Categoría: Finance, Business, Management, Economics and Accounting

ORIGINAL

An Overview of Information Systems in Auditing: Insights from Bibliometric Research

Una visión general de los sistemas de información en auditoría: Perspectivas desde la investigación bibliométrica

Sophia Vandapuye1

![]() *, Siham Jabraoui2

*, Siham Jabraoui2

![]() *

*

1Hassan 2 University, ISO Laboratory. Casablanca, Morocco.

2Hassan 2 University, ISO Laboratory. Casablanca, Morocco.

Cite as: Vandapuye S, Jabraoui S. An Overview of Information Systems in Auditing: Insights from Bibliometric Research. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:1013. https://doi.org/10.56294/sctconf20241013

Submitted: 18-02-2024 Revised: 27-04-2024 Accepted: 04-07-2024 Published: 05-07-2024

Editor:

Dr. William Castillo-González ![]()

ABSTRACT

Academic research on information systems in auditing has witnessed significant growth in the past two decades. This expansive field necessitates clear reference points for effective analysis. To aid researchers in navigating this domain, this bibliometric study identifies prominent trends and influential keywords, offering a comprehensive overview of existing literature. Methodologically, 309 documents from Web of Science and Scopus databases (2004–2024) were selected and analyzed. The bibliometric analysis pinpointed five emerging topics related to distinct technologies: Big Data Analytics, Blockchain, Computer-Assisted Audit Tools, Decision Aid Systems, and Audit Clouds.

Keywords: Information Systems; Auditing; Bibliometric Study; Emerging Technologies; Audit Digitization.

RESUMEN

La investigación académica sobre sistemas de información en auditoría ha experimentado un crecimiento significativo en las últimas dos décadas. Este campo expansivo requiere puntos de referencia claros para un análisis efectivo. Para ayudar a los investigadores a navegar por este dominio, este estudio bibliométrico identifica tendencias prominentes y palabras clave influyentes, ofreciendo una visión general exhaustiva de la literatura existente. Metodológicamente, se seleccionaron y analizaron 309 documentos de las bases de datos Web of Science(WOS) y Scopus (2004–2024). El análisis bibliométrico identificó cinco temas emergentes relacionados con tecnologías distintas: Análisis de Grandes Datos, Herramientas de Auditoría Asistida por Computadora, Blockchain, Sistemas de Ayuda a la Decisión y Auditorías en la Nube. Palabras clave: Sistemas de información, Auditoría, Estudio bibliométrico, tecnologías emergentes, digitalización de auditorías.

Palabras clave: Sistemas de Información; Auditoría; Estudio Bibliométrico; Tecnologías Emergentes; Digitalización de Auditorías.

INTRODUCTION

The rapid pace of

digital transformation is challenging organizations to constantly adapt to keep

pace with changes in the digital era.(1) Organizations that have

embraced these technologies have seen various benefits, both financially and

organizationally, including increased volumes of transactions and information.(2)

The advancements in technology have resulted in the acceptance of numerous

fresh technologies within the auditing field. Innovations such as cloud-based

auditing empower auditors to handle data digitally, easing the provision of

real-time and uninterrupted auditing services.(3) Meanwhile,

blockchain technology with its smart flows enhances the auditability of

transactions, and artificial intelligence is useful for audit-related

decision-making.(4)

However, the large volumes of information and transactions pose a challenge for the accounting profession, especially auditing, as audit firms and auditors must ensure the quality of their services amid the exponential growth of structured and unstructured data. This has led to a need to embrace digital transformation.

Today, auditing faces three major challenges:(5) First, the issuance of the final audit report, particularly the one certifying the financial statements, which is typically completed several months after the fiscal year-end, relying on historical data. Second, auditing relies on samples taken from a broader dataset, with a significant and representative threshold for applying corresponding tests. The increase in digital transactions can heighten risks related to omissions, completeness, and accuracy in daily sample selections. Third, the verification process in general, which involves various activities and operations with structured information, can benefit from improvements and optimization.

Reinventing auditing is not a new concept. According to Rosli et al.(6), audit firms must develop their business models and services by adopting the newest technologies to offer digital solutions that enhance audit quality and uphold market relevance.

The bibliometric review

The transformation in technological progress during the previous twenty years has resulted in the integration of numerous pioneering technologies in the auditing domain. This topic has emerged as a relevant and rapidly evolving research theme, attracting significant scholarly interest. In this context, we turned our focus toward researching the implementation of information technologies within the auditing field.

