Category: Finance, Business, Management, Economics and Accounting

ORIGINAL

Fuzzy Clustering Algorithm for Trend Prediction of the Digital Currency Market

Algoritmo de agrupación difusa para la predicción de tendencias en el mercado de divisas digitales

1College of Statistics and Big Data, Henan University of Economics and Law. Zhengzhou, Henan.

2School of Economics, Fudan University. Shanghai, 200433, China.

Cite as: Sun S, Qin Y. Fuzzy Clustering Algorithm for Trend Prediction of The Digital Currency Market. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:1094. https://doi.org/10.56294/sctconf20241094

Submitted: 11-02-2024 Revised: 08-05-2023 Accepted: 11-07-2024 Published: 12-07-2024

Editor: Dr.

William Castillo-González ![]()

ABSTRACT

Digital currencies, such as Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), Stellar (XLM) and Tether (USDT), have been attracting the interest of investors and speculators. Over the last several years, the exponential growth in the value of digital currency has captured the interest of many individuals who see it as an attractive investment opportunity. After all, investors must deal with the expected volatility of Bitcoin prices as part of their investments. The future development of cryptocurrency can be challenging to forecast because of the extreme unpredictability and disorder of external events. In this research, fuzzy models for cryptocurrency price forecasting using a level set-based Fuzzy Clustering Based on Multi-Criteria Decision-Making (FC-MCDM). Compared to linguistic and functional fuzzy clustering, the construction and processing of fuzzy rules in a multi-criteria decision-making-based collection set differ. Based on level sets, the model produces the weighted average of the functions that active fuzzy rules provide as output. In the model’s outputs, the activation levels of the fuzzy rules are represented directly by the output functions. Computational experiments are carried out to test the efficacy of the level-set approach for one-step-ahead prediction of cryptocurrency closing prices. Meanwhile, level set-based fuzzy clustering outperforms the other methods when the direction of price change evaluates performance.

Keywords: Fuzzy Clustering; Digital Currencies; Cryptocurrency; Fuzzy Modelling.

RESUMEN

Las monedas digitales, como Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), Stellar (XLM) y Tether (USDT), han atraído el interés de inversores y especuladores. En los últimos años, el crecimiento exponencial del valor de la moneda digital ha captado el interés de muchas personas que la ven como una atractiva oportunidad de inversión. Después de todo, los inversores deben hacer frente a la volatilidad esperada de los precios de Bitcoin como parte de sus inversiones. Puede resultar difícil pronosticar el desarrollo futuro de las criptomonedas debido a la extrema imprevisibilidad y el desorden de los acontecimientos externos. En esta investigación, se utilizaron modelos difusos para el pronóstico de precios de criptomonedas utilizando una agrupación difusa basada en conjuntos de niveles basada en la toma de decisiones multicriterio (FC-MCDM). En comparación con la agrupación difusa lingüística y funcional, la construcción y el procesamiento de reglas difusas en un conjunto de colecciones basado en la toma de decisiones de múltiples criterios difieren. Basado en conjuntos de niveles, el modelo produce el promedio ponderado de las funciones que las reglas difusas activas proporcionan como salida. En las salidas del modelo, los niveles de activación de las reglas difusas están representados directamente por las funciones de salida. Se llevan a cabo experimentos computacionales para probar la eficacia del enfoque de conjunto de niveles para la predicción un paso adelante de los precios de cierre de las criptomonedas. Mientras tanto, la agrupación difusa basada en conjuntos de niveles supera a los otros métodos cuando la dirección del cambio de precio evalúa el rendimiento.

Palabras clave: Agrupación Difusa; Monedas Digitales; Criptomonedas; Modelado Difuso.

INTRODUCTION

The very unpredictable and disruptive structure of the digital currency market makes keeping tabs on its trends a difficult undertaking. The success or failure of a market for digital currencies may be impacted by a myriad of variables, such as market sentiment, economic trends, and political events.(1) Despite this, several forms of fuzzy logic have been used by futures and stock traders to predict market trends. Financial market forecasting has been the subject of several efforts, using anything from time series analysis to FC-MCDM.(2) The secret to success for digital market traders is the creation of a reliable FC-MCDM instrument. It is necessary to develop new methods for predicting stock prices that account for nonlinearity and noise, as the stock price series is influenced by both random and deterministic variables.(3) A decision tree designed to sift through massive amounts of data in search of previously unknown rules.(4) An innovative and effective method for analyzing time series has been developed.(5)

The decision making approaches have shown their interpretability, efficiency, issue independence, and ability to handle applications on a wide scale.(6) On the other hand, they are known to be very sensitive to even little changes in the training data and therefore very unstable classifiers.(7) The flexibility of the fuzzy sets formalism is what makes fuzzy logic so useful for dealing with these kinds of variations.(8) In this paper a FC-MCDM for digital mrket trending decisions by combining a decision tree tool with fuzzy theory and evolutionary algorithms.(9) The tree evolves and clusters over time. When it comes to stock trading, the suggested methodology provides speculators with a superior information platform and can more accurately forecast digital market developments.(10)

It is feasible to merge the clustering outcomes derived from many cryptocurrency representations, each of which takes into account distinct cryptocurrency features in the digital market.(11) With the clustering findings added together, and describe cryptocurrencies along several dimensions, one for each clustering method.(12) Combining cluster strategies that have relevant clusters would provide a more in-depth market characterisation and valuable data for portfolio management in the trend prediction.(13) FC-MCDM identify the primary market trends by examining the most densely packed clustering intersections. By selecting the relevant prototype for each clustering approach, the analyst may identify intersections with certain financial behaviors.(14) The profile of the investor determines if this can assist them address intriguingdigital currency market. The findings of FC-MCDM support many statistical techniques and it’s easy to scale up or down to accommodate a changing market.(15)

The main objective of this paper is as follows:

· To create fuzzy models for cryptocurrency price forecasting in the digital marketing trend prediction.

· To determine fuzzy model approach in terms of accurately forecasting the final values of cryptocurrencies. To make sure the fuzzy clustering can reliably anticipate one step ahead, computational tests are conducted.

· Predicting bitcoin prices using FC-MCDM with level set-based fuzzy clustering, with an emphasis on methodological improvement and practical financial forecasting applications.

The ramianing of this paper is structured as follows: the related research work of digital currency market is studied. The proposed methodology of FC-MCDM is explained and the efficiency of fuzzy clustering in the digital market is discussed and analysed.

Related work

The global financial markets have taken notice of the meteoric ascent of digital currencies, especially Bitcoin. Due to the complexity of cryptocurrency values, which are both nonstationary and volatile, researchers have investigated a variety of approaches for price prediction. Several methods, demonstrating its dependability in financial analysis and investing choices. When trying to anticipate the daily trend in Bitcoin prices and market confidence, there are a number of obstacles to overcome. Cryptocurrency index forecasts, with an emphasis on tradeability and precision. To improve digital currency forecasting in the face of global economic uncertainty, another SPT approach is being considered.

