ORIGINAL

Assessment of Factors Influencing the Stability of the Banking System: Experience of the European Union Countries

Evaluación de los factores que influyen en la estabilidad del sistema bancario: experiencia de los países de la Unión Europea

Andrii Meshcheriakov1

![]() *, Anatoliy

Maslov2

*, Anatoliy

Maslov2 ![]() ,

Grygorii Saienko3

,

Grygorii Saienko3 ![]() ,

Oksana Antoniuk4

,

Oksana Antoniuk4 ![]() ,

Tetiana Sunduk5

,

Tetiana Sunduk5 ![]()

1University of Customs and Finance, Department of Finance, Banking and Insurance. Dnipro, Ukraine.

2Taras Shevchenko National University of Kyiv, Department of Economic Theory, Macro and Microeconomics. Kyiv, Ukraine.

3Academy of Applied Sciences – Academy of Management and Administration in Opole, Department of Logistics and Marketing Management. Opole, Poland.

4University of Economics and Entrepreneurship, Department of Accounting and Finance. Khmelnytskyi, Ukraine.

5State University of Trade and Economics, Department of Banking. Kyiv, Ukraine.

Cite as: Meshcheriakov A, Maslov A, Saienko G, Antoniuk O, Sunduk T. Assessment of Factors Influencing the Stability of the Banking System: Experience of the European Union Countries. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:.647. https://doi.org/10.56294/sctconf2024.647

Submitted: 17-02-2024 Revised: 21-06-2024 Accepted: 28-11-2024 Published: 29-11-2024

Editor: Dr. William Castillo-González

![]()

Corresponding author: Andrii Meshcheriakov *

ABSTRACT

Introduction: in modern developed European countries, the banking system reflects the economy’s state and financial sector efficiency. Its stability significantly impacts the financial system and economic growth. Banking institutions act as intermediaries between sectors like trade, manufacturing, agriculture, and consumers, underscoring their critical role.

Objective: this study aims to identify factors influencing banking system stability by analyzing the European Union’s banking experience.

Method: a statistical analysis was conducted to determine the key factors affecting stability and prioritize those requiring regulatory focus. The research employed general scientific methods (analysis, synthesis, generalization, systematization) and a specific method—a multiple regression model—to identify factors ensuring financial stability.

Results and conclusions: findings reveal regional disparities and instabilities in the distribution of major banks across EU countries. This highlights the need for proactive fiscal stability measures. The multiple regression analysis identified significant determinants of banking stability, including capital cost and accessibility, investment activity, financial stability risks, digital security, and data protection. These insights emphasize the importance of targeted regulatory efforts to enhance the EU banking sector’s resilience and sustainable growth.

Keywords: Banking Stability; Financial Factors Of Influence; Economic Crises; Regulatory Policy; Financial Integration; Risk Management; Bank Liquidity.

RESUMEN

Introducción: en los países europeos desarrollados modernos, el sistema bancario refleja el estado de la economía y la eficiencia del sector financiero. Su estabilidad influye significativamente en el sistema financiero y en el crecimiento económico. Las instituciones bancarias actúan como intermediarios entre sectores como el comercio, la industria manufacturera, la agricultura y los consumidores, lo que subraya su papel fundamental.

Objetivo: este estudio pretende identificar los factores que influyen en la estabilidad del sistema bancario analizando la experiencia bancaria de la Unión Europea.

Método: se llevó a cabo un análisis estadístico para determinar los factores clave que afectan a la estabilidad y priorizar aquellos que requieren una atención reguladora. La investigación empleó métodos científicos generales (análisis, síntesis, generalización, sistematización) y un método específico -un modelo de regresión múltiple- para identificar los factores que garantizan la estabilidad financiera.

Resultados y conclusiones: los resultados revelan disparidades e inestabilidades regionales en la distribución de los principales bancos en los países de la UE. Esto pone de relieve la necesidad de adoptar medidas proactivas de estabilidad fiscal. El análisis de regresión múltiple identificó determinantes significativos de la estabilidad bancaria, como el coste y la accesibilidad del capital, la actividad inversora, los riesgos para la estabilidad financiera, la seguridad digital y la protección de datos. Estas conclusiones subrayan la importancia de adoptar medidas reguladoras específicas para mejorar la resistencia del sector bancario de la UE y su crecimiento sostenible.

Palabras clave: Estabilidad bancaria; Factores financieros de influencia; Crisis económicas; Política regulatoria; Integración financiera; Gestión de riesgos; Liquidez bancaria.

INTRODUCTION

In the contemporary world, the banking system of any nation serves as the linchpin of the economic apparatus, interfacing with all sectors of the economy, the populace, and governmental bodies, thereby exerting a significant influence on them. The effective operation of the banking system acts as a catalyst for the advancement of the domestic economy.

The banking system fulfills numerous functions, including but not limited to:

· Upholding currency stability

· Accumulating and allocating funds among various business entities

· Facilitating the seamless operation of the payment system, among others.

In light of these roles, the steady progress of the banking sector emerges as a pivotal prerequisite for national economic advancement and the preservation of financial security within the country.(1) The increasing volatility in the development of individual economies, spurred by adverse external influences, not only triggers national banking crises but also fosters global financial turmoil.

