Category: Finance, Business, Management, Economics and Accounting

ORIGINAL

Analysis of Policy Options Based on Data-Driven Economic Cycles and Industrial Structure Upgrading

Análisis de las opciones políticas basadas en los datos de los ciclos económicos y la modernización de la estructura industrial

Zhe Sun1 ![]() *

*

1College of Applied Chinese Studies,Beijing Language and Culture University. Beijing, 100083, China.

Cite as: Sun Z. Analysis of Policy Options Based on Data-Driven Economic Cycles and Industrial Structure Upgrading. Salud, Ciencia y Tecnología - Serie de Conferencias. 2024; 3:796. https://doi.org/10.56294/sctconf2024796

Submitted: 14-01-2024 Revised: 29-03-2024 Accepted: 07-06-2024 Published: 08-06-2024

Editor: Dr.

William Castillo-González ![]()

Note: paper presented at the 3rd Annual International Conference on Information & Sciences (AICIS’23).

ABSTRACT

China’s economy has achieved a high growth rate of 9,8 % in cyclical fluctuations, and the industrial structure has been continuously improved with growth. However, the irrationality of the tertiary industry structure and its internal structure still restricts the sustainable development. The optimization of the industrial structure depends on many factors, such as government policies, economic growth mode, resource constraints, economic development stage and economic cycle stage. Based on data-driven analysis, this paper analyzes the general path and policy choice of economic cycle to adjust China’s industrial structure, and the impact of economic cycle on the upgrading of industrial structure. After the actual analysis, we found that the threshold of economic growth in economically developed regions is high, the role of financial development in stimulating industrial structure is not prominent, and industrial upgrading is relatively difficult. Industrial upgrading is difficult.

Keywords: Economic Cycle; Industrial Structure Upgrading; Data-Driven; Policy Choice.

RESUMEN

La economía china ha alcanzado una elevada tasa de crecimiento del 9,8 % en fluctuaciones cíclicas, y la estructura industrial ha mejorado continuamente con el crecimiento. Sin embargo, la irracionalidad de la estructura de la industria terciaria y su estructura interna siguen limitando el desarrollo sostenible. La optimización de la estructura industrial depende de muchos factores, como las políticas gubernamentales, el modo de crecimiento económico, las limitaciones de recursos, la fase de desarrollo económico y la fase del ciclo económico. Basándose en un análisis basado en datos, este documento analiza la trayectoria general y la elección de políticas del ciclo económico para ajustar la estructura industrial de China, y el impacto del ciclo económico en la mejora de la estructura industrial. Tras el análisis real, comprobamos que el umbral de crecimiento económico en las regiones económicamente desarrolladas es alto, el papel del desarrollo financiero en el estímulo de la estructura industrial no es prominente, y la modernización industrial es relativamente difícil. La modernización industrial es difícil.

Palabras clave: Ciclo Económico; Mejora de la Estructura Industrial; Basada en Datos; Elección de Políticas.

INTRODUCTION

Through more than three decades of rapid economic development, China's economic conditions have relatively stabilized and entered a peaceful phase, with the economic structure transformed and upgraded, and the factors driving economic growth have changed.(1) However, the reform has also brought a lot of new problems, and the economic development of China has encountered unprecedented challenges while the reform is in progress.(2) Specifically, since 2018, China's economic operation has changed steadily, facing greater downward pressure, some enterprises have become more difficult to operate, and the long-accumulated risks have been revealed.(3) It can be seen visually from the data that GDP in the first six months of 2018 was 6,8 ‰ higher than the first six months of the previous year, and some conclusions can be drawn with reference to the year-on-year trend of GDP, which was 6,7 % higher in the second quarter than the second quarter of the previous year, but compared with the first quarter, it dropped by 0,1 percentage points, which is the first drop since the second half of 2017, while in the third quarter of 2018 Economic growth fell to 6,5 percent, the lowest since the first quarter of 2009, but the overall volume of the economy was about twice as high as in 2009.(4)

