Category: Finance, Business, Management, Economics and Accounting

ORIGINAL

Exploring Strategies for Revitalizing the Informal Sector: A Case Study of Morocco’s Three Most Significant Regions

Explorando Estrategias para Revitalizar el Sector Informal: Un Estudio de Caso de las Tres Regiones más Importantes de Marruecos

Imad El Ghmari1

![]() *, Omar El Ghmari2

*, Omar El Ghmari2

![]() *, Oukassi Mustapha1 *

*, Oukassi Mustapha1 *

1Mohamed V University, Faculty of Legal, Economic and Social Sciences – Souissi. Rabat, Morocco.

2Sidi Mohamed Ben Abdellah University, Faculty of Legal, Economic and Social Sciences. Fez, Morocco.

Cite as: El Ghmari I, El Ghmari O, Mustapha O. Exploring Strategies for Revitalizing the Informal Sector: A Case Study of Morocco’s Three Most Significant Regions. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:1017. https://doi.org/10.56294/sctconf20241017

Submitted: 19-02-2024 Revised: 21-04-2024 Accepted: 07-07-2024 Published: 08-07-2024

Editor:

Dr.

William Castillo-González ![]()

ABSTRACT

This article discusses the informal sector and its impact on the economy, highlighting the importance of understanding its various dimensions, from its historical origins to its contemporary implications. By examining the theoretical foundations and dynamics of the transition to economic formality, the research makes a significant contribution to the advancement of existing knowledge in economic and social fields. By focusing on the Moroccan context, the thesis enriches the scientific literature by highlighting national specificities linked to the informal sector. The in-depth analyses of the Moroccan situation offer unique perspectives that can serve as a basis for international comparisons and case studies.

The study also explores policies and initiatives aimed at facilitating the transition from the informal sector to economic formality, offering valuable recommendations for policymakers. These recommendations, based on rigorous analysis, can contribute to the design of more effective policies to foster this transition, stimulate economic growth and improve working conditions. With regard to the research methodology, our article sets out the epistemological and methodological choices adopted, providing a reference and inspiration for other researchers in the fields of economics and social sciences. The research focuses on a quantitative approach, aiming to examine the results neutrally and objectively in order to formulate proposals and solutions to address the problems identified. In conclusion, this study provides an in-depth analysis of the informal sector, highlighting its economic and social importance, while offering valuable guidance for public policy and strengthening research methodology in the field.

Keywords: Informal Sector; Informal Workers; Morocco; Self-Employment; Microcredit.

RESUMEN

Este artículo analiza el sector informal y su impacto en la economía, destacando la importancia de comprender sus diversas dimensiones, desde sus orígenes históricos hasta sus implicaciones contemporáneas. Al examinar los fundamentos teóricos y la dinámica de la transición a la formalidad económica, la investigación aporta una contribución significativa al avance de los conocimientos existentes en los ámbitos económico y social. Al centrarse en el contexto marroquí, la tesis enriquece la literatura científica al poner de relieve las especificidades nacionales vinculadas al sector informal. Los análisis en profundidad de la situación marroquí ofrecen perspectivas únicas que pueden servir de base para comparaciones internacionales y estudios de casos.

El estudio también explora las políticas e iniciativas destinadas a facilitar la transición del sector informal a la formalidad económica, ofreciendo valiosas recomendaciones a los responsables políticos. Estas recomendaciones, basadas en un análisis riguroso, pueden contribuir al diseño de políticas más eficaces para favorecer esta transición, estimular el crecimiento económico y mejorar las condiciones laborales. En cuanto a la metodología de la investigación, nuestro artículo expone las opciones epistemológicas y metodológicas adoptadas, proporcionando una referencia e inspiración para otros investigadores en los campos de la economía y las ciencias sociales.

La investigación se centra en un enfoque cuantitativo, con el objetivo de examinar los resultados de forma neutral y objetiva para formular propuestas y soluciones que aborden los problemas identificados. En conclusión, este estudio proporciona un análisis en profundidad del sector informal, destacando su importancia económica y social, al tiempo que ofrece valiosas orientaciones para las políticas públicas y refuerza la metodología de investigación en este ámbito.

