Category: Finance, Business, Management, Economics and Accounting

ORIGINAL

A systematic review of models for the prediction of corporate insolvency

Revisión sistemática de los modelos de predicción de la insolvencia empresarial

N. Sathyanarayana1 ![]() *, Raja Narayanan2

*, Raja Narayanan2 ![]() *

*

1Dayananda Sagar University, Bangalore, India.

2SCMS, Dayananda Sagar University, Bangalore, India.

Cite as: Sathyanarayana N, Narayanan R. A systematic review of models for the prediction of corporate insolvency. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:952. https://doi.org/10.56294/sctconf2024952

Submitted: 13-02-2024 Revised: 01-05-2024 Accepted: 16-06-2024 Published: 17-06-2024

Editor: Dr.

William Castillo-González ![]()

ABSTRACT

A thorough evaluation of recent developments in bankruptcy prediction models developed specifically for listed firms in India is presented in this research. Beginning with influential contributions from the evolution of bankruptcy prediction methodologies is traced through various statistical techniques, including logistic regression, neural networks and discriminant analysis. Recent innovations, such as duration models, partial least squares with support vector machines, and efficiency-driven distress prediction, are discussed in the context of their applicability to the Indian market. The paper highlights the significance of early warning systems in the wake of bankruptcy reforms in India and examines the regulatory framework’s impact on bankruptcy prediction modeling. And it goes further into how macroeconomic variables and industry-specific variables might make bankruptcy models better predictors. Limitations such as small sample sizes, short time periods for samples, and the incorporation of qualitative data into predictive models are highlighted in the study as areas that require further investigation in future studies. Overall, this paper provides valuable insights for academics, practitioners, and policymakers involved in bankruptcy prediction and risk management within the Indian corporate sector.

Keywords: Bankruptcy Prediction; Indian Listed Companies; Statistical Techniques; Early Warning Systems; Regulatory Framework; Macroeconomic Factors; Industry-specific Variables; Risk Management; Predictive Accuracy; Corporate Sector.

RESUMEN

En esta investigación se presenta una evaluación exhaustiva de la evolución reciente de los modelos de predicción de quiebras desarrollados específicamente para las empresas que cotizan en bolsa en la India. Comenzando por las influyentes contribuciones de la evolución de las metodologías de predicción de quiebras, se hace un recorrido por diversas técnicas estadísticas, como la regresión logística, las redes neuronales y el análisis discriminante. Las innovaciones recientes, como los modelos de duración, los mínimos cuadrados parciales con máquinas de vectores de apoyo y la predicción de dificultades basada en la eficiencia, se analizan en el contexto de su aplicabilidad al mercado indio. El artículo subraya la importancia de los sistemas de alerta temprana a raíz de las reformas concursales en la India y examina el impacto del marco regulador en los modelos de predicción de quiebras. Y profundiza en cómo las variables macroeconómicas y las específicas del sector podrían hacer que los modelos de predicción de quiebras fueran mejores. Limitaciones como el pequeño tamaño de las muestras, los cortos periodos de tiempo de las muestras y la incorporación de datos cualitativos a los modelos de predicción se destacan en el estudio como áreas que requieren una mayor investigación en futuros estudios. En general, este trabajo ofrece valiosas perspectivas para académicos, profesionales y responsables políticos implicados en la predicción de quiebras y la gestión de riesgos en el sector empresarial indio.

Palabras clave: Predicción de Quiebras; Empresas Indias que Cotizan en Bolsa; Técnicas Estadísticas; Sistemas de Alerta Temprana; Marco Normativo; Factores Macroeconómicos; Variables Específicas del Sector; Gestión del Riesgo; Exactitud Predictiva; Sector Empresarial.

INTRODUCTION

The research conducted by Mario H constitutes a comprehensive empirical investigation aimed at elucidating the intricate dynamics of corporate credit risk through the integration of macro-economic, market-based and accounting data. Mario H’s 1980–2011 study used 23 218 observations of listed businesses to provide a comprehensive dataset for analysis. The primary objective of this endeavour was to develop robust risk models tailored specifically for listed companies, with a particular focus on predicting financial distress and bankruptcy. Mario H combined accounting data, stock market indicators, and macroeconomic proxies to attain his objective. By incorporating these diverse datasets into the risk models, Mario H aimed to enhance their predictive accuracy, practical utility, and sensitivity to macroeconomic dynamics, thereby rendering them more suitable for stress testing applications. A comprehensive benchmarking experiment compared the estimated models to neural networks(2) original Z-score specification. contributed to the discourse by exploring the adoption of contingent claims valuation approaches in corporate bankruptcy prediction models. The literature has rarely compared these models to classic accounting-ratio-based techniques, despite their theoretical promise.(33) He found that the z-score technique captures distinct components of bankruptcy risk and increases bank profitability under certain scenarios. Moreover, Tyler S advocated for the adoption of hazard models over single-period models for forecasting bankruptcy. Hazard models, characterized by their consistency in estimations, were deemed more appropriate for this purpose. Market size, Idiosyncratic & Past stock returns vary highly correlated with bankruptcy. To enhance the accuracy of out-of-sample predictions, Tyler S. proposed a mixed model that incorporates both accounting ratios and market-driven variables. Data Envelopment Analysis (DEA) was first used to assess corporate bankruptcy.(4) To compare default and non-default enterprises, this non-parametric method was employed to measure the weight estimates of a classification function. DEA outperformed logistic regression (LR) in out-of-sample bankruptcy assessment in a recent sample of significant US corporate bankruptcies. The subject was furthered(42) who developed a measure of corporate success and failure based on an additive super-efficiency DEA model. Yao Chen found that the DEA model is less accurate at forecasting business failures than healthy firms by applying this approach to a random sample of 1001 firms, including significant US bankrupt firms and healthy matched firms. To make up for this shortcoming, the evaluation index provided decision-makers with options for total forecast precision, non-bankrupt, and bankruptcy. Premachandra(42) Bankruptcy prediction models have progressed over time, with a change from simpler multivariate models to more complex univariate financial ratio analysis. Recent advancements include the incorporation of capital market data and contingent claims valuation approaches. The effectiveness of older models, like Altman’s Z-score model, has been questioned in modern contexts because of changing market dynamics and their shortcomings.(1) Recent corporate bankruptcy prediction models include contingent claims valuation and a financial risk assessment paradigm change. Despite the theoretical allure of these models, their empirical performance relative to traditional accounting-ratio-based approaches remains underexplored within the existing literature. In our investigation, we have unearthed distinct facets of bankruptcy risk captured by these two contrasting methodologies. Surprisingly, we observed minimal disparity in their predictive efficacy within the UK context. But when there are varying costs for different types of decisions and prices are competitive, the z-score technique helps banks turn a profit.(35) A comprehensive review spanning from 1968 to 2005 offers a panoramic view of the landscape of bankruptcy prediction methodologies, elucidating the diverse array of statistical and intelligent techniques employed in addressing this multifaceted challenge. Statistical methods, operational research, case-based reasoning (CBR), neural networks, evolutionary approaches, decision trees, rough set-based procedures, and other soft computing strategies are carefully categorized in this overview. Each paper scrutinized in this review sheds light on critical aspects such as the source of datasets, financial ratios utilized, geographical origins, temporal scope, and comparative performance metrics, thereby paving the way for future research endeavours aimed at refining and enhancing existing methodologies.(27) Finance, economics, and accounting have been interested in corporate bankruptcy dynamics. Starting with univariate financial ratio analysis, models for predicting corporate failure have progressed to multivariate and now logit models, which can directly estimate the risk of failure under less rigorous statistical assumptions. Multinomial logit models, which use secondary categorization information and expand outcome space to incorporate a third state of financial hardship, are powerful tools. These algorithms have reduced misclassification error rates and improved prediction capacities for detecting financially fragile enterprises at risk of severe financial crisis. Early bankruptcy prediction models based on pre-bankruptcy financial ratios performed well in-sample and out-of-sample.(24) Later advances in the literature included capital market data like excess stock returns and volatility, as well as sophisticated option-pricing models like the Black Scholes Merton model.(3)