The digital currency is now a major consideration for investors throughout the world. To help investors in the digital currency market make better decisions, this study proposes a Hybrid Model-Markov Chain (HM-MC) technique that combines the benefits of the stochastic index. The outcomes validate the viability of the suggested methodologies as a basis for trustworthy market research and financial investment choices by Shou, M. H et al.(16)

According to Seo. Y et al.(17) the bitcoin market has emerged as a topic worthy of technical analysis as the cryptocurrency gains popularity as an investment option. Bitcoin price time series are complicated, nonstationary, and chaotic due to the market’s extreme volatility. Here, use a Deep Neural Network (DNN) to try to foretell the future of the bitcoin market. There are fourteen input variables in the dataset that are associated with the daily recorded prices of bitcoin. Date, market price, high price, low price, and closing price are thirteen input variables that are associated with bitcoin prices. Additionally, eight technical indicators are produced from bitcoin prices.

Almeida, J. et al.(18) studied the emphasis is on using an Artificial Neural Network (ANN) to forecast the trend of Bitcoin for the next day by analyzing its price and volume from the previous day. The overview of Bitcoin, its characteristics, and the reasoning for prediction that its future development should be predictable. An explanation of the choices taken and the trade-offs that were necessary to build such a prediction network, along with the tools and methodologies that were used, is provided. To a large extent, the value of Bitcoins is based on people’s confidence in the currency and their ability to forecast its daily price movement.

As one of the most widely traded financial assets in the world, cryptocurrencies have swept the financial sectors throughout the globe. In addition to being one of the most esoteric and complex areas of financial instruments, the extreme volatility of cryptocurrency makes it a difficult and confusing challenge in the industry. This paper is trying to use machine learning (ML) methods on the cryptocurrency index and its components to predict or forecast cryptocurrency prices. This paper uses machine learning models and techniques for estimating closing costs of 30 cryptocurrencies index and nine individual cryptos in an attempt to make crypto buying and selling greater accessible by Chowdhury, R. Et al.(19)

Predicting the market price of digital currencies is extra crucial than ever earlier than in this period of world economic crises. Many studies have shown that forecasts crafted from a single model do no longer deliver correct predictions for digital currencies due to the fact they have got nonlinear dynamics which include their inherent fractality and chaos. Digital forex forecasts with simplest one version might not constantly be the pleasant way to head because of strengths and weaknesses present in every version recommended via Altan A et al.(20)

The research highlighted specific strategies toward predicting digital currency prices the use of random models and neural networks that pertain to tool learning and signal processing strategies. In each technique, it tries to seize the complicated dynamics of cryptocurrency markets as a manner to enhance prediction accuracy even as making well informed funding selections amidst worldwide monetary uncertainties and erratic market conditions.

METHOD

Data assessment and management are essential in the complex region of digital currency. For each desire point from cleaning up raw datas thru fuzzy clustering algorithms used for forecasting market inclinations, it is been identified that each stage is critical. Traders, investors, and many others play a role for the duration of this complicated manner where they must advantage from possibilities provided via a unstable marketplace location thereby curbing risks involved.

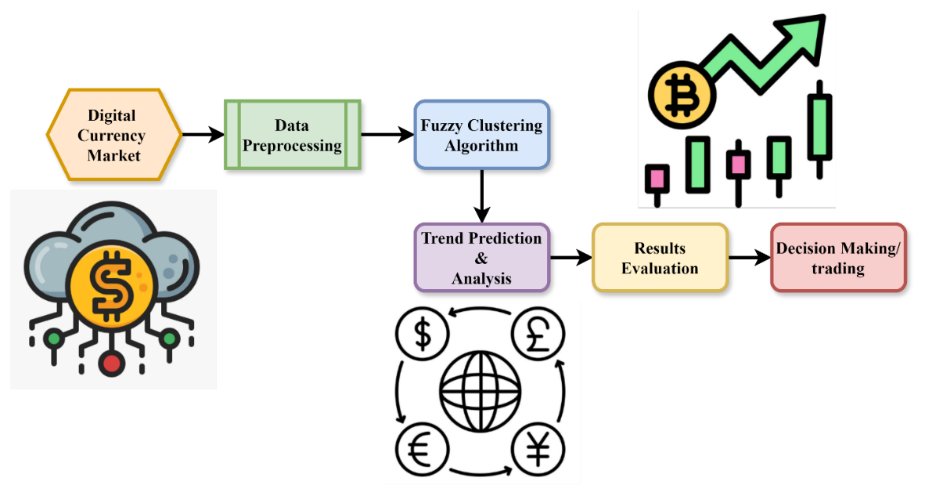

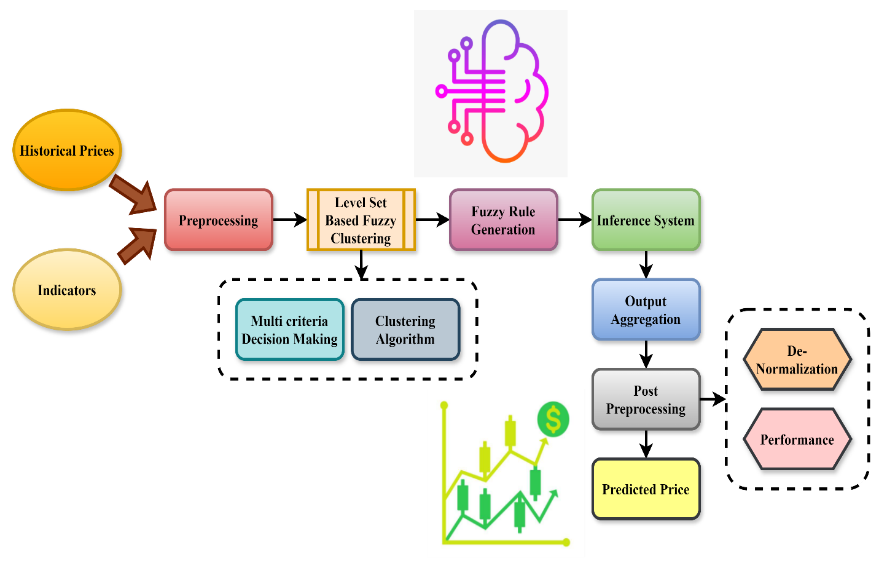

The first section involved in preparing statistics for digital currency includes cleansing up raw facts into paperwork suitable for evaluation with the aid of analysts is explained in figure 1. Hence this step ensures accuracy at the subsequent levels. Using Fuzzy Clustering Algorithm as a top device aimed at detecting patterns/traits within the marketplace allows us better apprehend how dynamic the market is. The next step after clustering will involve analyzing trends can predict the behavior of prices in the future. After this, a thorough examination of the results is vital to evaluate whether there has been accuracy and dependability on the model predictions. From this point, various trading techniques and decision making processes are directed by insights obtained in these surveys. Such information would help investors and other stakeholders wade through a volatile digital currency market to identify opportunities that come with exposure to risks. The strategy is iterative so as to keep refining strategies and adjusting them continuously according to investor needs as well as changing market conditions.