Palabras clave: Sector Informal; Trabajadores Informales; Marruecos; Autoempleo; Microcrédito.

INTRODUCTION

Contemporary economic research attaches great importance to the concept of the “informal sector”, which is attracting growing national and international interest. This research aims to explore in depth the multiple dimensions of this concept, highlighting its origin, historical development and conceptual implications.

There can be no doubt that the informal economy is a very real phenomenon, on a significant scale, and constantly growing.(1,2) This transparent reality deserves our full attention and study,(3) especially as it is not always easy to define or identify.(4) While some may hope that this phenomenon can be eradicated over time, others, like Jones et al.(5), believe that it is deeply rooted and difficult to eliminate. This impression of invincibility associated with the informal economy has prompted many governments to introduce repressive policies to halt its progress. However, these measures, often based on incomplete statistics, generally result in the adoption of ineffective policies to counter the phenomenon.

Prior to the pandemic, most informal workers were not entitled to government benefits. Many migrant workers and grey market factory workers are not protected by trade unions or entitled to unemployment insurance, nor can they report their poor working conditions to local authorities, for fear of being exposed to moonlighting. In case we think this is an exception, the United Nations’ International Labour Organization estimates that 2 billion people worldwide work informally, representing over 60 % of the global workforce. Most of them work in cottage industries or agriculture, sectors particularly prone to under-regulation. Fewer, but still numerous, work in export industries such as textiles. To some extent, these gaps exist by necessity. The countries with the highest proportion of workers employed in the informal sector are those least able to afford an extensive welfare state.(6)

The World Bank notes that in these countries, less than 3 % of the population is entitled to unemployment benefits. Despite the well-documented benefits of the welfare state in developed economies, such as greater social mobility, less extreme poverty and, importantly in the current crisis, better population health, the simple truth is that the generous coffers and expansive borrowing capacities that enable elsewhere, rich countries to maintain stable safety nets is a chimera. When emerging economies take on new debt, they often pay exorbitant interest rates because of the very real risk of default.

Morocco is no exception to this trend, but it has responded proactively to mitigate the negative effects of the crisis. The current health crisis has highlighted the vulnerabilities of the informal sector and the importance of public assistance to support the purchasing power of its workers. Although the informal sector can provide a fallback solution in the face of unemployment and lack of income, its structure and productivity do not promote economic development or guarantee adequate social protection in the event of economic crises.

Theoretical Framework of The Study

Generally speaking, the informal sector refers to all income-generating economic activities that are not registered or controlled by law. According to the ILO’s famous KENYA report,(7) the informal sector can simply be defined according to two key criteria: size, and compliance with the law. However, the informal economy has received little attention from academics, but there are a number of reasons why it should not be ignored.(8,9)

· Firstly: informal activities exist in all countries, whatever their level of economic development.

· Secondly: the informal sector represents a significant share (on average over 30 %) of global economic activity, and accounts for 70 % of total employment.

· Thirdly: the wealth created by IPUs is spent within the formal economic circuit.(10,11,12)

We deduce that the informal sector plays an important role in the global economy, and Morocco is no exception to this trend.(13) However, the informal sector is an essential component of the Moroccan economy, employing 77 % of total employment, but remains a detriment to tax revenues and long-term economic growth.(13,14) The emergence of informal activities can therefore be explained by several factors:

· Urbanization and demographic trends: amplify social imbalances and encourage the creation of subsistence activities.

· Employment market imbalance: in Morocco, unemployment is the main reason for choosing the informal sector, either as a worker or as an owner.

· Poverty dynamics: among the exciting types of IPU in Morocco are those with limited productive capacity and subsistence activities.

· The state of the education system: given the prevailing abundance of schooling in Morocco, the informal sector has become the best choice for these people.

· The COVID-19 pandemic: the outbreak of COVID had a significant negative impact in terms of loss of income, which encouraged the creation of several UPIs.(15,16,17)

The efforts of the public authorities to remedy the scale of the informal sector in Morocco(18) and encourage the transition to formalization cannot be overlooked:

· Fiscalization of the informal sector in Morocco: tax measures adopted to encourage the transition to formalization include: encouraging taxpayers to identify themselves for the first time, reducing corporation tax in favor of VSEs and SMEs, and creating the status of entrepreneur.