Notably, the efficacy of these models varied over time, with the introduction of a new model incorporating key variables from existing models yielding improved predictive performance, particularly concerning the degree of diversification within firms.(15) Despite being a pioneer in company financial health evaluation, The Z-score model developed by Altman has some shortcomings as a result of its antiquated origins and sample characteristics. Modern firms have become harder to classify, prompting a critical evaluation of their utility. Our empirical study using recent sample data examines the model’s efficacy across various dimensions, giving deep insights into its applicability across firm kinds and stress levels. A new model integrating key factors from all five models and a company diversification variable was established. Bankruptcy risk decreases with diversification. In-sample and out-of-sample studies demonstrate this more generic model outperforms current models.(59) While the quest to design reliable bankruptcy prediction models remains ongoing, it is imperative to adopt a multidimensional perspective that transcends unidimensional assessments. Comparing prediction models can lead to future research focused on improving current methods and creating new techniques to tackle the changing issues of corporate financial risk.(17)

Review of literature

To forecast bankruptcies, hazard models that incorporate accounting and market data have lately become the norm. There hasn’t been a comprehensive literature review that compares these hazard models to conventional accounting-based approaches or contingent claims procedures. Through Receiver Operating Characteristics (ROC) curve analysis using data from UK-listed firms between 1979 and 2009, it has been demonstrated that hazard models outperform alternative approaches.(9) Additionally, information content tests reveal that hazard models encompass all bankruptcy-related information contained in established models such as the(54) z-score(12) contingent claims-based models.(9)

A Pakistani non-financial sector bankruptcy prediction study examined financial ratios over five years before bankruptcy for enterprises that went bankrupt between 1996 and 2006. Cash flow ratio, EBIT to current liabilities, and Sales to total assets were significant predictors of bankruptcy in this discriminant analysis, with 76,9 % accuracy on the sample dataset.(43)

The use of neural network models for bankruptcy prediction has garnered attention, presenting a viable alternative to traditional methods like Multivariate Discriminant Analysis (MDA). A comparative study shows that neural networks might be useful in this area, as they can make accurate predictions.

The effectiveness of bankruptcy prediction models is crucial for informed lending decisions by financial institutions. While Machine Learning (ML) and statistical techniques have been explored, the synergistic integration of financial ratios and corporate governance indicators remains underexplored. Experimental findings underscore the significance of solvency and profitability ratios, alongside board structure and ownership indicators, in enhancing prediction accuracy.(29)

Addressing the unique context of Belgian small-and medium-sized enterprises (SMEs), a study develops a logit model incorporating various financial ratios to predict bankruptcy. Results underscore the predictive power of liquidity and profitability ratios in identifying firms at risk of insolvency, offering valuable insights for stakeholders including investors, managers, and credit institutions.(18)

Previous bankruptcy prediction studies employing Multiple Discriminant Analysis (MDA) have yielded inconsistent results, partly due to variations in the selection of financial ratios and methodological approaches.(31) Challenges such as multicollinearity and temporal aggregation underscore the need for robust methodologies in this domain.

Amidst the rising prevalence of corporate bankruptcies, the efficacy of Partial Least Squares Logistic Regression (PLS-LR) in bankruptcy prediction is explored. The results highlight the superiority of PLS-LR over conventional methods, offering a promising avenue for enhanced predictive accuracy. The emergence of Partial Least Squares Logistic Regression (PLS-LR) as a predictive tool offers a novel approach to bankruptcy forecasting, particularly in the context of the USA banking crisis in 2008. Comparative analysis demonstrates the effectiveness of PLS-DA alongside traditional techniques like Support Vector Machine (SVM) and Linear Discriminant Analysis (LDA).(23)

The Technique for Order Performance by Similarity to Ideal Solution (TOPSIS) framework, traditionally employed for ranking, is adapted as a classifier for bankruptcy prediction. Empirical validation on UK firms demonstrates robust predictive performance, opening new avenues for risk modelling applications. Productivity and firm strategy play pivotal roles in mitigating bankruptcy risk, as evidenced by empirical findings employing data envelopment analysis. Because of its mediating role, productivity is significant in the strategy-bankruptcy risk relationship.(38)

Gradient boosting models offer a flexible approach to bankruptcy prediction, accommodating a vast array of predictors. When it comes to improving predictive efficacy, empirical study highlights the importance of non-traditional variables, like as ownership structure and CEO pay. Comparative evaluation of bankruptcy prediction models, including MDA, the linear probability model, and logistic regression, underscores the importance of selecting appropriate methodologies aligned with the theory of financial distress.(25)

Convolutional neural networks are applied innovatively to predict corporate bankruptcy, leveraging financial statement data transformed into grayscale images. Results demonstrate superior performance compared to traditional methods, highlighting the potential of deep learning in financial analysis. The use of data mining techniques in bankruptcy prediction highlights the significance of feature selection in enhancing predictive performance.(22) The experimental results highlight the effectiveness of the t-test method in choosing relevant features to enhance the accuracy of classification.(22)

To further understand the mediating impacts of productivity and business strategy, we investigate their roles in reducing the likelihood of bankruptcy. Findings underscore the positive impact of productivity and strategic orientation in reducing bankruptcy risk, offering practical implications for stakeholders. Genetic Programming (GP) emerges as a promising tool for bankruptcy prediction, offering superior performance compared to traditional methods like MDA. GP’s adaptive nature and ability to handle complex problems position it as a valuable asset in financial risk assessment.(37)

Models Used by Various Authors

In the decades following Altman’s 1968 publication of a prominent bankruptcy prediction model, a deluge of similar models have been produced.(11) In addition to a rise in the total number of articles on the topic, this trend indicates a wide range of models used to forecast which businesses will fail. The advancement of statistical methods and IT in the last several years has allowed for the incorporation of a wider variety of predictive methodologies, leading to the creation of a more accurate model for bankruptcy prediction.

The MDA model with five factors was proposed.(2) Logit analysis, MDA, neural networks and probit analysis are the main methodologies that have been utilized to create models.(11) One of the famous and hopeful technologies, neural networks has been around since the 1990s, when academic interest in AI technology began to surge. Several seminal studies in the field of business failure prediction used this methodology.(5,20,28,55,58) In addition,(39) aimed to optimize a Neural Network model using an algorithm; the model achieved good convergence results, indicating good prediction capability.

Additionally, numerous authors in the area of bankruptcy prediction have embraced a variety of ML and Artificial Intelligence (AI) techniques. These include rough sets, CBR, SVM, and others. Rough set theory has found extensive application in diverse financial decision analysis problems. It was initially developed to address the challenge of distinguishing between objects that appear indiscernible within a set. Reported bankruptcy accuracy has been found to range from 76 % to 88 %. Case-based thinking has become an important tool for predicting when a business will fail. It is highly effective and easily understandable, making it a popular choice for solving real-world problems. This approach offers competitive edge over modern methods and is known for its simplicity and ease of pattern maintenance.(30) The SVM, which originated from the field of statistical learning theory, was first utilized in corporate failure prediction in 2005. Studies conducted(50, 34) demonstrated that it outperformed artificial neural networks in terms of performance.(26)

Since the year 2000, there has been a proliferation of publications discussing how to forecast when a company would fail, and some writers have even provided insight into how to compare and contrast various models for this purpose. In contrast to the two accounting-based models—the Z-score(2) and the O-score(36) — the authors of the market-based model(21) demonstrate that their model, which is derived from the Black-Scholes-Merton model, can provide substantially more information. Balcaen(7) examined classic statistical methods employed over the last 35 years to learn about their characteristics and associated issues.

METHODOLOGY

To start, we used the bibliographic database Scopus to conduct a systematic literature review (SLR) that aimed to find the most important papers published in English between 1968 and 2022. It is the main objective to “find all relevant individual studies, thereby making the available evidence more accessible to decision-makers.”.(16)

A crucial component of any academic work is the systematic literature review methodology. The objective is to address the issue by uncovering pertinent and reliable individual studies and combining their findings. This approach assists researchers in obtaining a deeper understanding of their subject matter.(57) The SLR offers numerous advantages, including the provision of reliable information, facilitated by its promotion of methodological transparency and support for future replication. Scopus offers a wide range of abstracts and citations from scientific journals, books, and conference proceedings, giving a comprehensive view of research from around the world.(19) Additionally, to analyze the connections between authors in articles related to bankruptcy prediction, we utilized VOS Viewer to identify key concepts and conduct a visually captivating network analysis. This will provide a clear visualization of the existing relationships.

