |

Economic environment (EEN) |

||

|

15 |

EEN1 |

The stability of the economy has a positive impact on the development of green finance. |

(17,24) |

|

16 |

EEN2 |

The level of economic development has an effect on the demand for green finance. |

(8,34) |

|

17 |

EEN3 |

Changes in interest rates have an impact on green finance development. |

(17,24) |

|

18 |

EEN4 |

The inflation rate has an impact on the development of green finance. |

(17,24,34) |

|

VIII |

Green finance development in Vietnam (GFDV) |

||

|

19 |

GFDV1 |

The ratio of green financial instruments (e.g., green bonds, green loans, green insurance) to the total financial product provided. |

(14,34) |

|

GFDV2 |

Financial institutions actively promote and invest in green projects and businesses. |

(10,34) |

|

|

21 |

GFDV3 |

The growth rate of green financial investment compared to traditional financial investment. |

(14,34) |

In addition, to ensure the study sample size, based on the minimum sample size requirement for EFA analysis and regression. According to Gorsuch,(28) the sample size is calculated according to the formula n = 5*i (i is the number of observed variables in the model), corresponding to this study, the sample size will be 21 variables * 5 = 105. According to Green,(29) the sample size in the multiple linear regression analysis is calculated according to the formula n = 50 + 8q (q is the number of independent variables in the model), whereby the sample size of the study will be 50 + 8*5 = 90. In order to improve the reliability of the survey information, the study selects the largest sampling for the model according to one of the above principles.

The author uses a convenient sampling method and 152 valid votes are obtained out of a total of 250 submitted through the distribution of direct questionnaires, sending and receiving questionnaires through the Google forms tool to the above survey subjects. Implementation duration: from July 2024 to June 2024. Based on the collected data, the author uses quantitative techniques such as reliability testing of the scale, exploratory factor analysis... with the support of SPSS 22.0 software to summarize and present the basic results of the study.

RESULTS

Descriptive Statistical Analysis

The majority of respondents were men (56,58 %), while women accounted for 43,42 %. This disparity is relatively small, indicating a relative gender balance in the sample. In terms of age, the highest age group is from 31 to 35 years old (27,63 %), followed by the group from 26 to 30 years old (25,0 %), the age group over 40 has the lowest rate (11,19 %). This shows that the sample consists mainly of young and middle-aged people. In terms of education, the majority of respondents have bachelor's degrees (64,47 %), while the number of people with master's and doctoral degrees is 21,71 % and 13,82 %, respectively. This shows that the survey sample has a relatively high level of education. In terms of job positions, the survey subjects came from many different job positions, including managerial positions (Financial Director, Branch Director, Project Director) and professional positions (Credit Support Staff, Corporate Finance, Relationship Director). The diversity in these job positions provides insights from a variety of perspectives. In terms of work experience, the majority of respondents have experience from 6 to 10 years (36,84 %) and from over 1 year to 5 years (31,58 %). Those with 11 to 15 years of experience and over 16 years accounted for a lower proportion, 17,1 % and 14,48 %, respectively.

In general, the survey sample includes diverse subjects in terms of gender, age, education level, job position and experience. This diversity ensures a comprehensive and multidimensional understanding of the factors that affect green finance development in Vietnam.

