Category: Finance, Business, Management, Economics and Accounting

ORIGINAL

CEO characteristics and R&D expenditure of IPOs in China

Características de los CEO y gasto en I+D de las OPI en China

Haoshu Zhang1 ![]() *, Astri Yulia1

*, Astri Yulia1 ![]() *

*

1Faculty of Education and Social Sciences, Universiti Selangor, Malaysia (UNISEL), Jalan Timu Tambahan, 45600 Bestari Jaya, Selangor Darul Ehsan, Malaysia.

Cite as: Zhang H, Yulia A. CEO characteristics and R&D expenditure of IPOs in China. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:798. https://doi.org/10.56294/sctconf2024798

Submitted: 15-01-2024 Revised: 12-04-2024 Accepted: 10-07-2024 Published: 11-07-2024

Editor: Dr.

William Castillo-González ![]()

ABSTRACT

In the rapidly evolving landscape of Mainland China’s stock market, there is a substantial correlation between the research and development (R&D) spending of companies that are going through initial public offerings (IPOs) and the characteristics of the CEO. This study aims to investigate how CEO traits influence the allocation of resources towards R&D activities within the context of IPOs in Mainland China. The CEO plays a pivotal role in shaping the strategic direction and innovation agenda of companies, especially during the IPO process where firms seek to raise capital and expand their operations. Policymakers must comprehend the influence of CEO attributes on research and development spending, investors, and managers seeking to foster innovation and sustainable growth in Mainland Chinese firms. This research will focus on analyzing CEO traits such as educational background, prior experience, age, tenure, risk aversion, and management style, and their influence on the decision-making process regarding R&D investment. This study intends to determine significant links between R&D expenditure and characteristics of CEOs by looking at a sample of IPOs in the stock market of Mainland China. The analysis takes into account many factors like industry competition, market dynamics, regulatory environment, and firm-specific traits. Data on CEO traits, company finances, and R&D spending will be analysed using quantitative techniques like regression analysis and event research procedures. Furthermore, qualitative research techniques like case studies and interviews will offer deeper understandings of the contextual elements influencing the IPO market in Mainland China as well as the mechanisms underpinning these linkages. All things considered, this study will advance knowledge of how CEO traits affect R&D spending in the particular setting of initial public offerings (IPOs) on the stock market of Mainland China. The findings will offer valuable insights for policymakers, investors, and managers navigating the complexities of fostering innovation and sustainable growth in Mainland Chinese firms undergoing IPOs.

Keywords: CEO Traits; Research and Development (R&D); Initial Public Offerings (IPOs); Mainland China Stock Market.

RESUMEN

En el panorama en rápida evolución del mercado de valores de China continental, existe una correlación sustancial entre el gasto en investigación y desarrollo (I+D) de las empresas que salen a bolsa y las características del director general. El objetivo de este estudio es investigar cómo influyen los rasgos del director general en la asignación de recursos a actividades de I+D en el contexto de las OPI en China continental. El CEO desempeña un papel fundamental en la configuración de la dirección estratégica y la agenda de innovación de las empresas, especialmente durante el proceso de OPI en el que las empresas tratan de obtener capital y ampliar sus operaciones. Los responsables políticos deben comprender la influencia de los atributos del CEO en el gasto en investigación y desarrollo, los inversores y los directivos que buscan fomentar la innovación y el crecimiento sostenible en las empresas de China continental. Esta investigación se centrará en el análisis de los rasgos de los directores generales, como la formación académica, la experiencia previa, la edad, la permanencia en el cargo, la aversión al riesgo y el estilo de gestión, y su influencia en el proceso de toma de decisiones relativas a la inversión en I+D. Este estudio pretende determinar los vínculos significativos entre el gasto en I+D y las características de los directores generales analizando una muestra de OPI del mercado bursátil de China continental. El análisis tiene en cuenta muchos factores, como la competencia en el sector, la dinámica del mercado, el entorno normativo y los rasgos específicos de las empresas. Los datos sobre los rasgos de los directores generales, las finanzas de las empresas y el gasto en I+D se analizarán mediante técnicas cuantitativas como el análisis de regresión y los procedimientos de investigación de sucesos. Además, las técnicas de investigación cualitativa, como los estudios de casos y las entrevistas, ofrecerán una comprensión más profunda de los elementos contextuales que influyen en el mercado de las OPI en China continental, así como de los mecanismos que sustentan estos vínculos. En definitiva, este estudio permitirá avanzar en el conocimiento de cómo los rasgos de los directivos influyen en el gasto en I+D en el contexto particular de las ofertas públicas iniciales (OPI) en el mercado de valores de China continental. Los resultados aportarán valiosas ideas a los responsables políticos, los inversores y los directivos que se enfrentan a la complejidad de fomentar la innovación y el crecimiento sostenible en las empresas de China continental que salen a bolsa.