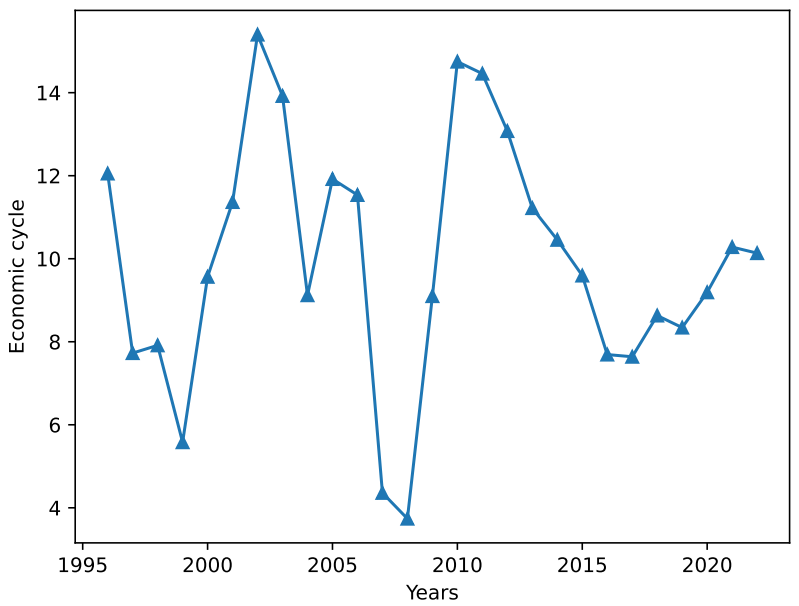

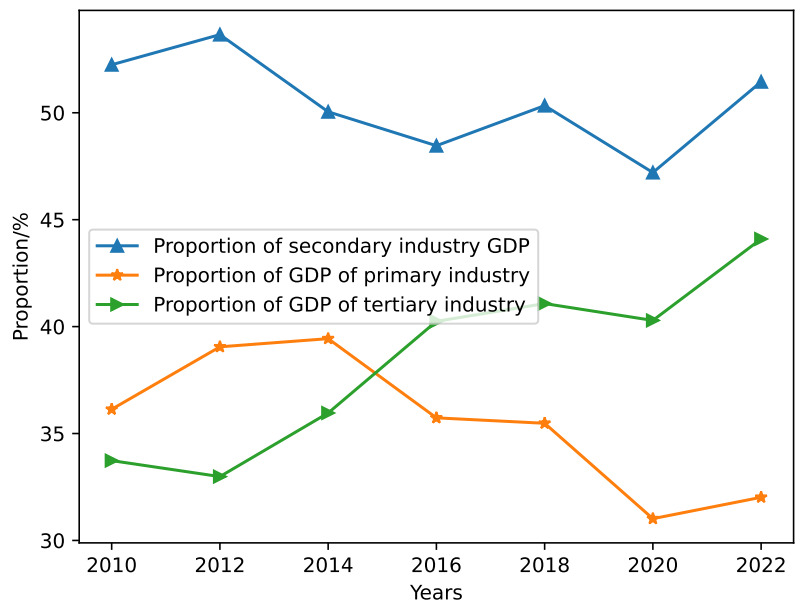

The classical British political economist(5) in the 17th century was the first to introduce the term industrial structure in his book Political Arithmetic, where he argued that more income was obtained from industry and commerce than from agriculture and manufacturing; and the economist from New Zealand(6) was the first to propose the method of classifying three industries, in his book "Conflict of Security and Progress" he was the first to divide industries into three types, he proposed a new term, the industries in the first stage are called primary industries, by the same token, the industries in the second stage are called secondary industries, and the industries in the third stage are called tertiary industries, which is equivalent to dividing The industry is divided into primary, secondary and tertiary industries. Since its introduction, this industry classification method has been widely accepted and has been used until now. Based on this theory, the British economist(7) studied the connection between primary, secondary and tertiary industrial structure and economic development through the method of classification of three industries, and after a series of empirical analysis, put forward the distribution Clark's theorem, and summarized the law of change of three industrial factors and the influence of industrial structure on economic development. In their respective works, this is evident from the comparison of figures 1 and 2.