· Financing young entrepreneurs: numerous programs have been set up to promote entrepreneurial action, such as INTELKA, FORSA, MOUKAWALATI.

· The development of microcredit in Morocco: enabling the financing of people with low economic capacity who are excluded from the banking system.

· Implementation of developed souks: the aim is to gradually reorganize, control and integrate street vendors.(18,19,20)

METHOD

The problem surrounding this subject is linked to the existence of rigorous scientific research over a wider geographical area, which would enable us to identify and model the behaviour of informal sector operators in Morocco, as well as describing their current situation. This leads us to pose the following research problem:

“How is the current situation of the informal sector in Morocco characterized, particularly in terms of its size, structural challenges and impact on the national economy?”

Based on this central problem, we will set out a number of questions that we will attempt to answer throughout our study:

· Question 1: what are the main components of the informal sector in the Moroccan context?

· Question 2: what is the scale of the informal economy in Morocco, and what are the priority socio-economic impacts at national level?

· Question 3: what factors have contributed to the persistence of the informal sector in Morocco?

· Question 4: how has the COVID-19 pandemic affected the informal sector in Morocco, and how have the authorities responded to support workers and informal production units?

The methodology envisaged for our research is summarized in the following points:

· Type of research: quantitative research based on a research questionnaire.

· Population: informal production units in Morocco.

· Research approach: this approach combines descriptive research, evaluation and correlation research. Indeed, our aim is to address our target population, which consists of informal production units. In this context, we will first seek to describe (descriptive research) the various behaviours of these actors. Next, we will undertake an evaluation (evaluative research) of these behaviours. Finally, we will examine the relationships (correlational research) that might exist between the various variables associated with them.

· The nature of the study: this is an explanatory study of informal production units in Morocco, using a questionnaire.

· The reasoning followed: this is an abductive approach that draws on both theoretical and empirical knowledge, as suggested by HCP.(23) Our method involves an iterative process between empirical observations and theoretical knowledge throughout the research. The researcher moves back and forth between theory and the field to formulate hypotheses about the possible causes of an observed phenomenon.(24,25)

Search Structure

The process of selecting research variables is a painstaking task, as it will influence the design of our questionnaire. For our empirical study, we chose a set of qualitative variables closely related to our central problematic. In this respect, we have organized these variables into two distinct groups, each comprising a “Key Variable” and an “Associated Variable”. In this section, we present a summary, in the form of a table, bringing together all the parameters retained as well as the coding we have given them.

|

Table 1. Summary of variables selected and coded |

||

|

V1: choice of individuals |

V8: characteristics |

V17: workforce |

|

Associated variables: V2: gender V3: age V4: civil status V5: place of residence V6: level of education V7: experience

|

Associated variables: V9: business sector V10: location V11: premises V12: service/equipment V13: problems/solutions V14: registration V15: creation V16: source of financing

|

Associated variables: V18: number of employees V19: relationship V20: sex/age V21: stability V22: type of contract V23: recruitment method V24: type of payment V25: bonus/benefit V26: training |

|

V27: production and marketing |

V32: upi stakeholders |

V37: operation and financing |

|

Associated variables: V28: sales V29: raw material V30: standard per customer V31: expenses |

Associated variables: V33: customers V34: supplier V35: competitor V36: pricing |

Associated variables: V38: problems refocused V39: credit application V40: microcredit V41: the impact of credit V42: subsidies |

|

V43: social security |

V47: the role of the state |

V52: the effect of covid-19 |

|

Associated variables: V44: social security institutions V45: satisfactions V46: creation |

Associated variables: V48: pricing V49: registration V50: taxes V51: area where tax is to be spent |

Associated variables: V53: impact/activity V54: impact/staffing levels V55: impact/production V56: measures taken |

The combinations of variables we have selected have led us to formulate the main hypotheses we will test in our study of informal production units in Morocco. These hypotheses will form the basis of our research and enable us to assess the relationships and impacts between the variables studied.