Palabras clave: Rasgos de los CEO; Investigación y Desarrollo (I+D); Ofertas Públicas Iniciales (OPI); Mercado de Valores de China Continental.

INTRODUCTION

In the dynamic landscape of Mainland China’s stock market, Initial Public Offerings (IPOs) represent significant milestones for companies seeking capital infusion and market expansion.(1) The decision-making processes and strategic directions adopted by CEOs during IPOs play a crucial role in shaping the future trajectory of these firms. The relationship between research and development (R&D) expenditure and CEO traits is a crucial topic of interest among the several elements determining the result of initial public offerings (IPOs).(2,3,4)

This paper explores the complex relationship between R&D spending and CEO characteristics in the context of initial public offerings (IPOs) in the stock market of Mainland China. By focusing on the unique characteristics and dynamics of the Chinese market, this research seeks to shed light on how CEO attributes influence firms’ R&D investment decisions during the IPO process.(5)

In recent years, Mainland China has emerged as a global hub for innovation and entrepreneurship, with an increasing number of companies seeking to leverage IPOs as a means to fuel their growth aspirations.(6) As these companies navigate the complexities of the IPO journey, understanding the role of CEO characteristics in driving R&D expenditure becomes paramount.

CEO traits such as educational background, prior industry experience, leadership style, risk appetite, and vision significantly impact firms’ strategic priorities and resource allocation decisions, particularly concerning R&D investment.(7) The extent to which CEOs prioritize innovation and technology development during the IPO process can have far-reaching implications for firms’ competitiveness, market positioning, and long-term sustainability.

Against the backdrop of Mainland China’s evolving regulatory environment, market dynamics, and industry competition, the purpose of this study is to provide light on the processes by which R&D spending in IPO companies is influenced by CEO attributes. By analyzing a comprehensive dataset of IPOs in Mainland China’s stock market, this research endeavors to uncover patterns, trends, and correlations between CEO traits and R&D investment levels.(8)

Methodologically, this study adopts a mixed-method approach combining quantitative analysis with qualitative insights. Regression models and event study methodologies will be utilized to examine the relationship between CEO characteristics and R&D expenditure, while interviews and case studies will offer nuanced perspectives on the underlying mechanisms driving these relationships.

Through clarifying the relationship between R&D spending and CEO traits in the context of mainland China IPOs, this study aims to offer insightful information to managers, investors, and policymakers who are navigating the opportunities and challenges of the ever-changing Chinese stock market.(9) Ultimately, a deeper understanding of these dynamics can contribute to informed decision-making, foster innovation-driven growth, and enhance the competitiveness of firms in Mainland China’s burgeoning IPO market.

Related work

In academic research, the relationship between R&D expenditure and CEO traits in the context of initial public offerings (IPOs) has received considerable attention, especially when considering the stock market in Mainland China. This section provides an overview of existing research in this domain, highlighting key findings, methodologies, and gaps in understanding.