Figure 1. Block Diagram of Fuzzy Clustering

![]()

Systemic and random variables influence the price trend vgr, as shown by the equation (1) Sk Rlog in this context. The combined influence of external events and previous price data, tempered by the clustering criterion f(g+1)es, is represented by the term (k+1). At last, the model’s adaptive skills in predicting price changes are highlighted by (l(p,E))+ Z(s,pT)×r(-z), which reflects the dynamic change of fuzzy rules over time Sc(f+1).

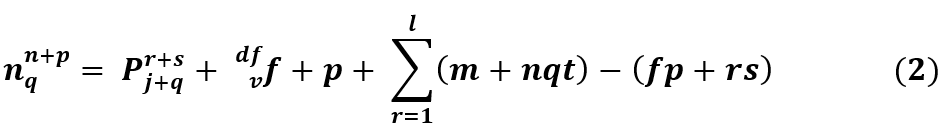

The future value or trend measure for a certain digital currency might be represented using the equation 2, nq(n+p). This word takes into consideration the effects of past prices and outside events. The contributions of both fixed parameters and dynamic fuzzy variables are included in the component P(j+q)(r+s). The model is further refined by including iterative modifications based on multiple variables p decision factors (m+nqt), which guarantee accurate and adaptive trend predictions, as shown by the summation (fp+rs).

![]()

The combined effect of many fuzzy decision factors fd and e+f across a given range is shown by the equation 3, n+mkl. The contributions from both lp⁄(h-jk) historical data and current trend adjustments are outlined, which is represented by (T(f+1)r (n+hp))/(f+jk).

Based on previous observations, the adjusted value or state of the cryptocurrency trend is represented by the equation 4, a(p+q)(k-1). A basic fuzzy adjustment factor and historical price smoothing are included in the expression F(f+1)+(l+1)/∂+p. Highlighting the intricacy and interconnected aspects in trend prediction, the nested summation ∑p+dfWe g=1 incorporates multi-layered criteria from the decision-making process h+pj. The accuracy and robustness of the model in predicting future cryptocurrency prices are guaranteed by the term of correction introduced by the final summation (p-er), which accounts for external changes and residual effects ∑p+dfWe g=1.

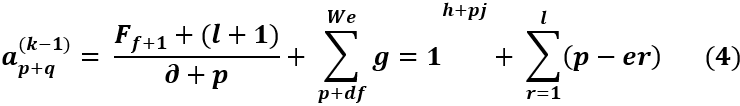

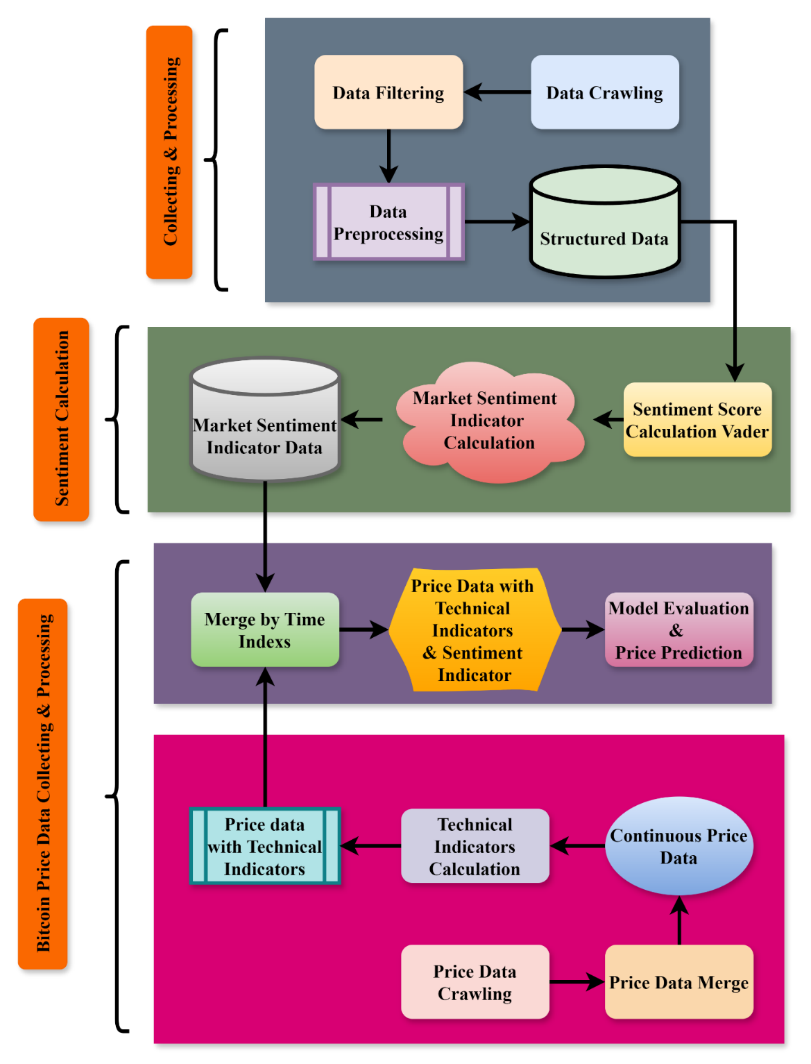

Figure 2. Architecture of Cryptocurrency Market Statistics

Preparing raw data for analysis and prediction is done through data preprocessing in the bitcoin market is shown in figure 2. In datasets, such variables like trade volumes, historical prices, as well as technical indicators as relative strength index (RSI) and moving averages are supposed to be cleaned, transformed, or standardized. Thus it becomes important consequently that information excellent is assured for the duration of this method because it allows for correct evaluation. Several FC-MCDM algorithms are used to generate rate predictions of bitcoins. Fuzzy logic uses multilayer neural networks to study difficult model from preprocessed. Such algorithms work will in forecasting long-term charge modifications because of their capability to alter stochastic fluctuations and nonlinear interactions inherent in Bitcoin values. To be able to make predictions SMP models have first been educated on beyond facts in which they may be then evaluated on sparkling statistics for its predictive power however. Metrics which includes Root Mean Squared Error (RMSE) and Mean Absolute Error (MAE) study how correctly these models are expecting each day charges of bitcoins. A mixture of robust records preprocessing with superior prediction algorithms gives investors and traders realistic insights into ever changing cryptocurrency market.

![]()

To estimate the trend value, taking into account different variables, the equation 5, ae+rqw is used. A basic adjustment and smoothing factor is included to stabilize the prediction via the phrase DEPS+1/(∂+4). The weighted total of multi-criteria decision-making factors q(j+1)(r+1), according to their relevance to historical KP and real-time data g∝P, is given by the equation (1-∀)e. To guarantee the model’s flexibility and precision in predicting trends in cryptocurrency prices utilizing fuzzy clustering methods e=1, the cumulative effects from previous p observations are taken into consideration in the final accumulation (vp).