|

Table 2. Research hypotheses |

||

|

Context |

N° |

Hypotheses |

|

The State |

H1 |

The presence of the informal sector in Morocco can lead to a loss of income for the State in terms of tax revenues and social security contributions. |

|

H2 |

The formalization of informal businesses in Morocco can be encouraged by offering tax benefits and providing easier access to financial services and formal markets. |

|

|

Workforce |

H3 |

Informal workers in Morocco often face precarious working conditions and increased vulnerability. |

|

Financing |

H4 |

Microcredit and subsidies can help reduce poverty and financial exclusion by offering a financing opportunity to UPIs who do not have access to traditional banking services. |

|

H5 |

The high interest rates and complex procedures imposed by microcredit institutions can be a barrier for workers in the informal sector, who often have low incomes. |

|

|

COVID-19 |

H6 |

The COVID-19 pandemic has had a significant negative impact on the informal sector in Morocco. |

To analyze the reliability of our research instrument, we chose Cronbach’s alpha, which is used to check the reliability of the variables and questions used in data collection.

|

Table 3. Test of the data collection tool |

|

|

Variable |

Cronbach's alpha |

|

TVA |

0,798 |

|

Tax benefits |

0,843 |

|

Access to financing |

0,733 |

|

Number of employee |

0,914 |

|

Workforce stability |

0,695 |

|

Poverty reduction |

0,754 |

|

Access to credit |

0,838 |

|

Interest rate |

0,814 |

|

COVID-19 (Difficulties) |

0,865 |

|

COVID-19 (Impact) |

0,795 |

|

Source: IBM SPSS software |

|

The above table shows that all the variables show a sufficient level of confidence to be used as a measurement variable that allows us to reproduce the same results.

RESULTS

To begin our analysis of the hypotheses, we must first review each hypothesis, then present the Null Hypothesis and the Alternative Hypothesis, followed by the appropriate statistical analysis protocol.

Hypothesis 1: the presence of the informal sector in Morocco can lead to a loss of income for the State in terms of tax revenues and social security contributions

To test this hypothesis, we have collected data for estimation purposes, since the hypothesis can be measured and given meaning in this way, and can explain our hypothesis with clear-cut evidence, so we have asked questions about monthly sales.

|

Table 4. Sales figures |

||

|

Montant en DH |

Quantité |

Total |

|

10000 |

43 |

430 000 |

|

12000 |

21 |

252 000 |

|

14000 |

28 |

392 000 |

|

1500 |

61 |

91 500 |

|

2500 |

24 |

60 000 |

|

25000 |

19 |

475 000 |

|

3000 |

24 |

72 000 |

|

3300 |

24 |

79 200 |

|

3700 |

21 |

77 700 |

|

4500 |

24 |

108 000 |

|

4800 |

22 |

105 600 |

|

5000 |

41 |

205 000 |

|

5700 |

22 |

125 400 |

|

6000 |

43 |

258 000 |

|

6500 |

21 |

136 500 |

|

7000 |

80 |

560 000 |

|

Total |

521 |

3 427 900 |

|

|

Amount HT |

2856583,33 |

|

|

TVA/m |

571316,67 |

|

|

TVA/An |

6855800,04 |

From the above table we can clearly identify that the treasury loses a monthly amount of VAT equivalent to a sum of 571316,67 DH monthly which is equivalent to 6 855800,04 DH annually which generates tax losses that can be a significant source if we take into account the real number and if we take into account the other taxes. The amount of 571 316,67 DH not paid to the State each month in VAT demonstrates the significant financial impact of informal activity on public revenues. This amount represents the money that could have been collected in the form of taxes if informal activities were regulated and taxed. These results underline the need to take steps to further formalize the informal sector, in order to ensure a fair contribution to the national economy and maintain the financial stability of the state.

Based on the above results, we can confirm our hypothesis. The confirmation of the hypothesis that the presence of the informal sector in Morocco can cause a loss of revenue for the state in terms of tax receipts and social security contributions is highlighted by the results.