The nature of economic activities significantly influences the choice of the banking system’s development model. Commercial banks, as autonomous entities, operate under the purview of the central bank of the country and their shareholders. Their primary objective is to conduct profitable banking operations while minimizing the risk of financial instability. Regulatory authorities continuously prioritize mitigating risks to financial stability, particularly in light of crises in the banking sectors of developed nations, which are exacerbated by various events and recessionary trends. The instability in the financial sector and the rising inflation in developed European countries and the United States serve as stark reminders of the importance of averting excessive vulnerabilities in the financial system and economy. Additionally, they underscore how the growing interconnectedness of financial markets and institutions can significantly contribute to crisis development.(2,3)

For decades, participants in the EU financial markets have grown accustomed to historically low interest rates set by major central banks. The majority of the EU population expected these refinancing rates to persist for an extended period. Consequently, financial institutions diverted their attention away from interest rate risk hedging and effective balance sheet management. However, the cycle of aggressive interest rate hikes initiated amidst the economic downturn in 2022 to combat inflation has forced banks to confront the reality of interest rate risk.

In today’s ever-changing landscape, there is a continual search for effective models of banking system development.(4) The latter part of the twentieth century saw a series of crises that shook the foundations of previous economic and social progress. With both external and internal factors presenting risks, it is crucial to understand the factors that influence the stability of the banking system in order to promote its long-term growth. This study will center on exploring these determinants.

Aims and Objectives

Given the proven relevance of the study and the conducted literature review, the main goal of the study is to specify the factors that affect the stability of the banking system using correlation analysis. To accomplish this objective, it is imperative to conduct a statistical analysis of the present condition of the banking system within the European Union. This analysis will help in identifying the factors that could have a significant impact on the stability of the banking system, with a focus on determining which of these factors warrant special attention in the regulation of banking activities.

METHOD

The study entails an analysis of statistical data concerning the development of the EU banking system and identifies factors that may influence the effectiveness of measures aimed at ensuring financial stability within this system. It acknowledges the need for the banking sector to swiftly adapt to external economic changes in developed countries. The determination of financial stability factors within the banking system is based on the multiple correlation method.

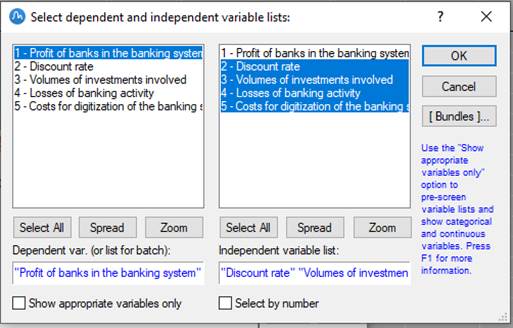

The main direction of achieving the research goal was the application of the multiple correlation method to determine the factors that directly affect the stability of the banking system. Accordingly, the main specific research method is the multiple correlation method, which allowed to specify the factors that affect the financial stability of the banking sector and determine the development of the banking sector in the EU countries. The following indicators were selected as independent variables: discount rate, volume of investments attracted, banking losses, costs of digitalization of the banking system. The dependent variable was determined as the indicator: profit of banks in the banking system.

Data Collection

Scientific sources were procured through searches conducted on prominent databases, namely Web of Science and SCOPUS. These databases are renowned for their comprehensive coverage of scientific literature across various disciplines. Emphasis was placed on sourcing materials from the past five years to ensure the utmost relevance, given the dynamic nature of banking sector development.

The writing base for this consider was chosen through looks within the central databases Web of Science and Scopus. Through a audit of scientific writing, bunches inquisitive about the inquire about were recognized, counting government authorities, trade pioneers and proprietors, budgetary chiefs, specialized masters, and others. The period for database looks was set from February 2019 to May 2024 to ensure the coherence and astuteness of the inquire about conducted within the final five a long time.

Search Criteria

Through systematic review and analysis of scientific literature, target groups for the study were identified, including representatives from governmental bodies engaged in banking, international banking organizations, as well as bank proprietors and personnel. The search timeframe spanned from January 2019 to April 2024 to maintain continuity and comprehensiveness in capturing research trends over the preceding five years.

Data Analysis

Furthermore, the article utilizes the multiple correlation method, a scientific technique focused on identifying the various factors that impact the stability and financial viability of the banking industry. By employing this method, the study is able to examine the specific intricacies of the banking sector and aid in the creation of effective strategies for future growth within the EU banking industry.

RESULTS

The academic literature posits that banking system stability entails the ability to withstand both external and internal pressures while maintaining a consistent balance and reliability over time. The financial health of individual components significantly influences the overall stability of the system. Measures aimed at bolstering the resilience of commercial banks play a pivotal role in ensuring the steady progress of the banking system amidst economic turbulence.(5,6,7)

Scholars Doroshenko et al.(8), Myronchuk et al.(9), and Luo(10) argue that the quest for banking system sustainability transcends national borders and has become a multinational concern. In the twenty-first century, the global landscape cannot be shaped without due consideration of the monetary realm. The increasing number of crises, bankruptcies, and financial losses can no longer be ignored. A sustainable society needs to create a strong and resilient banking system model. Banks strive to enhance their resilience through various means, such as bolstering capital adequacy ratios, refining risk management systems, and broadening the diversity of their products and services across different regions.