Figure 1. Changes in China's economic cycle

Figure 2. The share of industrial structure since 2010

In turn, the lag in industrial structure upgrading will slow down the development of regional financial industry(8). In Andronie et al.(9), they explored the correlation between economic development and industrial structure in the central region based on VIAR model analysis using 30 years of time series data from 2010 to 2022, which showed that although there was some long-term steady-state link between economic development and industrial restructuring, it did not show a mutually reinforcing trend.

As for the industrial structure, since 2008 until now, China's financial and real estate industries have ushered in a "honeymoon period" and have developed at a high speed during this period for two main reasons:(10) first, under the stimulus of the global financial crisis in 2008, the Chinese government took corresponding countermeasures and launched ten measures to further ten measures, which made the overall domestic monetary environment present a state of wide money and wide credit, which led China's real estate market to a boom period of sustained development.(11) Second, at the end of 2008, our government adopted a four-trillion infrastructure plan. On the other hand, due to the positive downstream demand, heavy asset industries such as manufacturing industries also saw a continuous rise in prosperity, and the huge demand for real financing was leveraged, so the financial industry also received more market attention.(7) From the data, it can be observed that since 2008, the GDP ratio of China's financial industry as well as the real estate industry has increased rapidly, and by 2017, the ratio has increased from 10,34 % in 2008 to 14,46 %. These policies have led to the gradual optimization of China's economic structure in recent years.(8) The share of primary industry has continuously F decreased, the secondary industry has remained stable, and the tertiary industry has steadily increased. The share of secondary industries in GDP shifted from 28,2 %, 47,9 %, and 13 23,9 % in 1978 to 8,6 %, 39,8 %, and 51,6 % in 2016.(9) Despite the significant improvement in the share of industries, at the same time, the problems in the economic structure remain relatively prominent in the village, and there is still a significant gap in the secondary sector compared to other developed countries.

Data-driven economic cycles

Initial construction of the indicator system

Since the research data in this paper are derived from the indicator data of 31 provinces and municipalities from 2003 to 2014, the indicator data are necessary for both the depth of vertical research and the breadth of horizontal research. Therefore, in the process of index optimization, the differences in time span and the differences between provincial and municipal cross-sections are taken into account, so in addition to the basic principles of scientificity, systematicity, comprehensiveness and hierarchy in the index optimization stage, this paper pays special attention to the principle of regionalism. Since the relevant data vary greatly between provinces and municipalities, there is an obvious regional dimension, and optimization and upgrading in 31 provinces and municipalities. In order to eliminate this influence, therefore, when setting the indicators, comprehensive consideration needs to be given to eliminate the differences between regions, so that the indicator data are comparable in the cross-section.

Initial construction of economic cycle index system

According to the definition of economic cycle, this paper measures the economic cycle from the perspectives of consumption, industry, knowledge support, and development effectiveness.

Consumption reflects the penetration of the application of the economic cycle at the micro-individual level. For the public, the development of the economic cycle is most directly reflected in the rapid development of commerce and the growth of consumption in telecommunications and mobile Internet.

With the continuous development of industry informatization and social informatization, the development of industries such as industrial manufacturing and service industries has greatly contributed to the development of the economic cycle, and the level of development of industries reflects the development of the economic cycle to a certain extent.