Hypothesis 2: the formalization of informal businesses in Morocco can be encouraged by offering tax benefits and providing easier access to financial services and formal markets

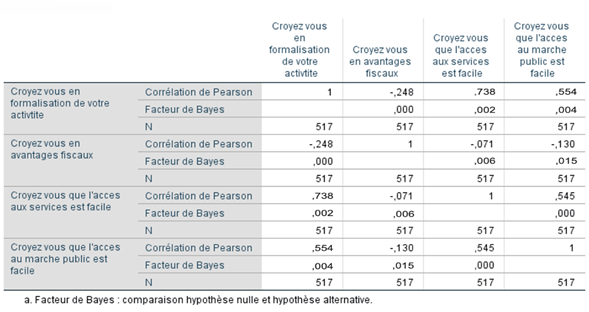

Source: SPSS software output

Figure 1. Bayes factor inference for correlation

According to the correlation table above, which studies the correlation between business formalization, tax advantage, access to financing and access to the public market.

· The correlation between business formalization and tax advantage is - 0,248; we can see that this is a weak negative correlation due to the perception of our sample, which remains poorly informed about taxation.

· The correlation between business formalization and access to financing stands at 0,738; this is a strong positive correlation which is quite normal, since business formalization will enable access to bank financing.

· The correlation between business formalization and access to the public market stands at 0,545; this is a moderately significant correlation, the cause of this reduced correlation being the conviction of some informal practitioners that they are unable to access the public market.

However, it is essential to state that the validity and confirmation of our second hypothesis remains partially confirmed; for complete validity of the hypothesis, it is essential to highlight awareness-raising programs.

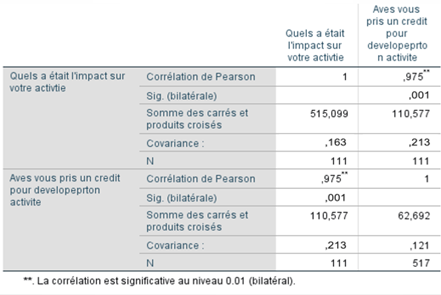

Hypothesis 3: microcredit and subsidies can help reduce poverty and financial exclusion by offering a financing opportunity to UPIs who do not have access to traditional banking services

From the previous data we can identify a perfect correlation 0,975 between the two variables and that the margin of error is tolerable. The previous data offer interesting insights into the relationship between the variables “credit taking” and “positive impact on PIUs”. The perfect correlation of 0,975 between these two variables suggests a strong, positive link between them.

Source: SPSS software output

Figure 2. Correlation table

This high correlation indicates that, in most cases, when “credit uptake” increases, “positive impact on PIUs” also increases proportionally. This strong relationship between the variables reinforces the idea that access to credit can play a significant role in improving the performance of informal Production Units. The tolerable margin of error is also an important point to note. This means that, despite natural fluctuations in the data, the correlation between variables remains consistent and does not vary significantly. This stability reinforces the credibility of the conclusions drawn from this analysis.

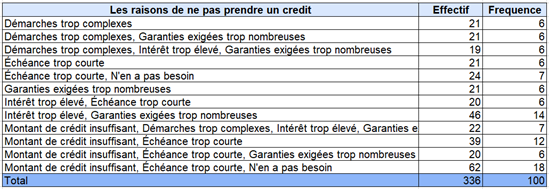

Hypothesis 4: the high interest rates and complex procedures imposed by microcredit institutions may constitute a barrier for UPIs, who often have low incomes

To provide evidence that they support or reject this hypothesis, we chose to present the various constraints first to link them to the possibility of repayment. The results show that 33 % of the population share the problem of high interest as the main reason for not taking out a loan.

Source: SPSS software output

Figure 3. Reasons for not taking out a loa

The results show that 33 % of the population share the problem of high interest as the main reason for not taking out a loan, while 35 % of the production units studied share the problem of the complexity of the steps taken to obtain credit. From this, we deduce that 68 % of informal production units experience difficulties in applying to microcredit institutions, which can be summed up in the following points: high interest rates, as well as the complexity of the procedures imposed. Other causes may include insufficient amounts or shorter repayments. However, the second most dominant cause is insufficient credit amount, with 43 %. These results, on the other hand, are confirmed by the annual reports of several microcredit institutions. This naturally confirms our hypothesis.

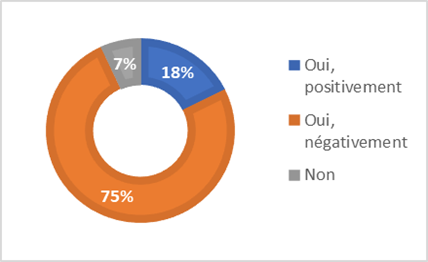

Hypothesis 5: the COVID-19 pandemic has had a significant negative impact on the informal sector in Morocco

The use of graphs to address our hypothesis has not been found to be relevant. Statistical evidence confirms our hypothesis that, as there were negative effects, others found an opportunity within this crisis.