Finding relevant keywords and selecting articles for analysis

To address the research questions, a set of twelve specific terms, consisting of six primary and six secondary keywords, were utilized in 36 unique combinations. These combinations were employed to search for scholarly articles from around the globe that were pertinent to the subject matter. The information regarding the design of the keyword combination is displayed in table 1.

|

Table 1. No. of articles based on primary & secondary keyword searches |

||||||

|

Primary Key Word(s) |

No of articles – Secondary keyword(s) |

|||||

|

Model |

Prediction |

Forecast |

Indicator |

Ratio |

Score |

|

|

Bankruptcy |

179 |

195 |

7 |

7 |

57 |

30 |

|

Default firm |

11 |

5 |

0 |

0 |

1 |

2 |

|

Early warning |

131 |

38 |

3 |

62 |

2 |

1 |

|

Failure prediction |

82 |

197 |

17 |

2 |

22 |

5 |

|

Financial distress |

90 |

67 |

4 |

7 |

30 |

10 |

|

Insolvency |

30 |

17 |

2 |

2 |

10 |

8 |

|

Total |

523 |

519 |

33 |

80 |

122 |

56 |

RESULTS

Evolution of Published Papers

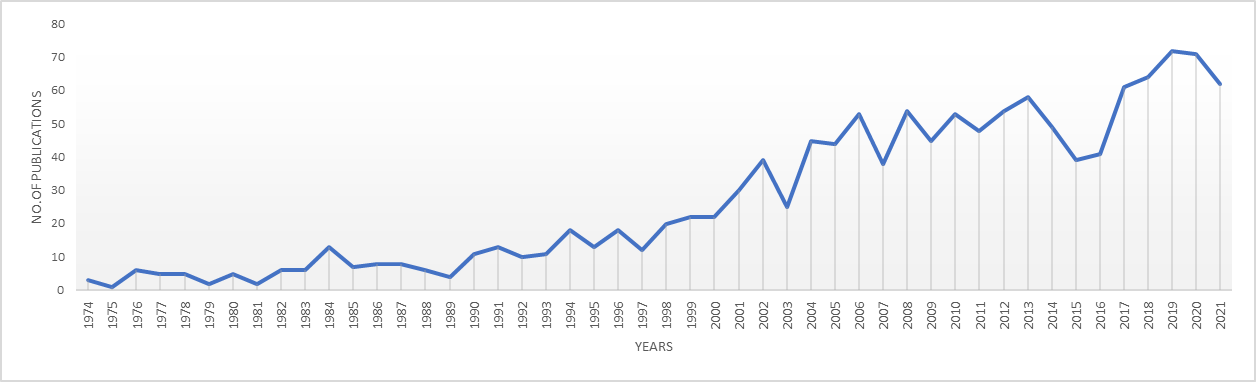

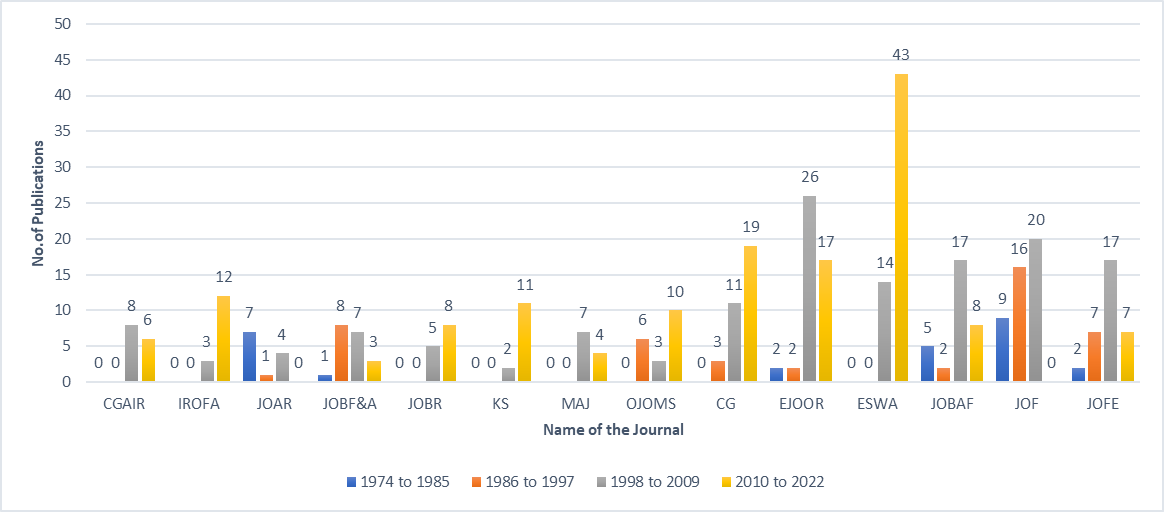

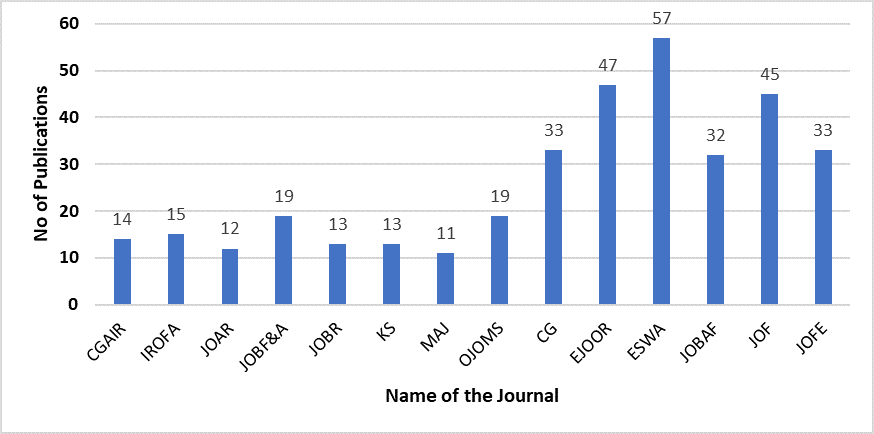

Bankruptcy prediction is a crucial area of research in corporate finance and financial analysis. Understanding the dynamics and patterns of bankruptcy prediction models over time is essential for both academia and industry practitioners. In this analysis (table 2), we will examine the publication trends in prominent journals from 1974 to 2022, focusing on four distinct periods: 1974-1985, 1986-1997, 1998-2009, and 2010-2022. Journals with the major number of publications in shown in table 3. Year-wise publications for the last 48 years on bankruptcy prediction models in shown figure 1. No. of research paper publications in major journals in shown figutr 2. No. of research paper publications in major journals in shown figure 3.

|

Table 2. Showing the number of publications year-wise for the last 48 years |

|||||||

|

Years |

No. of Publications |

Years |

No. of Publications |

Years |

No. of Publications |

Years |

No. of Publications |

|

1974 |

3 |

1986 |

8 |

1998 |

20 |

2010 |

53 |

|

1975 |

1 |

1987 |

8 |

1999 |

22 |

2011 |

48 |

|

1976 |

6 |

1988 |

6 |

2000 |

22 |

2012 |

54 |

|

1977 |

5 |

1989 |

4 |

2001 |

30 |

2013 |

58 |

|

1978 |

5 |

1990 |

11 |

2002 |

39 |

2014 |

49 |

|

1979 |

2 |

1991 |

13 |

2003 |

25 |

2015 |

39 |

|

1980 |

5 |

1992 |

10 |

2004 |

45 |

2016 |

41 |

|

1981 |

2 |

1993 |

11 |

2005 |

44 |

2017 |

61 |

|

1982 |

6 |

1994 |

18 |

2006 |

53 |

2018 |

64 |

|

1983 |

6 |

1995 |

13 |

2007 |

38 |

2019 |

72 |

|

1984 |

13 |

1996 |

18 |

2008 |

54 |

2020 |

71 |

|

1985 |

7 |

1997 |

12 |

2009 |

45 |

2021 |

62 |

Figure 1. Year-wise publications for the last 48 years on bankruptcy prediction models