CEO Qualities and Business Results

Previous studies have looked closely at how CEO traits affect business performance, with a focus on various dimensions such as leadership style, educational background, and prior experience. Research by (10) and (11) has shown that CEOs with more education and experience in a particular business typically have superior decision-making skills and strategic vision, leading to improved firm performance post-IPO. Moreover, the leadership style of CEOs, characterized by traits such as vision, charisma, and risk-taking propensity, has been shown to influence firms’ R&D investment strategies and subsequent market performance.(12)

CEO Salary and R&D Expenditure

The tenure of CEOs has been identified as a significant determinant of R&D expenditure in IPO firms. Research by (13) suggests that CEOs with longer tenures are more likely to prioritize long-term growth and innovation, leading to higher levels of R&D investment both pre and post-IPO. However, conflicting findings exist, with some studies indicating that shorter CEO tenures may incentivize CEOs to focus on short-term performance metrics at the expense of R&D spending.(14)

Institutional Environment and CEO Behavior

The institutional environment of Mainland China’s stock market, characterized by regulatory frameworks, market competition, and investor sentiment, also shapes CEO behavior and R&D investment decisions during IPOs. Studies by (15) and (16) emphasize the role of institutional factors in influencing CEOs’ risk appetite, information disclosure practices, and strategic orientation towards R&D. Additionally, the presence of venture capital and private equity investors in IPO firms has been shown to exert pressure on CEOs to allocate resources towards R&D activities that enhance firm valuation and market competitiveness.(17) In addition, qualitative research techniques such as case studies, interviews, and content analysis of company disclosures provide important insights into the fundamental processes that influence CEO behaviour and decision-making.(18)

In conclusion, even if earlier studies have made a substantial contribution to our comprehension of the connection between CEO traits and R&D spending in the context of mainland initial public offerings (IPOs), There are still a number of questions and areas that need to be investigated in China’s stock market.(19) Future research should examine the moderating influence of market conditions and industry dynamics, as well as the mediating effects of CEO traits on the relationship between institutional elements and R&D expenditure. Additionally, longitudinal analyses tracking CEO transitions and changes in R&D spending patterns over time could provide deeper insights into the dynamics of CEO behavior and its implications for firm performance in Mainland China’s evolving IPO landscape.(20,21)

METHOD

Samples and data

The annual cross-sectional mixed data of listed manufacturing firms from 2019 to 2023 that meet the following requirements serve as the research samples for this study. First, a total of 681 samples are obtained by screening listed companies that have disclosed their R&D investment in their annual reports from 2019 to 2023; second, given that the organisation usually plans and makes decisions prior to implementing a choice, the explanatory factors are one period behind, and firms that have been listed for less than a year are eliminated, leaving 597 samples; finally, ST companies’ samples and those with missing data for several variables are eliminated, yielding a final sample of 369 samples.

The costs of an organization’s internal R&D projects are included in the current period’s profit and loss in compliance with the Chinese Accounting Standards for Business Enterprises (CASBE). On the other hand, expenses incurred during the development phase are recorded in the account of “development expenditures” prior to their intended use and are recognised as an intangible asset thereafter.(22) Therefore, there are primarily two ways in which businesses disclose their R&D expenses. As a result, there are two primary ways that the company discloses its research and development expenses: first, through the balance sheet “development expenditures” item, which represents costs associated with developing intangible assets that can be capitalised; and second, through the disclosure of current year costs associated with research and development that will be expensed in the notes.

The CSMAR database provided the R&D expense data used in this study, with the exception of the manual collection of expensed expenses by reading the notes to the listed companies’ statements; the database also provided the CEO characteristics, including age, gender, education, and number of shares held; the official websites of listed companies, as well as the financial websites of the Financial Sector and Oriental Wealth Network, were checked for information on years of experience, expertise, a Expertise, political affiliation, and tenure data were manually gathered.

Research models

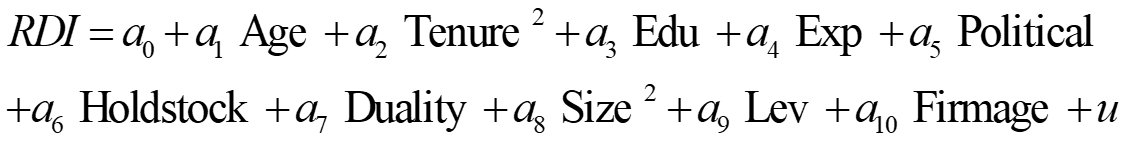

This study used the following regression model to investigate the association between R&D investment by businesses and CEO attributes:

We employ intensity (RDI), which is defined as the ratio of inputs to operating income, as an explanatory variable in this work. We take into account the CEO’s personal traits and the corporate governance framework as explanatory variables. The CEO’s age is represented by the first factor, Age, which is simply stated as actual age. Which is the square of the CEO’s years in office, is the second factor that indicates the CEO’s duration. The CEO’s education or experience is represented by another variable called Edu, which uses numerical values to indicate different educational levels: secondary school and lower is represented by 1, college by 2, bachelor’s degree by 3, master’s degree by 4, PhD by 5, and post-doctoral degree by 6. The CEO’s work history is represented by Exp, which has a value of 1 in the event that the CEO has experience in technology, sales, or research and development and 0 in all other cases. The political association variable takes on a value of 1 when a CEO has held or is currently holding a position as an official of a government agency, a deputy to the National People’s Congress (NPC), a member of the Standing Committee of the Chinese People’s Political Consultative Conference (CPPCC), etc. The CEO’s holdings in the company where they work are represented by Holdstock, which is selected directly from the database; Duality, which takes a value of 1 if the CEO is also the chairman of the board of directors and 0 otherwise, indicates whether or not the CEO holds this position.

We included firm size, firm capital structure, and years on the market as control variables based on previous research. Within this range, the intensity of inputs will increase with increasing firm size; however, when the firm size is too large, the substitution effect may occur, resulting in a decrease in inputs. Taking into account the distinct advantages of large and small firms in technological innovation, we assume that firm size has an inverse U-shape relationship with inputs. The capital structure (Lev) of the company shows how leveraged it is; our hypothesis is that the more indebted a company is, the less it will invest in R&D since creditors choose risk-averse and prudent investment strategies. Firm age is a reflection of the company’s past and present. Generally speaking, a longer time on the market indicates a firm’s propensity for cautious operations, which is counterproductive to higher R&D spending.

RESULTS

Correlation analysis and descriptive statistics

Descriptive input statistics

We start with Table 1’s descriptive data regarding the sample firms’ inputs. Table 1 shows that from 2019 to 2023, the sample firms’ average inputs increase gradually. After excluding the price rise component, the average yearly growth rate is greater than double digits. With an average RDI of 1,86 percent in 2019, 2,20 percent in 2022, and 2,55 % in 2023, the average input intensity (RDI) is also rising.

|

Table 1. Sample company inputs |

||||||

|

Year |

Total investment (10000 yuan) |

Number of companies |

Average investment amount (10000 yuan) |

Average investment growth |

Consumer Price Index for Residents |

Average RDI |

|

2019 |

532560 |

80 |

6640 |

18,56 % |

95,8 |

1,86 % |

|

2020 |

874571 |

100 |

7858 |

20,35 % |

102,5 |

2,20 % |

|

2021 |

1569842 |

180 |

8985 |

15,54 % |

106,4 |

2,55 % |

In collaboration with the Ministry of Finance, the Ministry of Science and Technology of China, and the National Bureau of Statistics, the “2023 National Science and Technology Investment Statistics Bulletin” discloses that 11 industries exhibit investment intensities (measured as a percentage of main business income) that surpass the average for industries above designated size. The manufacturing of instruments, metres, and machinery for office and cultural use ranks first, followed by the manufacturing of pharmaceuticals, computers, and other electronic equipment, and communication equipment. The sample businesses’ average R&D intensity in 2023 is significantly higher than the average of the country’s manufacturing sector.