The stability of the banking system within the European Union hinges on the monetary policy (MP) orchestrated by the European Central Bank (ECB), alongside regulations, oversight, and the individual resilience of each commercial bank. Monetary policy serves as a macroeconomic tool encompassing the management of money supply, credit, interest rates, and exchange rates to regulate the overall expenses of the economy.(11,12)

The ECB oversees the operations of EU credit institutions, shaping the methodological framework within which commercial banks function and conducting banking supervision. While the ECB has made strides in fortifying and refining the banking system, challenges persist.

In line with ECB policy, the tools for regulating banking activities include:(13)

· Discount rate (refinancing rate)

· Mandatory reserve requirements

· Operations in the foreign exchange market

· Economic standards for credit institutions.

Analyzing these tools and delineating their specific applications enables the formulation of a set of actions for the optimal management of banking services and regulations. Scholars in the field Kolinets(14) and Liu et al.(15) highlight that the stability of the banking system hinges on the financial market. Without a developed financial market, commercial banks lack the ability to diversify risks and effectively manage assets, including those of enterprises, firms, and households. Underdeveloped financial markets diminish the banking system’s resilience to external shocks, rendering it unstable. Another crucial element for banking system stability is the presence of market infrastructure, encompassing legislation, financial markets, and their organizational frameworks.

The international economic landscape is in a constant state of flux. Amid significant shifts and escalating global financial turbulence, credit institutions can emerge as major sources of crisis in any financial setting. This underscores the imperative of ensuring the overall stability of the banking system and the resilience of individual financial institutions. In summarizing the perspectives of scholars Kulikov et al.,(16) Lomaka et al.,(17) and Tymoshenko et al.,(18) we can identify several key factors influencing the stability of the banking system:

· Political instability

· Globalization of financial markets

· Impact of external global crises

· Macroeconomic factors

· Monetary policy

· Investment climate

The economy’s competitiveness is essential for sustainable growth. Advancements in information and communication systems must be balanced with robust data protection measures. Ensuring a solid resource base and capital adequacy is crucial for financial stability. Continual innovation in banking products and services is necessary to meet evolving customer needs. Proactive management of banking risks is vital to safeguard the sector’s stability.

In summary, regulators must remain vigilant in monitoring these key areas to maintain a stable and resilient banking sector. To enhance the resilience of the banking system and mitigate systemic risks, continuous monitoring of risks and improvement of risk management practices at the commercial bank level is essential. The resilience of credit institutions is directly influenced by the policies of the central bank and the effectiveness of measures to address key factors impacting financial stability.

When examining European countries, it’s crucial to delve into the legal framework of the European Central Bank (ECB), which holds a pivotal role in the structure of EU banking systems and is instrumental in safeguarding the financial stability of the EU banking sector. This is primarily because the central banks of EU member states have delegated certain authorities to the ECB, granting it the mandate to execute various functions within their respective banking systems. Presently, the ECB stands as the principal financial institution of the EU, responsible for shaping, regulating, and optimizing monetary policies across Eurozone countries.(19)

The unique quality of the ECB is its ability to provide guidance on a global scale and shape the direction of banking development in various countries, each with its own individual economic and financial environment. In line with legislation and insights gained from analyzing the ECB’s operations, its primary functions can be delineated as follows:

· Managing inflationary trends and curbing the depreciation of the euro currency.

· Ensuring sustained economic growth within Eurozone nations.

· Formulating and overseeing monetary policy in the Eurozone.

· Monitoring and evaluating the utilization of foreign exchange reserves.

· Facilitating the issuance of the euro currency.

· Providing rationale for and setting the key policy rate, alongside offering recommendations on interest rate adjustments.

The idea of financial stability in global practice involves two distinct interpretations. One aspect focuses on the smooth functioning of all aspects of the financial system, while the other involves a broader and narrower understanding of the concept. The broader view considers risks to the stability of the financial system, such as increased volatility in financial markets. In contrast, the narrower interpretation looks at specific indicators, with institutions like the ECB focusing on factors like profitability, capitalization, and risk management in banks.(20) Similarly, the German Central Bank defines financial stability as the effective functioning of the financial system in meeting its current and future obligations.

In updated documentation, the ECB defines financial stability as a “condition wherein the monetary structure can withstand shocks without triggering cumulative disruptions to the flow of savings into investments and payments within the economy.” This pragmatic definition, rather than an academic one, serves as the foundation for the ECB’s monitoring and policymaking efforts.