|

Table 3. Journals with the major number of publications |

|||||

|

Name of the Journal |

No of Publications |

1974 to 1985 |

1986 to 1997 |

1998 to 2009 |

2010 to 2022 |

|

Corporate Governance: An International Review - (CGAIR) |

14 |

0 |

0 |

8 |

6 |

|

International Review of Financial Analysis - (IROFA) |

15 |

0 |

0 |

3 |

12 |

|

Journal of Accounting Research - (JOAR) |

12 |

7 |

1 |

4 |

0 |

|

Journal of Business Finance & Accounting - (JOBF&A) |

19 |

1 |

8 |

7 |

3 |

|

Journal of Business Research - (JOBR) |

13 |

0 |

0 |

5 |

8 |

|

Knowledge-Based Systems - (KS) |

13 |

0 |

0 |

2 |

11 |

|

Managerial Auditing Journal - (MAJ) |

11 |

0 |

0 |

7 |

4 |

|

Omega-international Journal of Management Science - (OJOMS) |

19 |

0 |

6 |

3 |

10 |

|

Corporate Governance - (CG) |

33 |

0 |

3 |

11 |

19 |

|

European Journal of Operational Research - (EJOOR) |

47 |

2 |

2 |

26 |

17 |

|

Expert Systems With Applications - (ESWA) |

57 |

0 |

0 |

14 |

43 |

|

Journal of Banking and Finance - (JOBAF) |

32 |

5 |

2 |

17 |

8 |

|

Journal of Finance - (JOF) |

45 |

9 |

16 |

20 |

0 |

|

Journal of Financial Economics - (JOFE) |

33 |

2 |

7 |

17 |

7 |

Figure 2. No. of research paper publications in major journals (Year wise)

Figure 3. No. of research paper publications in major journals (Total)

Interpretation

Evolution of Research Focus

The data indicates a significant increase in publications related to bankruptcy prediction models over the years, with a notable surge observed from 1998-2009 onwards. Journal of Finance and Expert Systems With Applications have consistently maintained a strong presence in publishing research on bankruptcy prediction models, indicating sustained interest in the topic.

Shift in Academic Interest

The decline in publications during the 1986-1997 period compared to the previous decade might suggest a shift in academic interest towards other financial research areas. However, the substantial increase in publications from 1998-2009 and 2010-2022 indicates a resurgence of interest in bankruptcy prediction models, possibly driven by global financial crises and regulatory changes.

Emergence of New Journals

The emergence of journals like European Journal of Operational Research and Corporate Governance: An International Review as significant contributors in the late 1990s and early 2000s reflects the interdisciplinary nature of bankruptcy prediction research, incorporating aspects of governance and operational analysis.

Implications for Practice

The rising amount of studies in this field indicates that people are starting to realize how important it is for businesses to have reliable models to anticipate when they will go bankrupt so that they may better manage risk, comply with regulations, and make important decisions. Practitioners can benefit from staying updated with research published in leading journals to leverage the latest methodologies and insights for enhancing their bankruptcy prediction frameworks.

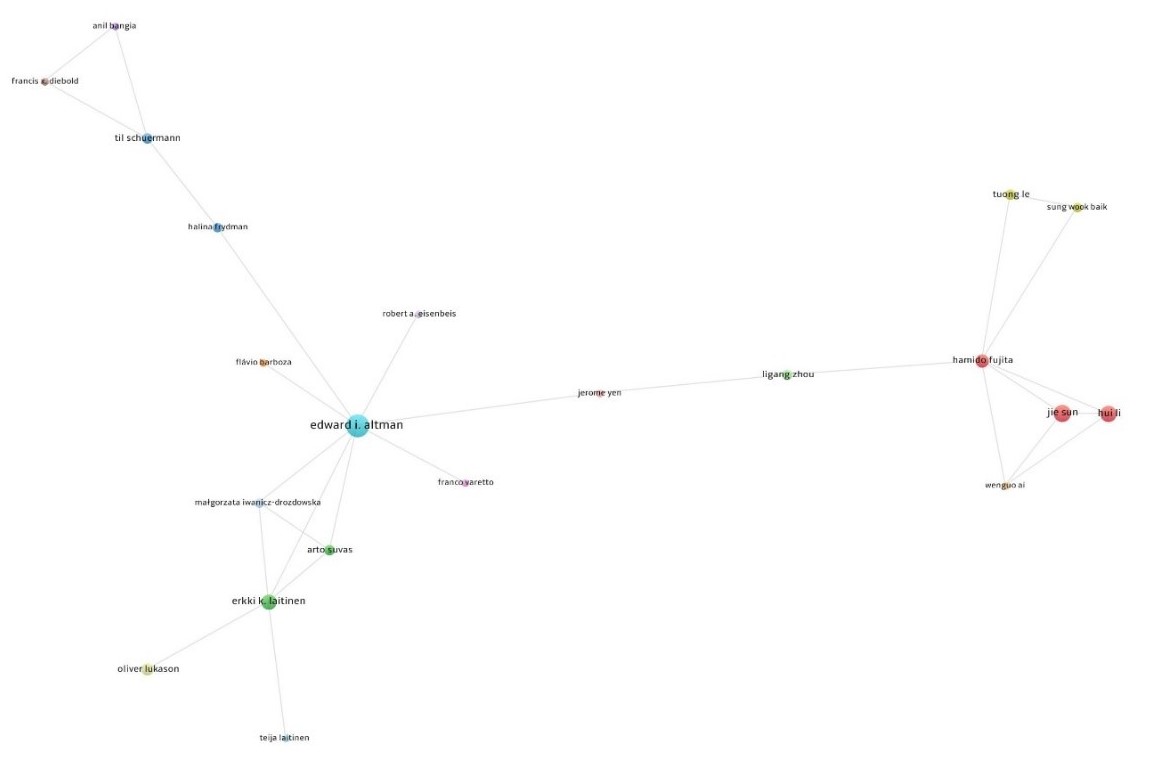

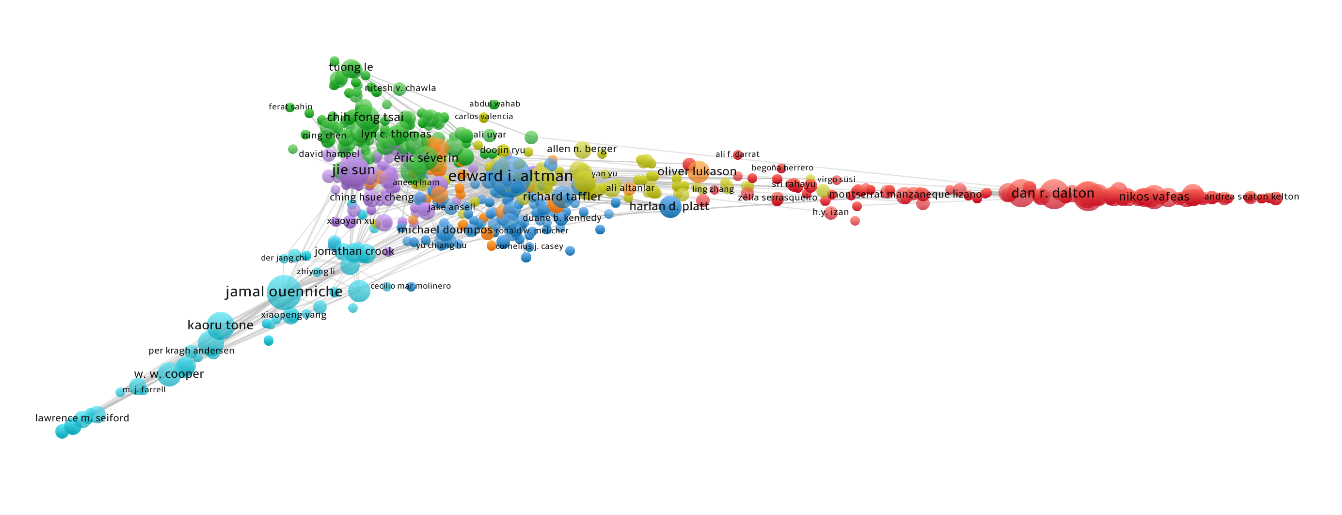

Relationship among Authors (Co-authorship)

Using VOS Viewer, an analysis tool that specializes in interactive social network visualization, a co-authorship has been developed to show that the many authors of the selected articles in the SLR collaborated. Co-authorship network visualization in shown figure 4. Citations network visualization in shown figure 5.