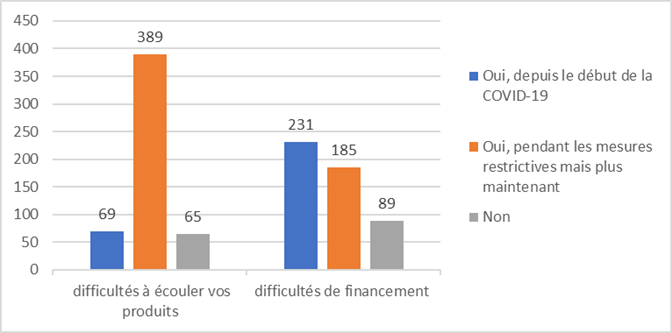

Figure 4. The occurrence of COVID-19

Interpretation: according to the results obtained, the occurrence of COVID-19 affected the UPIs, 18 % positively, 75 % negatively. While 7 % are not affected by the occurrence of COVID-19.

Figure 5. Difficulty of COVID-19

Interpretation: according to the following graph, 69 PIUs show difficulty in selling products since the beginning of the pandemic, 389 PIUs show difficulty in selling products during the restrictive measures, but no longer, while 65 PIUs find no problem in selling. In terms of financing difficulties, 231 UPI found financing difficulties since the start of the pandemic, 185 UPI found difficulties during the restrictive measures, but no longer, while 89 found no financing problems.

DISCUSSION

Having carried out the necessary checks on our research hypotheses, we summarize them in table 5.

|

Table 5. Summary of hypothesis testing |

||

|

Number |

Hypotheses |

Verification |

|

H1 |

The presence of the informal sector in Morocco can lead to a loss of income for the state in terms of tax revenues and social security contributions. |

Confirmed |

|

H2 |

The formalization of informal businesses in Morocco can be encouraged by offering tax benefits and providing easier access to financial services and formal markets. |

Partially confirmed |

|

H3 |

Microcredit and subsidies can help reduce poverty and financial exclusion by offering a financing opportunity to UPIs who do not have access to traditional banking services. |

Confirmed |

|

H4 |

High interest rates and complex procedures imposed by microcredit institutions can be a barrier for PIUs, who often have low incomes. |

Confirmed |

|

H5 |

The COVID-19 pandemic has had a significant negative impact on the informal sector in Morocco. |

Confirmed |

Impact of public policies and loss of income for the State: the hypothesis that the presence of the informal sector in Morocco leads to a loss of income for the State in terms of tax revenues and social contributions was confirmed.

Data analysis showed that considerable amounts of TVA are not collected each month, underlining the significant financial impact of informal activity on public revenues. This highlights the need to further formalize the sector to ensure a fair contribution to the national economy.

Formalization, tax incentives and microcredit institutions: hypotheses concerning tax incentives to encourage the formalization of informal enterprises and the impact of microcredit in reducing poverty and financial exclusion were discussed. The results showed that linearity between tax benefits, access to finance, access to the public market and formalization is partially accepted, suggesting a potential role for tax incentives in formalization. In addition, access to microcredit was confirmed as having a positive impact on PIUs, highlighting its potential role in improving the economic performance of informal units.

Impact of the COVID-19 pandemic: the hypothesis concerning the impact of the COVID-19 pandemic on the informal sector in Morocco was analyzed. The data showed that the pandemic had mixed effects on the sector, with both positive and negative responses. Some identified development opportunities, while others suffered economic disruption. The results also showed that a minority of informal production units were able to adapt quickly and identify new opportunities, strengthening their resilience.

CONCLUSIONS

In conclusion, an in-depth analysis of the informal sector in Morocco highlights its complexity and importance to the national economy. The causal relationships between the choice of the informal sector and socio-economic and cyclical factors are manifold, making understanding this phenomenon complex. Moreover, the very definition of the informal sector is the subject of debate among researchers, underscoring the need for clarification.