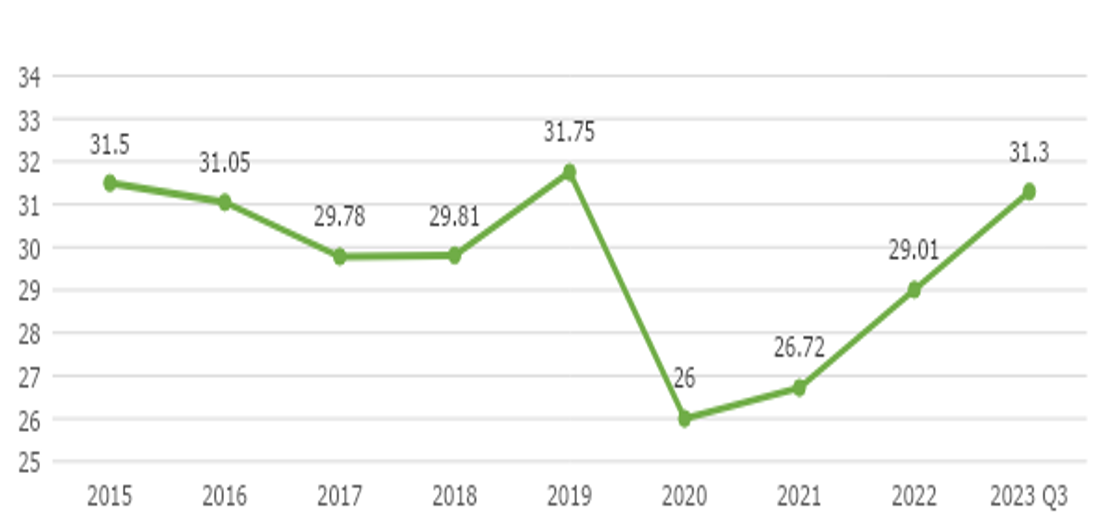

According to ECB data for the third quarter of 2023, banks’ assets in EU member states amounted to €31,3 trillion, showing a year-on-year increase compared to the same period the previous year. The trend in the EU banking sector’s assets is depicted in the figure. It’s noteworthy that the asset value experienced a sharp decline between 2019 and 2020 as a result of the pandemic. In the third quarter of 2020, EU banking sector assets totaled €26 trillion, marking a roughly 15 % decrease from 2019, when it reached €31,75 trillion. Three years ago, there was an upward trajectory.(21,22)

Importantly, this period coincided with the exclusion of assets owned by UK banks from the EU aggregate, rendering the 2020 data non-indicative for this reason. Conversely, assets reached their peak value in 2019, with a year-on-year increase of over 6 % to €29,81 trillion.

Source: Data by Euro Banking Association and European Central Bank.(21,22)

Figure 1. Overall assets of the EU banking sector

The increase in assets coincided with escalating geopolitical tensions following Russia’s invasion of Ukraine, which rendered Europe strategically vulnerable. Banks played an active role in assisting regulators in implementing economic sanctions against the aggressor country. Table 1 presents the breakdown of European countries based on the number of major banks and the combined value of their assets in each country.

|

Table 1. Distribution of the top 50 European banks by region (assets, €B) |

||

|

Geography |

Total of banks in each geography (ranking) |

Assets (€B) |

|

France |

6 |

9 914,19 |

|

U.K. |

6 |

7 274,07 |

|

Germany |

6 |

3 134,07 |

|

Italy |

5 |

2 291,62 |

|

Spain |

4 |

3 265,41 |

|

Switzerland |

3 |

2 057,21 |

|

Netherlands |

3 |

1 975,91 |

|

Sweden |

3 |

883,40 |

|

Finland |

2 |

770,36 |

|

Russia |

2 |

843,79 |

|

Denmark |

2 |

721,02 |

|

Belgium |

2 |

535,34 |

|

Austria |

2 |

530,92 |

|

Ireland |

2 |

281,08 |

|

Norway |

1 |

307,38 |

|

Türkiye |

1 |

127,66 |

|

Total |

50 |

34 913,43 |

|

Source: Data by Euro Banking Association, EBA CLEARING, and European Commission.(21,23,24) |

||

France, the United Kingdom, and Germany emerge as the key players in the European banking arena, boasting the highest number of major banks. This highlights their significant influence in the European banking sector. Given the fluctuating nature of asset dynamics and the variation in the concentration of major banks across Europe, it becomes crucial to discern the primary factors impacting the financial constancy of the investment industry.

Two predominant financial system models exist, each delineating distinct roles for banks and capital markets: the Anglo-American model (observed in the USA, the United Kingdom, and many Latin American nations) and the continental model (notably found in Germany, Japan, and much of Europe). These models diverge in terms of bank market entry, operational principles, institutional infrastructure diversity, and the predominant securities traded. The roots of this dichotomy concerns the historical evolution of banking systems and their industrial ties, particularly evident in the UK and Germany, alongside the differing legal frameworks—Anglo-Saxon and German, respectively.

The Anglo-Saxon legal system, known for fostering the securities market, provides robust protection for investor rights, thereby encouraging securities market transactions over traditional banking activities. Conversely, civil law countries tend to favor banking markets due to legal preferences.

The Anglo-Saxon banking model is characterized by several distinctive features:

· Predominantly relies on legal methods for regulation.

· Seeks to minimize direct government intervention in the investment and lending activities of banks.

· Shifts investment functions across various sectors of the economy to private investors.

· Oversight of capital requirements to ensure banks have enough reserves to withstand economic downturns.

· Regular monitoring and assessment of banks’ risk management practices and policies.