![]()

Taking into account both current and historical data D(w+p)⁄Qf , the predicted trend value is given by the equation 6, hx(y+z). The effect of certain choice variables and moments in history is captured by the phrase1+∝ ∂. The dynamic adjusting factors that react to real-time fluctuations in the market and external parameters are included in the component ∝(k+p). To ensure that the model appropriately represents the volatility, the subtraction term T(f+1)+l+1/∝+4 is used to compensate for smoothing and adjustment factors.

![]()

Here, the predicted trend adjusted for many contributing variables is represented by the equation 7, Eh-fg. The expression ∝+f/g+p takes into account both current and past market dynamics, such as price elasticity and volatility. The correction factor is introduced by the last term (ew-kp) to take complicated interactions and dependencies in the data into consideration (fg(2g+p)+2ekps+p)/∂+gp.

![]()

While (1+pq) accounts for initial circumstances, the complex function e(f+1)erf captures the influence of several variables on the market trend. Immediate impacts and interactions with past k+q data are reflected in the phrase fkf+2g(n-1)+ Sfpj(z+pq), which mixes static and dynamic components.

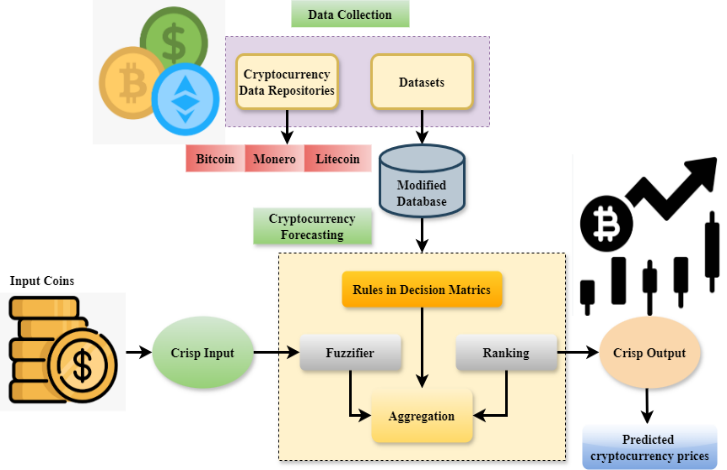

Figure 3. Fuzzy clustering based on Multi-Criteria Decision-Making

Figure 3 shows gathering historical data, including daily prices, trading volumes, and technical indicators from different digital currencies like Bitcoin, Ethereum, and others is the first step in predicting cryptocurrency prices. Data preparation is the next critical step in preparing raw data for analysis by cleaning, normalizing, and transforming it into a consistent format. This technique gets the data ready for processing by making sure it is consistent. The next step is to use fuzzy clustering algorithms to find patterns or clusters in the preprocessed data. Data points with comparable fuzzy membership degrees are grouped together in fuzzy clustering algorithms like Fuzzy C-Means and Level Set-Based Fuzzy Clustering. Inference techniques together with Mamdani or Sugeno are used to create fuzzy rules from those clusters. Predicted charge changes or stages are the cease result of these algorithms’ shooting of correlations among enter factors like cost traits and buying and selling volumes. To make buying and selling picks based totally on meaningful interpretations of expected values, denormalization is conducted as soon as fuzzy regulations are generated. Fuzzy inference systems are the final arbiters of cryptocurrency fee predictions, illuminating the virtual foreign money marketplace and supporting buyers and investors navigate it with confidence.

![]()

The adjusted value that is anticipated using the fuzzy clustering outputs is given by equation 9, Ap(w+p)e. After adjusting for the baseline, the expression E(w+1)w indicates that significant components should be added together. Incorporating both immediate and cumulative impacts on the market trend, the nested expression ∑cv(1+pw)(n+pst) incorporates historical data and features of multiple-criteria decision-making (n+1).

![]()

The symbol tan1 A stands for the market’s trend angle or rate of change equation 10. The combined effect of several fuzzy choice criteria (1+E2) and past data points is accounted for by the expression Bq(r+sp)+ Cq(r+sp). New modifications based on real-time statistics and new decision-making criteria are introduced via the following summation s(P+1f).

![]()

As a systematic approach to predicting trends in cryptocurrencies, equation 11 is in line with the suggested fuzzy clustering technique S.f(k-1)v. In this context, s(v+1)dr represents the accumulation of fuzzy membership functions that are derived from past data and present market circumstances. The following expression follows: mp+wrn+t⁄sp+1h+k. This equation incorporates changing variables like market sentiment and price volatility.

![]()

The use of fuzzy logic techniques to comprehend market dynamics is shown by equation 12, T2 in a particular trend analysis scenario. In different market conditions, the degree of participation (represented by gk) is one of the several criteria that are integrated in the equation p+qw(z-pk)+(fg+1).

Cryptocurrency Data Collection involves gathering a wide range of information needed for studying and predicting markets is explained in figure 4. This consists of Bitcoin’s Ethereum, among other cryptocurrency exchanges where the respective historical price records made over different times ranging from day by day up to hourly minutes can be found Gathering information concerning market capitalization, transactions also bring out a clearer picture of what the market is all about However numbers alone cannot help us understand what goes beyond the numbers when we try understanding market dynamics sentiment analysis becomes necessary Therefore you need to dig through news articles social media or any online platform just to get an idea on how society thinks about cryptocurrency Often fuzzy methods are used so that sentiments strengths and polarities can be established The prices assigned to bitcoin should clean normalized and processed into features after collection It ensures that there is good quality data available which could then be applied in various fuzzy logics for further analysis. To assist the traders and investors make well informed decisions within the dynamic world of cryptocurrency sentiment research is being integrated with price data to better market insights.

Figure 4. Architecture of the Price Prediction in the Digital currency Market

![]()

In this case, fuzzy logic is used to assess and forecast market circumstances, as shown by the equation T3. The sentence evaluates the extent to which market variables such as S(r+kp) and (1+hjr2 ) impact market outcomes by integrating multiple fuzzy sets and criteria. Using fuzzy clustering methods, this formulation S(k+p)z takes into consideration the uncertainties and complicated interconnections in market data wf(h+kp), allowing for more nuanced insights into the price fluctuations of cryptocurrencies.

![]()

This equation 14, T4 shows the fuzzy membership functions that describe the level of effect of both past and current data points, where Sf(p+jk). To guarantee that the components that are included are relevant, the expression sq(k+1)s sets up a conditional check that is based on certain criteria. To further improve the model’s precision, the equation ∝(p+1)+(β+ϑω) incorporates dynamic variables including market sentiment, external influences s(f+p)w (p+1), and weighted adjustments.

![]()

The estimated value representing the aggregated influence of many influencing variables is represented by equation 15, Bk. A fuzzy logic-based weighted average adjustment is used in the expression 1/4(∝E-sd+pp ) to take into consideration unpredictable and changing factors such as market sentiment Wq+p and particular pricing dynamics Tu-1f. The following calculation f-ght incorporates extra factors that play a vital role in forecasting future price changes, such as external market circumstances past patterns Tu-1f.