Setting of industrial structure evaluation index system

With the gradual attention to resources and environmental resources, sustainable development is particularly important, therefore, it is also necessary to focus on sustainability. The employment elasticity coefficient of tertiary industry to reflect the energy utilization efficiency, employment elasticity and comprehensive utilization of environmental resources, as in table 1.

|

Table 1. Industrial structure transformation and upgrading |

||

|

|

Primary Indicators |

Secondary Indicators |

|

Evaluation of industrial structure optimization and upgrading |

Rationalization of industrial structure |

Density of output value per capita |

|

Rational allocation coefficient of resources |

||

|

Deviation of industrial structure |

||

|

Advanced industrial structure |

Percentage of employment in tertiary industry |

|

|

Value added of tertiary industry |

||

|

Degree of industrial growth of tertiary industry |

||

|

Efficient Industrial Structure |

Labor productivity of the whole society |

|

|

Capital tax rate |

||

|

Tertiary industry location quotient |

||

|

Sustainable industrial structure |

Three waste "emissions" |

|

|

Employment elasticity coefficient of tertiary industry |

||

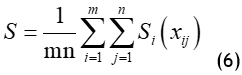

The relevant indicators are calculated as follows:

1) Output density per capita:

![]()

Q denotes the regional output density per capita, and Y denotes the national output density per capita.

2) Rational allocation coefficient of resources:

![]()

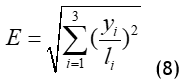

The marginal output of each factor is:

And the average marginal output of the factor is:

![]()

The coefficient of deviation of the marginal output of the j th factor in industry i is:

The industrial structure deviation coefficient is:

The degree of resource allocation rationalization is:

![]()

The calculation process generally follows the three industry classifications to calculate the human and capital elements.

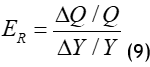

3) Industrial structure deviation degree:

4) Growth degree of tertiary industry:

Q and Y denote tertiary output and GDP, respectively; ∆Q denotes the change in tertiary output and ∆Y denotes the change in GDP.

5) Social labor productivity:

![]()

Q denotes gross regional product, L denotes total regional employment

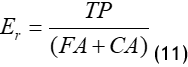

6) Capital gains tax rate:

TP denotes total profits and taxes, FA denotes average balance of net fixed assets, CA denotes average balance of current assets

7) Tertiary industry location quotient:

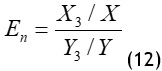

X3 denotes the output value or employment of an industry in a region, X denotes the total output value or employment in the region, and Y denotes the national GDP.

8) Employment elasticity coefficient of tertiary industry:

![]()

∆L denotes the change in tertiary employment, L denotes tertiary employment; ∆Y denotes the change in tertiary output, Y denotes tertiary output.

Optimization of the index system

Since the index system research in this paper will be divided into longitudinal research and horizontal research, in order to maintain the rigor of the index system optimization, on the premise of ensuring data availability, this paper will optimize the indicators from the longitudinal data and optimize the horizontal indicators, so that the longitudinal research and horizontal research exclude the influence of individual abnormal indicators.

The principle of feature regression algorithm based on feature selection method to screen the evaluation index system is as follows.

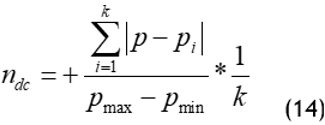

1) Calculation:

Where p is the 1st dimensional variable value of variable Di(1≤i≤r); then the k groups of variables with the highest similarity to Di(1≤i≤r) are searched from the remaining r-1 groups of variables, and pi(1<i<k) is the 1st dimensional feature value of the i-th row of the subset of variables composed of these k groups of features; pmin, pmax denote the extreme and extreme small values of p.

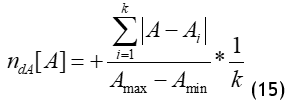

2) Calculation:

A is the value of a dimensional feature in the row where p is located; Ai is the value of the feature in that dimension corresponding to the i th feature in the k-group of features with the highest similarity selected in the previous step.

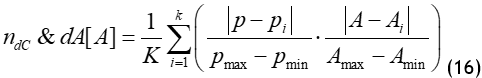

3) Calculation:

4) Repeat steps 1 to 3, each time selecting a different Di.

5) Calculate the W [A] value of feature A.