|

Table 2. Characteristics of survey subjects |

|||||||

|

No. |

Demographic Information |

Person |

Percentage(%) |

||||

|

1 |

Gender |

Male |

86 |

56,58 |

|

||

|

Female |

66 |

43,42 |

|

||||

|

2 |

Age |

21 to 25 years old |

26 |

17,10 |

|

||

|

26 to 30 years old |

38 |

25,00 |

|

||||

|

31 to 35 years old |

42 |

27,63 |

|

||||

|

36 to 40 years old |

29 |

19,08 |

|

||||

|

40 years old |

17 |

11,19 |

|

||||

|

3 |

Educational attainment |

PhD |

21 |

13,82 |

|

||

|

Master |

33 |

21,71 |

|

||||

|

Bachelor |

98 |

64,47 |

|

||||

|

4 |

Job Applications |

Credit support officer |

54 |

35,53 |

|

||

|

Ministry of Environment |

12 |

7,89 |

|

||||

|

Chief financial officer |

16 |

10,53 |

|

||||

|

Branch Manager |

28 |

18,42 |

|

||||

|

Project Director |

14 |

9,21 |

|

||||

|

Corporate Finance Relationship Manager |

28 |

18,42 |

|

||||

|

5 |

Experiences |

Of between over one year and five years |

48 |

31,58 |

|

||

|

From 6 to 10 years |

56 |

36,84 |

|

||||

|

From 11 to 15 years |

26 |

17,10 |

|

||||

|

16 years |

22 |

14,48 |

|

||||

Assess the reliability of the scale

The results of Cronbach's Alpha test show that: independent variables Legal environment; Institutional capacity; The level of awareness and demand for green investment; International Finance; Economic environment is measured by 18 observed variables. The reliability analysis results of the scale all have a Cronbach's Alpha coefficient greater than 0,6. At the same time, the observed variables are correlated with total variables > 0,3 and Cronbach's Alpha coefficient if the type of variables of the observed variables is less than Cronbach's Alpha. Therefore, the independent and dependent variables above meet the reliability. The test results of the scale of factors affecting green financial development in Vietnam with 21 observed variables are shown in table 3 below:

|

Table 3. The results of testing the reliability of the scale of factors in the model |

|||

|

No. |

Factor |

Cronbach’s Alpha |

N |

|

1 |

Legal environment |

0,863 |

3 |

|

2 |

Institutional capacity |

0,820 |

3 |

|

3 |

The level of awareness and demand for green investment |

0,857 |

4 |

|

4 |

International Finance |

0,771 |

4 |

|

5 |

Economic environment |

0,768 |

4 |

|

6 |

0,852 |

3 |

|

Thus, the model retains the same 6 factors to ensure good quality, with 21 variables characteristic of Cronbach's Alpha coefficient of the overall is greater than 0,6; Variable correlation coefficient - the sum of the observed variables is greater than 0,3.

Exploratory factor analysis EFA

The EFA exploratory factor analysis was performed separately for 02 groups of independent and dependent variables, the results are as shown in table 4.

|

Table 4. KMO and Bartlett test results for independent variables |

||

|

KMO and Bartlett's Test |

||

|

Kaiser-Meyer-Olkin Measure of Sampling Adequacy |

0,766 |

|

|

Bartlett's Test of Sphericity |

Approx. Chi-Square |

910,460 |

|

df |

516 |

|

|

Sig. |

0,000 |

|

The EFA analysis results for the independent variable in table 4 show that the KMO value is 0,766 and the Barlett test has a value of 910,460 with a Sig significance level. = 0,000 < 0,05 proves that the data used in the analysis is suitable. There are 5 factors extracted at Eigenvalues = 1,078 > 1, so it can be confirmed that the number of factors extracted is appropriate. The total explanatory variance of factor analysis is 64,216 % > 50 %. This means that 64,216 % of the change of factors is explained by the observed variables. Next, the factor matrix table after rotation will be considered, the analysis results show that the observed variables have been gathered into 05 groups of variables with the order of the observed variables being kept the same compared to the original independent variables, the factor load factors are greater than 0,5, so these 05 groups of independent variables are of practical significance.

The results of the EFA analysis for the dependent variable show that the KMO coefficient = 0,784, so the exploratory factor analysis is appropriate for the actual data. Sig quantity. Satisfy the condition ≤ 0,05 should be statistically significant and the observed variables are correlated with each other in the whole, proving that the data used in the analysis is appropriate. Analysis of the total variance extracted for the dependent variable shows that the percentage value of the entire variance Percentage of variance = 61,241 % > 50 %, the Eigenvalue = 2,006> 1, so the model is eligible for exploratory factor analysis and the load factor of the observed variables is greater than 0,5, so the observed variables are of practical significance. So the dependent variable is kept the same as the original independent variable and there are 05 observed variables.

Regression Analysis

Pearson Correlation Analysis

This step is performed before the regression analysis to check the correlation between the independent variable and the dependent variable.