· Enforcing strict compliance with anti-money laundering and customer due diligence regulations to prevent illicit activities within the banking sector.

· Implementation of deposit insurance schemes to protect customer funds and maintain trust in the banking system.

· Collaboration with international regulatory bodies to coordinate efforts and prevent regulatory arbitrage.

· Regulation of the territorial and functional specialization of commercial banks through financial instruments.

· Stringent legislative oversight of investment banks’ activities.

· Regulation of banking system risks through economic measures such as establishing substantial mandatory reserves and deposit insurance.

· Allocation of functions for collecting and managing individual depositors’ funds among investment companies, investment funds, commercial and investment banks, and pension funds.

The continental banking system, observed in countries like Italy, Germany, and France, employs a blend of legislative, direct administrative, and indirect economic methods for state regulation. The involvement of banks in investment processes across other sectors of the economy is governed by several approaches:

· Public sector management within the investment structure.

· Fixing interest rates within specified recommended ranges.

· Establishment of specialized medium- and long-term lending institutions and their alignment with specific industries.

· Regulation of terms and conditions for issuing, securing, directing, etc., investment loans.

· Promotion of broadening commercial banks’ activities while maintaining a relatively underdeveloped securities market.

· Oversight of the investment base of investment investments.

· Rotation of senior civil servants and bank managers.

· Establishment of a system of postal and savings banks that function as retail banks for commercial institutions.

· Regulation of the personal union of financial and industrial capital.

· Preferential taxation of borrowed funds.

Unlike the Anglo-Saxon model countries, which use economic tools to encourage investment, the continental model relies heavily on administrative strategies. Overall, the regulator’s role in shaping banking sector development policies highlights crucial elements for maintaining financial stability within the banking system, as illustrated in table 2.

|

Table 2. Overview of factors influencing the financial stability of the investment structure and corresponding indicators |

|

|

A factor of financial stability of the banking system |

Indicator |

|

Financial stability of the investment structure |

Income of banks in the investment structure |

|

Cost and availability of capital |

Discount rate |

|

Investment activity in the investment structure |

Amounts of investments attracted |

|

Financial stability risks |

Losses from banking activities |

|

Digital security and data protection |

Expenditures on digitalization of the investment structure |

|

Source: Compiled by the authors based on.(25,26,27) |

|

By utilizing the primary aggregated factors influencing the financial stability of the banking system outlined in table 2, a multiple correlation model can be constructed to identify the most crucial elements in maintaining financial stability. Data from the countries listed in table 1 were used to model the relationship among the indicators. The model was developed by setting bank profits within the banking system as the dependent variable, with the remaining indicators from Table 2 designated as independent variables – refer to figure 2 for details.

Figure 2. Selection of the dependent and independent variables for constructing a multiple regression model

The outcomes of constructing the model demonstrate a positive outcome, with both R and R2 exceeding 0.9, indicating that the model is over 90 % accurate (figure 3).

Figure 3. Results of the adequacy assessment of the multiple regression models

The modeling outcomes are illustrated in figure 4.

Figure 4. The outcomes of constructing a multiple correlation model

Based on the results shown in figure 4, it is clear that all the suggested factors for inclusion in the model are important. The banking loss ratio has a significant impact on financial stability, as expected, since lower loss ratios are linked to stronger financial stability indicators in banking institutions. The factors with the greatest influence on the financial stability of the banking system are the level of investments attracted and the extent of digitization in the banking sector.

The central bank plays a crucial role in the banking systems of many European countries, such as Germany’s Bundesbank, Spain’s Bank of Spain, and France’s Banque de France. Its duties involve implementing a coherent monetary policy and carrying out different financial transactions with credit institutions and other actors in the financial market. These activities may involve offering secured loans, participating in open market operations, and accepting term deposits. The main objective of central banks, like the NBU, is to maintain the stability of the currency and oversee the circulation of money and credit.

In order to maintain the financial stability of the banking system in European countries, central banks need to carefully consider and address various factors identified through the multiple regression model process. These factors include the cost and availability of capital, investment trends within the banking sector, risks to financial stability, as well as digital security and data protection measures. It is crucial for central banks to comprehensively tackle all these aspects of banking operations in order to positively impact the financial stability of the banking system as a whole.

DISCUSSION

Today, more and more attention is paid in the literature to the issues of the stability of the banking system, but with the increase in attention to this issue, the number of debatable opinions on this issue is also increasing. For example, in the literature there are studies assessing the stability of the European banking system to three types of shocks.(28,29,30) The first - the least painful - scenario assumes a crisis in the financial market of Eastern Europe: in the Baltic countries, Slovakia, Slovenia and Romania.(4) In particular, such events as the depreciation of government debt, corporate and retail loans. This type of shock leads to the loss of 6,5–10 % of capital by the European banking sector, depending on the intensity of the crisis. It is worth emphasizing that the possibility of such a scenario exists, but it can be assessed as minimal, since today the Baltic countries and Romania are actively developing the information environment and creating favorable conditions for the inflow of investment into these countries, respectively, the inflow of investment resources reduces the risks of loss of financial stability. One can fully agree with this view of scientists, since they focus on possible problems in the financial sector for most countries that have an unstable financial situation and are at risk of losing financial equilibrium.