|

Table 2. Variable descriptive statistics |

|||||

|

Variable |

Homodactyly |

Median |

Standard deviation |

Minimum value |

Maximum value |

|

RDI |

2,325 |

1,368 |

3,057 |

0,0001 |

20,589 |

|

Holdstock |

0,295 |

0 |

- |

0 |

0,568 |

|

Age |

46,857 |

46 |

5,968 |

31 |

70 |

|

Edu |

3,784 |

4 |

0,857 |

1 |

5 |

|

Exp |

0,714 |

1 |

0,465 |

0 |

1 |

|

Political |

0,154 |

0 |

0,356 |

0 |

1 |

|

Tenure |

4,458 |

2,897 |

6,596 |

0 |

20,658 |

|

Duality |

0,164 |

0 |

0,374 |

0 |

1 |

|

Size |

472,6 |

458,06 |

55,64 |

358,80 |

658,23 |

|

Lev |

0,421 |

0,461 |

0,215 |

0,015 |

0,898 |

|

Firmage |

9,184 |

9,987 |

5,564 |

0,878 |

19,421 |

The manufacturing industry in China has a relatively high intensity of research and development (R&D) investment compared to other industries, but experience in developed nations indicates that an enterprise can only become highly competitive when its R&D spend accounts for more than 5 % of its sales revenue; a business with 1 % of its revenue can barely survive. By this criterion, the sample companies’ R&D expenditures are modest and sufficient to ensure their basic survival. This demonstrates how far behind industrialised nations worldwide in terms of R&D intensity are Chinese businesses.

Descriptive statistics of CEO characteristics.

CEOs typically have high levels of education, with over 50 % holding a master’s degree or above; over 70 % having studied or worked in R&D, technology, and sales (Exp); a small percentage have backgrounds in finance or other fields; approximately 15 % of the CEOs in the sample have political ties, CEOs have an average tenure of 4,45 years and an average age of 0, with the majority holding posts as representatives to local people’s congresses and members of the Chinese People’s Political Consultative Conference and a handful having worked for governmental organisations. The longest CEO tenure is 20,56 years, with an average of 4,45 years. Approximately 16 % of the CEOs in the sample also hold the position of chairman of the board of directors (Duality).

Relevance analysis

Table 3 demonstrates that the following variables are significantly and positively correlated with RDI intensity: education level (Edu), technical sales background (Exp), shareholding ratio (Hold-stock), two jobs (Duality), and political affiliation (Political). In contrast, CEO age (Age) and tenure (Tenure) are not significantly correlated with RDI intensity; among the control variables, the size of the company, the degree of indebtedness, the state-owned holdings.

|

Table 3. Correlation test between explanatory variables and test variables |

||||||||||||

|

|

RDI |

Age |

Edu |

Exp |

Political |

Tenure |

Tenure2 |

Holdstock |

Duality |

Size |

Lev |

Firmage |

|

RDI |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

Age |

-0,025 |

1 |

|

|

|

|

|

|

|

|

|

|

|

Edu |

0,04 |

-0,125 |

1 |

|

|

|

|

|

|

|

|

|

|

Exp |

0,0092 |

-0,0018 |

0,023 |

1 |

|

|

|

|

|

|

|

|

|

Political |

0,075 |

-0,024 |

0,0149 |

0,052 |

1 |

|

|

|

|

|

|

|

|

Tenure |

0,01 |

0,088 |

-0,035 |

-0,001 |

0,077 |

1 |

|

|

|

|

|

|

|

Holdstock |

0,152 |

-0,032 |

0,045 |

0,0156 |

0,132 |

0,115 |

-0,006 |

1 |

|

|

|

|

|

Duality |

0,136 |

-0,023 |

0,077 |

0,122 |

0,265 |

0,203 |

-0,003 |

0,374 |

1 |

|

|

|

|

Size |

-0,092 |

0,053 |

-0,012 |

0,055 |

0,124 |

0,012 |

-0,059 |

-0,342 |

-0,236 |

1 |

|

|

|

Lev |

-0,323 |

-0,045 |

0,002 |

-0,074 |

-0,005 |

-0,0040 |

0,003 |

-0,332 |

-0,255 |

0,488 |

1 |

|

|

Firmage |

-0,186 |

-0,025 |

-0,117 |

-0,065 |

-0,055 |

0,145 |

-0,066 |

-0,454 |

-0,294 |

-0,399 |

0,445 |

1 |

Multivariate regression analysis

The multiple regression analysis of R&D investment and CEO characteristics is done in this paper using the statistical programme SPSS18.0. Table 4 displays the regression results.

|

Table 4. Multiple regression results |

|||

|

Variable Name |

Predictive symbols |

Regression coefficient |

Sig (Double tailed) |

|

Age Edu Exp Political Tenure2 Holdstock Duality |

- + + + - + + |

0,101 -0,000 0,003 0,001 0 0,001 0,005 |

0,006 0,522 0,325 0,014 0,023 0,575 0,712 |

|

Size2 Lev Firmage Adjust R square |

- - - 0,335 |

-0,002 -0,014 0,002 |

0 0 0,044 |

|

F |

7,245 |

|

|

The regression results in table 4 show that the regression equation passed the F-test. The t-statistic significance test was applied to the explanatory variables, and the results showed that the variables related to professional background, political affiliation, shareholding ratio, company size (Size2), debt level, when the duration of the listed companies’ listing passed the amount of years. Nevertheless, the test was not passed by the variables pertaining to the CEO’s age, educational background, length of service, and decision to become or not become chairman of the board of directors.