To begin delving into the scientific literature, we opted for a bibliometric review to catalog the various articles addressing the topic and create a well-defined and relevant database for analysis to understand the trends and directions in research on this subject. This approach provides a valuable guide for researchers, particularly at the early stages of their research process.

A bibliometric review

offers a useful tool for literature analysis during the pre-reading phase by

directing researchers to the most influential studies and mapping the research

field comprehensively.(7) Bibliometric methods serve two main

purposes: 1) to analyze performance and 2) to map scientific landscapes. The

first examines the performance of individuals and institutions in terms of

research and publication output. The second seeks to uncover the structures and

dynamics within the studied scientific field.(7)

Utilizing quantitative techniques, specifically bibliometrics, this study aims

to delineate the evolutionary path of research regarding the integration of

information technologies in the auditing domain over the past twenty years.

Previous scholarly appraisals have attempted to synthesize this body of

knowledge qualitatively, with a focus on significant themes such as big data

analysis, continuous auditing, and the broader application of artificial

intelligence in accounting contexts. These reviews have explored diverse

technological advancements across auditing, management accounting, and

financial accounting. These reviews have examined various technologies across

auditing, management accounting, and financial accounting.(7)

Earlier bibliometric analyses have offered broad methodological insights into reviews of accounting information systems. For instance, one analysis scrutinized methodologies employed in publications from a specific journal, “Journal Of Economics & Management Strategy”, while another provided an overview of the initial decade of publications in the “Accounting Auditing & Accountability Journal”. Additionally, specific studies, like Marques and Santos examination of continuous auditing,(8) have delved into metrics such as the yearly distribution of publications across various document types, authors’ affiliations by country, and the distribution of publications across scientific domains.

Objective

Taking into account the previously mentioned points, our examination will concentrate on the main patterns of research in the realm of auditing technologies. This will furnish a summary of the subjects scrutinized over the last twenty years, furnishing scholars and auditing professionals with an inclusive manual where they can promptly locate informative sources on auditing technologies. Furthermore, it will illuminate less investigated areas, such as suggestions for forthcoming research.

METHOD

The methodology used involves selecting articles from two databases: Web of Science(WOS) and Scopus, totaling 5121 articles dealing with the use of information system in audit and the digitization of audit, which are two closely correlated subjects complementing each other. These articles are drawn from 38 different journals to list the most treated topics and annotate current topics that could be the subject of further research.

In parallel, the development of this bibliometric review involved thorough reading of various accounting and auditing-focused journals indexed in WOS (Web of Science) and Scopus to ensure high standards of relevance for the information gathered for the development of the work. Below are the selected journals:

|

Table 1. Selected Journals |

||

|

No. |

Journal’s Name |

Number of articles |

|

1 |

International Journal Of Applied Business And Economic Research |

32 |

|

2 |

Information And Computer Security |

44 |

|

3 |

Financial And Credit Activity: Problems Of Theory And Practice |

51 |

|

4 |

Financial Innovation |

70 |

|

5 |

Engineering Management In Production And Services |

71 |

|

6 |

Emerald Emerging Markets Case Studies |

77 |

|

7 |

Economic And Labour Relations Review |

79 |

|

8 |

Decision Support Systems |

87 |

|

9 |

European Accounting Review |

87 |

|

10 |

Contemporary Accounting Research |

90 |

|

11 |

Construction Management And Economics |

91 |

|

12 |

Business Strategy And The Environment |

96 |

|

13 |

Australian Accounting Review, |

98 |

|

14 |

Current Issues In Auditing |

100 |

|

15 |

Accounting Perspectives |

101 |

|

16 |

Accounting And Business Research |

105 |

|

17 |

Academy Of Accounting And Financial Studies Journal |

120 |

|

18 |

Asia-Pacific Journal Of Accounting And Economics |

124 |

|

19 |

International Journal Of Accounting Information Systems |

125 |

|

20 |

Journal Of Product Innovation Management |

125 |

|

21 |

Accounting Organizations And Society |

128 |

|

22 |

Advances In Accounting |

131 |

|

23 |

Accounting Auditing & Accountability Journal |

133 |

|

24 |

Intelligent Systems In Accounting Finance & Management |

135 |

|

25 |

Journal Of Management Information Systems |

139 |

|

26 |

Auditing-A Journal Of Practice & Theory |

139 |

|

27 |

Journal Of Accounting Auditing And Finance |

140 |

|

28 |

Journal Of Business Ethics |

141 |

|

29 |

Accounting Auditing & Accountability Journal |

157 |

|

30 |

International Journal Of Auditing |

178 |

|

32 |

Accounting Review |

197 |

|

33 |

Management Science |

199 |

|

34 |

Journal Of Product Innovation Management |

223 |

|

35 |

Journal Of Accounting Research |

299 |

|

36 |

Information Systems Research |

329 |

|

37 |

Accounting Horizons |

330 |

|

38 |

Journal Of Economics & Management Strategy |

350 |

|

Total of articles |

5121 |

|

The three most influential journals, ranked by the number of articles related to the utilization of Information systems in auditing are: Information Systems Research, Accounting Horizons Journal Of Economics and Management Strategy.

The trio constitutes approximately one-fourth of all publications within the sample.

|

Table 2. Tools used |

|

|

Category |

Tools |

|

Bibliographic Database |

SCOPUS and WOS (Web of Science) |

|

Bibliographic Management Software |

ZOTERO |

|

Data Visualization Software |

VosViewer |

|

Bibliometric Mapping Tools |

BibExcel |

|

Word processing software |

Microsoft Word |

Advanced Search

In order to reduce the number of articles for analysis, a second refinement search was conducted in both databases using Boolean operators with terms for all existing technologies used in auditing (Table 3).

In each stage, we limit the search results to the fields of economics and computer science information systems because the search yields result in other areas such as medicine, telecommunications, electronic engineering, etc. Subsequently, we adjust the outcome by taking into consideration the existence of duplicated articles published on both Scopus and WOS.

Table 3. Search Keywords |

||

|

Steps |

Key words of the search |

Articles number |

|

1 |

(“Auditing*”OR”audit*”)AND(“information systems*”OR”digitalization*”OR “digitization*”OR”technology*”) |

314 |

|

3 |

(“big data*”) AND (“Auditing*”OR”audit*”) |

89 |

|

4 |

(“Auditing*”OR”audit*”)AND(“business intelligence*”OR”data analytics*” OR”blockchain*” OR “artificial intelligence*” |

251 |

|

5 |

(“Auditing*” OR “audit*”) AND (“machine learning*” OR “automation*”) After reviewing the abstracts of the identified articles, we decided to include additional synonyms of keywords such as: machine learning, continuous monitoring, CAATs, cloud, internet, knowledge-based systems, decision aid systems, intelligent system, and machine learning in the Boolean search function for exhaustive research. These keywords were collected from our literature review. |

77 |

|

6 |

(“Auditing*” OR “audit*”) AND (“artificial intelligence*” OR “automation*” OR “business intelligence*” OR “big data*” OR “blockchain*” OR “decision aid system*” OR “Internet of things*” OR “digitalization*” OR “information technology*” OR “digitization*”) |

468 |

|

7 |

After reviewing the titles, abstracts, and conducting a brief analysis of the 468 documents, a total of 309 documents comprised the final sample. This selection of articles includes all the keywords from previous research in order to determine the main research themes related to the use of information systems in auditing, which we will explore in the following section. |

309 |

Results visualization

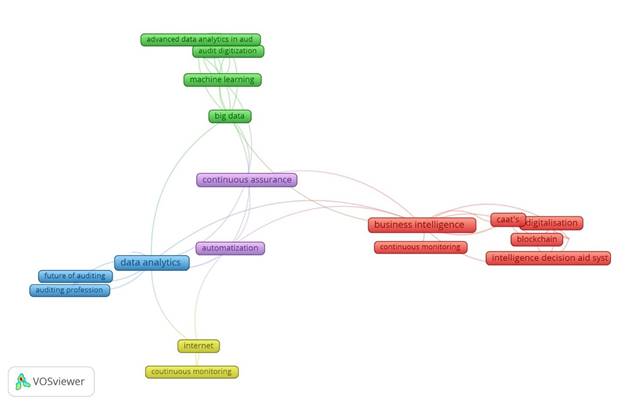

Bibliographic mapping

(Figure 1) was employed for content analysis by transferring the library of

selected articles from Zotero to VOSviewer to create a keyword map.

The articles in our sample (Table 3) exhibited robust bibliographic coupling

with each other and were all employed to uncover underlying research trends in

VOSviewer.

VOSviewer was selected for intellectual mapping owing to its user-friendly visualization features.(9) BibExcel was chosen and employed for content analysis.(7) Although there are various trending data exploration tools available, BibExcel was preferred because it provides the author with greater control over the article and enables a more nuanced understanding through a detailed concept matrix.