![]()

The Analysis of Efficiency showing the combined influence of several market variables is represented by equation 16, Qz+p. In Zq+q-qmin⁄qmax-qmin, a normalized factor is introduced to indicate the relative position within a specific range, which accounts for market volatility; Zp is the baseline or starting condition. Potentially reflecting foreign economic indicators (u+p), the inclusion of Wk (p+1) adds extra effects.

Figure 5. Multi Criteria Decision Making in Currency Market

Figure 5 shows the cryptocurrency data repositories are significant centers of large volumes of information concerning digital currencies whereby huge quantities of data can be collected, sorted, and analyzed. These archives work as databases that store records such as user habits, market trends, and transactional details either centrally or decentrally. Fuzzifier might refer to anything dealing with various methods or procedures making information contained in this database more specific and detailed. For example fuzzyifiers help in handling the inherently complex and unpredictable data associated with cryptocurrencies by using techniques such as fuzzy logic or probabilistic modeling. The reliability of analytics and decision-making for researchers, traders, and investors is improved by fuzzy clustering which enables the repository to handle data from diverse sources having different levels of quality. fuzzifiers become essential in decreasing the odds of having erroneous or outliers within the bitcoin kept data thereby enhancing their credibility as well as usability. Therefore fuzzifiers will increasingly play a pivotal role in improving representation, interpretation and analysis of data in response to the changing crypto market; thus they facilitate marketing research and guidance on what should be done about it for an informed decision making.

![]()

The resulting value represents the Analysis of Price Forecasting of Cryptocurrency influence of several market variables Pd(y+1)s is represented by the equation 17, Z(x+1). An adjusted weighted contribution based on past data and market sentiment ∂∀(∝+1), taking into account changes over time is indicated by the expression (1,2,…9). To improve the accuracy of the model’s predictions, the phrase (q+1) probably includes a mix of parameters that can be adjusted and correction factors.

![]()

This equation 18, denoted as S1, shows the Analysis of Predictability incorporates several effect variables e(1-ρσu). Factors including market volatility and outside economic circumstances are used to change the base value, which is represented by the expression hρ(p+1). This edition C2 (p+ew) takes into account a weighted adjustment parameter that is affected by price dynamics PL(x-q)pl and market sentiment.

![]()

This equation 19, highlights the selection of the Analysis of Exponential Growth by representing the highest possible amount between max(a,q). The weighted mean of fuzzy membership functions∑(z=1)LF(a)/K is reflected in the expression F(w+pst) and represents the combined effect of different inputs on market forecasts h(kpt). The model may be better adjusted to changing market circumstances since it incorporates weighted factors that are connected to market trends and anticipatory behavior EFT.

![]()

The equation 20, Qs+gh(z) represents the expected value affected by the combined effects of the components Ul(z-k), taking into account their individual effects on the result a1. The phrase most likely stands for an Analysis of Performance baseline or historical reference point that has been changed by v2 Sin, indicating the cumulative impacts of the market. Incorporating dynamic variables such as sine functions and fuzzy membership efd(1+p), the expression inside the true value Fg(p+ht) assesses deviations from anticipated market behavior.

Cryptocurrency information repositories are critical for comprehending marketplace dynamics whilst consider that they aggregate and refine huge volumes of information. When it comes to detecting and predicting traits, using fuzzy clustering techniques improves statistics accuracy. Data guidance and assessment of prediction fashions shape an iterative system that yields useful insights for navigating the Bitcoin surroundings. Amidst the ever-converting virtual currencies marketplace, stakeholders also moreover make knowledgeable alternatives by using using combining superior analytics with sturdy facts management techniques.

RESULT AND DISCUSSION

Investigating digital currencies the use of cutting-edge techniques along with Fuzzy Clustering Insights into digital asset marketplace forecasting and analysis are revealed by means of FC-MCDM. These procedures take volatility and unpredictability into account, allowing for extra particular charge forecasts. The effects show that FC-MCDM is better than the others, particularly on the subject of projecting the future of prices. To make educated investment and speculating decisions, stakeholders must have get right of entry to to effective gear, and those improvements satisfies the person expectancies.

Dataset Description: featuring records on extra than 7 500 cryptocurrencies, every matched with the United States Dollar (USD), the Global Crypto Currency Database is an extensive and well decided on resource. Anyone curious in virtual currencies or interested in studying their market activity will locate this dataset to be an fundamental useful resource.(21) This consists of each established and rising cryptocurrencies, inclusive of BTC, ETH, and SOL, and it is also freshly issued coins. A formal designation of the cryptocurrency that allows short and simple referencing to character virtual currencies. Traders and traders depend upon this subject because it gives the unique buying and selling symbol for every cryptocurrency. A photo of the cryptocurrency’s best performance inside a positive period may be visible within the maximum rate pronounced in the course of the day.