Explanatory variables

With a regression coefficient of 0,004 at the 5 % significance level, this study indicates that the work history (Exp) of CEOs and R&D intensity are positively correlated.This implies that CEOs with a background in sales, technology, or R&D are more likely to increase their R&D expenditure when all else is equal. This results aligns with Barker and Mueller’s research and validates Hypothesis 4 of this study. It implies that in the current climate, which promotes autonomous creativity, businesses should carefully evaluate the executive’s professional background when choosing new hires. The data on government affiliation (Political) is significant at the 5 % confidence level with a regression coefficient of 0,001, which is consistent with the predicted sign, indicating that CEOs with political ties are significantly and positively associated with R&D investment. This suggests that compared to CEOs without political affiliation, CEOs with political affiliation are more ready to invest in R&D. This finding validates the study’s fifth hypothesis.

CEO shareholding and R&D intensity are positively connected, according to a regression coefficient of 0,001, which means that a higher shareholding corresponds to a higher level of R&D investment from the CEO. At a 10 % confidence level, this association is significant. This bolsters Hypothesis 6 of this paper as well and is consistent with the findings of most researchers, which state that CEOs will be less shortsighted and more driven to put in a lot of effort to maximise the long-term value of the company the more shareholders’ and managers’ interests are aligned. Though it is consistent with expectations, the CEO age coefficient is negative, failing the significance test. This suggests that senior executives could be less inclined to take part in creative endeavours, yet the study does not corroborate this theory.

Furthermore, the coefficient regarding the dual role of chairman of the board (Duality) is positive as anticipated; nonetheless, it does not pass the significance test. This implies that CEOs who are also chairpersons do not invest more in R&D than CEOs who are not, all other things being equal. This could be because of the sample, or it could be because at companies where the two roles are not combined, the CEO has complete operational autonomy from the chairman of the board, particularly when it comes to research and development, and the chairman and board of directors provide the CEO with a lot of assistance.

Furthermore, although the CEO education level coefficient is positive, it does not pass the significance test. This could be because CEOs have been more educated on average in recent years, which has decreased the variation in education levels. However, it’s possible that as the information and knowledge economies grow, a lot of CEOs are continuing to hone their skills through training and self-education. The CEO tenure variable likewise fails the significance test, presumably because R&D decision-making is influenced by factors other than the number of years held in the CEO role, such as other work experience gained inside the company or even in the industry. Thus, in line with other researchers’ methods, the duration of the CEO’s employment with this organisation is utilised as a proxy variable in this study.

Control variables

R&D intensity and firm size have an inverse U-shaped connection, which means that while R&D intensity rises with growth, the substitution effect causes it to start declining at a particular scale. This conclusion is supported by the regression coefficient of company size squared, which is negative and pointing in the same direction as predicted. Financial leverage and R&D expenditure have a strong, negative association, as was expected. Accordingly, a company’s R&D intensity will decrease as its debt level rises because of capital limitations and a shortage of funds necessary to carry out additional R&D. As anticipated, there is a significant negative association between R&D spending and the number of years since listing. This suggests that the longer the period since listing, the less of an incentive there is to innovate and the lower the intensity of R&D. Conversely, the recently listed companies are attempting to make a name for themselves as soon as possible. Conversely, recently listed businesses typically focus more on innovation and raise R&D spending to fast establish their core competitiveness and gain market dominance.