Research Directions

To identify research directions, the study employed bibliographic coupling method in VOSviewer, which enabled us to detect the most common keywords (figure 1).

Additionally, five research orientations were found in the literature on “audit and information systems”, these ones are the most pertinent and represent emerging topics, namely:

· The use of Big Data Analytics in auditing: impact on quality.

· The impact of Computer-Assisted Audit Techniques (CAATs) on continuous auditing.

· Blockchain within the auditing field.

· Emerging technologies for identifying fraud and risk assessment.

· Cloud auditing and audit support systems.

These areas reflect the evolving landscape of audit practices in response to technological advancements and changing business environments.

Figure 1. Bibliographic Mapping: Keyword Clustering via VOSviewer from the Bibliographic Sample of 309 Articles

ANALYSIS OF RESEARCH AXES

The Utilization of Big Data Analytics(BDA) in the Audit field:

Data analytics is characterized as “the process of deriving insights from data”.(10) It serves as an umbrella term encompassing a multitude of related concepts with overlapping definitions, which encompass a diverse range of techniques centered on data analysis - concepts like “data mining,” “data science,” “text mining,” “artificial intelligence,” and “machine learning.” Big Data technologies are molding the landscape of the audit profession, with audit methodologies and tools evolving continuously.(11) Advancements in financial auditing encompass technologies that streamline audit processes, boost organizational efficiency, and diminish audit risk levels, with data analytics playing a pivotal role.(12)

Adoption Factors of Data Analytics in Audit:

The rationales behind embracing data analytics in the audit realm can be categorized into internal and external factors. Typically, the extent to which this technology is embraced by the audited client determines the level of sophistication of data analysis tools employed during financial statement audits.(13) Disparities in technological proficiency between auditors and audited clients could potentially impact the audit opinion rendered. Thus, the imperative for auditors to strike a harmonious balance between their technological capabilities and those of their clients stands out as a primary external driver propelling the adoption of data analytics by auditors. An internal factor intertwined with the aforementioned external factor is the necessity for auditors to integrate technological tools that yield superior audit information, ultimately enhancing audit quality. Several research studies corroborate that data analytics enhances audit quality by bolstering auditors’ capacity to navigate through vast datasets, uncover concealed patterns, and amass sufficient evidence upon which to base their audit judgments.(13) Additionally, it enriches auditors’ insights, fostering improved auditor-auditee relationships.(15) The imperative for auditors to capitalize on these advantages represents one of the principal internal motivations for adopting Big Data Analytics (BDA) in financial statement audits. Despite these notable factors, the adoption rate of BDA in the audit domain has not matched that of other professions.(16) Various reasons, challenges, or barriers have impeded widespread adoption, with one of the most prevalent reasons being the lack of requisite skills to proficiently utilize complex data analysis tools.

Implications of Data Analytics utilization on Audit Quality:

One of the principal advantages of utilizing data analytics is the enhancement of audit quality. By thoroughly examining and drawing conclusions on potential irregularities,(17) it furnishes more precise and accurate insights into clients and their operations. As auditors cannot scrutinize every transaction, data analytics can sift through those that raise suspicions.(15) It not only leverages financial data to unearth these irregularities but also incorporates non-financial data. The entirety of the company’s environment, structure, and activities is encompassed in this analysis. The utilization of data analytics also elevates quality through population testing, rather than relying solely on sample-based tests. The greater the amount of information available, the more refined and accurate the outcomes can be.(18) Consequently, patterns become more discernible, and anomalies easier to pinpoint. This not only aids the auditor in attaining a more comprehensive and nuanced understanding of the analysis results but also facilitates a deeper comprehension of the global environment and operations of the audited company. Quality is not only augmented in terms of its intrinsic merit, but data analytics also presents the opportunity for expedited and thus more cost-effective audits.