Figure 4. Co-authorship network visualization

Figure 5. Citations network visualization

Bankruptcy prediction models applied in India

In the late 1960s(10,2,36) and others advanced bankruptcy prediction models. Altman(5) Financial distress or bankruptcy prediction usually uses a two-stage process. Initially, the first stage involves identifying the most effective financial ratio predictors. Subsequently, in the second stage, suitable statistical methods are developed to enhance estimators for improved prediction accuracy. Many bankruptcy prediction models exist, including univariate, multivariate, discriminant, decision tree, and logistic regression. In a univariate model of 30 financial ratios(10) found that net income to total assets ratio and working capital funds flow to total assets ratio are the best predictors of bankruptcy. Beaver made four assumptions about distressed enterprises. Altman(2) established the multiple discriminant approach and the bankruptcy measuring score (z-score). Altman’s approach used profitability variables to predict bankruptcy risk, classifying firms 90 % of the time. Altman’s approach assumes sample data normality, which can lead to incorrect predictions if a variable is non-normal.(45) Three logit models were used to forecast company failure at different time intervals.(36) Despite mixed findings, the Logit model demonstrated advantages over discriminant analysis, providing a probability of bankruptcy. In the 1980s and 1990s, logit analysis was compared to neural networks and became popular. Altman(5) found Logit and neural network techniques equivalent and useful for distress classification and prediction. Recent studies have explored innovative methodologies, such as duration models incorporating macroeconomic dependencies(35), and Partial Least Squares with Support Vector Machine (PLS-SVM) for corporate distress.(60,8) compared discriminant, neural network, and logistic models for listed Indian firms, finding neural networks to be the most accurate. Concurrently, bankruptcy reforms are underway globally, including in India, to enhance transparency and efficiency in bankruptcy procedures. A recent study used financial parameters to forecast Indian corporate distress from 2006 to 2015. The study applies both logistic and Bayesian techniques, revealing superior predictive performance and sharper model estimates with Bayesian logistic modelling compared to traditional logistic regression.(52) Shows summarised review of bankruptcy prediction research in india in shown table 4.

|

Table 4. Shows summarised review of bankruptcy prediction research in india |

||||

|

Author(s) |

Summarized Introduction |

Methods Used |

Limitations |

Results |

|

Shrivastava(52) |

Bayesian Logistic model predicts Indian corporate hardship. Uses Capital IQ panel dataset for distress prediction. Bayesian vs. Logistic prediction models. |

Predicting distress with Bayesian and logistic models. Adding firm-specific parameters to detect early distress. Financial ratio testing for Indian conditions. Logistic and Bayesian logistic model theory. |

Low distressed entity proportion lowers modeling robustness. Limited bankruptcy data for Indian corporations. |

Bayesian model predicts distressed Indian enterprises better than Logistic. Bayesian framework requires prior distributions and convergence checks. |

|

Shrivastav(51) |

Research focuses on Indian bank bankruptcy prediction and stress quantification. |

Relief feature selection algorithm. SVM with linear and radial basis function kernels. |

Failure data on Indian banks is scarce compared to surviving banks. Replicating the model may provide distinct SVM forms and confounding interpretations. |

SVM with linear kernel: 94. 44 % predictive accuracy, 75 sensitivity, 100 specificity. SVM with radial basis function kernel: 71. 43 % forecasting accuracy. |

|

Shetty(46) |

Investigated non-financial parameters of Indian company financial trouble prediction. Examined board independence and ownership structure in financial distress prediction. |

We created binary logistic regression models M1 and M2. The cut-off point was estimated using the Liu technique. |

The circumstances did not specify restrictions. |

The addition of non-financial factors enhanced financial distress prediction model efficacy, with Model 1 outperforming Model 2 in AUC and sensitivity. A model containing both financial and non-financial indicators is recommended for prediction. |

|

Shetty(48) |

The paper analyzes IT/ITES bankruptcy using a modified DEA model. Focus on company bankruptcy early warning systems. Introduces bankruptcy to find underperforming DMUs. |

A changed directional distance DEA Statistical methods, neural networks, CBR, decision trees |

Traditional bankruptcy prediction models are not compared in the study. No discussion of generalizing the bankruptcy assessment approach. |

Bankruptcy scores predict firm bankruptcy. The most likely to fail is Logix Microsystems.HP Globalsoft Ltd. is least likely to fail. |

|

Charalambakis(14) |

Compares UK and Indian accounting and market data to predict insolvency. Tests models’ ability to predict non-US financial problems. Examines UK financial hardship prediction models. |

Book leverage and equity market variables hazard modelIn-sample and out-of-sample static and dynamic logit models to forecast. Estimating bankruptcy risk using accounting ratios and market data. Stock volatility, EDF use, relative size, and excess returns. |

Indian market data fails to anticipate insolvency. Profitability and leverage accounting variables are definition-sensitive. |

Risk model with book leverage and equity market variables forecasts best in the UK. India: Profitability-FRISK model accurately predicts financial crisis. Indian market data fails to anticipate insolvency. |

|

Bapat(8) |

The paper evaluates Indian company bankruptcy prediction models utilizing financial ratios. MDA, logistic regression, and neural network models. Among models, neural network classifies best. |

MDA, Logistic regression, Neural network |

There is no comprehensive corporate bankruptcy policy in India. Exclude financial institutions, delisted corporations, and incomplete data. |

A neural network beat logistic regression and discriminant analysis. Before bankruptcy, descriptive data compared bankrupt and non-bankrupt enterprises. The pre-bankruptcy classification accuracy dropped from 70,45 % to 61,36. |

|

Balasubramanian(6) |

Predicting Indian listed company financial trouble using financial and non-financial characteristics. Combining financial and non-financial parameters improves prediction. |

Financial and non-financial conditional logit regression. Comparing logistic regression classifiers with and without non-financial variables. |

Short sample size and duration. Limited prediction to one year ahead. Not addressing macroeconomic factors like GDP growth. |

The accuracy of financial variable models was 85,19 and 86,11. The accuracy of financial and non-financial models was 89,81 % and 91,67 %. Net asset value, long-term debt-equity ratio, and ROI are key determinants. |

Reserve Bank of India (RBI) observed that Indian banks for over a decade, exhibited robust capitalization and regulation, integral to daily economic activities. Given the sector’s interconnectedness and the potential for major failures to pose operational and financial risks, the RBI has implemented measures like Prompt Corrective Action (PCA) and capital infusion, exemplified by the Rs. 2,11 trillion recapitalization package for public sector banks in October 2017. Given the historical context, such as the 2007–2008 financial crisis, the RBI’s proactive stance underscores the imperative of close supervision and preemptive strategies. Bankruptcy prediction assumes critical importance in this context, necessitating the development of precise and efficient models to measure financial distress. While traditional techniques like finance and accounting ratios have been utilized, they are limited in methodology. A significant body of literature, including works(2, 32) explores bankruptcy prediction using statistical methods and, more recently, machine learning techniques.(44) This work introduces a new approach to stress quantification and bankruptcy prediction using SVM with the right kernels for Indian banks. Notably, the study employs the Relief Algorithm for feature selection, a nonparametric approach distinct from previous parametric methods. Furthermore, the SVM model is fine-tuned using 5-fold cross-validation, enhancing generalization by establishing an optimal cut-off level. The study introduces a geometric analysis of the SVM technique, facilitating stress quantification and regulatory oversight. Organized into sections encompassing introduction, literature review, methodology, empirical results, conclusions, and limitations, the study emphasizes the importance of early warning systems for stakeholders. Utilizing SVM, the study employs a two-step feature selection process and achieves promising predictive accuracies, with SVMLK outperforming SVMRK. Notably, SVMLK identifies key features such as Provision for Loan Interest Income (Tire -1) and Tier -1 CAR(t-1). Also, a new stress quantification method is presented in the study, which allows us to compare the financial health of different banks and gives us a geometric interpretation of the decision boundary, so we can see what modifications are needed to keep banks from failure. These findings furnish actionable insights for bank management to preempt potential failures and safeguard financial stability.(51)