There is also another view of Muliarevych(31) and Luo et al.(32), which predicts a liquidity shock in the 50 largest banks in Europe, which may arise from an increase in interest rates and a corresponding drop in the value of bonds on their balance sheets, as well as an outflow of depositors’ funds. The occurrence of these events will mean capital losses in the range of approximately 10 to 23 %. It is also difficult to fully agree with this, since today there is already a trend towards reducing central bank interest rates and reducing the cost of capital. It is difficult to agree with the development of such a scenario, since effective protection mechanisms have been created for most EU countries today and strict control over compliance with banking safety requirements is carried out.

A separate view is presented in the works of the scientific community, which predicts that a crisis will arise in the event of a collapse of the markets of Southern Europe, in particular Italy, Spain, Portugal, Greece and Cyprus.(33,34,35,36,37) Capital losses of the banking system of the entire EU in this scenario are estimated at 11–50 %. It should also be emphasized that such a scenario is also plausible, especially against the backdrop of the real estate construction boom in these countries, however, the economies of these states are quite developed and there are no objective reasons to expect a systemic crisis in the near future. This development and the view of the scientists can also be considered likely, since the markets of Southern Europe have certain banking risks, which are caused by large amounts of debt and high indicators of national debt.

Another area that is actively discussed in the scientific community is the conduct of stress tests.(38) Stress tests conducted by supervisors should include market analysis, cover smaller creditors and test banks under more adverse, but plausible scenarios. Banking supervisors should act proactively and be ready to address identified weaknesses. One can fully agree with this, but it should also be added that international standards need to be raised in order to contain liquidity risks and interest rate risks in banks.(39) At least a fifth of the countries have poorly developed supervisory and regulatory practices to monitor and eliminate these risks, and fluctuations in discount rates are precisely evidence of this. Banks would be more resilient if they were better prepared to use central bank lending facilities. Banks should periodically review their access to such facilities, and supervisors should assess whether weaker lenders can easily access emergency assistance.

CONCLUSIONS

In the process of conducting the study, the goal was achieved, namely, the factors affecting the financial stability of banking systems were specified.

It is proven that a stable banking system is a key component of the country’s national and economic security, which determines the effectiveness of the transformation of savings into investments and the competitiveness of the economy, and also contributes to the implementation of the basic social functions of the state, which ensures the strengthening of its financial sovereignty. In the current realities, the banking system should become the foundation for solving strategic tasks for the development of the economies of European countries.

In the process of conducting the study, it was established that the banking system can be stable only if the following external conditions are met: stability of the entire economic system or macroeconomic stability: the absence of a crisis in the economic system and the predictability of economic development parameters; the availability, transparency and completeness of legal support for banking activities; the presence of market and banking infrastructure (developed financial markets); a low level of criminalization of the credit and financial sphere.

However, the realm of ensuring financial stability within Europe’s banking system is notably vulnerable, particularly in the aftermath of the pandemic and the evolving landscape following Russia’s full-scale war against Ukraine.

Based on the analysis of statistical data and scholarly literature, it is inferred that several factors hold significant sway over the financial stability of Europe’s banking system, including the cost and accessibility of capital, investment activity within the banking sector, risks to financial stability, and the realm of digital security and data protection. By constructing a multiple regression model and analyzing statistical metrics, it is demonstrated that these factors play a significant role in determining the financial stability of European countries’ banking systems.

REFERENCES

1. Dao LKO, Loc HH, Nguyen VC, Hang LTT, Do TT. Factors Affecting the Choice of Banks: Do Bank’s Interest Rate, Employee Image and Brand Matter? The Journal of Asian Finance, Economics and Business. 2021 Jan 30;8(1):457–70. doi: 10.13106/jafeb.2021.vol8.no1.457

2. Lupenko Y, Sytnyk I. Features of functioning of modern model of payment system of Ukraine. SBONEU. 2021;5–6(282–283):34–45.

3. Mejia-Escobar JC, González-Ruiz JD, Duque-Grisales E. Sustainable Financial Products in the Latin America Banking Industry: Current Status and Insights. Sustainability. 2020 Jul 14;12(14):5648. doi: 10.3390/su12145648

4. Zolotova O, Ivanova V, Simak D, Kudinov O, Slavuta O. Economy during marital state: problems and ways to overcome the crisis (Ukrainian experience). Financial and Credit Activity Problems of Theory and Practice. 2023 Jun 30;3(50):265–81. doi: 10.55643/fcaptp.3.50.2023.4076

5. Aristei D, Gallo M. Loan loss provisioning by Italian banks: Managerial discretion, relationship banking, functional distance and bank risk. International Review of Economics & Finance. 2019 Mar;60:238–56. doi: 10.1016/j.iref.2018.10.022

6. Kolodiziev O, Shcherbak V, Vzhytynska K, Chernovol O, Lozynska O. Clustering of banks by the level of digitalization in the context of the COVID-19 pandemic. Banks and Bank Systems. 2022 Feb 14;17(1):80–93. doi: 10.21511/bbs.17(1).2022.07