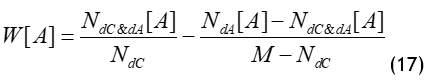

The judgment statistic W [Aj] corresponding to the 2~n-1 dimensional feature items Aj is obtained according to formula 17, and each W [Aj] corresponds to a -value, and the top q feature items constitute the most feature subset according to the P-value from the largest to the smallest. Where j=2,3,...,n+1.

According to the principle of feature selection algorithm, when P≥0,9, the feature selection iteration results in important, when 0,8≤P<0,9, the feature is generally important, and when P<0,8, the feature is not important.

Case Study

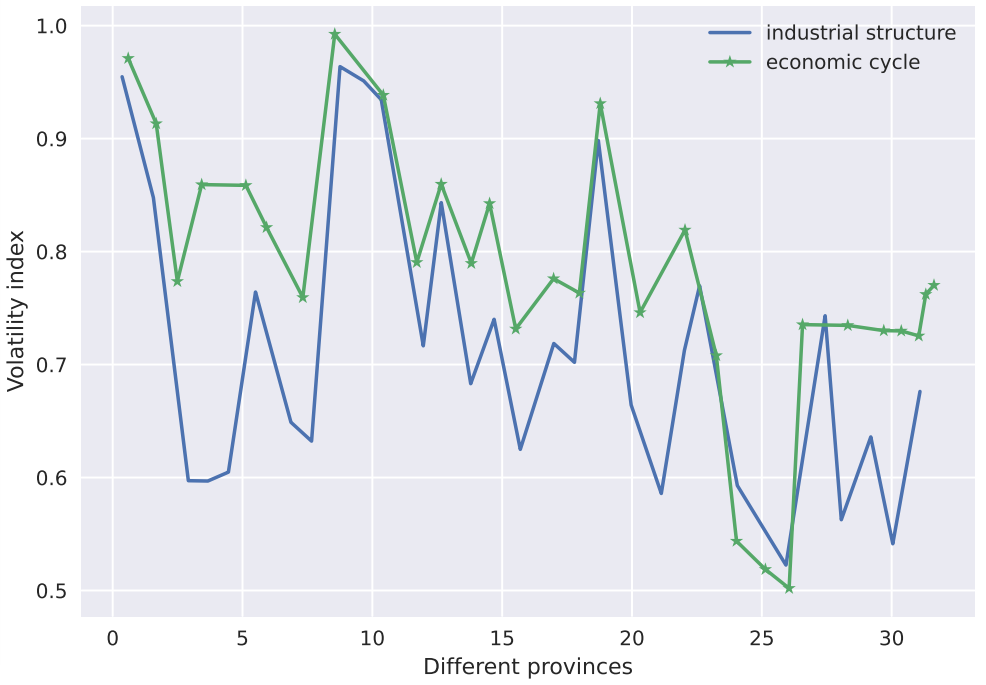

Considering the development of China's economy, this paper adopts the methods of total bank loans, total stock market value, real estate price index, GDP of the second and third sectors, GDP, per capita GDP, growth rate of urban per capita expenditure and growth rate of foreign direct investment. As shown in figure 3, compared with the economic cycle and industrial structure upgrading level of provinces and cities in 2014, the economic cycle and industrial structure upgrading indicators are generally consistent. In other words, the faster the economic cycle, the higher the level of industrial structure transformation.

Figure 3. Levels of the composite economic cycle index by provinces and cities nationwide

Data processing based on the data-driven panel threshold model

According to the data-driven panel threshold regression model set in the previous section and its corresponding test method, this paper uses STATA131 software to conduct the empirical analysis. First, we determine the number of thresholds, and thus the form of the model. After determining the variables and data, this paper uses two models for calculation. Referring to the parameter estimation method of the above models, the two models were estimated by 300 times of releasable self-sampling process, and then the F-values, P-values and threshold values of the two models were calculated. The threshold effect tests of the two models are in table 2.