In general, data analytics is perceived to enrich audit quality. It assists auditors in navigating complex judgment decision-making scenarios(19) by empowering them to devise innovative solutions to challenges encountered in these situations. Even the adoption of information technology by the audit client bolsters the quality and efficiency of both current and future audits. Furthermore, there is evidence supporting a positive correlation between internal control monitoring technology and audit effectiveness in both internal and external audit contexts.(3)

The Impact of Computer-Assisted Audit Techniques (CAATs) on Continuous Audit

Definition of Continuous Audit:

Continuous audit is a form of ongoing monitoring that operates without interruption. It involves the integration of technology and continuous management control utilizing computer-assisted audit tools, which afford organizations the opportunity for continuous control implementation and effective detection of fraud and risks, supported by evidence provided through computer systems. Continuous audit is a methodology that can be employed to establish and deliver real-time reporting within a digital environment.(3) To accomplish this, auditors must verify the accuracy of financial information and the dependability of systems responsible for storing, transmitting, and processing these transactions. The examination of accuracy entails identifying fraud and errors in operations. There exist established audit technologies that can aid in the identification of significant anomalies in financial documents. When utilized within a continuous audit framework, these technologies can enhance their effectiveness, as all transactions are analyzed in real-time. It has been suggested that cost-effective alternatives to traditional audit practices involve the incorporation of Computer-Assisted Audit Tools (CAATs) to facilitate data extraction, sorting, and analysis processes. Auditors have been employing CAATs for many years, encompassing a diverse array of technologies, some of which are relevant in the context of continuous audit. Consequently, the focus of financial auditing will transition from manual detection to prevention through technology-based approaches.(8)

The Advantages of Continuous Audit:

Over the past three decades, there has been a notable surge in the utilization of technology in financial reporting among various audit clients, leading to the production of nearly real-time financial reports and outcomes. As a result, information is now disseminated to users more swiftly compared to conventional methods. With this type of financial data, the continuation of traditional audit methods has become increasingly challenging, prompting the necessity for adopting continuous audit.(15) Moreover, numerous past scandals and ensuing regulations have fueled the adoption of continuous audit. Particularly in the United States, the uptake of continuous audit has been chiefly driven by the enactment of the Sarbanes-Oxley Act. Once implemented, continuous audit systems can furnish auditors with dependable information utilizing minimal resources.(21) In theory, continuous audit systems have the potential to streamline audits by furnishing pertinent and trustworthy financial data in real-time. External auditors appear to place greater reliance on internal audit efforts when employing continuous audit systems rather than those utilizing traditional methods, further contributing to efficient audits. Furthermore, the costs associated with implementing continuous audit systems are considerable, typically involving substantial consulting fees.(22) Additionally, the expenses related to infrastructure and software are significant, and the systems entail ongoing maintenance costs.

Blockchain and Audit:

Blockchain is an extensive ledger where transactions are recorded on computers within a network (nodes). There exist two types of blockchains: private ones that necessitate permission to join and public ones that do not require permission to join.(4) This technology gained prominence from 2017 onwards and has been heralded as a novel, game-changing force for the accounting and auditing profession, prompting inquiries into its purpose and capabilities. In the practical realm of auditing and accounting, audit firms equipped with blockchain software, alongside their clients, can streamline the audit process, saving time, money, and unnecessary validation procedures. Both the client and the auditor must integrate blockchain technology software features into their accounting systems.(23) Blockchain serves as a tool that streamlines transactions between businesses, fosters inter-business collaboration, enhances trust among partners, and reduces transaction costs across industries. The advantages for accounting and auditing encompass double verification and precise visualization of transactions, unaltered timestamped numbers, reliability, cutoff, efficiency, and confirmations.

The benefits of blockchain on auditing confer a competitive edge by automating tasks and enhancing accuracy with minimal human intervention. Despite the use of emerging technologies, human qualities of the auditor and limitations of computer tools persist; thus, auditors are expected to evolve by acquiring knowledge and skills and exploring new advisory and creative opportunities to meet client demands.

New Technologies in Fraud Detection and Risk Assessment:

The onset of the new millennium witnessed numerous prominent cases of companies facing bankruptcy due to accounting scandals associated with fraud.(24) Fraud detection has come under intense scrutiny, as the speed and method of detection can profoundly impact the scale of fraud. New technologies can be seamlessly integrated into a company’s overall compliance and risk framework to mitigate fraud risks. Subsequently, the auditing profession has faced scrutiny, with auditors being partially held accountable for these scandals. Auditors are tasked with gathering evidence and providing assurance that financial statements are free from fraud. Historically, auditors have primarily relied on financial statement information to assess fraud risks.(25) However, fraud detection within these same financial statements has been a prolonged and intricate decision-making process. While these methods cannot guarantee the detection and prevention of fraudulent activities, management’s commitment and investment in fraud prevention and detection procedures can identify warning signs of fraud and convey a strong message to employees, suppliers, customers, and other stakeholders about the company’s integrity.(24)

The emergence of technologies in auditing has led to the development of decision-making tools that facilitate the detection of financial fraud by auditors. Additionally, this has enabled auditors to make informed judgments on complex unstructured data, including financial and non-financial risk factors.(26)

These emerging technologies can be applied in various areas to bolster detection processes. Some of these include:

· AI: Artificial intelligence can help minimize asset misappropriation fraud. An AI-based verification system that estimates the cost of goods and services can make purchase prices more competitive.