Collecting data on the informal sector presents challenges, not least because of the difficulty of accessing data and the lack of traceability, which can affect the reliability and validity of results. The transition between the informal and formal sectors, and the reasons behind it, were also explored, highlighting Morocco’s efforts to regulate and supervise the informal sector. However, this transition is not without obstacles, including structural challenges, economic disparities and cultural issues. Public policies aimed at integrating the informal sector into the formal economy are crucial, but must be implemented in a balanced and gradual manner to minimize potential risks.

Finally, the study reveals that the informal sector has played a significant role in the Moroccan economy, but that there are opportunities to maximize its benefits while promoting a transition to formality. Recommendations suggest targeted tax policies, easier access to credit, skills enhancement, and increased communication on the benefits of formalization. Overall, this study provides an in-depth overview of the informal sector in Morocco, its complexities and implications, while proposing avenues for effective management of this complex economic reality. It highlights the importance of a balanced approach to maximizing the benefits while mitigating the challenges associated with informality.

RECOMMENDATIONS

After analyzing, interpreting and discussing the results of the quantitative survey of informal production units, and presenting our general conceptual model based on the convergence of the survey results, we devote this final section to proposals for improving the informal sector in Morocco.

In short, the complexity of Morocco’s informal sector calls for a multifaceted approach to stimulate its formalization and strengthen its role in the national economy. The results of this study provide essential food for thought to guide policy decisions and future actions aimed at maximizing the socio-economic benefits of the informal sector.

Appropriate tax policies: the government should develop targeted tax policies to encourage formalization and reduce tax losses. Well-designed tax incentives could encourage informal players to join the formal sector.

Facilitating access to credit: microcredit institutions can play a crucial role in providing access to credit for informal players. However, reasonable interest rates should be promoted to avoid excessive indebtedness.

Crisis management: government needs to adopt a flexible approach to supporting the informal sector in times of crisis, offering solutions tailored to the changing needs of stakeholders.

Resilience-building: authorities should consider skills-building and training programs to improve the resilience of informal players in the face of economic challenges.

Communication strategies: the government should strengthen communication on the benefits of formalization and compliance with regulations to encourage the transition from the informal to the formal sector.

BIBLIOGRAPHIC REFERENCES

1. Abashi Shamamba. Projet de loi de Finances - informel: Identification contre amnistie. L’Économiste. 2010;382:P2. https://doi.org/10.1016/s0992-5945(10)70605-x

2. Abba B. Les pratiques marketing dans le secteur informel : une appréhension par les défaillances du secteur informel. 2016. https://doi.org/10.1787/eco_surveys-col-2013-graph29-fr

3. D’Astous A. Le projet de recherche en marketing. 4e édition. Chenelière Éducation; 2010. https://doi.org/10.2307/j.ctv69sv3w.7

4. D’Astous A, Daghfous N, Balloffet P, Boulaire C. Comportement du consommateur. 3e édition. Chenelière Éducation; 2010. https://doi.org/10.3917/dunod.bree.2017.01

5. Anadón M. Les méthodes mixtes : implications pour la recherche « dite » qualitative. Recherches qualitatives. 2019;38(1):105-123. https://doi.org/10.7202/1059650ar

6. Autio E, Fu K. Economic and political institutions and entry into formal and informal entrepreneurship. Asia Pacific Journal of Management. 2015;32(1):67-94. https://doi.org/10.1007/s10490-014-9381-0

7. Babou O. L’économie informelle en Algérie. Essai d’analyse à travers une enquête mixte (ménage/entreprise). Les cahiers de l’association tiers-monde n°29-2014. 2013;52-53. https://doi.org/10.3406/tiers.1965.2107

8. Bigsten A, Isaksson A, Soderbom M, Collier P, Zeufack A, Dercon S, Fafchamps M, Gunning JW, Teal F, Appleton S, Gauthier B, Oduro A, Oostendorp R, Patillo C. Rates of Return on Physical and Human Capital in Africa’s Manufacturing Sector. Economic Development and Cultural Change. 2000;48:801-827. https://doi.org/10.1086/452478

9. BIT. La transition de l’économie informelle vers l’économie formelle. Conférence internationale du Travail 103e session. 2014;50-92. https://doi.org/10.4000/rdctss.332