7. Mazur N, Tkachuk V, Sulima N, Semenets I, Nikolashyn A, Zahorodnia A. Foreign Agricultural Markets: State and Challenges in Sustainable Development. In: Alareeni B, Hamdan A, editors. Innovation of Businesses, and Digitalization during Covid-19 Pandemic [Internet]. Cham: Springer International Publishing; 2023 [cited 2024 Dec 13]. p. 545–59. (Lecture Notes in Networks and Systems; vol. 488). Available from: https://link.springer.com/10.1007/978-3-031-08090-6_35

8. Doroshenko T, Orlenko O, Harnyk O. Mechanisms for ensuring the development of the future economy in the context of global changes. Futurity Economics&Law. 2023 Jun 25;132–50. doi: 10.57125/FEL.2023.06.25.09

9. Myronchuk V, Kirizleyeva A, Saienko V, Bodnar O, Muraviov K. Problems and Prospects of Improving the Banking System and its Impact on the Economy. EA [Internet]. 2023 Feb 12 [cited 2024 Dec 13];68(1s):27-34. Available from: http://ndpublisher.in/admin/issues/EAv68n1sd.pdf

10. Luo S. Digital Finance Development and the Digital Transformation of Enterprises: Based on the Perspective of Financing Constraint and Innovation Drive. Chen M, editor. Journal of Mathematics. 2022 Jan;2022(1):1607020. doi: 10.1155/2022/1607020

11. Varela M, Mishchenko V, Cherkashyna K. Sufficiency of banking capital: The experience of Portugal. Financial and credit activity: problems of theory and practice. 2023 Dec 31;6(53):9–20. doi: 10.55643/fcaptp.6.53.2023.4235

12. Vovchenko, O. ESG-strategy as a basis for sustainability risk management in banks. Economy and Society [Internet]. 2023 Apr 25 [cited 2024 Dec 13];(50). Available from: https://economyandsociety.in.ua/index.php/journal/article/view/2458

13. Thi Thuy DP, Nguyen Trong H. Impacts of openness on financial development in developing countries: Using a Bayesian model averaging approach. Lau E, editor. Cogent Economics & Finance. 2021 Jan 1;9(1):1937848. doi: 10.1080/23322039.2021.1937848

14. Kolinets L. International Financial Markets of the Future: Technological Innovations and Their Impact on the Global Financial System. Futurity of Social Sciences. 2023 Sep 20;4–19. doi: 10.57125/FS.2023.09.20.01

15. Liu H, Huang W. Sustainable Financing and Financial Risk Management of Financial Institutions—Case Study on Chinese Banks. Sustainability. 2022 Aug 8;14(15):9786. doi: 10.3390/su14159786

16. Kulikov P, Aziukovskyi O, Vahonova O, Bondar O, Akimova L, Akimov O. Post-war Economy of Ukraine: Innovation and Investment Development Project. EA [Internet]. 2022 Dec 25 [cited 2024 Dec 13];67(5). Available from: http://ndpublisher.in/admin/issues/EAv67n5z4.pdf

17. Lomaka V, Yakoviyk I, Bilousov Y. Europeanisation and Its Impact on Candidate Countries for EU Membership: A View from Ukraine. AJEE. 2023 May 14;6(2):59–81. doi: 10.33327/AJEE-18-6.2-a000221

18. Tymoshenko M, Saienko V, Serbov M, Shashyna M, Slavkova O. The impact of industry 4.0 on modelling energy scenarios of the developing economies. Financial and credit activity: problems of theory and practice. 2023 Feb 28;1(48):336–50. doi: 10.55643/fcaptp.1.48.2023.3941

19. Directorate-General for Financial Stability, Financial Services and Capital Markets Union [Internet]. Sustainability-related disclosure in the financial services sector; [cited 2024 Dec 13]. Available from: https://finance.ec.europa.eu/sustainable-finance/disclosures/sustainability-related-disclosure-financialservices-sector_en

20. Oneshko S. Assessing the Profitability of IT Companies: International Financial Reporting Standards. Review of Economics and Finance. 2023;21:1361-69.

21. Euro Banking Association [Internet]. Paris (France): Euro Banking Association (EBA); [cited 2024 Dec 13]. Available from: https://www.abe-eba.eu/

22. European Central Bank [Internet]. Frankfurt am Main (Germany): European Central Bank; [cited 2024 Dec 13]. Available from: https://www.ecb.europa.eu/

23. EBA CLEARING [Internet]. Single payments EURO1: A unique RTGS-equivalent large-value payment system; [cited 2024 Dec 13]. Available from: https://www.ebaclearing.eu/services/euro1/overview

24. European Commission [Internet]. The Commission adopts the European Sustainability Reporting Standards; 2023 Jul 31; [cited 2024 Dec 13]. Available from: https://finance.ec.europa.eu/news/commission-adoptseuropean-sustainability-reporting-standards-2023-07-31_en

25. Bertayeva KJ, Onaltayev DO, Zhagyparova AO. (2016). Assessing role of gold as world’s reserve currency in terms of uncertainty. Indian Journal of Science and Technology. 2016;9(27):94591. doi: 10.17485/ijst/2016/v9i27/94591