Corporate bankruptcy is a major economic risk. To avoid losses, governments, investors, and shareholders use bankruptcy analysis to make financial decisions. While DEA is normally used to examine the efficiency of decision-making units (DMUs), this study tweaks the directional distance formula to evaluate the risk of bankruptcy. On a scale from 0 to 1, the offered method has the lowest relative efficiency of any comprehensive non-oriented, non-radial directional distance model. Diverging from conventional DEA approaches that identify the best relative efficiencies, our model identifies underperforming DMUs and delineates an inefficiency frontier. This economic theory-based bankruptcy assessment model uses the worst relative efficiency measures and pessimistic performance ratings. In India’s IT and IT-enabled services (ITES) sector, Hewlett-Packard Globalsoft Ltd. is least likely to fail, while Logix Microsystems is most likely. The paper provides a precise bankruptcy measure as an early warning system and emphasizes the need to identify failing enterprises. The analysis uses 1998–2006 three-year moving averages for robustness and consistency. The worst-performing enterprises may not go bankrupt, but their financial vulnerability requires performance improvements. The report admits drawbacks like missing data, which may exclude some firms. For future study, we suggest using time-series data for a wider range of enterprises to track bankruptcy frontier changes, maybe through Malmquist productivity index changes. This study introduces a bankruptcy prediction model that combines statistical and artificial intelligence methodologies to help stakeholders analyze and mitigate bankruptcy risk.(46)

Scholars are increasingly using DEA operational research to assess organizations’ bankruptcy risks. DEA does not assume the functional form of interactions between various input and output variables, unlike traditional approaches. Many technologies have been developed to warn creditors of enterprises at risk of bankruptcy or failure. Financial ratios and MDA were first used to predict bankruptcy.(2) The discriminant analysis assumes linearity, multivariate normality, and predictive variable independence, which many financial ratios lack. Hazard models have been used to assess bankruptcy risk to overcome these constraints.(53) Shumway’s model outperformed Altman’s in prediction.(13) Used a variable returns to scale (VRS) DEA model to assess the financial stability of US Department of Defense civil sector air fleet participation. The VRS DEA model has constraints such as reduced translation invariance.(40) For out-of-sample bankruptcy predictions,(41) suggested an additive DEA model that outperformed logistic regression. This paper recommends modifying(47) the directional distance formulation of DEA for bankruptcy prediction. Our methodology identifies underperforming DMUs and establishes an inefficiency frontier by measuring the worst relative efficiency from zero to one, unlike previous DEA methods. This approach follows economic theory and introduces a precise bankruptcy measure for early warning. As a case study, we apply this paradigm to Indian IT and IT-enabled services organizations. Our study evaluates bankruptcy prediction models in the UK and India, adding to the literature. Consistent with earlier findings, a model combining book leverage and market-based characteristics predicts UK businesses well. A model using only market variables outperforms multivariate models with multiple predictors. Compared to other models, the hazard model with market-related factors identifies more insolvent enterprises with reduced misclassification rates in-sample and out-of-sample. Furthermore, we find that models based on market-based variables perform better than those relying solely on accounting ratios or combining different predictors. This shows the importance of market data in bankruptcy prediction models, especially amid economic volatility. As the Indian economy continues to grow, such predictive models play a crucial role in assessing and mitigating bankruptcy risks for firms operating in dynamic economic environments.(48)

Researchers are using the operational research method DEA to analyze corporate bankruptcy risk.(49) DEA does not assume the functional form that characterizes the interactions between many input and output variables, unlike traditional approaches. As said, numerous systems have been created to alert creditors of enterprises at risk of bankruptcy or failure. Financial ratios and MDA were used in a study(2) to forecast insolvency. Many financial ratios, however, do not adhere to the strong constraints of linearity, multivariate normality, and predictive variable independence that are imposed by discriminant analysis. Using data collected from UK enterprises between 1996 and 2005, a basic hazard model was used to evaluate the likelihood of bankruptcy.(56) The outcome of the hazard model comparison with the z-score model demonstrated that Shumway’s model outperformed Altman’s bankruptcy prediction models in terms of predictive capability. Using financial ratios from 1988 to 1997 and a variable returns to scale (VRS) DEA model,(13) assessed the robustness of the US Department of Defense’s civil service air fleet. Bowlin solved the problem of negative financial ratio values by taking their absolute values and turning them into positive ones. The VRS DEA model shows limited translation invariance, as shown(40), leading to efficiency scores that are data transformation dependent. Using an additive DEA model, DEA was employed(41) as a substitute approach to bankruptcy measurement. When it came to making predictions outside of the sample, the DEA model was much more effective than the logistic regression (LR) method. Here, we offer an improvement to the efficiency metric of the directional distance DEA formulation for bankruptcy prediction that was previously proposed.(47)

Our methodology finds the weakest decision-making units (DMUs), quantifies their worst relative efficiency from 0 to 1, and establishes an inefficient frontier. This methodology differs from conventional DEA methods that find optimal relative efficiencies. This bankruptcy evaluation method follows economic theory and provides a complete and accurate bankruptcy metric that may serve as a warning system. Indian IT and ITES companies are used to apply our technique to the IT industry. Bankruptcy prediction models have a lot of data on US firms’ financial difficulties, but not on their performance outside the US, notably in terms of new predictors and model performance. We assess these models’ ability to predict financial problems for UK and Indian enterprises, two more developed economies. Their results demonstrate that, similar to Shumway’s findings for the US, a model that includes book leverage and three market-based variables produces better predictions for UK firms. Multivariate models that include more than three predictors also perform worse than those that rely on the three market variables alone. Neither the Z-score nor EDF showed any enhanced predictive capability following the inclusion of variables to our top model. The hazard model’s out-of-sample and in-sample forecasting ability is enhanced by book leverage and the three market components. With the least amount of misclassification, it correctly tally the most bankrupt enterprises. Finally, models that include market capitalization, stock return volatility, and excess returns outperform those that employ Z-score, EDF, or both.(14)

GDP rose from 4,8 % in 2005–06 to 7 % in 2007-08. By 2009, seven Indian companies had amassed $60 billion in outsourced revenues, placing them among the top 15 technology outsourcing corporations. Indian software and service company Nasscom predicted US$225 billion by 2020. IT, ITES, and BPO are India’s fastest-growing commercial services, accounting for one-third of overall services output. Due to increased specialization and a big pool of highly qualified yet cost-effective human resources, the IT sector has grown rapidly to meet global customers’ demand for India’s service exports. Strong export revenue, a developing domestic market, and industrial expansion have all contributed to India’s IT industry’s recent success, positioning the country to become an IT powerhouse on a worldwide scale. The burgeoning IT prowess of India has spurred a surge in entrepreneurial ventures establishing IT companies within the country. The impending danger of company bankruptcy has been highlighted as one of the most serious threats to a national economy due to the global economic slump that has affected almost every country, including India. The study of corporate bankruptcies has gained paramount importance, given that the failure of numerous companies can engender economic and social ramifications for society at large. The IT companies that are most and least likely to go bankrupt are categorized in this study using the directional distance formulation of the DEA technique. This study develops and compares Neural network, MDA and LR bankruptcy prediction models for listed Indian companies. From 1991 to 2013, the dataset contains 72 matched pairs of businesses that went bankrupt and those that continued to be in business. Neural networks have 77,27 %, 63,64 %, and 65,91 % accuracy one, two, and three years before bankruptcy; logistic regression has 75,00 %, 59,09 %, and 61,36 %; and MDA has 70,45 %, 61,36 %, and 61,36 %. MDA and LR predict bankruptcy less accurately than neural networks for all three years prior. Given its comparative advantage, neural network modeling should be given more attention in professional circles to improve bankruptcy prediction for Indian enterprises. Future research endeavours could enhance this study by incorporating non-financial variables, as previous literature suggests their significant contribution to improving the prediction accuracies of bankruptcy models. Additionally, extending the scope beyond listed Indian companies to include relatively smaller private firms in India could further enrich the understanding of bankruptcy dynamics in the Indian context. One of the most investigated issues in finance and strategic management is bankruptcy prediction. The early 1930s and 1940s studies compared bankrupt and non-bankrupt firms’ financial ratios, showing bankrupt firms had lower ratios. Subsequently, MDA emerged as the primary method in the 1970s, followed by a shift towards logistic regression analysis in the 1980s. Recent years have witnessed a mounting interest in using neural network approaches, yielding promising results in bankruptcy prediction. This study uses MDA, LR, and neural network methods to create bankruptcy prediction models for Indian listed companies to help investors, managers, bankers, lenders, auditors, and finance professionals make decisions.(8)