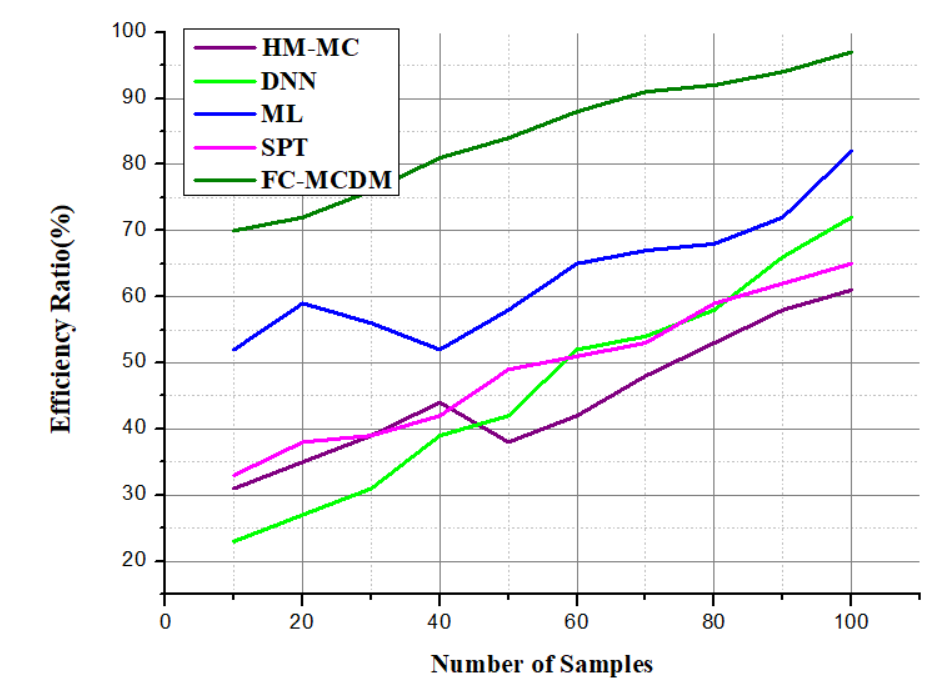

Analysis of Efficiency

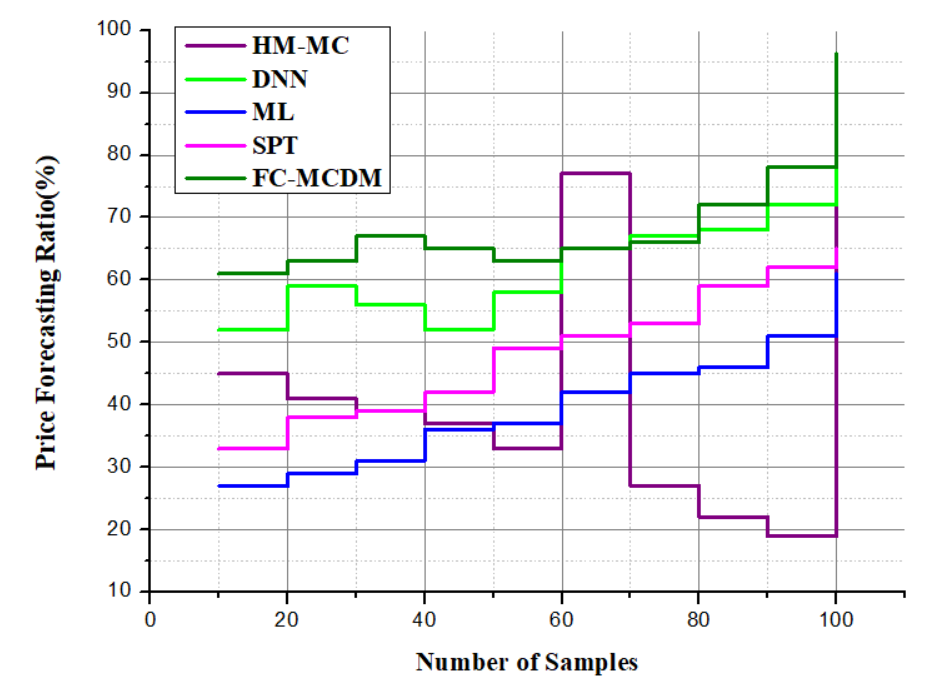

Figure 6. The Graph of Efficiency Ratio

Research on the efficacy of Fuzzy Clustering Based on FC-MCDM, a level set-based algorithm for predicting cryptocurrency prices, reveals a number of important features. The technology excels because it can deal with the complicated and unpredictable data seen in bitcoin markets. As opposed to more conventional linguistic and functional fuzzy clustering approaches, the FC-MCDM technique improves the accuracy of price forecasts by using multi-criteria decision-making to strengthen the credibility of fuzzy rule generation. Computational trials show that the model can accurately anticipate the closing values of cryptocurrencies one step ahead of time. The assessment criteria show that the FC-MCDM can beat other methods, especially when it comes to determining the direction of price movements. Given the unpredictability of digital currency markets, its outstanding performance highlights its possible use for investors and speculators looking for trustworthy forecasting tools. In the ever-changing world of finance, FC-MCDM is crucial in delivering insightful analysis and practical forecasts, as shown by the efficiency study. In this proposed the efficiency ratio of 97 % is achieved as it shown in figure 6 and equation 16.

Analysis of Price Forecasting of Cryptocurrency

Predicting the future cost of a cryptocurrency calls for searching at past statistics and the use of a variety of methods is expressed in equation 17 and figure 7. Investors and traders have a great challenge in correctly predicting the digital currency markets, which are complicated and prone to volatility. Methods encompass fashions primarily based on fuzzy logic and autoregressive integrated moving average amongst others. Market developments, alternate volumes, technical indicators (like as moving averages and RSI), and now and again outside variables (such regulatory modifications or macroeconomic occasions) are all a part of an powerful forecast’s toolbox. MAE and RMSE are commonplace metrics used to assess prediction accuracy, which measures the degree to which real market movements healthy up with anticipated prices. Predicting the future of cryptocurrencies efficiently requires expertise of marketplace dynamics, strong records analytic talents, and technical expertise. To make forecasting models greater reliable and applicable for directing investment selections, they’re continuously stepped forward via iterative checking out and validation against actual-global facts. The cost forecasting of cryptocurrencies is improved by 96,3 % on this excisting approach.

Figure 7. The Graphical Representation of Price Forecasting of Cryptocurrency

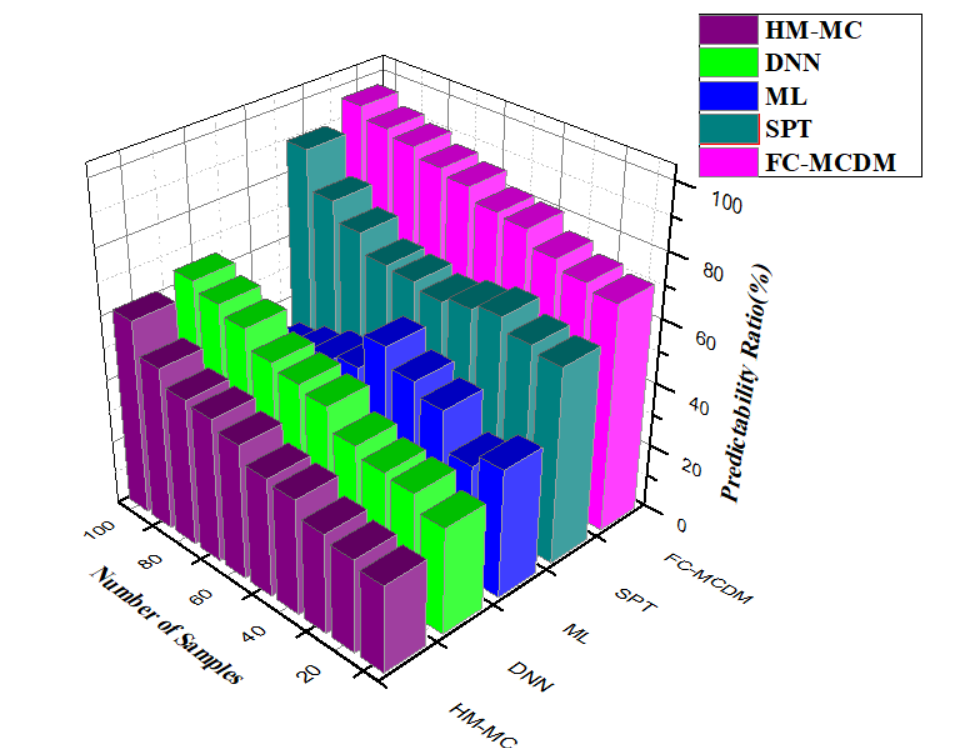

Analysis of Predictability

Figure 8. The Graphical Illustration of Predictability

The amount to which future price fluctuations can be reliably predicted using ancient facts and prediction model is what predictability analysis within the context of cryptocurrencies is all approximately is expressed in equation 18 and figure 8. Predictability is difficult to attain inside the cryptocurrency marketplace because of its notoriously excessive volatility and vulnerability to out of outside influences. Statistical model, Machine learning algorithms, hybrid techniques, and the supply and satisfactory of historic facts are a number of the important thing components that affect predictability. Other critical factors consist of the inclusion of pertinent marketplace signs and external activities. Metrics like as accuracy price, precision, and recollect are frequently used to assess predictability which will system the consistency and accuracy of predictions through the years. The dynamic character of the bitcoin market also necessitates the ongoing development and improvement of prediction methods. To make predictions extra accurate, analysts and researchers work to enhance records first-class, excellent-music models, and encompass new factors that higher mirror market dynamics. Improvements in analytical methodologies allow for extra knowledgeable selection-making and threat management in cryptocurrency buying and selling and making an investment, although general prediction continues to be unimaginable attributable to the complexity of the market. The predictability ratio is advanced through the ratio of 96,62 % within the propoed approach.