Robustness check

In this study, the following robustness tests are conducted to guarantee the consistency of the model fitting findings in various scenarios. In light of the sample size’s actual circumstances, this study first, in order to overcome the influence of the extreme values of observations on the results, the continuous variables below 1 per cent and above 99 per cent of the quartiles are de-tailed; secondly, from the perspective of the variables, the sensitivity of the regression coefficients in the empirical evidence is tested by replacing individual variables with replacement variables. Since Exp, Duality, and Political are dichotomous variables that are unique in themselves, they do not need to be measured by other variables. When conducting the robustness test, this paper changes the education level from the original 1-6 “hexadecimal” to 0-1 “dichotomous”, i.e., 1 for bachelor’s degree or above, 0 for bachelor’s degree or below; changes the shareholding percentage to whether or not to hold shares. The proportion of shareholding was changed to a dummy variable of whether or not to hold shares, i.e., taking 1 if holding shares and 0 otherwise, and the model was re-analysed by multiple regression. Table 5 presents the findings.

|

Table 5. Robustness test results |

||||

|

Variable Name |

Predictive symbols |

Non standardized coefficient |

Standardized Coefficient |

Sig (Double tailed) |

|

Age Edu Exp Political Tenure2 Holdstock Duality |

- + + + - + + |

-0,001 0,002 0,003 0,002 0,025 0,001 0,003 |

-0,032 0,086 0,125 0,0991 0,56 0,045 0,023 |

0,006 0,522 0,325 0,014 0,023 0,575 0,712 |

|

Size2 Lev Firmage |

- - - |

|

-0,002 -0,015 0,001 |

-0,388 -0,144 -0,045 |

|

Adjust R square |

0,322 |

|

|

|

|

F |

6,455 |

|

|

|

|

Sig (Double tailed) |

0,001 |

|

|

|

The results of this regression do not significantly differ from those of the prior regression. This indicates that the company’s R&D investment and the CEO qualities components this paper looks at have a stable link.

CONCLUSION

In this study, we examined a sample of Chinese manufacturing companies that are listed. Through analysis, we discovered that the professional background, political affiliation, and shareholding of CEOs significantly positively impacts R&D investment. This suggests that CEOs who have experience in sales, R&D, or technology, along with larger ownership and political ties, are more likely to invest more in R&D. However, the study suggests that the CEO’s age, educational background, and whether or not they also hold the position of chairman of the board of directors are not significant factors.Furthermore, we discover that R&D spending is significantly impacted by control variables including business size, debt level, and number of years on the market. We confirmed the stability of these findings with robustness testing. In conclusion, this study shows how CEO traits affect businesses’ R&D spending, and it serves as a valuable resource for learning more about the R&D choices made by listed enterprises in China’s manufacturing sector.

REFERENCES

1. Kao, L., & Chen, A. . CEO characteristics and R&D expenditure of IPOs in emerging markets: Evidence from Taiwan. Asia Pacific Management Review,2020; 25(4), 189-197.

2. Jingchun Zhou*, Dehuan Zhang, Weishi Zhang*. Cross-view enhancement network for underwater images. Engineering Applications of Artificial Intelligence, 2023, 121, 105952.

3. Farag, H., & Mallin, C. . The influence of CEO demographic characteristics on corporate risk-taking: evidence from Chinese IPOs. The European Journal of Finance,2018; 24(16), 1528-1551.

4. Jiang, H., & Liu, C. . Economic policy uncertainty, CEO characteristics and firm R&D expenditure: a Bayesian analysis. Applied Economics, 2020;52(34), 3709-3731.

5. Lin, C., Lin, P., Song, F. M., & Li, C. . Managerial incentives, CEO characteristics and corporate innovation in China’s private sector. Journal of comparative economics, 2011;39(2), 176-190.

6. Jingchun Zhou, Qian Liu, Qiuping Jiang, Wenqi Ren, Kin-Man Lam*, Weishi Zhang*. Underwater image restoration via adaptive dark pixel prior and color correction. International Journal of Computer Vision, 2023. DOI :10.1007/s11263-023-01853-3.

7. Wu, J., Li, S., & Li, Z. . The contingent value of CEO political connections: A study on IPO performance in China. Asia Pacific Journal of Management,2013; 30(4), 1087-1114.