CONCLUSION

Bankruptcy prediction models have evolved significantly since the late 1960s, with seminal contributions from researchers like(2,10,36) among others. These models typically employ a two-stage methodology, initially identifying effective financial ratio predictors and subsequently developing statistical methods for enhanced prediction accuracy. Bankruptcy prediction uses univariate models, multivariate models, discriminant analysis, decision trees, LR, and other methods. Beaver(10) proposed a 30-financial-ratio univariate model, while(2) introduced the multiple discriminant methodology, presenting Altman’s z-score. Ohlson(36) introduced the logit model in bankruptcy prediction, demonstrating advantages over discriminant analysis. Subsequent studies explored innovative methodologies, such as duration models and PLS-SVM, for corporate distress prediction. In the Indian context(8) for Indian listed enterprises, neural networks were the most accurate among discriminant, logistic, and neural networks. According to new research on early warning signs and distress prediction in India’s corporate sector, Bayesian approaches are more effective than logistic regression. Given the importance of the banking sector in India and the potential systemic risks posed by major failures, the Reserve Bank of India (RBI) has implemented measures like capital infusion and Prompt Corrective Action (PCA) to ensure stability. This underscores the importance of precise bankruptcy prediction models for financial institutions. A recent study proposed an innovative bankruptcy predictive model tailored for Indian banks, employing a support vector machine (SVM) with appropriate kernels. This study employed the Relief Algorithm for feature selection and 5-fold cross-validation to enhance model accuracy and generalization. The study introduced a novel stress quantification technique, providing actionable insights for bank management to preempt potential failures. Another study used DEA’s directional distance formulation to assess bankruptcy risk, creating a comprehensive early warning system. The study used this methodology to identify Indian IT and IT-enabled services enterprises at danger of failure and stressed proactive action. Research has shown that neural networks can forecast Indian company insolvency better than MDA and logistic regression.

Future research

Future research could enhance these models by incorporating non-financial variables and extending the scope to include smaller private firms in India. Bankruptcy prediction models play a crucial role in assessing and mitigating bankruptcy risks, particularly in dynamic economic environments like India. Continued research and innovation in this area are essential for the financial stability and resilience of Indian companies and institutions.

REFERENCES

1. Agarwal V, Taffler R. Comparing the performance of market-based and accounting-based bankruptcy prediction models. Journal of banking & finance. 2008 Aug 1; 32(8): 1541-1551. https://doi.org/10.1016/j.jbankfin.2007.07.014

2. Altman EI. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The journal of finance. 1968 Sep 1; 23(4): 589-609. http://doi.org/10.1111/j.1540-6261.1968.tb00843.x

3. Stojanovic L, Figun L, Trivan, J. Risk Management on Medjedja Dam on Tailing Storage Facility, Omarska Mine Prijedor. Arhiv za tehničke nauke. 2020; 1(22): 11–20. https://doi.org/10.7251/afts.2020.1222.011S

4. Altman EI, Haldeman RG, Narayanan P. ZETATM analysis A new model to identify bankruptcy risk of corporations. Journal of banking & finance. 1977 Jun 1; 1(1): 29-54. https://doi.org/10.1016/0378-4266(77)90017-6

5. Altman EI, Marco G, Varetto F. Corporate distress diagnosis: Comparisons using linear discriminant analysis and neural networks (the Italian experience). Journal of banking & finance. 1994 May 1; 18(3): 505-529. https://doi.org/10.1016/0378-4266(94)90007-8

6. Balasubramanian SA, GS R, PS, Natarajan T. Modeling corporate financial distress using financial and non-financial variables: The case of Indian listed companies. International Journal of Law and Management. 2019 Oct 23; 61(3/4): 457-484. https://doi.org/10.1108/IJLMA-04-2018-0078

7. Balcaen S, Ooghe H. 35 years of studies on business failure: an overview of the classic statistical methodologies and their related problems. The British Accounting Review. 2006 Mar 1; 38(1): 63-93. https://doi.org/10.1016/j.bar.2005.09.001

8. Bapat V, Nagale A. Comparison of bankruptcy prediction models: Evidence from India. Accounting and Finance Research. 2014; 3(4): 91-98. https://doi.org/10.5430/afr.v3n4p91

9. Bauer J, Agarwal V. Are hazard models superior to traditional bankruptcy prediction approaches? A comprehensive test. Journal of Banking & Finance. 2014 Mar 1; 40: 432-442. https://doi.org/10.1016/j.jbankfin.2013.12.013

10. Beaver WH. Financial ratios as predictors of failure. Journal of accounting research. 1966 Jan 1: 71-111. https://doi.org/10.2307/2490171

11. Bellovary JL, Giacomino DE, Akers MD. A review of bankruptcy prediction studies: 1930 to present. Journal of Financial Education. 2007 Dec 1: 1-42.

12. Bharath ST, Shumway T. Forecasting default with the Merton distance to default model. The Review of Financial Studies. 2008 May 1; 21(3): 1339-1369. https://doi.org/10.1093/rfs/hhn044

13. Bowlin WF. Financial analysis of civil reserve air fleet participants using data envelopment analysis. European Journal of Operational Research. 2004 May 1; 154(3): 691-709. https://doi.org/10.1016/S0377-2217(02)00814-7

14. Charalambakis EC, Garrett I. On the prediction of financial distress in developed and emerging markets: Does the choice of accounting and market information matter? A comparison of UK and Indian firms. Review of Quantitative Finance and Accounting. 2016 Jul; 47: 1-28. https://doi.org/10.1007/s11156-014-0492-y

15. Chava S, Jarrow RA. Bankruptcy prediction with industry effects. Review of finance. 2004 Jan 1; 8(4): 537-569. https://doi.org/10.2139/ssrn.287474

16. Dissemination CF. Systematic reviews: CRD’s guidance for undertaking reviews in healthcare. York: University of York NHS Centre for Reviews & Dissemination. 2009.

17. Ratih H, Ana A, Sulastri L, Thosporn S. Stock Market Trend Analysis and Machine Learning-based Predictive Evaluation. Journal of Wireless Mobile Networks, Ubiquitous Computing, and Dependable Applications. 2023; 14(3): 267-281.

18. Cultrera L, Brédart X. Bankruptcy prediction: the case of Belgian SMEs. Review of Accounting and Finance. 2016 Feb 8; 15(1): 101-119. https://doi.org/10.1108/raf-06-2014-0059

19. Elsevier. (2015). www.elsevier.com

20. Fletcher D, Goss E. Forecasting with neural networks: an application using bankruptcy data. Information & Management. 1993 Mar 1; 24(3): 159-167. https://doi.org/10.1016/0378-7206(93)90064-Z

21. Hillegeist SA, Keating EK, Cram DP, Lundstedt KG. Assessing the probability of bankruptcy. Review of accounting studies. 2004 Mar; 9: 5-34. https://doi.org/10.1023/B:RAST.0000013627.90884.b7

22. Hosaka T. Bankruptcy prediction using imaged financial ratios and convolutional neural networks. Expert systems with applications. 2019 Mar 1; 117: 287-299. https://doi.org/10.1016/j.eswa.2018.09.039

23. Jabeur SB. Bankruptcy prediction using partial least squares logistic regression. Journal of Retailing and Consumer Services. 2017 May 1; 36: 197-202. https://doi.org/10.1016/j.jretconser.2017.02.005

24. Johnsen T, Melicher RW. Predicting corporate bankruptcy and financial distress: Information value added by multinomial logit models. Journal of economics and business. 1994 Oct 1; 46(4): 269-286. https://doi.org/10.1016/0148-6195(94)90038-8

25. Jones S. Corporate bankruptcy prediction: a high dimensional analysis. Review of Accounting Studies. 2017 Sep; 22: 1366-1422. https://doi.org/10.1007/s11142-017-9407-1

26. Kim SY. Prediction of hotel bankruptcy using support vector machine, artificial neural network, logistic regression, and multivariate discriminant analysis. The Service Industries Journal. 2011 Feb 1; 31(3): 441-468. https://doi.org/10.1080/02642060802712848

27. Kumar PR, Ravi V. Bankruptcy prediction in banks and firms via statistical and intelligent techniques–A review. European journal of operational research. 2007 Jul 1; 180(1): 1-28. https://doi.org/10.1016/j.ejor.2006.08.043

28. Lee KC, Han I, Kwon Y. Hybrid neural network models for bankruptcy predictions. Decision Support Systems. 1996 Sep 1; 18(1): 63-72. https://doi.org/10.1016/0167-9236(96)00018-8