· Analytical Tools: Advanced analytical techniques can handle high data velocities to detect fraud red flags, particularly in procure-to-pay processes. These analyses can also be utilized to identify bid rigging, duplicate invoices, and other irregularities depending on the business activity.

· Data Mining: Data mining can uncover fraud trends, collusion, and false information, while data visualization aids in detecting corruption intent in payments or transactions.

· Other benefits of technology include process automation through RPA (Robotic Process Automation), which can significantly reduce human intervention in procurement activities, thus combating various methods fraudsters employ to conceal fraud and malpractices.

Cloud Audit and Audit Assistance Systems

Cloud Auditing:

Cloud computing is a technology that grants virtual access to an array of computing resources like storage, applications, and other services.(27) Within cloud computing, specific users within an organization act as consumers of cloud services provided by cloud service providers. Consequently, auditors can extend auditing services to both users and providers of cloud services or may themselves be users of such services. Auditors often opt for cloud audit services due to their ability to mitigate expenses associated with acquiring technological infrastructure.(28) Additionally, cloud-based technologies play a pivotal role in offering real-time and continuous audit services. Despite these considerable incentives for adopting cloud audit services, auditors harbor reservations about employing cloud technology. Notably, data privacy and confidentiality concerns loom large, particularly concerning public cloud service platforms. Auditing cloud data poses challenges for auditors, given that cloud providers might limit the information auditors can access due to privacy concerns of other parties utilizing the same cloud platform. Nevertheless, despite these apprehensions, many auditors are embracing cloud-based technologies owing to their capacity to enhance audit efficiency.(29)

Decision Support Systems:

The advancement of technologies has enabled the implementation of decision support systems in auditing. These systems don’t explicitly make decisions but aid auditors in doing so. They are seen as direct elements that improve audit effectiveness by helping auditors make impartial and precise professional assessments.(30) Nonetheless, these advantages rely not solely on the adoption of these decision support systems but rather on the response of auditors and their integration of these decision support tools into their decision-making process.(25) If auditors regard decision tools as constraining regulations, their willingness to utilize them diminishes, potentially resulting in abandonment. Conversely, if perceived as beneficial and enhancing their decision-making process, they are more likely to embrace them.(31) Therefore, the use of these support systems is always favorable in the auditing profession. They increase auditor confidence in decision-making under conditions of uncertainty.

CONCLUSION

From an examination of 309 documents centered on emerging technologies utilized in auditing, the research scrutinized studies spanning the past two decades. The investigation unearthed pivotal articles and significant viewpoints from the audit digitalization literature, offering valuable insights and guidance for researchers. Furthermore, it pinpointed fresh areas ripe for exploration, which could serve as future article subjects.

In terms of academic journals, the findings spotlighted “Information Systems Research” ,” Accounting Horizons” and “Journal Of Economics and Management Strategy” as the top three publications featuring technologies employed in auditing. Articles revolving around Big Data analysis emerged as the most influential and current, while those addressing data analytics are still in nascent stages. Keyword analysis unveiled a surge in terms such as big data, data analytics, cloud audit, and blockchain over the past decade. Notably, continuous audit remains a prevalent keyword among authors, while those related to audit assistance systems have diminished, particularly in recent years.Using VOSviewer, the study identified five research axes: (1) The utilization of Big Data Analytics(BDA) within the the audit domain.(2) The impact of CAATs (computer assisted auditing tools) on continuous audit. (3) The Blockchain technology and audit. (4) Emerging technologies for identifying fraud. (5) Audit cloud and assistance systems for auditors.

This study adds to the literature on auditing in various ways. Firstly, it provides insight into the intellectual structure of the literature over the past two decades through journals and authors in the field. It reveals the five major research axes that have been explored and trending keywords. This will help professionals and researchers have a reference guide for a summary of the current research available on audit digitization. In addition to the list of trending articles containing very rich information. This information can serve as a good basis for predicting potential areas of interest for forthcoming researches.

The investigation also adds to intriguing potential paths for future research, including:

· Assessing the influence of Big Data utilization on audit quality.