|

Table 2. Threshold effect test |

||||||

|

Model |

F-value |

P-value |

Number of BS |

Threshold value |

||

|

1 % |

5 % |

10 % |

||||

|

Single Threshold |

23,808*** |

0,000 |

300 |

12,352 |

7,137 |

5,508 |

|

Double threshold |

37,954*** |

0,000 |

300 |

6,487 |

-0,214 |

-3,624 |

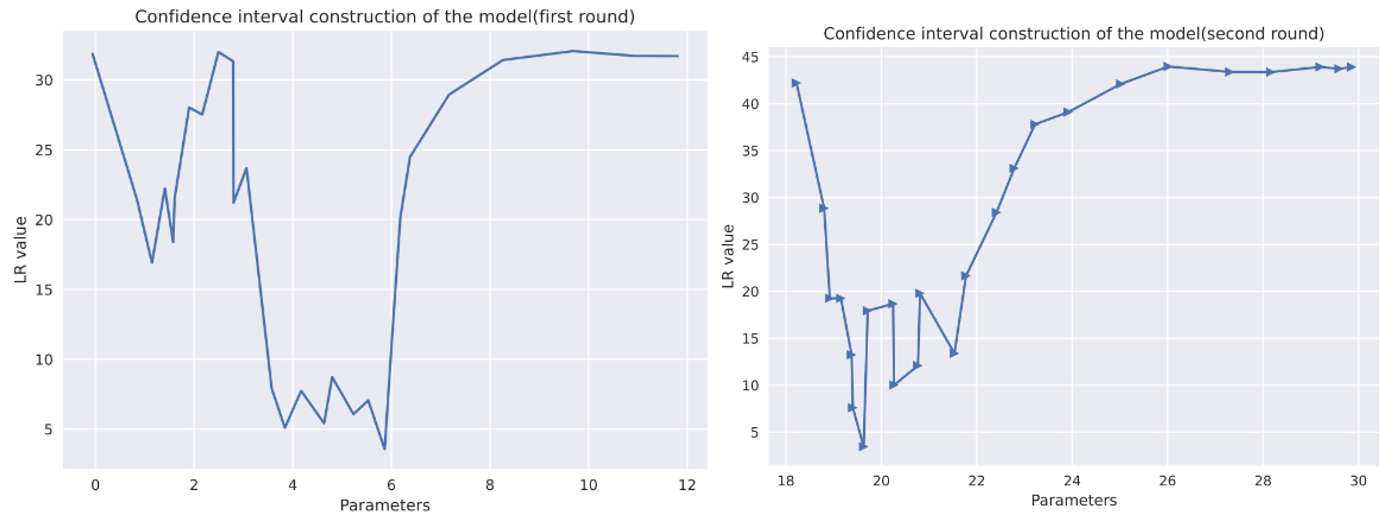

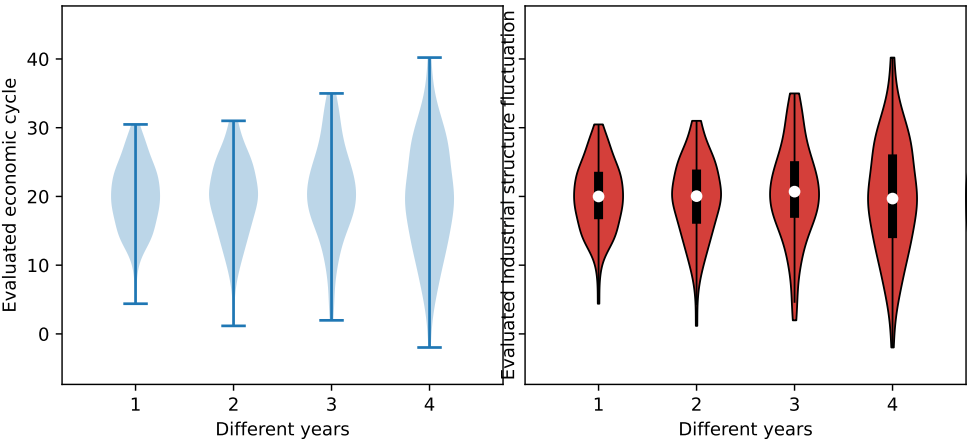

Figure 4 shows the approximate values of the two thresholds and trust intervals, and the left and right figures show the calculated values and trust intervals of the first and second thresholds respectively. The solid line in the figure is based on the LR value of equation 5 in the text, and the dotted line is based on the ratio of 7,35. Below the dotted line, LR value is the interval composed of 5 % significance threshold, and the threshold corresponding to lr-0 is the threshold. Search the first threshold again, then set the first threshold, continue to search the second threshold, then set the second threshold, and then search the first threshold again until all thresholds converge to a stable state, and obtain the estimated values of the two thresholds and their confidence intervals. We also analyze the relationship between industrial structure and economic cycle fluctuation as shown in figure 5.

Figure 4. Estimates and confidence intervals of the threshold

Note: the horizontal axis of the figure is the threshold parameter variable FC, and the vertical axis is the LR value

Figure 5. Relationship between industrial structure and economic cycle fluctuation

We further summarize the threshold values of the two models shown in figure 1 in table 3, which gives the occupancy values of the two thresholds and their confidence intervals. The results show that 4,205 is the first threshold value explored, and after the first threshold value is obtained, the second threshold value of size 7,292 is continued to be searched, and finally the first threshold value is searched again and found to be 3,364, but its confidence interval converges, which indicates that the search results are stable. The threshold model we finally chose is the double threshold model.

|

Table 3. Threshold estimation results |

|||

|

Model |

Threshold variable |

Threshold estimates |

95 % confidence interval |

|

Single Threshold |

FC1 |

4,205 |

[2,987, 4,341] |