10. BIT. Secteur de la protection sociale, accroître l’étendue et l’efficacité de la protection sociale pour tous dans le cadre de la stratégie de travail décent du B.I.T. Genève; 2000. pp. 15. https://doi.org/10.3917/lms1.276.0219

11. CEA. Etude sur la mesure du secteur informel et de l’emploi informel en Afrique. CEA African Center for Statistics. 2007. https://doi.org/10.4060/ca8560fr

12. Chagnon JB, Bignami S. Perdus mais pas oubliés : l’attrition dans l’ELDEQ. Université de Montréal. 2007. https://doi.org/10.4467/20843933st.20.025.12546

13. Chapelle K, Plane P. Technical Efficiency Measurement within the Manufacturing Sector in Côte d’Ivoire: A Stochastic Frontier Approach. The Journal of Development Studies. 2005;41(7):1303-1324. https://doi.org/10.1080/00220380500170964

14. Cohen M. Micro-credit benefits the client, evidence from control group studies. USAID, Office Of Microenterprise Development, Washington. 1997. https://doi.org/10.3362/0957-1329.1990.021

15. Banque mondiale. La Banque mondiale et la Société financière internationale publient leur 6e rapport annuel sur l’environnement des affaires. Doing Business. 2009. https://doi.org/10.1596/978-0-8213-8088-8

16. DIAL, Afrobarometer. Gouvernance et corruption à Madagascar : perceptions et réalité. Premiers résultats de l’enquête « Afrobaromètre 2005 » à Madagascar. DIAL, Paris. 2005. https://doi.org/10.1016/s0398-7620(05)84575-4

17. Diallo A. Politique de l’emploi au Sénégal : L’informelle rime avec la pauvreté. 2011. https://doi.org/10.1787/888933463943

18. Diandra D, Azmy A. Understanding definition of entrepreneurship. International Journal of Management, Accounting and Economics. 2020;7(5). https://doi.org/10.33830/isbest.v1i.607

19. Easterling A. Explaining Happiness. Department of Economics, University of Southern California-Los Angeles. 2003. https://doi.org/10.25270/con.2021.11.00012

20. HCP. Enquête nationale sur le secteur informel, contribution du secteur informel dans le PIB national. 2016. https://doi.org/10.1787/024680588131

21. HCP. Enquête nationale sur le secteur informel, évolution de l’effectif des UPI selon le milieu de résidence entre 1999 et 2014. 2013/2014. https://doi.org/10.1787/eag-2013-table212-fr

22. HCP. Enquête nationale sur le secteur informel, évolution de l’effectif des UPI par secteur d’activité entre 2007 et 2014. 2013/2014. https://doi.org/10.1787/eco_surveys-col-2013-graph29-fr

23. HCP. Enquête nationale sur le secteur informel, évolution de la répartition des UPI selon les régions. 2013/2014. https://doi.org/10.1787/eco_surveys-tur-2012-graph28-fr

24. Roubaud F. L’économie informelle au Mexique : de la sphère domestique à la dynamique macroéconomique. KARTHALA, Paris. 2005. https://doi.org/10.3406/tiers.1992.4736

25. Gartiser N, Dubois S. Du problème à son processus de résolution : entre positivisme et constructivisme. Application à la conception de systèmes techniques. XIVe Conférence internationale de Management stratégique (AIMS). 2005. p. ISSN 1815-0349. https://doi.org/10.4267/2042/61839

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Imad El Ghmari, Omar El Ghmari.

Data curation: Imad El Ghmari, Omar El Ghmari.

Formal analysis: Imad El Ghmari, Omar El Ghmari.

Acquisition of funds: Imad El Ghmari, Omar El Ghmari.

Research: Imad El Ghmari, Omar El Ghmari.

Methodology: Imad El Ghmari, Omar El Ghmari.

Software: Imad El Ghmari, Omar El Ghmari.

Supervision: Imad El Ghmari, Omar El Ghmari, Mustapha Oukassi.

Validation: Imad El Ghmari, Omar El Ghmari, Mustapha Oukassi.

Writing - proofreading and editing: Imad El Ghmari, Omar El Ghmari.