· Evaluating the effects of integrating data analytics tools into the audit procedure.

· Identifying the skill set necessary for auditors to proficiently employ blockchain technology.

· Establishing control measures for auditors to safeguard client data integrity amidst the prevalence of Big Data analytics.

· Exploring methods to incorporate blockchain mechanisms into the continuous audit framework.

Researchers can experiment with and enhance propositions, ideas, and theories regarding technology application in auditing, thus enhancing the likelihood of publication in leading academic journals.

REFERENCES

1. Ebert C, Duarte CH. Digital Transformation. IEEE Softw. 1 juill 2018;35:16‑21. https://doi.org/10.1109/ms.2018.2801537

2. Abdullateef Omitogun AO, Abdullateef Omitogun KAA. Auditors’ Perceptions of and Competencies in Big Data and Data Analytics: An Empirical Investigation. Int J Comput Audit. déc 2019;1(1):092‑113. https://doi.org/10.53106/256299802019120101005

3. Rezaee Z, Elam R, Sharbatoghlie A. Continuous auditing: the audit of the future. Manag Audit J. 1 janv 2001;16(3):150‑8. https://doi.org/10.1108/02686900110385605

4. Dai J, Vasarhelyi M. Toward Blockchain-Based Accounting and Assurance. J Inf Syst. 8 juin 2017;31. https://doi.org/10.2308/isys-51804

5. Adnan Allbabidi MH. Hype or Hope: Digital Technologies in Auditing Process. Asian J Bus Account. 29 juin 2021;14(1):59‑86. https://doi.org/10.22452/ajba.vol14no1.3

6. Rosli K, Yeow P, Siew EG. Factors Influencing Audit Technology Acceptance by Audit Firms: A New I-TOE Adoption Framework. J Account Audit Res Pract. 1 sept 2012;1‑11. https://doi.org/10.5171/2012.876814

7. Donthu N, Kumar S, Mukherjee D, Pandey N, Lim WM. How to conduct a bibliometric analysis: An overview and guidelines. J Bus Res. 1 sept 2021;133:285‑96. https://doi.org/10.1016/j.jbusres.2021.04.070

8. Marques RP, Santos C. Research on continuous auditing: A bibliometric analysis. In: 2017 12th Iberian Conference on Information Systems and Technologies (CISTI) [Internet]. 2017 [cité 9 mai 2024]. p. 1‑4. Disponible sur: https://ieeexplore.ieee.org/document/7976048 https://doi.org/10.23919/cisti.2017.7976048

9. van Eck NJ, Waltman L. VOSviewer Manual. https://doi.org/10.59350/rar8d-zmp93

10. Adrian C, Abdullah R, Atan R, Jusoh YY. Conceptual Model Development of Big Data Analytics Implementation Assessment Effect on Decision-Making. Int J Interact Multimed Artif Intell. 2018;5(1):101. https://doi.org/10.9781/ijimai.2018.03.001

11. Dagilienė L, Klovienė L. Motivation to use big data and big data analytics in external auditing. Manag Audit J. 1 juill 2019;34(7):750‑82. https://doi.org/10.1108/maj-01-2018-1773

12. Berumen A. Effective use of data analytics and its impact on business performance within small-to-medium-sized businesses. https://doi.org/10.4337/9781839100161.00018

13. Marchena Sekli GF, De La Vega I. Adoption of Big Data Analytics and Its Impact on Organizational Performance in Higher Education Mediated by Knowledge Management. J Open Innov Technol Mark Complex. déc 2021;7(4):221. https://doi.org/10.3390/joitmc7040221

14. Al-Qudah DAA, Baniahmad DAY, Al-Fawaerah DN. The Impact of Information Technology on the Auditing Profession. 2013;2(5):8. https://doi.org/10.24297/ijmit.v5i2.4442

15. Al-Ateeq B, Sawan N, Al-Hajaya K, Altarawneh M, Al-Makhadmeh A. Big data analytics in auditing and the consequences for audit quality: A study using the technology acceptance model (TAM). Corp Gov Organ Behav Rev. 1 janv 2022;6:64‑78. https://doi.org/10.22495/cgobrv6i1p5

16. ALRASHIDI M, ALMUTAIRI A, ZRAQAT O. The Impact of Big Data Analytics on Audit Procedures: Evidence from the Middle East. J Asian Finance Econ Bus. 28 févr 2022;9(2):93‑102. https://doi.org/10.1007/978-3-031-05258-3_22