8. Jingchun Zhou, Boshen Li, Dehuan Zhang, Jieyu Yuan, Weishi Zhang, Zhanchuan Cai. “UGIF-Net: An Efficient Fully Guided Information Flow Network for Underwater Image Enhancement,” IEEE Transactions on Geoscience and Remote Sensing, vol. 61, pp. 1-17, 2023, Art no. 4206117, doi: 10.1109/TGRS.2023.3293912.

9. Ali, J., Shan, G., Gul, N., & Roh, B. H. . An Intelligent Blockchain-based Secure Link Failure Recovery Framework for Software-defined Internet-of-Things. Journal of Grid Computing,2023; 21(4), 57.

10. Ali, Jehad, Rutvij H. Jhaveri, Mohannad Alswailim, and Byeong-hee Roh. “ESCALB: An effective slave controller allocation-based load balancing scheme for multi-domain SDN-enabled-IoT networks.” Journal of King Saud University-Computer and Information Sciences 35, no. 6 (2023): 101566.

11. Dong, Q., & Liu, X. Optimization Practice of University Innovation and Entrepreneurship Education Based on the Perspective of OBE. Journal of Combinatorial Mathematics and Combinatorial Computing, 118, 181-189.

12. Liao, Q. English Teaching Project Quality Evaluation Based on Deep Decision-Making and Rule Association Analysis. Journal of Combinatorial Mathematics and Combinatorial Computing, 118, 119-127.

13. Xu, J. Optimizing English Education in the Information Era: A Multimodal Approach Based on BOPPPS Teaching Model. Journal of Combinatorial Mathematics and Combinatorial Computing, 118, 33-48.

14. Ning, X. Evaluation of Individual Innovation and Entrepreneurship Effect Based on Linear Space Model and Grey Correlation. Journal of Combinatorial Mathematics and Combinatorial Computing, 118, 3-17.

15. Chai, R. Construction and analysis of a business English classroom teaching quality evaluation system based on multimodal neural network model assessment. Journal of Combinatorial Mathematics and Combinatorial Computing, 117, 149-158.

16. Shi, Y. Classroom Quality Evaluation of English Teaching Activities Based on Probabilistic Language Information. Journal of Combinatorial Mathematics and Combinatorial Computing, 117, 131-148.

17. Li, L. Forecasting the broadcast volume of cultural communication assisted by short video technology and analyzing the influencing factors. Journal of Combinatorial Mathematics and Combinatorial Computing, 117, 103-114.

18. Zhang, G. The Evaluation and Development of University English Teaching Quality Based on Wireless Network Artificial Intelligence. Journal of Combinatorial Mathematics and Combinatorial Computing, 117, 77-86.

19. Ren, X., Ahmed, I., & Liu, R. Study of Topological Behavior of Some Computer Related Graphs. Journal of Combinatorial Mathematics and Combinatorial Computing, 117, 3-14.

20. Nazeer, S., Sultana, N., & Bonyah, E. Cycles and Paths Related Vertex-Equitable Graphs. Journal of Combinatorial Mathematics and Combinatorial Computing, 117, 15-24.

21. Zeng, Y., & Chu, B. The Appropriate Scale of Competition Between Online Taxis and Taxis Based on the Lotka-Volterra Evolutionary Model. Journal of Combinatorial Mathematics and Combinatorial Computing, 117, 25-36.

22. Guo, Q. Minimizing Emotional Labor through Artificial Intelligence for Effective Labor Management of English Teachers. Journal of Combinatorial Mathematics and Combinatorial Computing, 117, 37-46.

FINANCING

There is no specific funding to support this research.

CONFLICT OF INTEREST

The authors declared that they have no conflicts of interest regarding this work.

AUTHORSHIP CONTRIBUTION

Conceptualization: Haoshu Zhang.

Data curation: Astri Yulia.

Acquisition of funds: Astri Yulia.

Research: Astri Yulia.

Methodology: Astri Yulia.

Project management: Haoshu Zhang.

Resources: Astri Yulia.

Software: Astri Yulia.

Supervision: Haoshu Zhang.

Validation: Astri Yulia.

Display: Astri Yulia.

Drafting - original draft: Haoshu Zhang.

Writing - proofreading and editing: Haoshu Zhang.