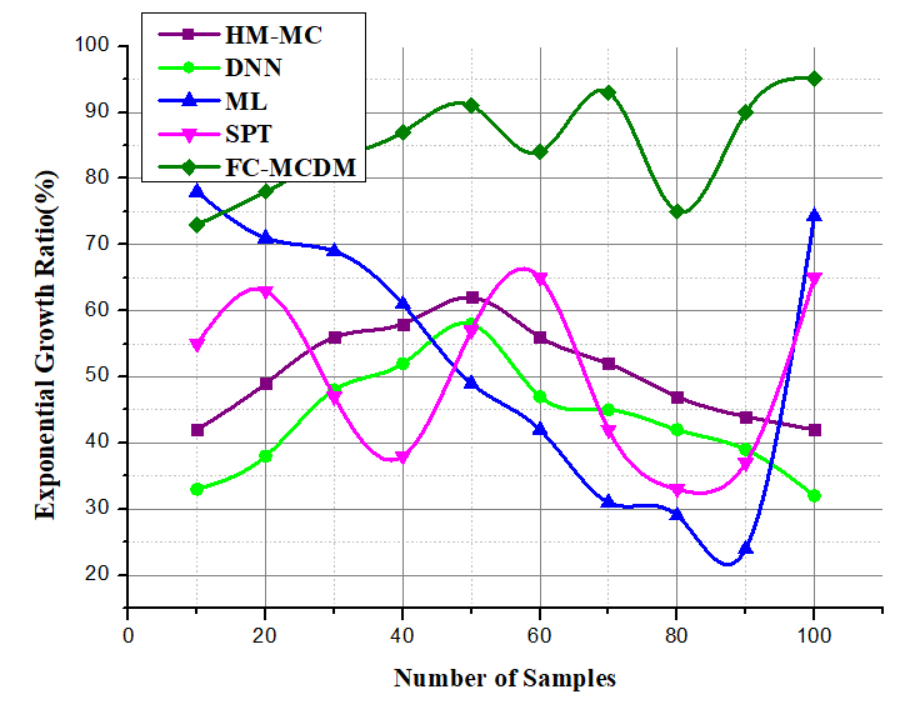

Analysis of Exponential Growth

Figure 9. The Graphical Representation of Exponential Growth

The exponential rise of digital currencies inclusive of Bitcoin, Litecoin, Ethereum, Stellar, and Tether may be better understood with the assist of this research is expressed in equation 19 and figure 9. A combination of things, which include tremendous use, new developments in era, and pure hypothesis, has caused the fee of these cryptocurrencies to skyrocket. Market capitalization, transaction volumes, and person adoption fees are crucial variables to investigate while looking at this growth. Most of the time, the take a look at seems at how things like media attention, new guidelines, network effects, and macroeconomic instances contribute to exponential growth. Additionally, it takes under consideration the problems that come with such enlargement, consisting of problems with scalability, unpredictable markets, and doubtful regulations. Predicting destiny trends and comparing feasible obstacles to non-stop development are critical to comprehending the sustainability of exponential increase. Reasons for this might consist of adjustments in market sentiment, technical constraints, or the presence of competing virtual belongings. These opinions assist researchers and investors understand the ever-changing global of digital finance and make smart judgments whilst investing in cryptocurrencies. In this excisting technique the ratio of 95,11 % exponential growth is completed.

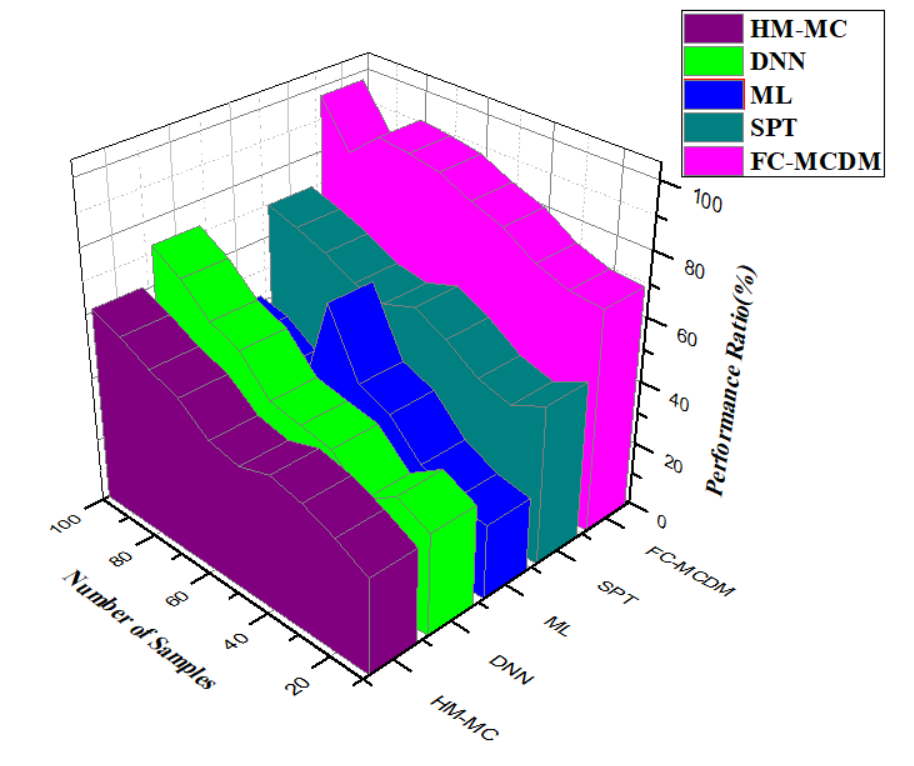

Analysis of Performance

Figure 10. The Graphical Representation of Performance

When looking at cryptocurrency overall performance, it is important to take into account a range of of factors, which include investment returns, marketplace tendencies, and buying and selling method efficacy is expressed in equation 20 and figure 10. Cryptocurrency investments are evaluated by way of buyers and analysts the use of overall performance standards. ROI, volatility metrics, most drawdown, and the Sharpe ratio are all considered key performance indicators (KPIs). The achievement of different cryptocurrencies can be better understood via evaluating them to benchmarks like as Bitcoin’s overall performance. Bitcoin is frequently used as a benchmark because of its dominance in market capitalization. Along with liquidity, risk management tactics, and transaction expenses, overall performance opinions have to take those under consideration. Performance evaluation consists of looking at how well buying and selling algorithms and forecasting models paintings for looking forward to the cost fluctuations of cryptocurrencies. To maximize income whilst limiting risks inside the very unpredictable cryptocurrency marketplace, it’s far important to continuously analyze performance and alter strategy as a result. When it comes to digital asset portfolios, thorough performance analysis helps with making educated choices and will increase the chances of achieving investment goals. The overall performance ration is received by 97,2 % within the Proposed method.