|

Table 5. Results of Pearson Correlation Analysis |

|||||||

|

|

GFDV |

LEN |

ICA |

ADI |

IFI |

EEN |

|

|

GFDV |

Pearson Correlation |

1 |

|

|

|

|

|

|

Sig. (2-tailed) |

|

|

|

|

|

|

|

|

LEN |

Pearson Correlation |

0,518 |

1 |

|

|

|

|

|

Sig. (2-tailed) |

0,001 |

|

|

|

|

|

|

|

ICA |

Pearson Correlation |

0,413 |

0,198 |

1 |

|

|

|

|

Sig. (2-tailed) |

0,002 |

0,023 |

|

|

|

|

|

|

ADI |

Pearson Correlation |

0,643 |

0,251 |

0,229 |

1 |

|

|

|

Sig. (2-tailed) |

0,000 |

0,003 |

0,006 |

|

|

|

|

|

IFI |

Pearson Correlation |

0,418 |

0,275 |

0,295 |

0,307 |

1 |

|

|

Sig. (2-tailed) |

0,000 |

0,001 |

0,001 |

0,000 |

|

|

|

|

EEN |

Pearson Correlation |

0,380 |

0,241 |

0,208 |

0,012 |

0,102 |

1 |

|

Sig. (2-tailed) |

0,000 |

0,007 |

0,015 |

0,018 |

0,003 |

|

|

|

**. Correlation is significant at the 0,01 level (2-tailed). *. Correlation is significant at the 0,01 level (2-tailed). |

|||||||

From table 5, the Sig. value correlates Pearson independent variables with dependent variables less than 0,05, so they are linearly correlated with each other. Between the ADI variable and the GFDV variable with the highest correlation with r is 0,643, between the EEN variable and the GFDV variable with the lowest correlation with r is 0,380. In addition, the Pearson coefficient of independent variables with dependent variables has a positive value, so these independent variables are directly correlated with the dependent variable.

Regression analysis

Based on the results of the EFA analysis, we have the multiple regression model as follows:

|

Table 6. Model summary tableb |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Durbin-Watson |

|

1 |

0,882a |

0,734 |

0,631 |

1,679 |

|

a. Predictors: (Constant), LEN, ICA, ADI, IFI, EEN. b. Dependent Variable: GFDV |

||||

R2 correction = 0,631 > 0,5 proves the suitability of the model is acceptable. This means that the independent variables explain 63,10 % of the change in the dependent variable "Green financial development in Vietnam", while 36,9 % is due to random errors or factors other than the model.

Test the relevance of the model

The assessment of the relevance of the model is based on the Analysis of Variance. Analysis of Variance test results with Sig significance level = 0,000 shows that the constructed multiple linear regression model is consistent with the dataset.

|

Table 7. Results of linear regression Coefficientsa |

||||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

Collinearity Statistics |

|||

|

B |

Std. Error |

Beta |

Tolerance |

VIF |

||||

|

1 |

|

0,856 |

0,249 |

|

3,508 |

|

|

|

|

LEN |

0,329 |

0,042 |

0,260 |

8,443 |

0,002 |

0,855 |

1,169 |

|

|

IFI |

0,129 |

0,049 |

0,102 |

2,323 |

0,000 |

0,842 |

1,187 |

|

|

ADI |

0,318 |

0,046 |

0,345 |

6,905 |

0,001 |

0,756 |

1,322 |

|

|

ICA |

0,276 |

0,054 |

0,168 |

3,388 |

0,000 |

0,690 |

1,449 |

|

|

EEN |

0,189 |

0,028 |

0,225 |

5,143 |

0,000 |

0,846 |

1,182 |

|

|

a. Dependent Variable: GFDV |

||||||||

Based on the above results, we see:

Testing of multicollinearity: the variance magnification factor (VIF) of all independent variables is less than 5, so multicollinearity in the model is assessed as not serious.

The Durbin-Watson coefficient used to test the correlation of the residues shows that the model does not violate when using the multiple regression method, because the Durbin-Watson value is 1,679. In other words, the model has no correlation of residues.

The independent variables LEN, ICA, ADI, IFI, EEN all have a statistically significant impact (due to Sig.< 0,05) to the GFDV-dependent variable and the coefficient β > 0 proves to have a positive effect on the GFDV-dependent variable. Therefore, accepting the initial hypothesis, the independent variables are linearly related to the dependent variable and are fully consistent with the model. The standardized recursive equation is as follows: GFDV = 0,260*LEN + 0,168*ICA + 0,345*ADI + 0,102*IFI + 0,225*EEN

The regression results with the standardized beta coefficient show that all 5 factors LEN, ICA, ADI, IFI and EEN have a positive influence on the development of green finance in Vietnam (GFDV).

Legal environment (β = 0,260): this result shows that the regulatory environment has a significant impact on green financial development. A solid, stable and supportive legal framework will encourage investment in green projects and initiatives.

Institutional Capacity (β = 0,168): institutional capacity, including policy, regulation, and supporting infrastructure, also plays an important role in promoting green finance. Strong and effective institutions will facilitate the development of this sector.