29. Liang D, Lu CC, Tsai CF, Shih GA. Financial ratios and corporate governance indicators in bankruptcy prediction: A comprehensive study. European journal of operational research. 2016 Jul 16; 252(2): 561-572. https://doi.org/10.1016/j.ejor.2016.01.012

30. Lin F, Yeh CC, Lee MY. The use of hybrid manifold learning and support vector machines in the prediction of business failure. Knowledge-Based Systems. 2011 Feb 1; 24(1): 95-101. https://doi.org/10.1016/j.knosys.2010.07.009

31. Mensah YM. An examination of the stationarity of multivariate bankruptcy prediction models: A methodological study. Journal of accounting research. 1984 Apr 1: 380-395. https://doi.org/10.2307/2490719

32. Meyer PA, Pifer HW. Prediction of bank failures. The journal of finance. 1970 Sep; 25(4): 853-868. https://doi.org/10.1111/j.1540-6261.1970.tb00558.x

33. Kalinin O, Gonchar V, Abliazova N, Filipishyna L, Onofriichuk O, Maltsev M. Enhancing Economic Security through Digital Transformation in Investment Processes: Theoretical Perspectives and Methodological Approaches Integrating Environmental Sustainability. Natural and Engineering Sciences. 2024 May 5; 9(1): 26-45. https://doi.org/10.28978/nesciences.1469858

34. Min JH, Lee YC. Bankruptcy prediction using support vector machine with optimal choice of kernel function parameters. Expert systems with applications. 2005 May 1; 28(4): 603-614. https://doi.org/10.1016/j.eswa.2004.12.008

35. Nam CW, Kim TS, Park NJ, Lee HK. Bankruptcy prediction using a discrete‐time duration model incorporating temporal and macroeconomic dependencies. Journal of Forecasting. 2008 Sep; 27(6): 493-506. https://doi.org/10.1002/for.985

36. Ohlson JA. Financial ratios and the probabilistic prediction of bankruptcy. Journal of accounting research. 1980 Apr 1: 109-131. https://doi.org/10.2307/2490395

37. Ouenniche J, Bouslah K, Perez-Gladish B, Xu B. A new VIKOR-based in-sample-out-of-sample classifier with application in bankruptcy prediction. Annals of Operations Research. 2021 Jan; 296: 495-512. https://doi.org/10.1007/s10479-019-03223-0

38. Ouenniche J, Pérez-Gladish B, Bouslah K. An out-of-sample framework for TOPSIS-based classifiers with application in bankruptcy prediction. Technological Forecasting and Social Change. 2018 Jun 1; 131: 111-116. https://doi.org/10.1016/j.techfore.2017.05.034

39. Pan WT. A new fruit fly optimization algorithm: taking the financial distress model as an example. Knowledge-Based Systems. 2012 Feb 1; 26: 69-74. https://doi.org/10.1016/j.knosys.2011.07.001

40. Pastor JT. Chapter 3 Translation invariance in data envelopment analysis: A generalization. Annals of operations research. 1996 Apr; 66: 91-102. https://doi.org/10.1007/BF02187295

41. Premachandra IM, Bhabra GS, Sueyoshi T. DEA as a tool for bankruptcy assessment: A comparative study with logistic regression technique. European Journal of Operational Research. 2009 Mar 1; 193(2): 412-424. https://doi.org/10.1016/j.ejor.2007.11.036

42. Premachandra IM, Chen Y, Watson J. DEA as a tool for predicting corporate failure and success: A case of bankruptcy assessment. Omega. 2011 Dec 1; 39(6): 620-626. https://doi.org/10.1016/j.omega.2011.01.002

43. Rashid A, Abbas Q. Predicting Bankruptcy in Pakistan. Theoretical & Applied Economics. 2011 Sep 1; 18(9): 103-128.

44. Kumar A, Joshi P, Bala A, Sudhakar Patil P, Jang Bahadur Saini DK, Joshi K. Smart Transaction through an ATM Machine using Face Recognition. Indian Journal of Information Sources and Services. 2023; 13(2): 7–13.

45. Sheppard JP. Strategy and bankruptcy: An exploration into organizational death. Journal of Management. 1994 Dec 1; 20(4): 795-833. https://doi.org/10.1016/0149-2063(94)90031-0

46. Shetty SH, Vincent TN. The role of board independence and ownership structure in improving the efficacy of corporate financial distress prediction model: evidence from India. Journal of Risk and Financial Management. 2021 Jul 19; 14(7): 333. https://doi.org/10.3390/jrfm14070333

47. Shetty U, Pakkala T. Generalized efficiency measurements of directional distance formulation of data envelopment analysis. Proceedings in the 57th session of ISI. 2009.

48. Shetty U, Pakkala TP, Mallikarjunappa T. A modified directional distance formulation of DEA to assess bankruptcy: An application to IT/ITES companies in India. Expert Systems with Applications. 2012 Feb 1; 39(2): 1988-1997. https://doi.org/10.1016/j.eswa.2011.08.043

49. Eckhart M, Brenner B, Ekelhart A, Weippl E. Quantitative security risk assessment for industrial control systems: Research opportunities and challenges. Journal of Internet Services and Information Security. 2019; 9(3): 52-73.

50. Shin KS, Lee TS, Kim HJ. An application of support vector machines in bankruptcy prediction model. Expert systems with applications. 2005 Jan 1; 28(1): 127-135. https://doi.org/10.1016/j.eswa.2004.08.009

51. Shrivastav SK, Ramudu PJ. Bankruptcy prediction and stress quantification using support vector machine: Evidence from Indian banks. Risks. 2020 May 22; 8(2): 52. https://www.mdpi.com/2227-9091/8/2/52

52. Shrivastava A, Kumar K, Kumar N. Business distress prediction using bayesian logistic model for Indian firms. Risks. 2018 Oct 9; 6(4): 113. https://doi.org/10.3390/risks6040113

53. Shumway T. Forecasting bankruptcy more accurately: A simple hazard model. The journal of business. 2001 Jan; 74(1): 101-124. https://doi.org/10.1086/209665

54. Taffler RJ. The assessment of company solvency and performance using a statistical model. Accounting and Business Research. 1983 Sep 1; 13(52): 295-308. https://doi.org/10.1080/00014788.1983.9729767

55. Tam KY, Kiang MY. Managerial applications of neural networks: the case of bank failure predictions. Management science. 1992 Jul; 38(7): 926-247. https://doi.org/10.1287/mnsc.38.7.926

56. Shumway T. Forecasting bankruptcy more accurately: A simple hazard model. The journal of business. 2001 Jan; 74(1): 101-124. https://doi.org/10.1086/209665

57. Webster J, Watson RT. Analyzing the past to prepare for the future: Writing a literature review. MIS quarterly. 2002 Jun 1. https://www.jstor.org/stable/4132319

58. Wilson RL, Sharda R. Bankruptcy prediction using neural networks. Decision support systems. 1994 Jun 1; 11(5): 545-557. https://doi.org/10.1016/0167-9236(94)90024-8

59. Wu Y, Gaunt C, Gray S. A comparison of alternative bankruptcy prediction models. Journal of Contemporary Accounting & Economics. 2010 Jun 1; 6(1): 34-45. https://doi.org/10.1016/j.jcae.2010.04.002

60. Yang Z, You W, Ji G. Using partial least squares and support vector machines for bankruptcy prediction. Expert Systems with Applications. 2011 Jul 1; 38(7): 8336-8342. https://doi.org/10.1016/j.eswa.2011.01.021

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: N Sathyanarayana, Raja Narayana.

Data curation: N Sathyanarayana, Raja Narayana.

Formal analysis: N Sathyanarayana, Raja Narayana.

Acquisition of funds: N. Sathyanarayana.

Research: N Sathyanarayana, Raja Narayana.

Methodology: N Sathyanarayana, Raja Narayana.

Project management: N Sathyanarayana, Raja Narayana.

Resources: N Sathyanarayana, Raja Narayana.

Software: N Sathyanarayana, Raja Narayana.

Supervision: Raja Narayana.

Validation: Raja Narayana.

Display: N Sathyanarayana, Raja Narayana.

Drafting - original draft: N Sathyanarayana.

Writing - proofreading and editing: Raja Narayana.