|

Double threshold |

FC1 |

7,292 |

[4,955, 7,298] |

|

FC2 |

3,364 |

[3,075, 3,922] |

|

The values of the coefficients and the t-statistics of the model regressions are presented in table 4, i.e., tols, and the t-statistics under the heteroskedasticity assumptions are also presented, i.e., twhite. The results in table 4 show that the average years of education, which is in line with the general findings, but the growth of consumption has a less significant negative relationship with industrial upgrading. In conclusion, the influence of control variables on China's industrial upgrading and optimization is consistent with the general theoretical logic.

|

Table 4. Parameter estimation results of the double threshold model |

|||

|

Variables |

Model I |

||

|

Coefficient value |

tols |

twhite |

|

|

Fixed |

0,008 |

1,39 |

1,23 |

|

Edu |

0,006 |

4,15*** |

4,32*** |

|

FDI |

0,002 |

0,32 |

0,41 |

|

Cost |

-0,003 |

-0,53 |

-0,75 |

|

FC1 |

-0,006 |

-3,77*** |

-2,54* |

|

FC2 |

-0,002 |

-0,05 |

-0,05 |

|

FC3 |

0,007 |

1,85* |

1,38* |

|

Constant |

0,835 |

55,48*** |

55,08*** |

|

Note: tols is the t-value under the assumption of homoskedasticity, twhite t-value under the assumption of heteroskedasticity. |

|||

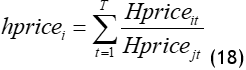

To do so, we need to first define the level of economic development of the different provinces, and our approach is to use three primitive variables Loanit, Hpriceit, Stockitto construct the economic cycle index FCAit so that the following index can be constructed. Taking Hprice as an example, we construct it as in equation 18.

Similarly for the Loan and sock indicators, the three indices constructed Loani, Hpricei, Stocki are weighted values, they represent the share of credit volume, real estate price level, and total stock market capitalization in GDP for province i in the total of 31 provinces, respectively. After calculating these three weights, we sum them up:

![]()

From equation 19, we can derive the Findexi index, which is relatively comprehensive and can more accurately measure the level of economic development of the i-th province in the whole country. Then we rank the Findexi indices of 31 provinces and cities according to their magnitudes, so as to classify the regions with different levels of economic development.