26. Mavlutova I, Spilbergs A, Verdenhofs A, Natrins A, Arefjevs I, Volkova T. Digital Transformation as a Driver of the Financial Sector Sustainable Development: An Impact on Financial Inclusion and Operational Efficiency. Sustainability. 2022 Dec 23;15(1):189–207. doi: 10.3390/su15010207

27. Vagin SG, Kostyukova EI, Spiridonova NE, Vorozheykina TM. Financial Risk Management Based on Corporate Social Responsibility in the Interests of Sustainable Development. Risks. 2022 Feb 2;10(2):35. doi: 10.3390/risks10020035

28. Bliznjuk O, Masalitina N, Myronenko L, Zhulinska O, Denisenko T, Nekrasov S, et al. Determination of rational conditions for oil extraction from oil hydration waste. EEJET. 2022 Feb 28;1(6(115)):17–23. doi: 10.15587/1729-4061.2022.251034

29. Mints A, Kolodiziev O, Krupka M, Vyshyvana B, Yastrubetska L. A cross-impact analysis of the bank payment card market parameters and non-financial sectors’ indicators in the Ukrainian economy. Banks and Bank Systems. 2022 Jun 30;17(2):163–77. doi: 10.21511/bbs.17(2).2022.14

30. Yin H. Bank globalization and financial stability: International evidence. Research in International Business and Finance. 2019 Oct;49:207–24. doi: 10.1016/j.ribaf.2019.03.009

31. Muliarevych O. Acceptance and shipping warehouse zones calculation using serverless approach. In: 2022 12th International Conference on Dependable Systems, Services and Technologies (DESSERT) [Internet]. Athens, Greece: IEEE; 2022 [cited 2024 Dec 13]. p. 1–6. Available from: https://ieeexplore.ieee.org/document/10018786/

32. Luo S, Sun Y, Yang F, Zhou G. Does fintech innovation promote enterprise transformation? Evidence from China. Technology in Society. 2022 Feb;68:101821. doi: 10.1016/j.techsoc.2021.101821

33. Romero-Carazas R. Collection Management Model for Late Payment Control in the Basic Education Institutions. Edu - Tech Enterprise 2024;2:12–12. https://doi.org/10.71459/edutech202412.

34. Mura L. The philosophy of personnel management of small and Medium-sized businesses in Slovakia. Futurity Philosophy. 2022 Sep 30;27–39. doi: 10.57125/FP.2022.09.30.02

35. Machaca MH. Relationship between physical activity and quality of work life in accountancy professionals: A literature review. Edu - Tech Enterprise 2024;2:13–13. https://doi.org/10.71459/edutech202413.

36. Serikova M. The Impact of Performance Improvement of the Tax System on the Economic Growth of Developing Countries Based on the Experience of the European Union. MNJE [Internet]. 2022 Sep 15 [cited 2024 Dec 13];18(4). Available from: https://mnje.com/sites/mnje.com/files/v18n4/203-214 %20- %20Serikova %20et %20al..pdf

37. León-Zevallos L, Casco RJE, Macha-Huamán R. Digital marketing positioning in a retail sector company. Edu - Tech Enterprise 2024;2:11–11. https://doi.org/10.71459/edutech202411.

38. Shair F, Shaorong S, Kamran HW, Hussain MS, Nawaz MA, Nguyen VC. Assessing the efficiency and total factor productivity growth of the banking industry: do environmental concerns matters? Environ Sci Pollut Res. 2021 Apr;28(16):20822–38. doi: 10.1007/s11356-020-11938-y

39. Kichurchak M. Bank deposit activity in Ukraine: Directions and factors of development activation. JEECAR. 2019 Mar 31;6(1):145–60. doi: 10.15549/jeecar.v6i1.275

FINANCING

No financing.

CONFLICT OF INTEREST

None.

AUTHORSHIP CONTRIBUTION

Conceptualization: Andrii Meshcheriakov, Anatoliy Maslov, Grygorii Saienko, Oksana Antoniuk, Tetiana Sunduk.

Research: Andrii Meshcheriakov, Anatoliy Maslov, Grygorii Saienko, Oksana Antoniuk, Tetiana Sunduk.

Methodology: Andrii Meshcheriakov, Anatoliy Maslov, Grygorii Saienko, Oksana Antoniuk, Tetiana Sunduk.

Resources: Andrii Meshcheriakov, Anatoliy Maslov, Grygorii Saienko, Oksana Antoniuk, Tetiana Sunduk.

Software: Andrii Meshcheriakov, Anatoliy Maslov, Grygorii Saienko, Oksana Antoniuk, Tetiana Sunduk.

Validation: Andrii Meshcheriakov, Anatoliy Maslov, Grygorii Saienko, Oksana Antoniuk, Tetiana Sunduk.

Display: Andrii Meshcheriakov, Anatoliy Maslov, Grygorii Saienko, Oksana Antoniuk, Tetiana Sunduk.

Writing - proofreading and editing: Andrii Meshcheriakov, Anatoliy Maslov, Grygorii Saienko, Oksana Antoniuk, Tetiana Sunduk.