Level of awareness and demand for green investment (β = 0,345): this factor has the strongest influence on green financial development in Vietnam. As awareness and understanding of the importance of green investment increases, the demand for green financial products and services will also increase, driving the development of this sector.

International Finance (β = 0,102): despite having the lowest impact among the factors, international finance still plays an important role in supporting green finance development. Access to international capital can help attract investment and transfer knowledge to green projects.

Economic Environment (β = 0,225): a stable and favorable economic environment will encourage investment in new and promising sectors such as green finance. Factors such as economic growth, inflation and interest rates influence investment decisions and the development of green financial markets.

DISCUSSION

The results of this study are similar to those that have been validated by previous studies, specifically: Wang et al.(30) have shown that the legal and policy environment plays an important role in promoting green finance in China. This result is consistent with the positive impact of LEN in the current study. Tolliver et al.(8) emphasized the importance of public awareness and understanding of green finance in promoting the development of this field in the United States, similar to ADI's role in this study. Volz et al.(31) discussed the role of international financial institutions in supporting green finance in developing countries, consistent with the positive impact of IFI in this study.

In addition, the research results are also different from some studies, for example, while this study shows that the level of awareness and demand for green investment (ADI) has the strongest influence on green finance development in Vietnam, Sachs et al.(32) emphasizes the key role of legal and policy frameworks (equivalent to LEN) in promoting green finance in the European Union. This study lays out the economic environment (EEN) factor as an important one, while Azhgaliyeva et al.(14) focuses on the impact of institutional and policy factors on green finance in East Asia, without explicitly mentioning the economic environment. Falcone et al.(33,34) studies green finance in Italy, a developed country, and emphasizes the role of financial markets and private sector participation. This may differ from the Vietnamese context, where factors such as regulatory environment (LEN) and institutional capacity (ICA) may have a larger role.

These similarities and differences show that the results of this study both reinforce and complement previous studies. However, direct comparison may be limited due to differences in context, scope, and methodology between studies.

The results of this study highlight the importance of a multifaceted approach to promoting the development of green finance in Vietnam. Policymakers need to focus on improving the regulatory environment, strengthening institutional capacity, raising awareness and demand for green investment, attracting international finance, and maintaining a stable economic environment, specifically as follows:

· Legal environment: (i) Develop and complete a solid and stable legal framework and support for green finance; (ii) Promulgate policies and regulations to encourage investment in green projects and initiatives; (iii) Simplify administrative procedures and facilitate green finance activities.

· Institutional capacity: (i) Strengthening the capacity of regulatory and supervisory agencies in the green finance sector; (ii) Promoting coordination and cooperation among relevant ministries, sectors and organizations; (iii) Investing in infrastructure and technology to support the development of green finance.

· The level of awareness and demand for green investment: (i) Organize communication and education campaigns to raise awareness among the public and stakeholders about the importance of green finance; (ii) Encourage private sector participation and attract investment in green projects; (iii) Develop diverse green financial products and services to meet the growing needs of the market.

· International Finance: (i) Actively seek and attract funding from international financial institutions and foreign investors for green projects; (ii) Cooperate with international partners to share knowledge, experiences and good practices in the field of green finance; (iii) Participate in global green finance initiatives and networks to enhance integration and learning.

· Economic environment: (i) Implementing stable macroeconomic policies, promoting sustainable growth and controlling inflation; (ii) Improving the business environment, creating favorable conditions for investment and promoting innovation; (iii) Encouraging the development of capital and financial markets, facilitating the development of green finance.

In order to develop green finance in Viet Nam effectively, close coordination and efforts of all stakeholders, including the government, the private sector, financial institutions and civil society, are needed. By implementing the above recommendations, Vietnam can create an enabling environment for green finance to thrive, contribute to sustainable growth and respond to climate change.

CONCLUSIONS

The research results indicate that there are 5 factors affecting the development of green finance arranged in descending order, as follows: the level of awareness and demand for green investment; legal environment; economic environment; institutional capacity; and international finance.

These results underscore the crucial role of raising awareness, attracting green investments, and leveraging international financial resources to advance green finance in Vietnam. The study highlights the need for a multi-stakeholder approach to foster an enabling environment for sustainable finance.

Based on the research outcomes, several recommendations are proposed for different stakeholders to promote green finance development. These include strengthening the regulatory framework, enhancing institutional capacity, increasing awareness and demand for green investments, tapping into international finance sources, and maintaining a conducive economic environment.