17. Gunasinghe HVS. - EFFECTIVE USE OF DATA ANALYTICS AND ITS IMPACT ON BUSINESS PERFORMANCE WITHIN SMALL-TO-MEDIUM-SIZED BUSINESSES IN SRI LANKA. 17 juin 2023; https://doi.org/10.1002/9781119448662.ch2

18. Mousa A, Abdullah A, Zraqat O. The Impact of Big Data Analytics on Audit Procedures: Evidence from the Middle East. J Asian Finance Econ Bus. 1 janv 2022;9:93‑0102. https://doi.org/10.1007/978-3-031-05258-3_22

19. Hamdam A, Jusoh R, Yahya Y, Jalil A, Zainal Abidin NH. Auditor judgment and decision-making in big data environment: a proposed research framework. Account Res J. 26 janv 2021;ahead-of-print. https://doi.org/10.1108/arj-04-2020-0078

20. Küçükgergerli N, Atılgan Sarıdoğan A. The Impact of IT Application Control on the quality of the Audit Evidence: An Application Example. Muhasebe Enstitüsü Derg J Account Inst. 31 janv 2022;0(66):65‑77. https://doi.org/10.26650/med.1020306

21. Cullinan C. Enron as a symptom of audit process breakdown: can the Sarbanes-Oxley Act cure the disease? Crit Perspect Account. 1 août 2004;15(6):853‑64. https://doi.org/10.1016/j.cpa.2003.06.007

22. Kim HJ, Mannino M, Nieschwietz RJ. Information technology acceptance in the internal audit profession: Impact of technology features and complexity. Int J Account Inf Syst. déc 2009;10(4):214‑28. https://doi.org/10.1016/j.accinf.2009.09.001

23. Nelaturu K, Du H, Le DP. A Review of Blockchain in Fintech: Taxonomy, Challenges, and Future Directions. Cryptography. juin 2022;6(2):18. https://doi.org/10.3390/cryptography6020018

24. Olasanmi OO. Computer Aided Audit Techniques and Fraud Detection. Res J Finance Account. 2013;14. https://doi.org/10.1007/978-94-007-5699-1_88

25. Olasanmi OO. Computer Aided Audit Techniques and Fraud Detection. Res J Finance Account. 2013;14. https://doi.org/10.1007/978-94-007-5699-1_88

26. Noordin NA, Hussainey K, Hayek AF. The Use of Artificial Intelligence and Audit Quality: An Analysis from the Perspectives of External Auditors in the UAE. J Risk Financ Manag. août 2022;15(8):339. https://doi.org/10.3390/jrfm15080339

27. Gupta S, Qian X, Bhushan B, Luo S. Role of Cloud ERP and Big Data on Firm Performance: A Dynamic Capability View Theory Perspective. Manag Decis. 8 sept 2018;57. https://doi.org/10.1108/md-06-2018-0633

28. Ryoo J, Rizvi S, Aiken W, Kissell J. Cloud Security Auditing: Challenges and Emerging Approaches. IEEE Secur Priv. nov 2014;12(6):68‑74. https://doi.org/10.1109/msp.2013.132

29. Halpert B. Auditing Cloud Computing: A Security and Privacy Guide. John Wiley & Sons; 2011. 224 p. https://doi.org/10.1002/9781118269091

30. Gupta S, Qian X, Bhushan B, Luo S. Role of Cloud ERP and Big Data on Firm Performance: A Dynamic Capability View Theory Perspective. Manag Decis. 8 sept 2018;57. https://doi.org/10.1108/md-06-2018-0633

31. Ghani R, Ismail NA, Saidin SZ. Adoption of Computer-Assisted Audit Tools and Techniques (CAATTs): An Exploratory Study in Audit Firms. 2016;6. https://doi.org/10.1201/9781315178141-26

CONFLICT OF INTEREST

None

FINANCING

None

AUTHORSHIP CONTRIBUTION

Conceptualization: Vandapuye Sophia, Jabraoui Siham.

Data curation: Vandapuye Sophia, Jabraoui Siham.

Formal analysis: Vandapuye Sophia.

Investigation: Vandapuye Sophia.

Methodology: Vandapuye Sophia.

Resources: Vandapuye Sophia , Jabraoui Siham.

Supervision: Jabraoui Siham.

Validation: Vandapuye Sophia, Jabraoui Siham.

Writing – original draft: Vandapuye Sophia, Jabraoui Siham.

Writing – review & editing: Vandapuye Sophia, Jabraoui Siham.