The cryptocurrency analysis has come an extended way and that FC-MCDM is a effective device for making accurate charge predictions. Computational checking out have shown that it may outperform other algorithms in performance assessments and estimate bitcoin remaining fees one step in advance. Research of standard performance, exponential increase, fee forecasting, and predictability screen profits of 95,11 % to 97,2 %. These results highlight the method’s ability to improve digital asset portfolio investment strategies and risk management, which in turn helps to comprehend the dynamics of the digital currency market.

CONCLUSION

The behavior of digital money movement has been the subject of a great deal of study. But rather than trying to forecast the stock price, the investor is more concerned with generating money by receiving straightforward trading decisions like “Buy,” “Hold,” or “Sell” from the algorithm. So, instead of just looking at the raw data, use an expanding fuzzy decision tree to break it down into its component parts. Based on the findings, the data does in fact have a structure that holds true even when looking at a longer time frame. A variety of features of the bitcoin market were brought to light by the various clustering techniques. Additionally, demonstrate that the integration of the various clustering outcomes was effective in identifying the primary market trends in the bitcoin space. Financially speaking, the whole market may be summed up in a digestible way by using the cluster descriptions, prototypes, and cluster divisions. By looking at where the clusters meet, it may potentially get more complex profiles.

By using the dissimilarity measure for each clustering approach, the analyst or investor may search for certain cryptocurrencies, ascertain to which clusters they belong, and then gauge their distance from the prototypes. As it reduces the dimensionality of the data set and identifies the main trends in a descriptive manner, the proposed methodology FC-MCDM offers a consistent and descriptive tool supported by both well-known and modern clustering techniques. This tool could be useful for investors who need to understand the cryptocurrency market. Each clustering method as a decision-maker in the heterogeneous large-scale group decision-maker approach, which is primarily based on fuzzy clustering.

BIBLIOGRAPHIC REFERENCES

1. Bansal A, Singh A, Vats S, and Ahlawat K. Identifying Critical Transition in Bitcoin Market Using Topological Data Analysis and Clustering. In International Conference on Communication and Intelligent Systems, pp. 79-90. Singapore: Springer Nature Singapore.

2. Islam MS, Hossain E, Rahman A, Hossain MS, and Andersson K. A review on recent advancements in forex currency prediction. Algorithms, 13(8), pp. 186.

3. Hajek P, and Novotny J. Fuzzy rule-based prediction of gold prices using news affect. Expert Systems with Applications, 193, pp. 116487.

4. Cortez K, Rodríguez-García MDP, and Mongrut S. Exchange market liquidity prediction with the K-nearest neighbor approach: Crypto vs. fiat currencies. Mathematics, 9(1), pp. 56.

5. Hao PY, Kung CF, Chang CY, and Ou JB. Predicting stock price trends based on financial news articles and using a novel twin support vector machine with fuzzy hyperplane. Applied Soft Computing, 98, pp. 106806.

6. Šťastný T, Koudelka J, Bílková D, and Marek L. Clustering and Modelling of the Top 30 Cryptocurrency Prices Using Dynamic Time Warping and Machine Learning Methods. Mathematics, 10(19), pp. 3672.

7. Alonso-Monsalve S, Suárez-Cetrulo AL, Cervantes A, and Quintana D. Convolution on neural networks for high-frequency trend prediction of cryptocurrency exchange rates using technical indicators. Expert Systems with Applications, 149, pp. 113250.

8. Singh J, Bowala S, Thavaneswaran A, Thulasiram R, and Mandal S. Data-Driven and Neuro-Volatility Fuzzy Forecasts for Cryptocurrencies. In 2022 IEEE International Conference on Fuzzy Systems (FUZZ-IEEE), pp. 1-8. IEEE.

9. Hernandez-Aguila A, García-Valdez M, Merelo-Guervós JJ, Castañón-Puga M, and López OC. Using Fuzzy inference systems for the creation of forex market predictive models. IEEE Access, 9, pp. 69391-69404.

10. Amiri A, Tavana M, and Arman H. An Integrated Fuzzy Analytic Network Process and Fuzzy Regression Method for Bitcoin Price Prediction. Internet of Things, 25, pp. 101027.

11. Cohen G. Algorithmic trading and financial forecasting using advanced artificial intelligence methodologies. Mathematics, 10(18), pp. 3302.

12. Chen W, Xu H, Jia L, and Gao Y. Machine learning model for Bitcoin exchange rate prediction using economic and technology determinants. International Journal of Forecasting, 37(1), pp. 28-43.

13. Munusamy S, and Murugesan P. Modified dynamic fuzzy c-means clustering algorithm–Application in dynamic customer segmentation. Applied Intelligence, 50(6), pp. 1922-1942.

14. Awotunde JB, Ogundokun RO, Jimoh RG, Misra S, and Aro TO. Machine learning algorithm for cryptocurrencies price prediction. In Artificial intelligence for cyber security: methods, issues and possible horizons or opportunities, pp. 421-447. Cham: Springer International Publishing.

15. Liu J, Wei Y, and Xu H. Financial sequence prediction based on swarm intelligence algorithms of internet of things. Computational Economics, 59(4), pp. 1465-1480.

16. Shou MH, Wang ZX, Li DD, and Zhou YT. Forecasting the price trends of digital currency: a hybrid model integrating the stochastic index and grey Markov chain methods. Grey Systems: Theory and Application, 11(1), pp. 22-45.

17. Seo Y, and Hwang C. Predicting bitcoin market trend with deep learning models. Quantitative Bio-Science, 37(1), pp. 65-71.

18. Almeida J, Tata S, Moser A, and Smit V. Bitcoin prediction using ANN. Neural networks, 7, pp. 1-12.

19. Chowdhury R, Rahman MA, Rahman MS, and Mahdy MRC. Predicting and forecasting the price of constituents and index of cryptocurrency using machine learning. arXiv preprint arXiv:1905.08444, pp. 1-15.

20. Altan A, Karasu S, and Bekiros S. Digital currency forecasting with chaotic meta-heuristic bio-inspired signal processing techniques. Chaos, Solitons & Fractals, 126, pp. 325-336.

21. https://www.kaggle.com/datasets/lasaljaywardena/global-cryptocurrency-price-database

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHOR CONTRIBUTION

Conceptualization: Suxia Sun.

Methodology: Yiyang Qin.

Investigation: Suxia Sun, Yiyang Qin.

Data Curation: Yiyang Qin.

Writing - Original Draft: Suxia Sun.

Writing - Review & Editing: Yiyang Qin.

Supervision: Yiyang Qin.