In conclusion, this study contributes to a deeper understanding of the determinants of green finance growth in Vietnam. The findings provide valuable insights for policymakers, financial institutions, enterprises, and other relevant actors to formulate and implement effective strategies and policies to accelerate the expansion of green finance in developing countries. By addressing the identified key factors, Vietnam can unlock the potential of sustainable finance to support its transition towards a low-carbon, climate-resilient, and environmentally sustainable economy.

BIBLIOGRAPHIC REFERENCES

1. Ren R, Wu C, Guo L. Green finance and environmental performance: Evidence from China’s listed companies. Journal of Cleaner Production. 2021;278:121-132. DOI: 10.1016/j.jclepro.2020.121132

2. Nguyen HTM, Ha NT. Green finance and sustainable development in Vietnam: Challenges and policy implications. Journal of Sustainable Development. 2021;14(1):1-13. DOI: 10.5539/jsd.v14n1p1

3. World Bank. Taking stock: An assessment of climate change impacts and adaptation in Vietnam [Internet]. World Bank. 2020 [cited 2024 Apr 13]. Available from: https://openknowledge.worldbank.org/handle/

4. Tran TT, Nguyen TT. Green finance for sustainable development in Vietnam: The role of commercial banks. Sustainability. 2020;12(10):40-63. DOI: 10.3390/su12104063

5. Hung PH. The Impact of Information Technology in Improving Supply Chain Sustainability: A Case Study on Green Logistics in the Manufacturing Sector in Vietnam. Onomázein. 2023 Nov 21;62(2023 December):560-567. DOI: 10.7764/onomazein.62.40

6. Nguyen PH, Le HN, Le TT. Green finance development in Vietnam: Opportunities and challenges. Journal of Cleaner Production. 2020;249:119-127. DOI: 10.1016/j.jclepro.2019.119127

7. United Nations Environment Programme. Mapping the landscape of green finance initiatives and actors [Internet]. UNEP Inquiry into the Design of a Sustainable Financial System. 2016 [cited 2024 Apr 13]. Available from: https://wedocs.unep.org/bitstream/handle/20.500.11822/14611/

8. Tolliver C, Keeley AR, Managi S. Drivers of green bond market growth: The importance of Nationally Determined Contributions to the Paris Agreement and implications for sustainability. Journal of Cleaner Production. 2020;244:118-134. DOI: 10.1016/j.jclepro.2019.118134

9. Zhang D, Zhang Z, Managi S. Green finance for sustainable development in China. Economic Analysis and Policy. 2020;64:178-191. DOI: 10.1016/j.eap.2019.11.016

10. Volz U, Anger-Kraavi A, Hafner S. Green finance and financial inclusion: A literature review. Sustainability. 2018;10(11):4130. DOI: 10.3390/su10114130

11. Banga J. The green bond market: A potential source of climate finance for developing countries. Journal of Sustainable Finance & Investment. 2019;9(1):17-32. DOI: 10.1080/20430795.2018.1498617

12. Dou X, Qi S. The choice of green finance policy in China: The role of the government. Sustainability. 2019;11(13):36-71. DOI: 10.3390/su11133671

13. Hafner S, Jones A, Anger-Kraavi A, Pohl J. Closing the green finance gap: A systems perspective. Environmental Innovation and Societal Transitions. 2020;34:26-60. DOI: 10.1016/j.eist.2019.11.002

14. Azhgaliyeva D, Kapoor A, Liu Y. Determinants of green bond market development in Asia. Journal of Cleaner Production. 2020;244:118-164. DOI: 10.1016/j.jclepro.2019.118164

15. International Finance Corporation. Green finance capacity building program [Internet]. 2021 [cited 2024 Apr 12]. Available from: https://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_external_corporate_site/climate+business/resources/green+finance+capacity+building+program

16. United Nations Environment Programme. The state of green banks 2020 [Internet]. 2021 [cited 2024 Apr 12]. Available from: https://www.unep.org/

17. Campiglio E, Dafermos Y, Monnin P, Ryan-Collins J, Schotten G, Tanaka M. Climate change challenges for central banks and financial regulators. Nature Climate Change. 2018;8(6):462-468. DOI: 10.1038/s41558-018-0175-0

18. Global Sustainable Investment Alliance. Global sustainable investment review 2020-2021 [cited 2024 Apr 12]. Available from: http://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf

19. Krueger P, Sautner Z, Starks LT. The importance of climate risks for institutional investors. The Review of Financial Studies. 2020;33(3):1067-1111. DOI: 10.1093/rfs/hhz137

20. Amel-Zadeh A, Serafeim G. Why and how investors use ESG information: Evidence from a global survey. Financial Analysts Journal. 2018;74(3):87-103. DOI: 10.2469/faj.v74.n3.2

21. OECD. The role of international public finance in mobilising private finance for green investments. OECD Publishing; 2016. https://doi.org/10.1787/9789264255416-en

22. International Finance Corporation. Emerging market green bonds report 2020 [Internet]. 2021 [cited 2024 Apr 12]. Available from: https://www.ifc.org/wps/wcm/connect/publications_ext_content/ifc_external_publication_site/publications_listing_page/emerging-market-green-bonds-report-2020

23. Falcone PM, Sica E. Assessing the opportunities and challenges of green finance in Italy: An analysis of the biomass production sector. Sustainability. 2019;11(2):517-532. DOI: 10.3390/su11020517

24. Eyraud L, Wane AA, Zhang C, Clements B. Green bonds and macroeconomic policy. Energy Policy. 2021;149:112-139. DOI: 10.1016/j.enpol.2020.112139

25. Asian Development Bank. Green finance in Southeast Asia: Trends and opportunities. 2021 [cited 2024 Apr 12]. Available from: https://www.adb.org/publications/

26. Deschryver P, De Mariz F. What future for the green bond market? How can policymakers, companies, and investors unlock the potential of the green bond market? Journal of Risk and Financial Management. 2020;13(3):61-82. DOI: 10.3390/jrfm13030061

27. Monasterolo I, De Angelis L. Blind to carbon risk? An analysis of stock market reaction to the Paris Agreement. Ecological Economics. 2020;170:106-121. DOI: 10.1016/j.ecolecon.2019.106451

28. Gorsuch RL. Factor analysis. 2nd ed. Hillsdale, NJ: Lawrence Erlbaum Associates; 1983. ISBN: 978-0898592023

29. Green SB. How many subjects does it take to do a regression analysis? Multivariate Behavioral Research. 1991;26:499-510. DOI: 10.1207/s15327906mbr2603_7

30. Wang Y, Zhi Q. The role of green finance in environmental protection: Two aspects of market mechanism and policies. Energy Procedia. 2016;104:311-316. DOI: 10.1016/j.egypro.2016.12.062

31. Volz U, Knaack P, Nyman J, Ramos L, Moling J. Inclusive green finance: From concept to practice [Internet]. Alliance for Financial Inclusion. 2020 [cited 2024 Apr 12]. Available from: https://www.afi-global.org

32. Sachs J, Woo WT, Yoshino N, Taghizadeh-Hesary F. Why is green finance important? Asian Development Bank Institute. 2019. URL: https://www.adb.org/sites/default/files/publication/499646/adbi-wp917.pdf

33. Falcone PM, Sica E. The European green bond market: A new financial instrument to support sustainable development. Sustainability. 2019;11(23):166-192. DOI: 10.3390/su11236106

34. Taghizadeh-Hesary F, Yoshino N, Aoyama Y. The role of green bond markets in financing the energy sector: A comparative study between developed and developing countries. Energy Strategy Reviews. 2019;26:100-137. DOI: 10.1016/j.esr.2019.100437

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Nguyen Thi Ngoc Diep, Vu Thi Hoang Yen.

Data curation: Vu Thi Hoang Yen.

Formal analysis: Nguyen Thi Ngoc Diep.

Acquisition of funds: Nguyen Thi Ngoc Diep, Vu Thi Hoang Yen.

Research: Nguyen Thi Ngoc Diep.

Methodology: Vu Thi Hoang Yen.

Project management: Nguyen Thi Ngoc Diep, Vu Thi Hoang Yen.

Resources: Nguyen Thi Ngoc Diep.

Supervision: Vu Thi Hoang Yen.

Validation: Nguyen Thi Ngoc Diep.

Display: Vu Thi Hoang Yen, Nguyen Thi Ngoc Diep.

Drafting - original draft: Nguyen Thi Ngoc Diep, Vu Thi Hoang Yen.

Writing - proofreading and editing: Nguyen Thi Ngoc Diep, Vu Thi Hoang Yen.