CONCLUSIONS

China's financial structure has been optimized and improved under the influence of economic and ecological development, which is particularly prominent and obvious in both investment and business aspects. In addition, the financial structure has changed in parallel with the way of economic growth in China. The distribution of industrial structure can more clearly reflect the quality of economic growth in a region than the overall economic situation of a region. On this basis, this paper selects the data of 31 provinces in China, selects the relevant economic cycle and industry structure indicators, and takes the data-driven panel threshold model as the research tool to make an empirical analysis of these two indicators, and studies the internal relationship between China's socio-economic development and China at this stage.

REFERENCES

1. Kamble, S. S., Belhadi, A., Gunasekaran, A., Ganapathy, L., & Verma, S. (2021). A large multi-group decision-making technique for prioritizing the big data-driven circular economy practices in the automobile component manufacturing industry. Technological Forecasting and Social Change, 165, 120567.

2. Cunningham, E. (2021). Artificial intelligence-based decision-making algorithms, sustainable organizational performance, and automated production systems in big data-driven smart urban economy. Journal of Self-Governance and Management Economics, 9(1), 31-41.

3. Nuccio, M., & Guerzoni, M. (2019). Big data: Hell or heaven? Digital platforms and market power in the data-driven economy. Competition & Change, 23(3), 312-328.

4. Tsai, F. M., Bui, T. D., Tseng, M. L., Lim, M. K., & Hu, J. (2020). Municipal solid waste management in a circular economy: A data-driven bibliometric analysis. Journal of cleaner production, 275, 124132.

5. Afrin, K., Nepal, B., & Monplaisir, L. (2018). A data-driven framework to new product demand prediction: Integrating product differentiation and transfer learning approach. Expert Systems with Applications, 108, 246-257. Afrin, K., Nepal, B., & Monplaisir, L. (2018). A data-driven framework to new product demand prediction: Integrating product differentiation and transfer learning approach. Expert Systems with Applications, 108, 246-257.

6. Jingchun Zhou, Dehuan Zhang, Weishi Zhang*. Cross-view enhancement network for underwater images. Engineering Applications of Artificial Intelligence, 2023, 121, 105952.

7. Wang, J., Yang, J., Zhang, J., Wang, X., & Zhang, W. (2018). Big data driven cycle time parallel prediction for production planning in wafer manufacturing. Enterprise information systems, 12(6), 714-732.

8. Lin, K. Y. (2018). User experience-based product design for smart production to empower industry 4.0 in the glass recycling circular economy. Computers & Industrial Engineering, 125, 729-738.

9. Andronie, M., Lăzăroiu, G., Iatagan, M., Hurloiu, I., & Dijmărescu, I. (2021). Sustainable cyber-physical production systems in big data-driven smart urban economy: a systematic literature review. Sustainability, 13(2), 751.

10. Wang, F., Wang, R., & He, Z. (2022). Exploring the impact of “double cycle” and industrial upgrading on sustainable high-quality economic development: Application of spatial and mediation models. Sustainability, 14(4), 2432.

11. Yanmin Xu, Yitao Tao, Chunjiong Zhang, Mingxing Xie, Wengang Li, Jianjiang Tai, "Review of Digital Economy Research in China: A Framework Analysis Based on Bibliometrics", Computational Intelligence and Neuroscience, vol. 2022, Article ID 2427034, 11 pages, 2022. https://doi.org/10.1155/2022/2427034

FINANCING

There is no specific funding to support this research.

CONFLICT OF INTEREST

All authors reviewed the results, approved the final version of the manuscript and agreed to publish it.

AUTHORSHIP CONTRIBUTION

Conceptualization: Zhe Sun.

Data curation: Zhe Sun.

Formal analysis: Zhe Sun.

Research: Zhe Sun.

Methodology: Zhe Sun.

Drafting - original draft: Zhe Sun.

Writing - proofreading and editing: Zhe Sun.